Persistent Systems

AR (2019-20) Notes

Watch this 9 Min short video to get a glimpse of what Persistent is all about.

Don’t miss that part where you get to know about their 1st project, which was for a French company.

Thread follows

AR (2019-20) Notes

Watch this 9 Min short video to get a glimpse of what Persistent is all about.

Don’t miss that part where you get to know about their 1st project, which was for a French company.

Thread follows

1/

Persistent completed 30 years of Operation in 2020.

A Glance

~Revenues: $501M

~Team Size: 10,600

~Annual Active Clients: 1,000

~Countries: 17

We covered the 30 yr old journey here:

Persistent completed 30 years of Operation in 2020.

A Glance

~Revenues: $501M

~Team Size: 10,600

~Annual Active Clients: 1,000

~Countries: 17

We covered the 30 yr old journey here:

https://twitter.com/SmartSyncServ/status/1305845026136653826

2/

Way forward

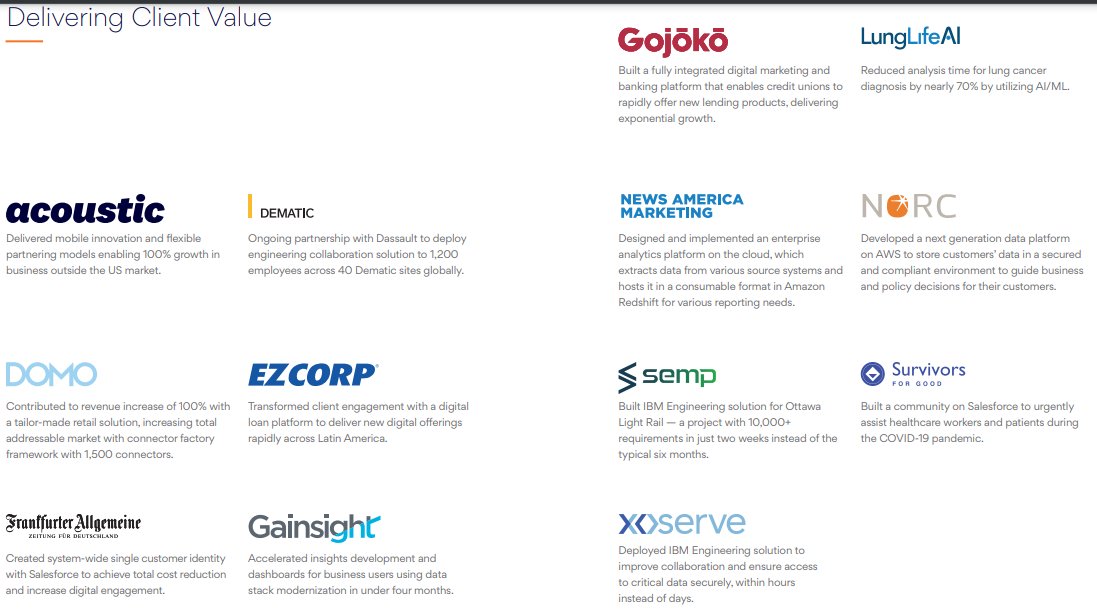

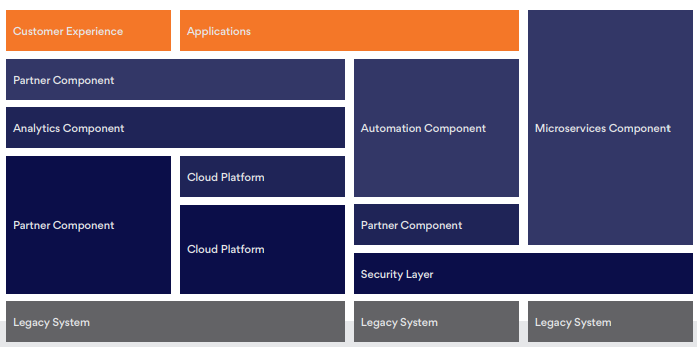

Unleashing client value through Digital Mosaics

A multi-cloud, multi-service business architecture, with composable tiles that together deliver the working applications and processes needed in an enterprise

Way forward

Unleashing client value through Digital Mosaics

A multi-cloud, multi-service business architecture, with composable tiles that together deliver the working applications and processes needed in an enterprise

3/

Way forward

~Global Solutions Company

~Delivering digital business acceleration

~Delivering enterprise modernization

Way forward

~Global Solutions Company

~Delivering digital business acceleration

~Delivering enterprise modernization

7/

Details of Buyback of Equity Shares

~Open Market Route

~4.47 % of Equity bought back @ 628

~CMP 1150

Details of Buyback of Equity Shares

~Open Market Route

~4.47 % of Equity bought back @ 628

~CMP 1150

9/

Top 10 Shareholders

~HDFC MF

~L&T MF

~Govt Pension Fund

~PSPL ESOP Mgmnt Trust

~Kotak MF

~PPFAS

~ICICI

~Shridhar Shukla

~Ashutosh Joshi

~Mobius Inv Trust

Top 10 Shareholders

~HDFC MF

~L&T MF

~Govt Pension Fund

~PSPL ESOP Mgmnt Trust

~Kotak MF

~PPFAS

~ICICI

~Shridhar Shukla

~Ashutosh Joshi

~Mobius Inv Trust

10/

3 Stage Impact of CVOID-19 on Business:

~Immediate response to the pandemic

~Recovery & Path to Next Normal

~Subsequent Growth

3 Stage Impact of CVOID-19 on Business:

~Immediate response to the pandemic

~Recovery & Path to Next Normal

~Subsequent Growth

11/

Immediate response to the pandemic

~ Facing the pandemic

~ Work from home – IT Enablement

~ Cash flow crisis

~ Communications with relevant stakeholders

Immediate response to the pandemic

~ Facing the pandemic

~ Work from home – IT Enablement

~ Cash flow crisis

~ Communications with relevant stakeholders

12/

Recovery & Path to Next Normal & Subsequent Growth

~ Penetrate and grow in some focused segments

~ Partnerships with leaders(IBM, Salesforce, etc)

~ Partner engagement in BFSI

Recovery & Path to Next Normal & Subsequent Growth

~ Penetrate and grow in some focused segments

~ Partnerships with leaders(IBM, Salesforce, etc)

~ Partner engagement in BFSI

13/

Tech Trends Ahead

~Future of the Digital: See Beyond, Rise Above

~Compose your digital enterprise mosaic

~Scale enterprise intelligence

~Leverage Cloud & Edge for flexible infrastructure

~Build a zero-trust enterprise

~Create personalized multiple experiences for customers

Tech Trends Ahead

~Future of the Digital: See Beyond, Rise Above

~Compose your digital enterprise mosaic

~Scale enterprise intelligence

~Leverage Cloud & Edge for flexible infrastructure

~Build a zero-trust enterprise

~Create personalized multiple experiences for customers

15/

This brings us to the end of AR 2019-20 Notes

We are not done yet.

More to come soon on Persistent Systems

End

This brings us to the end of AR 2019-20 Notes

We are not done yet.

More to come soon on Persistent Systems

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh