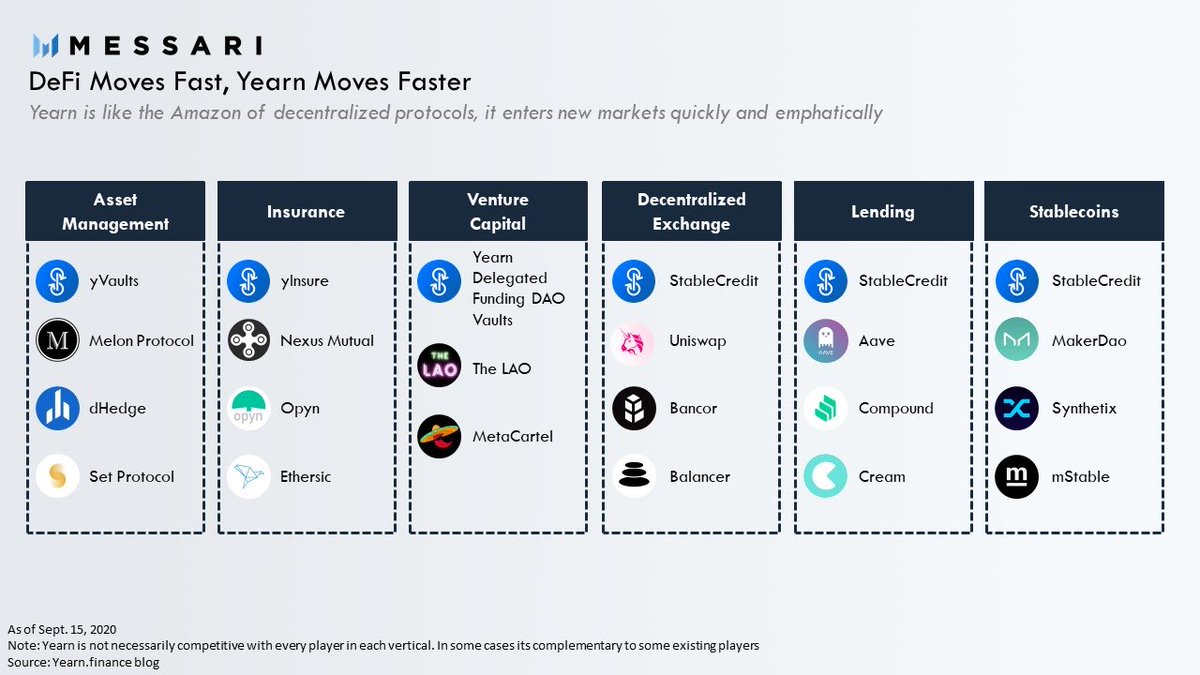

DeFi moves fast. Yearn moves faster.

As if launching a $1bn asset management platform in 8 weeks wasn’t enough, Yearn is now entering new markets rapidly.

The latest being AMMs, lending, and stablecoins through a potentially disruptive new protocol called StableCredit.

1/

As if launching a $1bn asset management platform in 8 weeks wasn’t enough, Yearn is now entering new markets rapidly.

The latest being AMMs, lending, and stablecoins through a potentially disruptive new protocol called StableCredit.

1/

In a nutshell StableCredit is MakerDAO + Aave + Bancor combined, but with minimal governance and no token ($YFI is not involved).

The latter two points hint at StableCredit’s ambition to be truly decentralized infrastructure that requires minimal human interaction to run.

The latter two points hint at StableCredit’s ambition to be truly decentralized infrastructure that requires minimal human interaction to run.

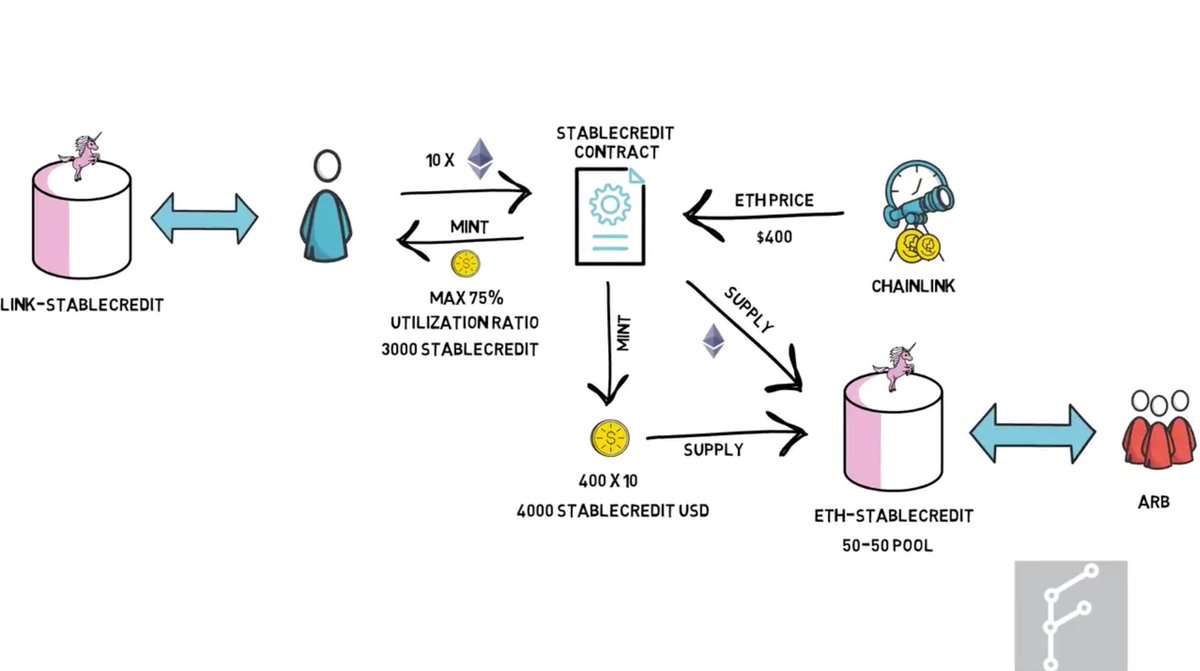

StableCredit allows users to deposit an asset and then receive a credit line that allows them to borrow up to 75% of the collateral they provided.

In the internal StableCredit economy when a user deposits an asset the protocol mints an equivalent amount of StableCredit USD (a new stablecoin) using an oracle to determine price, then supplies the deposited asset and StableCredit USD into a Uniswap pool.

The protocol then calculates a system utilization ratio (what the percentage contribution of the pool you added to the entire ecosystem worth) up to a maximum of 75%, then mints the utilization ratio value of the deposited asset as StableCredit USD.

StableCredit USD is like a “lending credit” that allows users to borrow any of the other assets supplied to StableCredit.

To borrow an asset you “sell” your StableCredit USD for it.

To borrow an asset you “sell” your StableCredit USD for it.

To repay your debt you “sell” the borrowed asset back for StableCredit USD, which you can use to repay your debt and receive your collateral back.

Below is a great visual overview from @finematics of how this works using ETH and LINK as an example.

So that’s how StableCredit works in a nutshell.

But what does it mean for the rest of DeFi and why does it matter for Yearn?

But what does it mean for the rest of DeFi and why does it matter for Yearn?

In my latest piece I cover:

1. How StableCredit could disrupt the DEX, lending, and stablecoin verticals

2. How StableCredit helps scale Yearn’s vaults by orders of magnitude (and what it means for )

Why DeFi investors should pay attention.

messari.io/article/stable…

1. How StableCredit could disrupt the DEX, lending, and stablecoin verticals

2. How StableCredit helps scale Yearn’s vaults by orders of magnitude (and what it means for )

Why DeFi investors should pay attention.

messari.io/article/stable…

Appendix (yea we’re doing that on tweet storms now).

There’s a lot of moving parts here and a lot of interesting stuff going on that this thread doesn’t fully capture.

Highly recommend reading the piece.

You can start a free 7-day trial here.

messari.io/pricing?utm_so…

There’s a lot of moving parts here and a lot of interesting stuff going on that this thread doesn’t fully capture.

Highly recommend reading the piece.

You can start a free 7-day trial here.

messari.io/pricing?utm_so…

• • •

Missing some Tweet in this thread? You can try to

force a refresh