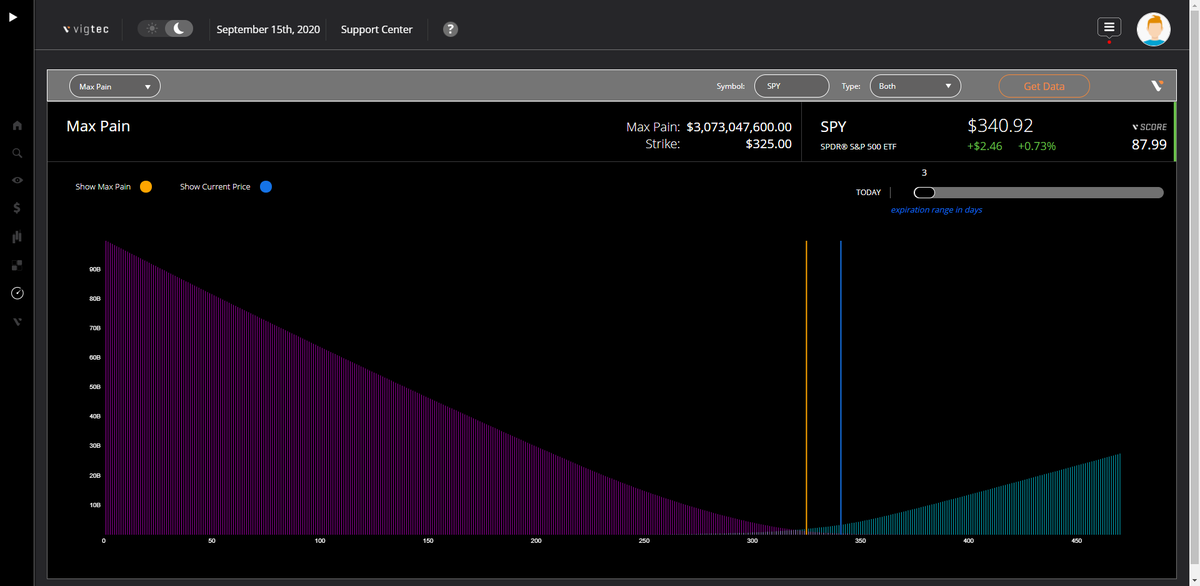

This Friday is Options Expiration (referred to as OPEX). This is also the quarterly OPEX which is called 'QUAD WITCH'. It can and usually does have an impact on the markets. Here is the current picture for the @StateStreetETFs $SPY ETF for this Friday via our market indicators.

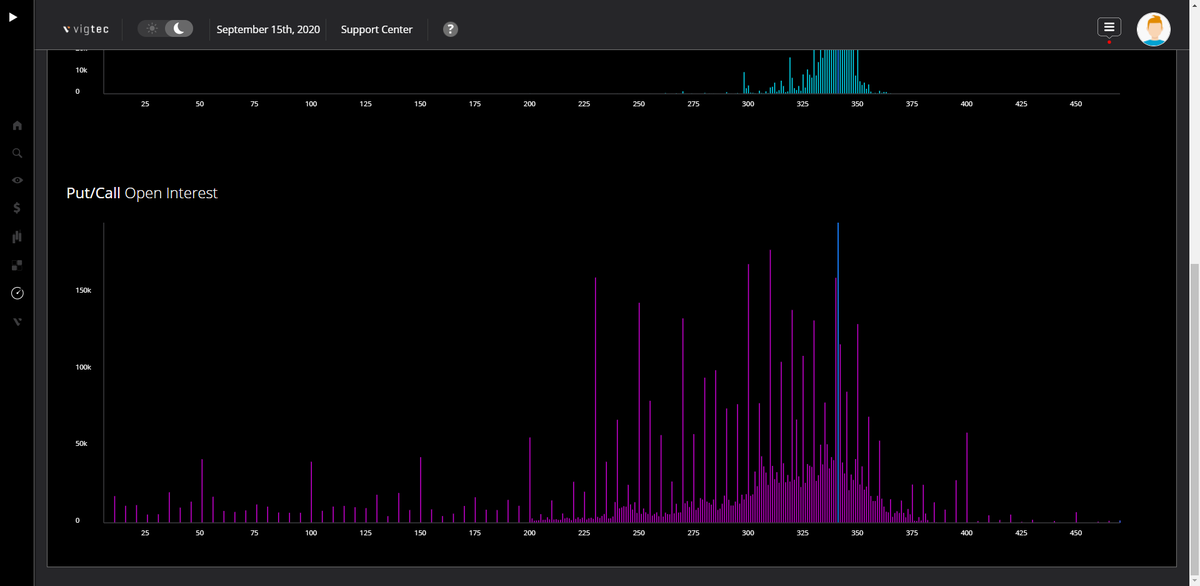

3/ Here is the actual executed options trades for this Friday. You can see they form a bell curve. This implies that the market participants have positioned themselves around a pretty specific set of strikes for this Friday's QUAD WITCH OPEX.

To learn more and try out our App for free visit vigtec.io/learn and dive into hundreds of articles on Options trading!

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh