🧵Since it's Friday, I want to tell you a story that has nothing to do with COVID or lockdowns or any of that. A story of human ingenuity that boggles the mind. It begins with this, @apple's latest product launch this week apple.com/apple-events/s…

Now, on the face of it this keynote was a less exciting than usual. No new iPhones or Macs. Just an upgraded watch and new mid-range iPad. But anyway for me the most interesting bit of these presentations is the bit about the chips. You know: the bit where we go into the lab...

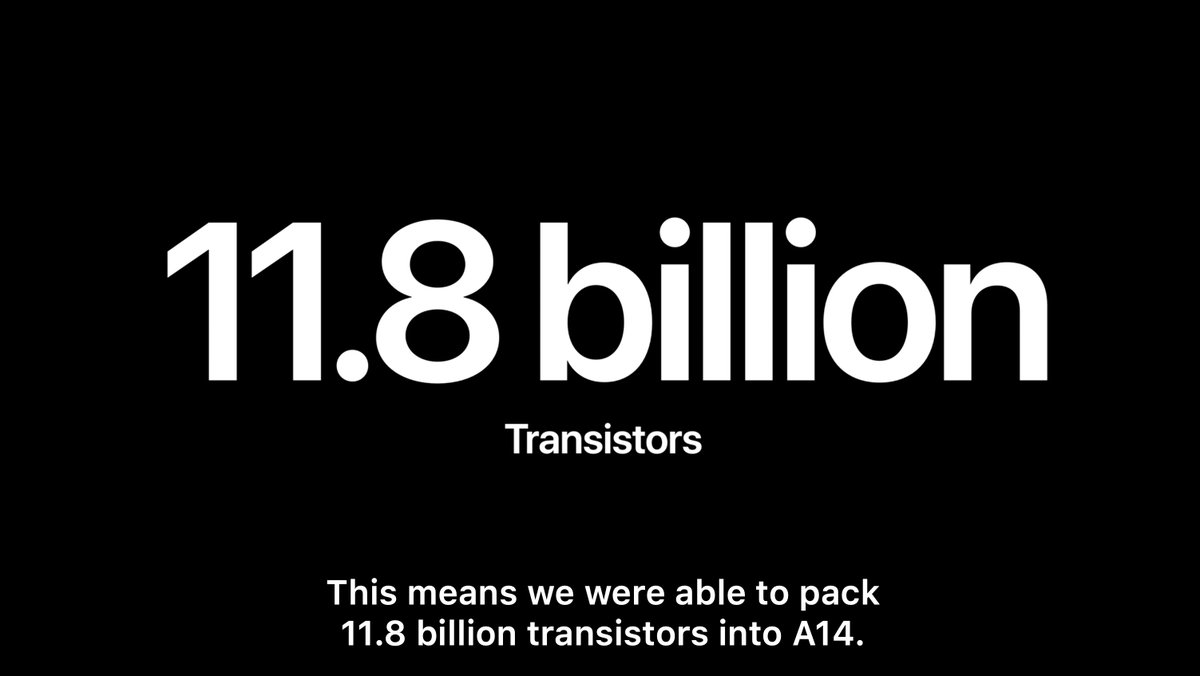

And this time around the news from the lab is genuinely exciting. The A14 chip going into the new iPad (and the new iPhone once they announce that) is built out of transistors measuring five nanometres. This is truly amazing.

The transistors in these chips are 1,000 times smaller than a red blood cell.

24 times smaller than a particle of COVID-19.

It'll be 16 times more powerful than Deep Blue, the IBM supercomputer that beat @Kasparov63 in 1997. But small enough to balance on your fingertip

24 times smaller than a particle of COVID-19.

It'll be 16 times more powerful than Deep Blue, the IBM supercomputer that beat @Kasparov63 in 1997. But small enough to balance on your fingertip

There wasn't much fanfare about this (look new iPads everyone!) and it was buried away at the end of the presentation but this is a stunning achievement. And one some people thought we'd never reach. Some chipmakers have already given up on getting to these levels of complexity

True - some will moan about whether Moore's Law is coming to an end. And the speed jump from 7nm to 5nm is nothing like the exponential leaps we saw in the earlier days of computing, but at these scales the chips are running up against the laws of physics - quantum effects etc

The marvel is not only this staggering piece of engineering, more intricate than anything ever created by humankind, but that in a few months millions of us will have them in their pockets. Remember that the next time you complain about how long it's taking for Netflix to load

But - back to the lab - the most interesting thing from that presentation is the little lie we always get in these things. Apple's Tim Millet says "our goal is to build chips..." before going on about the A14's amazing 5nm structure. But here's the thing: Apple didn't build it

Apple doesn't make any chips. It designs them, yes, and it's doing more and more of that. But it doesn't MAKE the chips. That job - perhaps the trickiest job in computing - is done by a company most people outside tech have never heard of: Taiwan Semiconductor Manufacturing Corp

The story of TSMC and how it was associated with a revolution in computing, is one of the most fascinating tales in modern economics, because in a way it's a continuation of a principle which goes all the way back to this fellow, Adam Smith

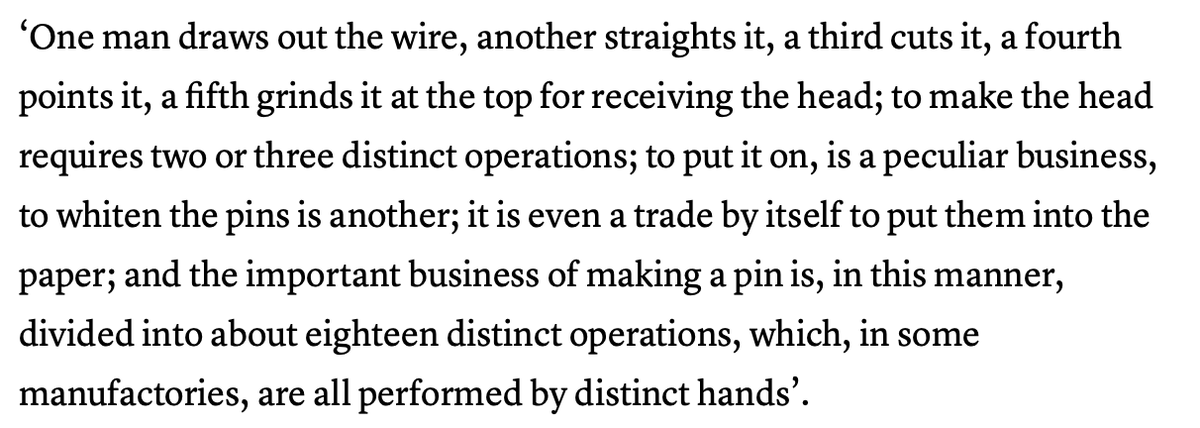

One of the key principles in The Wealth of Nations (1776) was division of labour. Focus on one thing & collaborate & everyone wins. His famous analogy was a pin factory where people worked on different stages making a pin. Far, far more efficient than one person doing everything.

Back in the early days of computing most processor companies were a bit like the single person making a pin. They designed the chip but also wrote the architecture library to control it and had their own factories which made them. Intel still works in that integrated way today.

But over the past couple of decades the whole ecosystem has fragmented. Now many chip companies design their chips but then get someone else to do the other bits like the architecture and the manufacturing. Division of labour writ large!

So Apple relies on Arm for the architecture on its chips and relies on TSMC to make them. Or take Nvidia. It's one of the world's biggest processor companies but it doesn't make any of its chips either! It also relies on Arm for some libraries and gets TSMC to make its chips

Were it not for all this, we might never have gotten to 5nm chips. Intel, which plugs on with the old-fashioned model, is still plugging away at 7nm and won't be down at 5nm for years. By quietly making chips for everyone else TSMC got more biz & invested more in fabrication

In short, the structure of this ecosystem is crucial. That brings us back to two of those companies: Nvidia & Arm. Nvidia wants to buy Arm. Here in the UK there's been some hand-wringing about this since Arm was UK born so is an important employer here. But the stakes are higher

Because if Nvidia succeeds it would represent a seismic change in the direction of travel in the computer processor business. Integration rather than fragmentation and specialisation. One of the anonymous companies which has been the bedrock for these leaps 👆would be gobbled up

Arm is involved in the design & architecture of the vast majority of chips produced these days - in much the same way as TSMC is responsible for building so many of them. They are part of the foundations on which 21st century technological progress is built. Something to ponder.

Apple may be the tip of the tech iceberg, it's worth occasionally thinking about the bit under the water. Lots more on all of this 👆in my @thetimes column today: thetimes.co.uk/article/6a0ef4…

• • •

Missing some Tweet in this thread? You can try to

force a refresh