Some encouragement to comment on $SNOW IPO. While it would be easy to do normal post wrt mispricing, it is important to understand what is different here from other IPOs. The most important data is broad (40 years of underpricing, 2020 worst year yet), vs. 1 company. [cont]

First, its important to acknowledge that @SnowflakeDB is an amazing outlier, & proof of the innovation that develops from this great place we call Silicon Valley. Hats off to the employees, Frank Slootman, @laserlikemike, @altcap, @carl_eschenbach, & all those involved. [cont]

Outside of if the company/shareholders "gave up" anything, the hand allocated investors received $4.3B is one day wealth transfer. That's an insane amount of REAL money. That, along with watching the theatre and drama today, it is HARD to say - this is exactly how it should work!

In many ways, $SNOW is the final proof of just how broken process is. Frank Slootman is a HIGHLY experienced IPO CEO. He knows the game, & pushed hard to make sure he wasn't short-changing the company. But it didn't matter, because the process is set up to deliver this silliness.

Two other thoughts. One of the main arguments for hand-allocation is "you want to choose long term shareholders." $SNOW sold 32.2mm shares last night. Today, 35.7mm shares traded; how does that work? And no one checks to see who held, who sold, etc. Never measured/disclosed.

One company I worked with went to do a secondary 4 months after IPO, and only 10% of the IPO shares were still held. It's ludicrous to think you can "control" who owns your stock. IPO allocators aren't locked up, and once your public, your investors choose you. And that's OK.

The last point is about fairness. One well-known individual said to me "I tried so hard, for weeks, to get into the SNOW IPO. They said it was the hottest IPO since FB...I could not get allocation." This $4.3B of 1-day free money is reserved for those "closest" to banks.

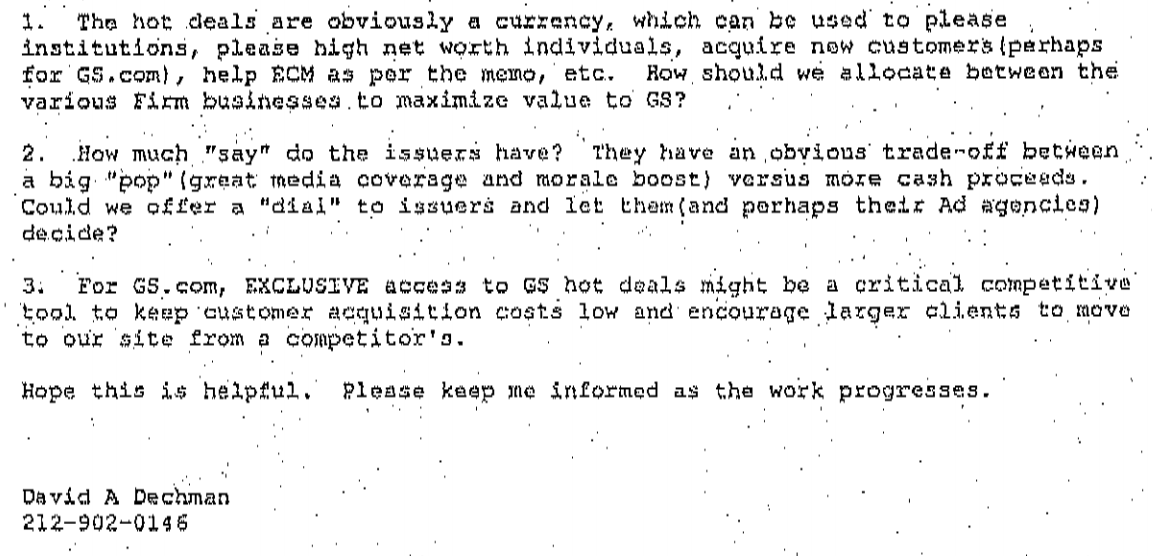

In world where we are all decrying inequity/unfairness, is this really how we want our capital markets to work? Is this not the epitome of the rich getting richer as a direct result of being rich? The attached email shows exactly who receives said rewards.

• • •

Missing some Tweet in this thread? You can try to

force a refresh