Fashion trends come and go. PoW is a timeless foundation of our new digital civilization.

In this article, we explore some deep questions about the hashpower market dynamics. Sure you've heard of "hashrate follows price", but how does it REALLY work?

aniccaresearch.tech/blog/the-alche…

In this article, we explore some deep questions about the hashpower market dynamics. Sure you've heard of "hashrate follows price", but how does it REALLY work?

aniccaresearch.tech/blog/the-alche…

In Part I, we presented a simple heuristic for understanding hashpower as an asset class. The hashpower market dynamics is driven by a convoluted interplay of exogenous and endogenous factors. We need to untangle them and scrutinize how they interact in greater depth.

We start by breaking the mining market cycle into four archetypal stages, each with distinct price trends, hashrate trends, hardware capacity, and underlying sentiments.

We call them: a. The Rising Bull, b. Mining Gold Rush, c. Inventory Flush, and d. The Shake Out.

We call them: a. The Rising Bull, b. Mining Gold Rush, c. Inventory Flush, and d. The Shake Out.

We go through each scenario with plenty of real war stories, examine the key characteristics in each scenario, and illustrate how they shape these macro cycles.

We intend to introduce a guiding framework for understanding different investment environments in mining.

We intend to introduce a guiding framework for understanding different investment environments in mining.

But knowing these patterns exist is not enough. We need to understand why the hashpower market manifest these cycles. How come changes in price don’t lead to commensurate adjustments in hashpower? In other words, why isn’t the hashpower market efficient?

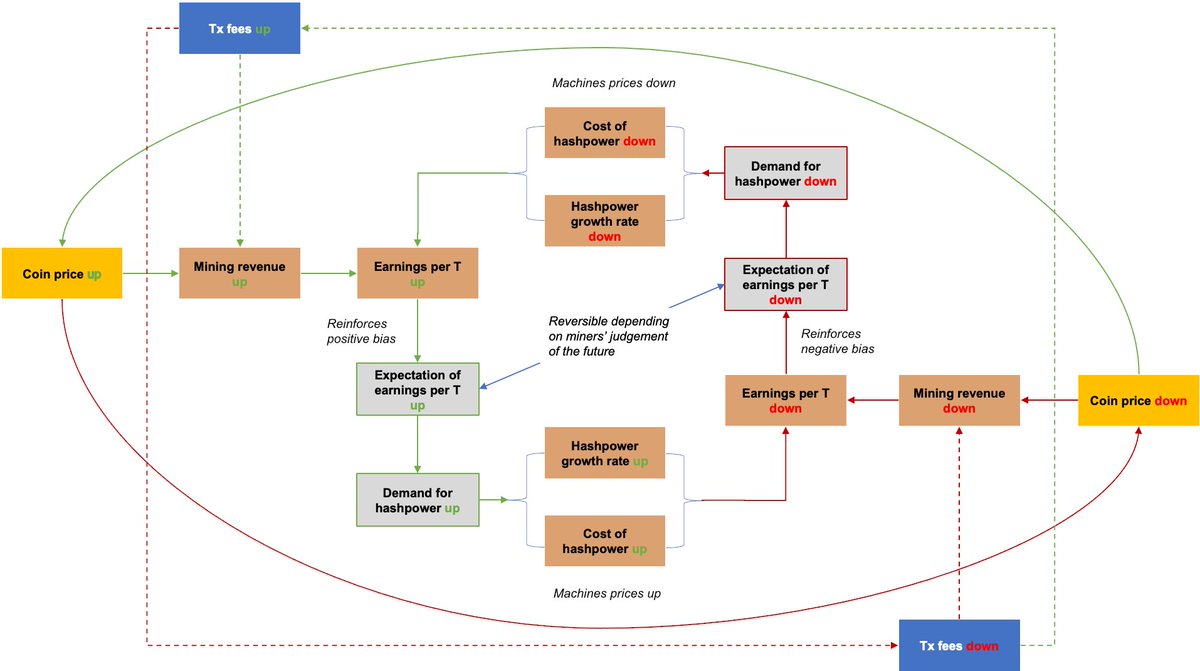

While for most physical commodities, the supply is largely determined by production and demand by consumption, speculation pushes the crypto investors to make decisions based on expectation of future price rather than the current supply and demand curves.

Miners always bring their own bias to the game. This is Plato’s Allegory of Cave for the market fundamentals.

With cognitive fallibility comes reflexivity. Buy and sell decisions are based on the participant’s own expectation of the future mining revenue.

With cognitive fallibility comes reflexivity. Buy and sell decisions are based on the participant’s own expectation of the future mining revenue.

Everyone has their own bias for guess the price. Hashrate growth, on the other hand, is much more challenging to build models for. It's dynamic & recursive: every participant in the hashpower market constantly changes the rest of the market.

We often see divergences in hashpower and price as illustrated in the four stages of the market. Information in capital markets travels fast. Hardware manufacturing & transportation is slow. The hashpower market is the opposite of what’s idealized in Efficient Market Hypothesis.

This means vanilla correlation analysis is useless. The time-series need to be analyzed on different time scales.

Take Litcoin for example, between Jan-May 2018 its hashrate took a long time to respond to the price change. After July, hashpower and price became very synchronized

Take Litcoin for example, between Jan-May 2018 its hashrate took a long time to respond to the price change. After July, hashpower and price became very synchronized

The responsiveness is neither inherently good or bad. It is a function of the availability of the hashpower on the market at the given time, as well as the time-preference of the miners.

In most cases changes in price precedes changes in hashpower. Occasionally we can observe the inverse in altcoin markets, usually altcoins that are about to go through Halving or special market events (P&D group accumulating, new GPU project launching)

To take the macro model further, fee trend should be a principal variable as well. As discussed, at the moment the expectation of mining revenue is primarily driven by price trends. In the past August, Ethereum miners made a total of $113 million in profit.

Having fees as a key variable opens up new games (cc. @phildaian @tzhen @gakonst @tarunchitra). There will be more services that tackle the emerging fees market. As fee income constitutes a growing % of mining revenue, it adds another dimension to mining revenue considerations.

As fees as % mining revenue increases, the four archetypal stages will expand to even more complex scenarios.

The combined effect will introduce more challenges and uncertainties to risk management.

The hashpower industry is still young. We have a lot work to do.

The combined effect will introduce more challenges and uncertainties to risk management.

The hashpower industry is still young. We have a lot work to do.

Big thanks to @thinktankkv for helping me with the data.

Again, thanks to @nic__carter @derek_hsue @QwQiao for taking the time to review the article.

Special thanks to @hasufl for critical feedbacks that made this significantly better!

Again, thanks to @nic__carter @derek_hsue @QwQiao for taking the time to review the article.

Special thanks to @hasufl for critical feedbacks that made this significantly better!

• • •

Missing some Tweet in this thread? You can try to

force a refresh