Check out what some of the best VC's were saying about...

- Wix

- Shopify

- Twitch

- Twilio

- PagerDuty

- Fiverr

- Pinterest

- LinkedIn

...when they were still small companies.

[THREAD] 👇🏽

Thanks for sharing @BessemerVP

bvp.com/memos

- Wix

- Shopify

- Twitch

- Twilio

- PagerDuty

- Fiverr

...when they were still small companies.

[THREAD] 👇🏽

Thanks for sharing @BessemerVP

bvp.com/memos

1/ Wix pt. 1

Wix was a customizable MySpace. Funny to think how things change so quickly.

bvp.com/memos/wix

Wix was a customizable MySpace. Funny to think how things change so quickly.

bvp.com/memos/wix

2/ Wix pt. 2

Look at this user interface! Wix has come so far.

Goes to show you that pace of innovation matters more than where a company is in the present.

Look at this user interface! Wix has come so far.

Goes to show you that pace of innovation matters more than where a company is in the present.

3/ Shopify pt. 1

So interesting that replacing Tobi was even in the realm of possibility seeing how well he has performed.

bvp.com/memos/shopify

So interesting that replacing Tobi was even in the realm of possibility seeing how well he has performed.

bvp.com/memos/shopify

5/ Shopify pt. 3

$400 million exit rate in the best-case scenario. Off just a little bit 😂

I know these projections are so difficult but fascinating to see how people thought about the opportunity without hindsight.

$400 million exit rate in the best-case scenario. Off just a little bit 😂

I know these projections are so difficult but fascinating to see how people thought about the opportunity without hindsight.

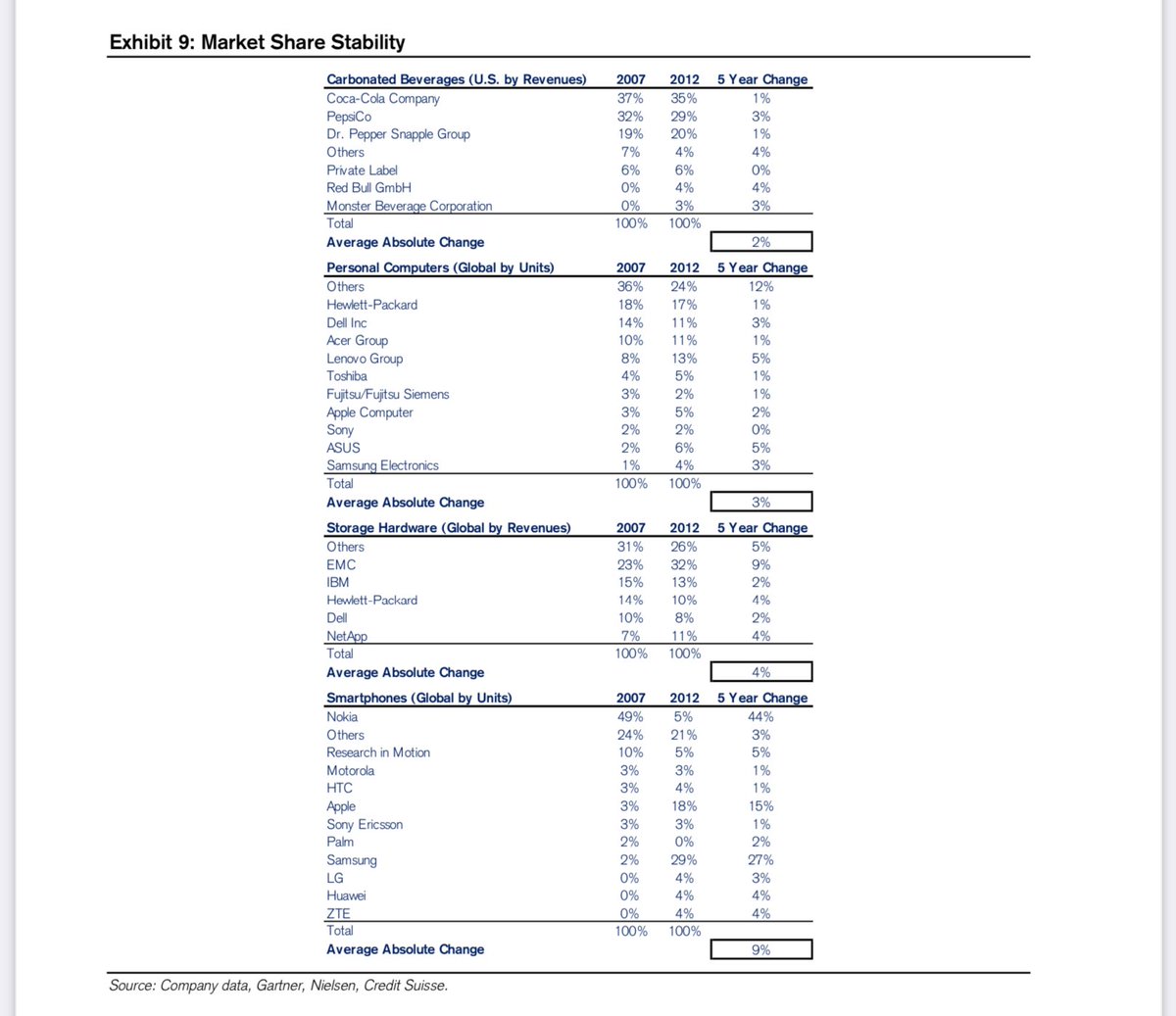

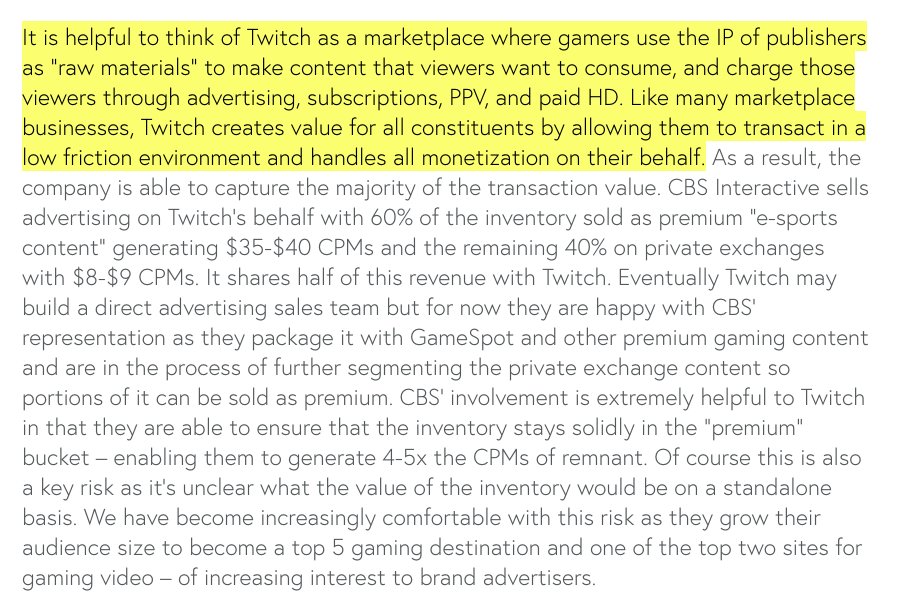

6/ Twitch pt. 1

Never thought about it like this.

Raw materials were the streams and Twitch was acting as a marketplace to get those streams monetized.

bvp.com/memos/twitch

Never thought about it like this.

Raw materials were the streams and Twitch was acting as a marketplace to get those streams monetized.

bvp.com/memos/twitch

7/ Twitch pt. 2

Great insights into the value props of Twitch.

They are able to take a high rake because streamers view the money as a cherry on top, they aren't entitled to it.

Also, Twitch is aligned with publishers because it is essentially free marketing for games.

Great insights into the value props of Twitch.

They are able to take a high rake because streamers view the money as a cherry on top, they aren't entitled to it.

Also, Twitch is aligned with publishers because it is essentially free marketing for games.

8/ Twilio pt. 1

"While growth has not been explosive..."

- it's still growing faster than 40% after all these years

And check out that valuation.

- $800k for its seed

bvp.com/memos/twilio

"While growth has not been explosive..."

- it's still growing faster than 40% after all these years

And check out that valuation.

- $800k for its seed

bvp.com/memos/twilio

10/ Twilio pt. 3

Twilio was on the verge of landing Google. Apparently, Google picked it over its internal Voice team.

Twilio was on the verge of landing Google. Apparently, Google picked it over its internal Voice team.

14/ Fiverr pt. 2

Great origin story. Always cool to see a company born out of a founder's frustration

Great origin story. Always cool to see a company born out of a founder's frustration

15/ Pinterest pt. 1

Pinterest first started out as a product catalog for iPhone apps.

Pinterest was a pivot.

[Forgot to mention this but so was Twitch. Gaming was not the original focus.]

bvp.com/memos/pinterest

Pinterest first started out as a product catalog for iPhone apps.

Pinterest was a pivot.

[Forgot to mention this but so was Twitch. Gaming was not the original focus.]

bvp.com/memos/pinterest

17/ Pinterest pt. 3

The company didn't have an established business model yet. Interesting how the affiliate model seemed more obvious than the ad-driven model.

The company didn't have an established business model yet. Interesting how the affiliate model seemed more obvious than the ad-driven model.

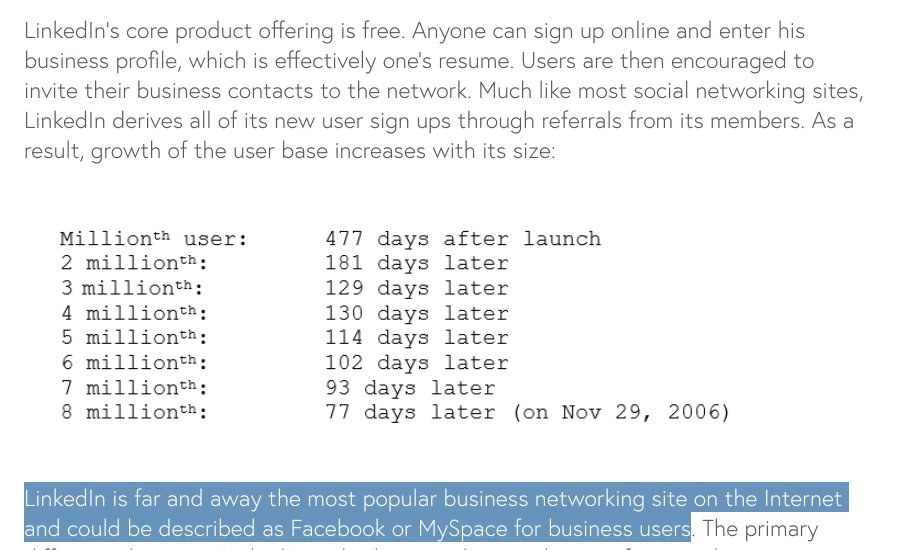

19/ LinkedIn pt. 2

Very cool to see how user growth was scaling. Took 477 days to get to 1 million but then only 77 days to get from 7 to 8 million.

Very cool to see how user growth was scaling. Took 477 days to get to 1 million but then only 77 days to get from 7 to 8 million.

20/ LinkedIn pt. 3

LinkedIn still has a lot of business model optionality. From advertising to subscriptions to vertical offerings, it's cool to see what growth was like in the early days.

LinkedIn still has a lot of business model optionality. From advertising to subscriptions to vertical offerings, it's cool to see what growth was like in the early days.

End/

So cool to see how Bessemer's investors thought about analyzing these companies when they were still very small.

Thanks again for releasing these @BessemerVP!

So cool to see how Bessemer's investors thought about analyzing these companies when they were still very small.

Thanks again for releasing these @BessemerVP!

• • •

Missing some Tweet in this thread? You can try to

force a refresh