Mishra Dhatu Nigam Limited

#midhani

midhani-india.in

This PSU gem should be a part of our portfolio. Let us understand the key factors which make this company special like the special alloys it makes!

Cons:

PSU Enterprise

OFS Overhang

Scalability Capped

#Fibonalysis

#midhani

midhani-india.in

This PSU gem should be a part of our portfolio. Let us understand the key factors which make this company special like the special alloys it makes!

Cons:

PSU Enterprise

OFS Overhang

Scalability Capped

#Fibonalysis

1/n

Market Cap: 3,848 Cr.

Reserves: 771.04 cr

ROCE: 20.44 %

ROE: 17.64 %

Face Value:10.00

Debt to equity:0.14

Days Payable Outstanding:91.27

Days Receivable Outstanding:152.27

Inventory Turnover Ratio:0.26

Debtors Turnover:2.19

Current Ratio:2.17

OPM: 23.24%

NPM: 22.41%

EPS: 8.53

Market Cap: 3,848 Cr.

Reserves: 771.04 cr

ROCE: 20.44 %

ROE: 17.64 %

Face Value:10.00

Debt to equity:0.14

Days Payable Outstanding:91.27

Days Receivable Outstanding:152.27

Inventory Turnover Ratio:0.26

Debtors Turnover:2.19

Current Ratio:2.17

OPM: 23.24%

NPM: 22.41%

EPS: 8.53

2/n

Established- 1973

Located- Hyderabad, India

MIDHANI has been set up to achieve self-reliance in production and supply of various super alloys, special steels and materials to Defence, other Strategic Sectors such as, aerospace and energy.

Established- 1973

Located- Hyderabad, India

MIDHANI has been set up to achieve self-reliance in production and supply of various super alloys, special steels and materials to Defence, other Strategic Sectors such as, aerospace and energy.

3/n

Rising demand for high performance materials in the aerospace, automotive, defense industrial gas turbines used in power generation, and growing government spending and private players entering in these sectors are the key demand drivers of the business.

Rising demand for high performance materials in the aerospace, automotive, defense industrial gas turbines used in power generation, and growing government spending and private players entering in these sectors are the key demand drivers of the business.

4/n

High-Performance Alloys market is forecasted to grow at a rate of approximately 5% from an estimated USD 9.0 billion in 2019 to USD 13 billion in 2027

The increasing demand in the aerospace and automotive industry for light materials due to stringent emission norms and

High-Performance Alloys market is forecasted to grow at a rate of approximately 5% from an estimated USD 9.0 billion in 2019 to USD 13 billion in 2027

The increasing demand in the aerospace and automotive industry for light materials due to stringent emission norms and

5/n

increasing fuel efficiency is one of the critical drivers of the market.

India domestically produces only 45% to 50% of defence products it uses, and the rest are imported.

In the aerospace segment about 70% of the raw materials are imported.

increasing fuel efficiency is one of the critical drivers of the market.

India domestically produces only 45% to 50% of defence products it uses, and the rest are imported.

In the aerospace segment about 70% of the raw materials are imported.

6/n

With focus on self reliance, Defence Production Policy of 2018 (DPP-2018) has a goal of India becoming among the top 5 global producers of the aerospace and defence manufacturing with annual export target of US$5 billion by 2025.

Manufacturing: Advanced metals & alloys.

With focus on self reliance, Defence Production Policy of 2018 (DPP-2018) has a goal of India becoming among the top 5 global producers of the aerospace and defence manufacturing with annual export target of US$5 billion by 2025.

Manufacturing: Advanced metals & alloys.

7/n

Special Alloys: 100 grades to meed the demand for critical applications.

Manufacturing: Maraging Steel

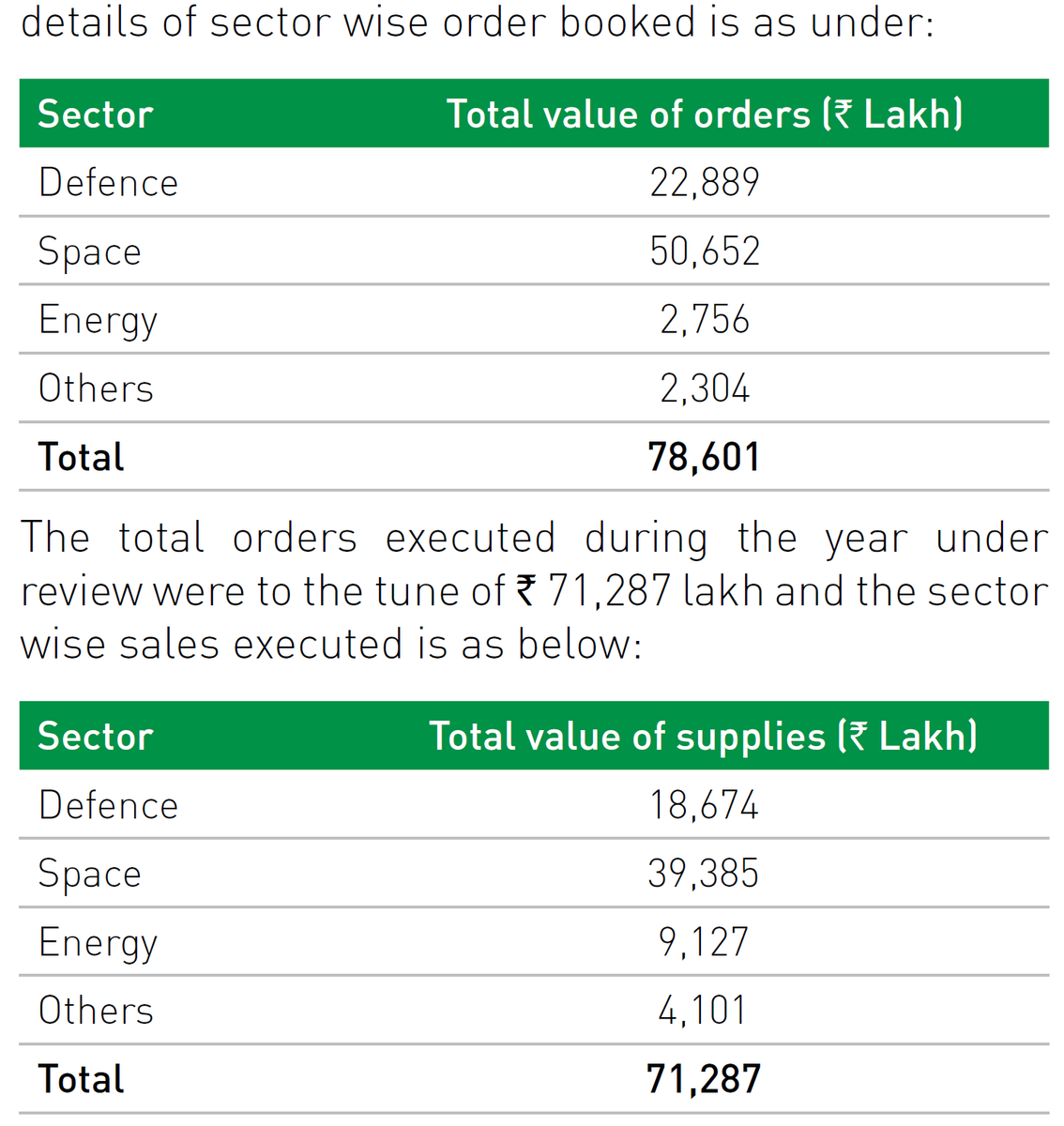

Order Book (as on 01.04.2020):1687 cr

All the business activities contributing 10% or more of the total turnover of the company:

Other Alloy Steel in Semi-finished forms

Special Alloys: 100 grades to meed the demand for critical applications.

Manufacturing: Maraging Steel

Order Book (as on 01.04.2020):1687 cr

All the business activities contributing 10% or more of the total turnover of the company:

Other Alloy Steel in Semi-finished forms

8/n

Special Stainless Steel and Super Alloys: 87.33%

Titanium and Titanium Alloys: 12.67%

Dispatched first consignment of Ultra High Strength Steel and Cobalt alloy ” with stringent quality requirements for Prestigious Human Space Flight Program of ISRO “Gaganyaan”.

Special Stainless Steel and Super Alloys: 87.33%

Titanium and Titanium Alloys: 12.67%

Dispatched first consignment of Ultra High Strength Steel and Cobalt alloy ” with stringent quality requirements for Prestigious Human Space Flight Program of ISRO “Gaganyaan”.

9/n

Under Make in India initiative, MIDHANI has developed for the first time in the country; Heaviest Titanium Alloy Casting (74 kg) for Strategic Application.

Joint Venture with National Aluminium Co. Ltd (NALCO) under the name of “Utkarsha Aluminium Dhatu Nigam Limited”

Under Make in India initiative, MIDHANI has developed for the first time in the country; Heaviest Titanium Alloy Casting (74 kg) for Strategic Application.

Joint Venture with National Aluminium Co. Ltd (NALCO) under the name of “Utkarsha Aluminium Dhatu Nigam Limited”

10/n

to manufacture high end Aluminium Alloy at Nellore, Andhra Pradesh was also incorporated.JV Company has been allotted around 110 acre of land in Andhra Pradesh and yet to commence the commercial operation. The manufacturing plant: estimated capital expenditure of 4,500 Cr.

to manufacture high end Aluminium Alloy at Nellore, Andhra Pradesh was also incorporated.JV Company has been allotted around 110 acre of land in Andhra Pradesh and yet to commence the commercial operation. The manufacturing plant: estimated capital expenditure of 4,500 Cr.

11/n

Sets of Isothermally Forged Titanium Alloy High Pressure Compressor Disc conceived using complete indigenous technology under Industry Research Partnership was developed & supplied for aerospace application.

Successfully developed and supplied to National Aluminium Co. Ltd

Sets of Isothermally Forged Titanium Alloy High Pressure Compressor Disc conceived using complete indigenous technology under Industry Research Partnership was developed & supplied for aerospace application.

Successfully developed and supplied to National Aluminium Co. Ltd

12/n

(NALCO) Caster Roll Shells which are shrink fitted on the core and used for casting of Aluminium Strip with nominal thickness of 7 mm under the “Make in India” initiative.

MIDHANI has developed and supplied 1.5 kg. of 0.16 mm Nickel Wire with purity better than 99.6% which

(NALCO) Caster Roll Shells which are shrink fitted on the core and used for casting of Aluminium Strip with nominal thickness of 7 mm under the “Make in India” initiative.

MIDHANI has developed and supplied 1.5 kg. of 0.16 mm Nickel Wire with purity better than 99.6% which

13/n

was critically required for manufacture of Oxygen sensors pertaining to “Critical Core Ventilator” being produced by Bharat Electronics Limited (BEL) for COVID-19 patients. The material was developed and supplied for the first time within 96 hours during the lockdown period.

was critically required for manufacture of Oxygen sensors pertaining to “Critical Core Ventilator” being produced by Bharat Electronics Limited (BEL) for COVID-19 patients. The material was developed and supplied for the first time within 96 hours during the lockdown period.

14/n

MIDHANI’s supply has helped establish an indigenous source of critical raw material which otherwise had to be imported.

Armour plant at Rohtak will focus on the local and global demand for body and vehicle armouring.

MIDHANI’s supply has helped establish an indigenous source of critical raw material which otherwise had to be imported.

Armour plant at Rohtak will focus on the local and global demand for body and vehicle armouring.

15/n

3 Patents were granted to MIDHANI during the year in special steel, super alloy and titanium alloy for respective applications

An expenditure of 7.97 cr was incurred on R&D in FY 2019-20 and over 10 new products and 7 new manufacturing and technological process have been

3 Patents were granted to MIDHANI during the year in special steel, super alloy and titanium alloy for respective applications

An expenditure of 7.97 cr was incurred on R&D in FY 2019-20 and over 10 new products and 7 new manufacturing and technological process have been

16/n

developed for application in Energy, Space and Defence sector.

MIDHANI has successfully developed spider casting with stringent Aerospace requirements for “Semi Cryo-Engine of Satellite Launch Vehicle”.

Three (3) Billet Grinding machines were manufactured indigenously and

developed for application in Energy, Space and Defence sector.

MIDHANI has successfully developed spider casting with stringent Aerospace requirements for “Semi Cryo-Engine of Satellite Launch Vehicle”.

Three (3) Billet Grinding machines were manufactured indigenously and

17/n

successfully commissioned in the 3rd quarter of FY 2019-20, with this the requirement of imported costly equipment has been eliminated.

A dedicated team has been constituted to develop roadmap for Artificial Intelligence (AI) for alloy development and process optimization.

successfully commissioned in the 3rd quarter of FY 2019-20, with this the requirement of imported costly equipment has been eliminated.

A dedicated team has been constituted to develop roadmap for Artificial Intelligence (AI) for alloy development and process optimization.

18/n

During the FY 2019-20, MIDHANI has filed 50 IPRs which constituted of 24 copyrights and 26 trademarks.

Manufacturing Locations: Hyderabad : Hyderabad Plant is equipped with highly produce a wide variety of special metals and alloys in various mill forms such as

During the FY 2019-20, MIDHANI has filed 50 IPRs which constituted of 24 copyrights and 26 trademarks.

Manufacturing Locations: Hyderabad : Hyderabad Plant is equipped with highly produce a wide variety of special metals and alloys in various mill forms such as

19/n

forged bars/ flats, Rings; near net shapes and closed die forgings, hot rolled bars/ sheets, cold rolled sheets, strips and foils; wires, castings, tubes and fasteners.

Rohtak Plant: At Rohtak plant, Armour products will be manufactured.

forged bars/ flats, Rings; near net shapes and closed die forgings, hot rolled bars/ sheets, cold rolled sheets, strips and foils; wires, castings, tubes and fasteners.

Rohtak Plant: At Rohtak plant, Armour products will be manufactured.

20/n

The primary raw materials used for manufacturing various products are: (a) Nickel metal; (b) Cobalt metal; (c) Various Master Alloys; (d) Pure Iron; (e) Titanium sponge; (f) Chromium metal; (g) Mild Steel scrap/ Stainless Steel scrap; (h) High Carbon/ Low Carbon Ferro Chrome

The primary raw materials used for manufacturing various products are: (a) Nickel metal; (b) Cobalt metal; (c) Various Master Alloys; (d) Pure Iron; (e) Titanium sponge; (f) Chromium metal; (g) Mild Steel scrap/ Stainless Steel scrap; (h) High Carbon/ Low Carbon Ferro Chrome

21/n

; (i) Aluminium metal; (j) Manganese Metal; and (k) Various Ferro alloys.

Property Plant & Equipment has grown from 342.77 cr in FY 2018 to 439.70 cr in FY 2020

Capital work-in-progress has grown from 64.99 cr in FY 2018 to 404.82 cr in FY 2020

; (i) Aluminium metal; (j) Manganese Metal; and (k) Various Ferro alloys.

Property Plant & Equipment has grown from 342.77 cr in FY 2018 to 439.70 cr in FY 2020

Capital work-in-progress has grown from 64.99 cr in FY 2018 to 404.82 cr in FY 2020

22/n

Automobile Sector: This is a very competitive sector with high import content. MIDHANI has undertaken tool steel development and also approached market leader in this sector.

Bio-Medical Implants: This business area is being revived and new MoUs were signed.

Automobile Sector: This is a very competitive sector with high import content. MIDHANI has undertaken tool steel development and also approached market leader in this sector.

Bio-Medical Implants: This business area is being revived and new MoUs were signed.

23/n

Indian Railways: The upcoming Spring manufacturing unit and the Wide Plate Mill will be useful in providing import substitution of LHB Springs and also high-quality Plates for Railway use. MIDHANI is working closely with Railway Board and RDSO as Indian source for the Axles.

Indian Railways: The upcoming Spring manufacturing unit and the Wide Plate Mill will be useful in providing import substitution of LHB Springs and also high-quality Plates for Railway use. MIDHANI is working closely with Railway Board and RDSO as Indian source for the Axles.

• • •

Missing some Tweet in this thread? You can try to

force a refresh