Bitcoin is the most compelling monetary asset to emerge since gold.

As the birth of a new asset class, it could scale more than an order of magnitude to the trillions during the next decade

Part 2 is officially here: Bitcoin As An Investment

@coinmetrics

ark-invest.com/white-papers/b…

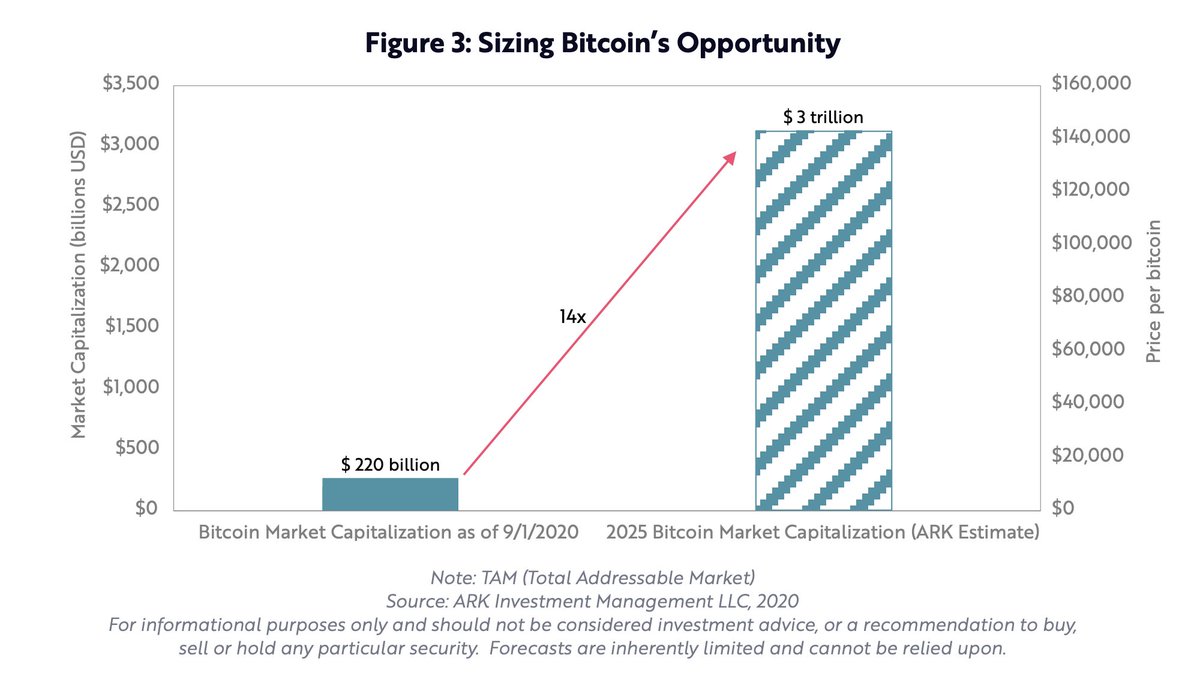

As the birth of a new asset class, it could scale more than an order of magnitude to the trillions during the next decade

Part 2 is officially here: Bitcoin As An Investment

@coinmetrics

ark-invest.com/white-papers/b…

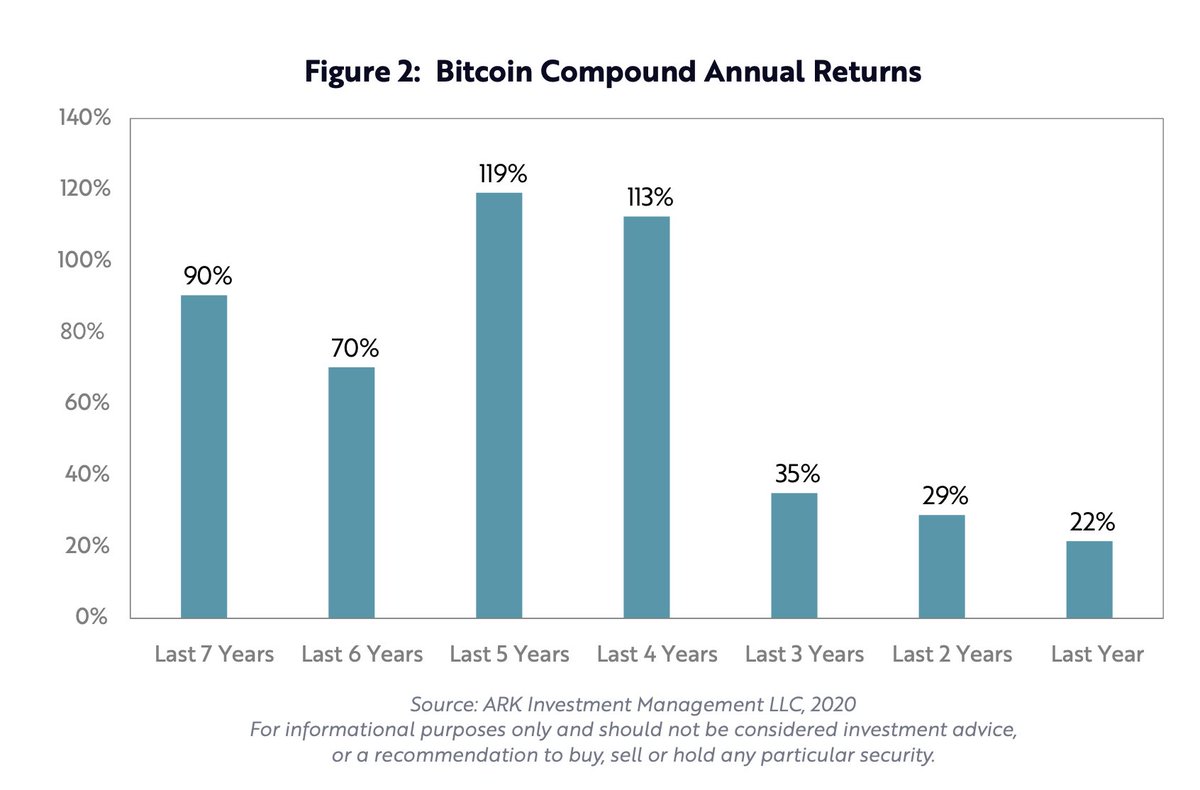

Five years ago, a $10,000 investment in bitcoin would have delivered a 119% CAGR and would be worth roughly $500,000 today.

In fact, during any yearly holding period since inception through September 1, 2020, bitcoin’s return has been positive, significantly so in most case.

In fact, during any yearly holding period since inception through September 1, 2020, bitcoin’s return has been positive, significantly so in most case.

Despite its run, bitcoin is early on its path to monetization, with substantial appreciation potential.

In our view, Bitcoin’s $200 billion market capitalization - or network value - will scale more than an order of magnitude to the trillions during the next decade.

In our view, Bitcoin’s $200 billion market capitalization - or network value - will scale more than an order of magnitude to the trillions during the next decade.

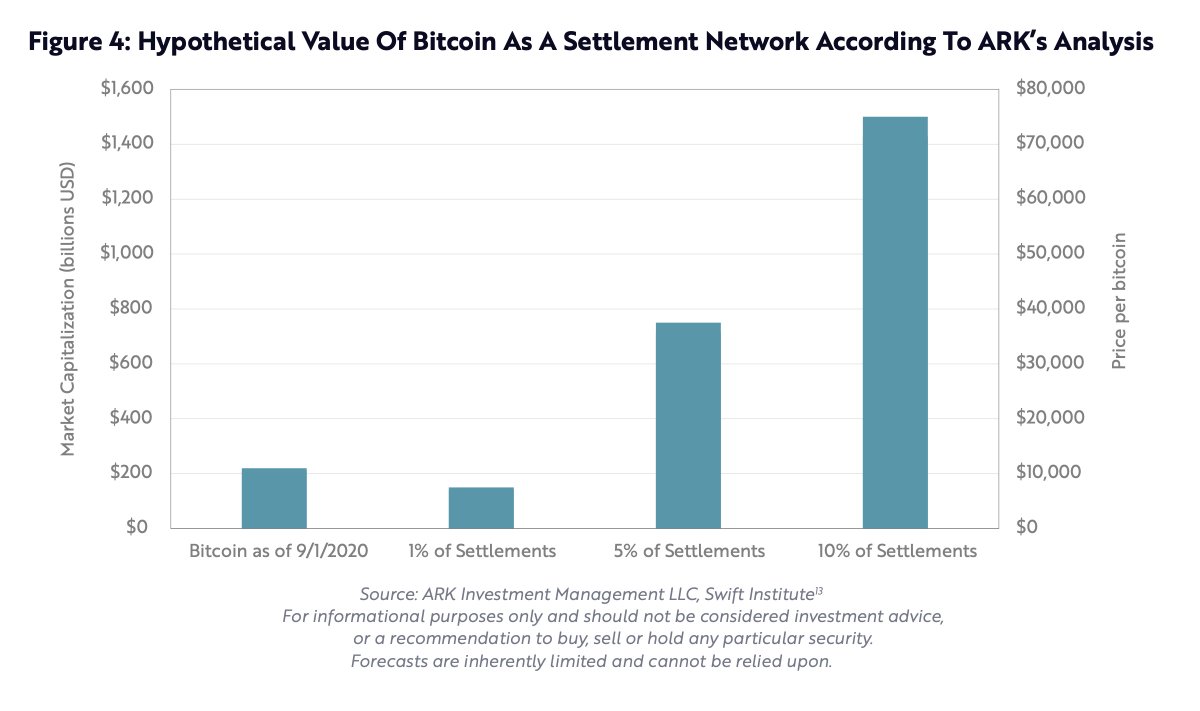

Bitcoin could become a settlement system for banks and businesses. Unlike traditional settlement systems, the Bitcoin network is global, it cannot censor transactions, and its money cannot be inflated by institutions like central banks.

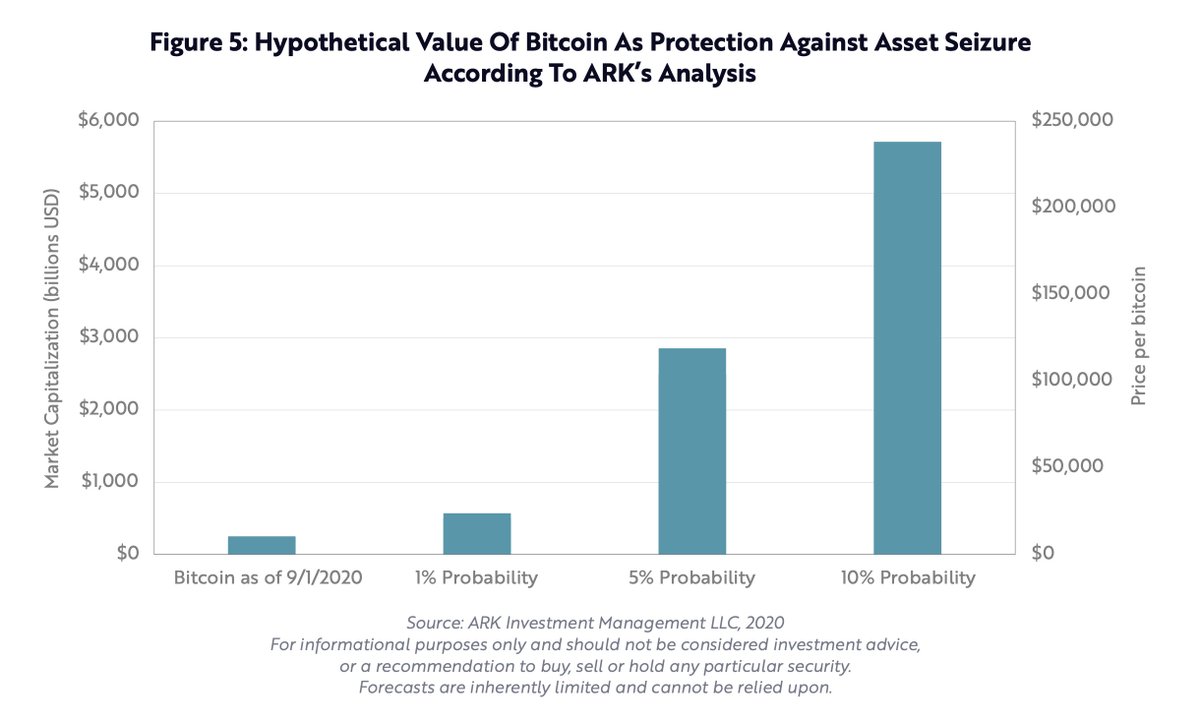

Bitcoin could provide protection against the arbitrary seizure of assets

In our view, a sensible allocation to bitcoin would approximate the probability that a misguided regime will confiscate assets - whether by inflation or by outright seizure - during an individual’s lifetime

In our view, a sensible allocation to bitcoin would approximate the probability that a misguided regime will confiscate assets - whether by inflation or by outright seizure - during an individual’s lifetime

Not only is bitcoin scarce and durable, but it also is divisible, verifiable, portable, and transferable, all of which protect from the threat of centralization. If it were to take 10% share of the physical gold market, bitcoin’s network value could increase nearly $1 trillion.

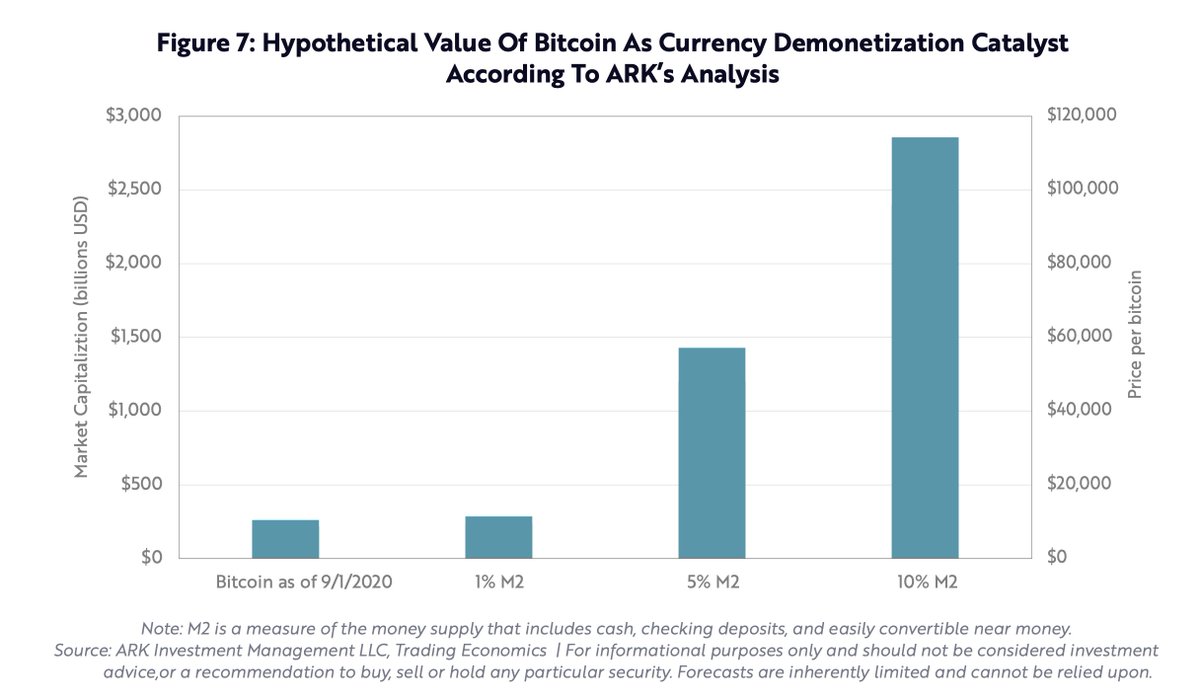

While Bitcoin has not evolved enough to service an entire economy, we believe demand for bitcoin in emerging markets should increase as its infrastructure reaches critical mass.

Many investors resist exposure to bitcoin because of its volatility. While distracting perhaps, bitcoin’s volatility actually highlights its uniqueness. Bitcoin does not prioritize exchange rate stability, relying instead on a quantity rule of money and the free flow of capital.

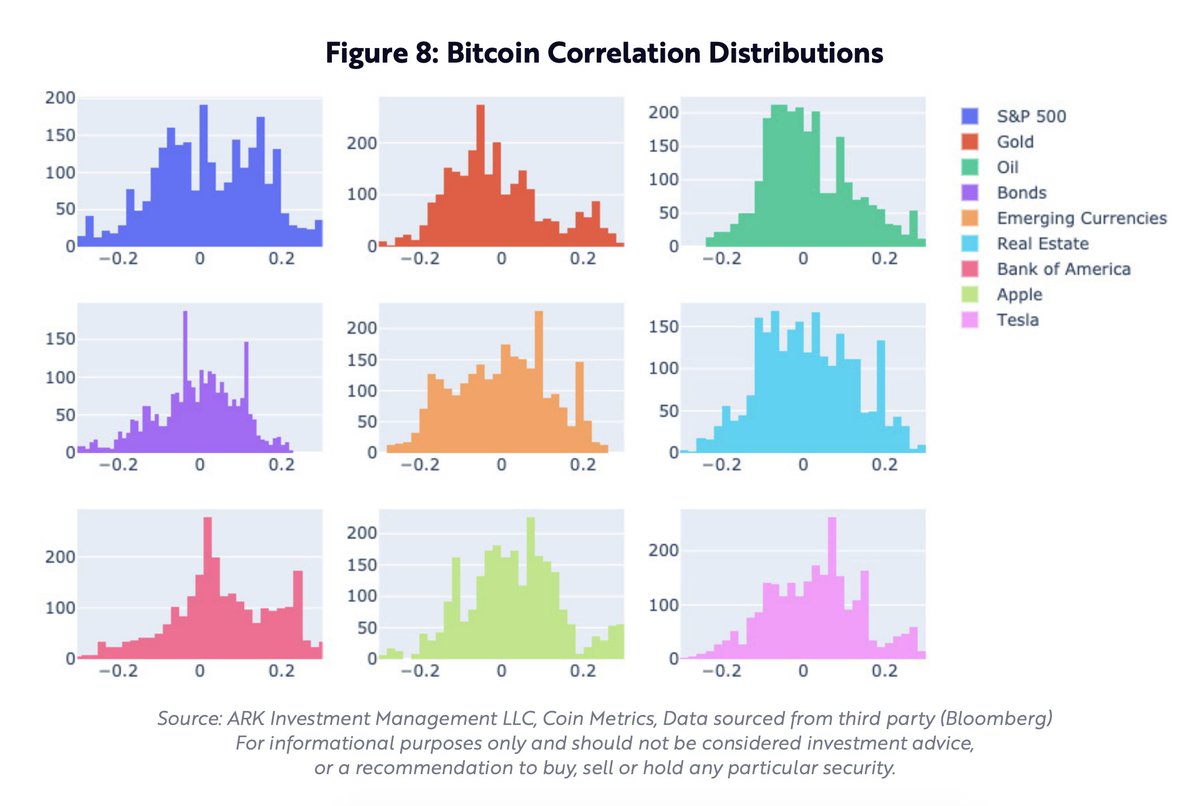

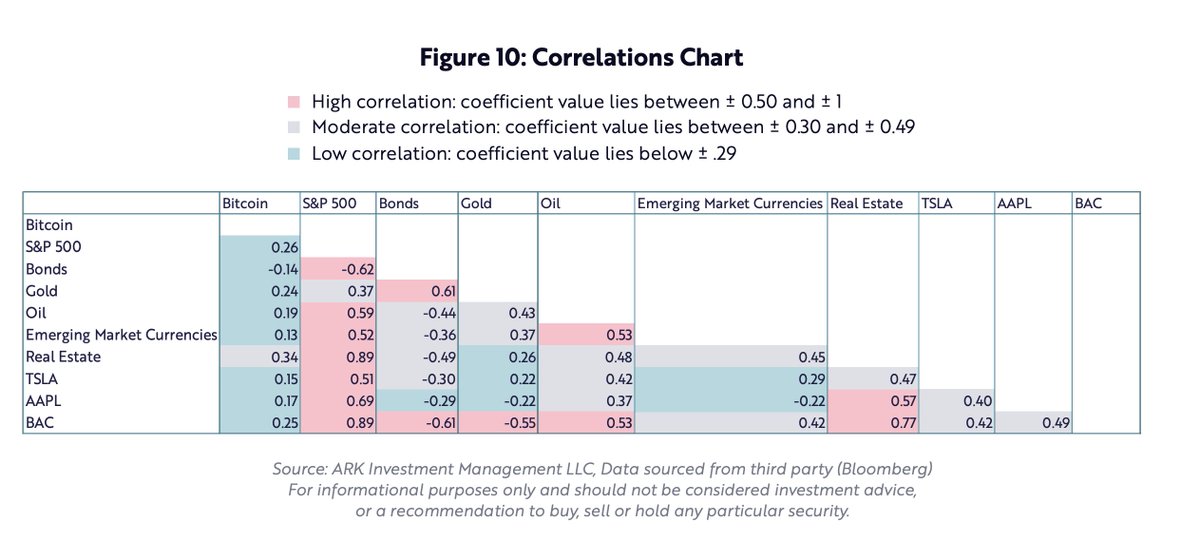

Untethered from traditional rules and regulations and, generally uncorrelated to the behavior of other

asset classes, bitcoin could serve as a strategic allocation in well-diversified portfolios, despite its

volatility.

asset classes, bitcoin could serve as a strategic allocation in well-diversified portfolios, despite its

volatility.

Even at extremes, bitcoin appears to be the only asset with consistently low correlations relative to traditional asset classes.

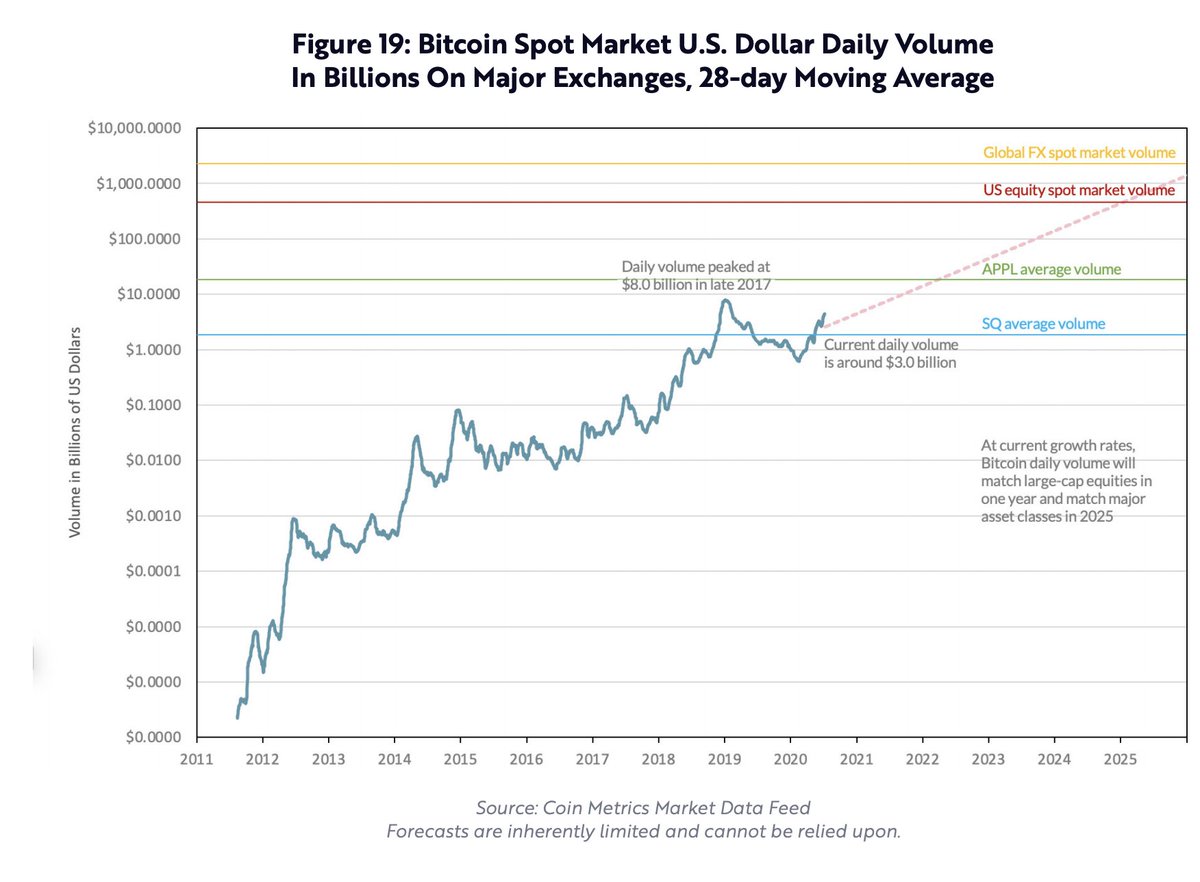

Bitcoin’s trading volume ranges from $200 million to $12.4 billion per day. Given $200 million in daily trading, a buy-side institution limited to 10% of the volume could deploy roughly $20 million per day.

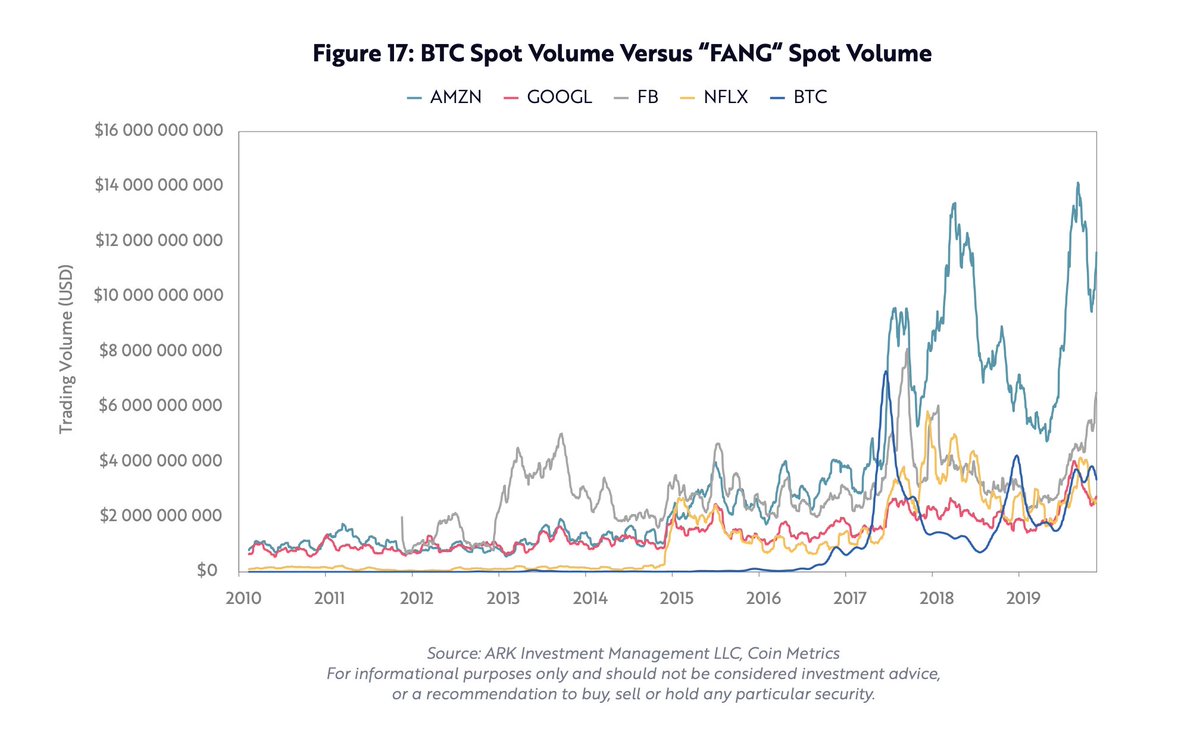

With daily trading volume of $3 billion, bitcoin’s spot markets are di minimis compared to U.S. equity markets, U.S. bond markets, and global foreign exchange markets. In other words, bitcoin trading is comparable in size to a large cap stock rather than an entire asset class.

Compared to the “FANG” stocks, bitcoin’s trading volume is higher than that of Netflix and Google but lower than that of Amazon and Facebook.

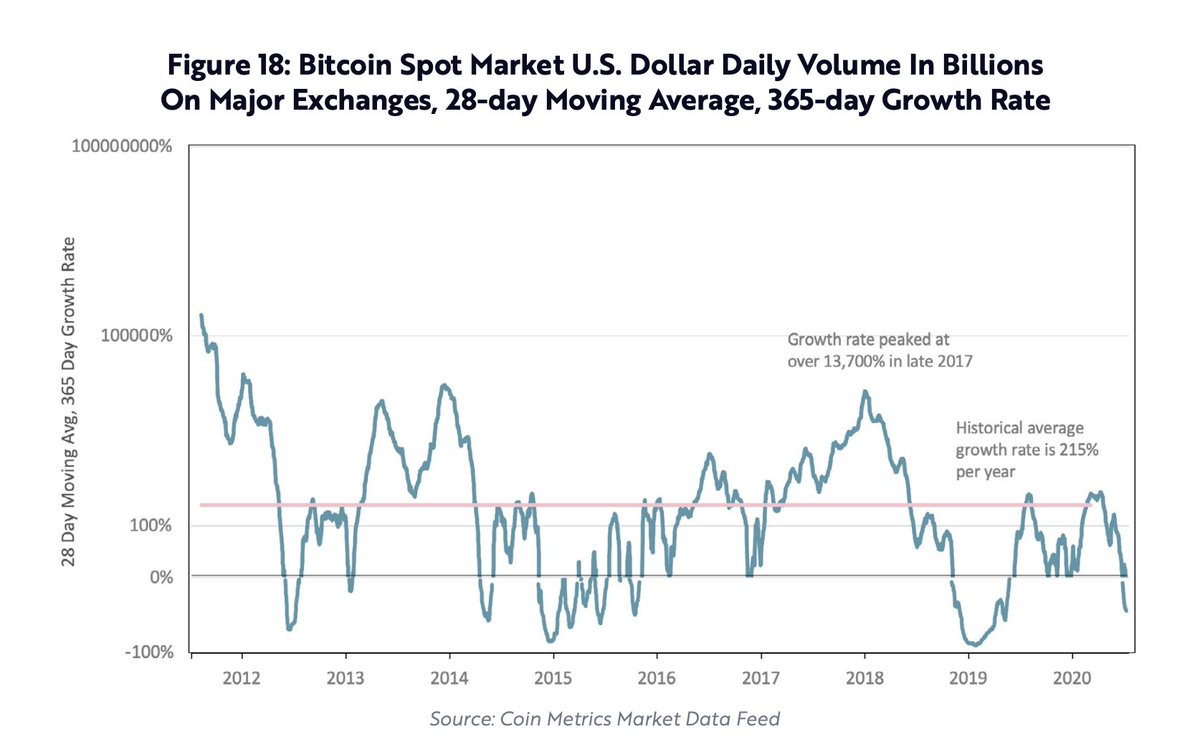

That said, bitcoin’s trading volume has been growing exponentially. Since early 2013, it has been compounding at an annual rate of 215%, tripling volumes every year, as shown below.

At historical growth rates, bitcoin’s daily volume would exceed the volume of the US equity market in fewer than 4 years, and the volume of the US bond market in fewer than 5 years.

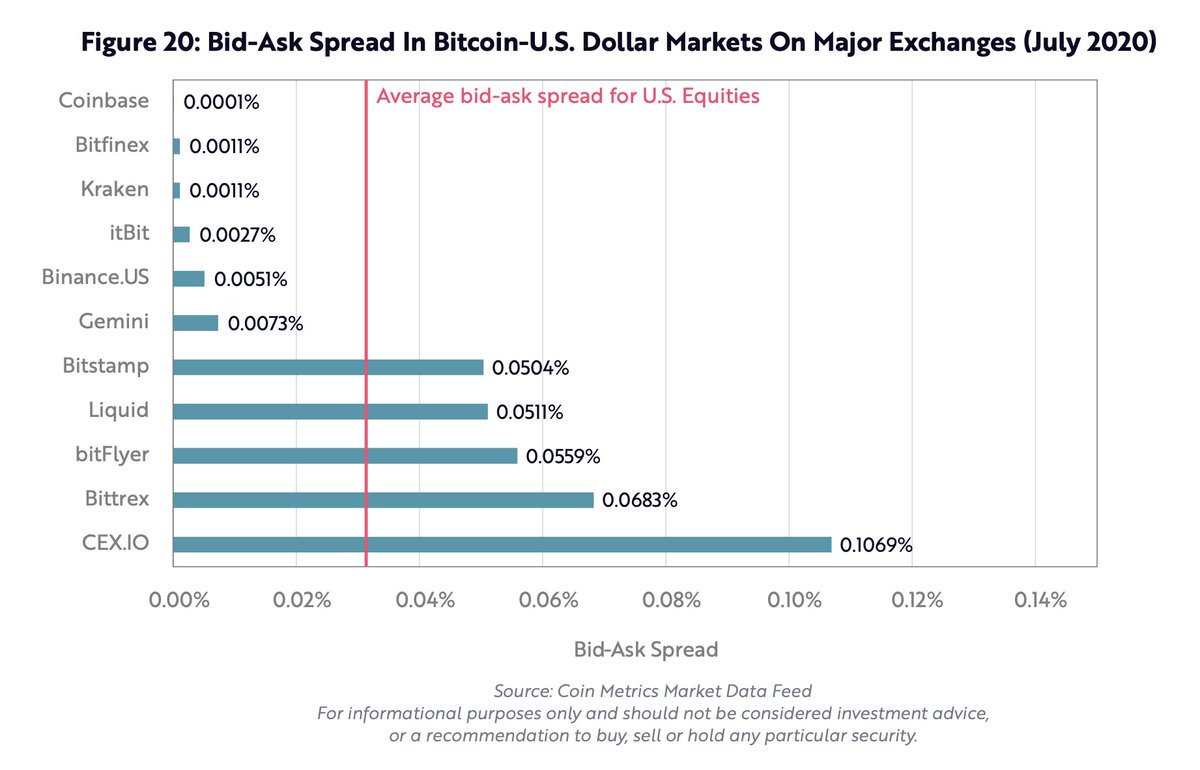

Bitcoin's liquidity also looks healthy. Today, at the largest

trading venues globally, spreads can be di minimis at the top exchanges, as low as 0.0001%. For comparison, the average US equity bid-ask spread is roughly 0.035%.

trading venues globally, spreads can be di minimis at the top exchanges, as low as 0.0001%. For comparison, the average US equity bid-ask spread is roughly 0.035%.

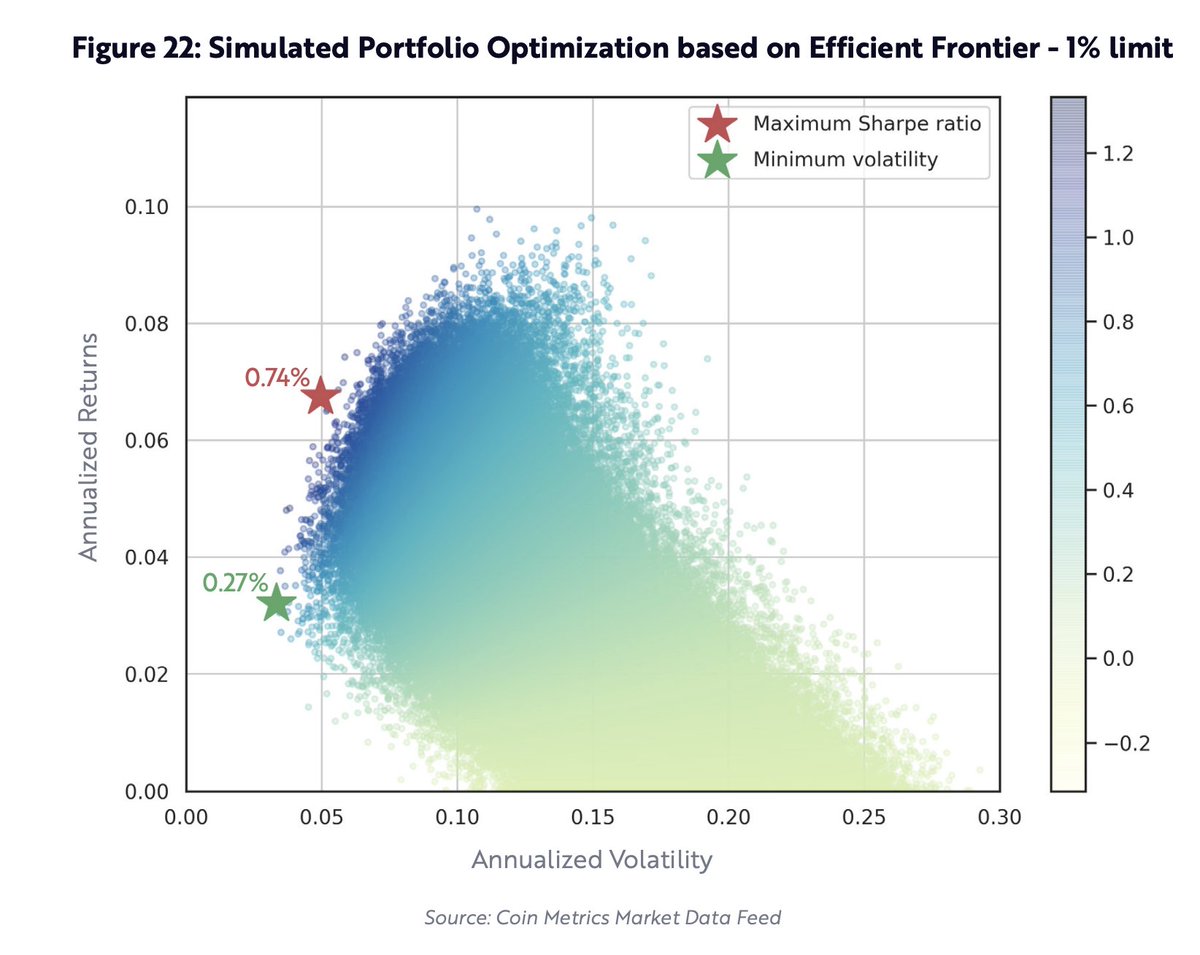

Because bitcoin’s liquidity and volume appear to approach those of mega-cap public equities, they can inform institutional allocations. Based on daily returns during the past 10 years, we simulated 1,000,000 portfolios composed of various asset classes.

In our first simulation, when limited to 1% bitcoin, institutions optimizing for returns relative to volatility would allocate 0.27%, while those aiming for the highest

Sharpe Ratio would allocate 0.74%.

Sharpe Ratio would allocate 0.74%.

Removing the 1% limit to allocation as bitcoin’s volume and liquidity approach those of a separate asset class, allocations to bitcoin would range from 2.55% when maximizing returns and minimizing volatility to 6.55% when maximizing Sharpe Ratios.

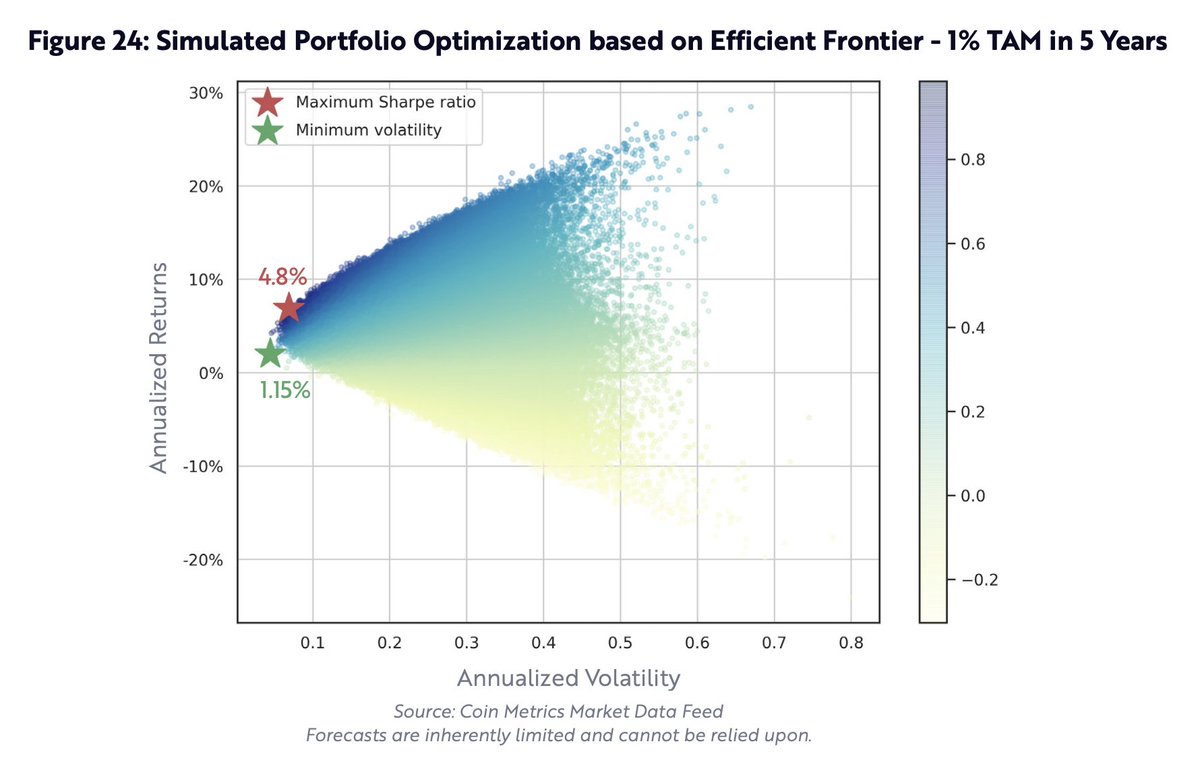

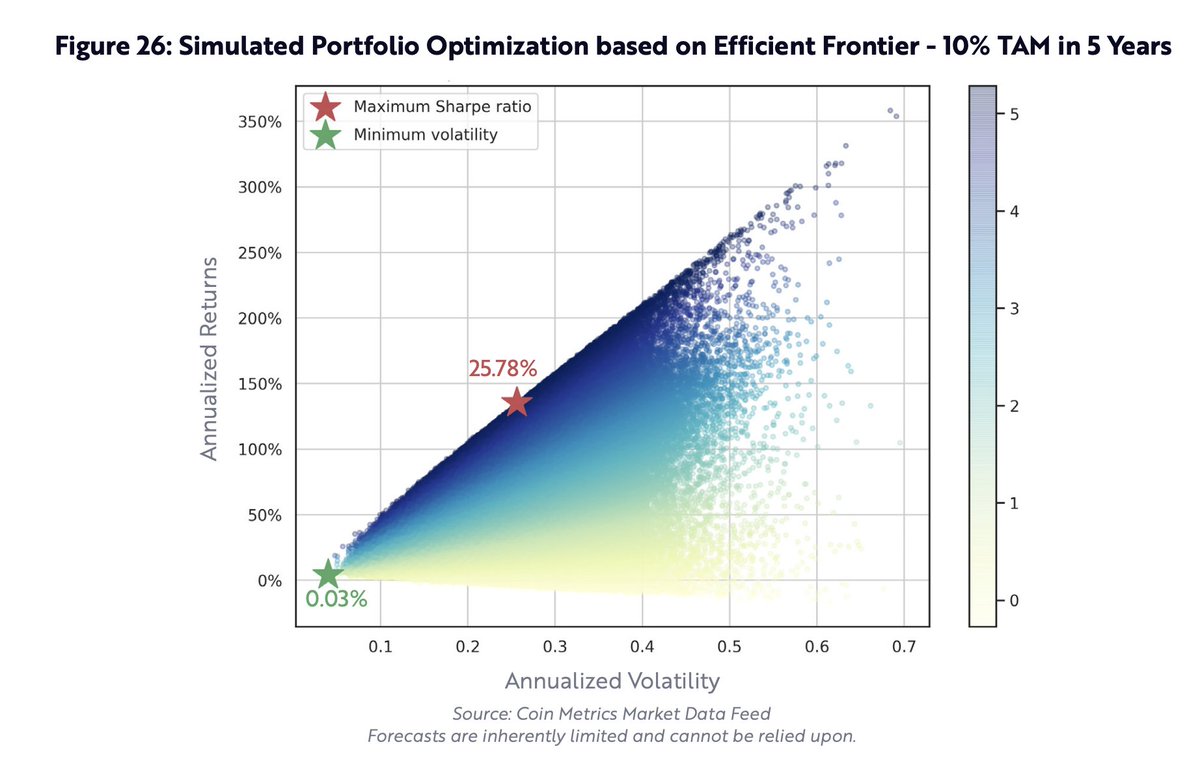

Constructing a predictive model which includes our 5-year forecast for bitcoin’s TAM, investors seeking to minimize volatility would allocate between 0.03% and 1.28% to bitcoin. Investors seeking to maximize Sharpe Ratio would allocate between 4.8% and 25.78% to bitcoin.

Bitcoin offers one of the most compelling risk-reward profiles among assets of the 21st century. Capital allocators must deeply consider the opportunity cost that will be associated with ignoring it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh