Hello Friends,

Here are the details of how one can do relative fundamental analysis in the sector. As pharma and IT are going to be theme and earnings visibility is there at least till FY21 for sure.

I selected the IT theme and similar analysis one can extend to any sector.

Here are the details of how one can do relative fundamental analysis in the sector. As pharma and IT are going to be theme and earnings visibility is there at least till FY21 for sure.

I selected the IT theme and similar analysis one can extend to any sector.

Common Valuation parameters most of the investors use are PE, PB, ROCE, etc. However, most of the professional value investors use " Enterprise Value" Based metrics. So, let's continue.

EV=Mcap+Debt-Cash

EV is the value one has to pay to buy the company.

EV=Mcap+Debt-Cash

EV is the value one has to pay to buy the company.

Professor Greenblat a well-known value investor and Hedge-fund manager from Colombia University introduced a ratio called

EBIT/EV, this will tell the company efficiency in generating Operating profit in terms of entire company value.

The higher it is, that much efficient.

EBIT/EV, this will tell the company efficiency in generating Operating profit in terms of entire company value.

The higher it is, that much efficient.

Another great fundamental indicator is Free Cash Flow(FCF) Yield.

FCF is the cash in the bank of the company after all the business operations in a year.

We want bank balance to be +ve right!!

So, FCF should be +ve.

FCF is the cash in the bank of the company after all the business operations in a year.

We want bank balance to be +ve right!!

So, FCF should be +ve.

FCF yield

FCF/EV expressed in % tells you the company bank balance from its operations in a year compared to the entire company value.

The higher the percentage the better.

FCF/EV expressed in % tells you the company bank balance from its operations in a year compared to the entire company value.

The higher the percentage the better.

FCF/sales

How much free cash the company is generating from sales. This is what matters.

Whatever the company is, from its sales, how much cash is going into bank balance, this will tell.

So, higher the better.

How much free cash the company is generating from sales. This is what matters.

Whatever the company is, from its sales, how much cash is going into bank balance, this will tell.

So, higher the better.

EV/EBITDA

EBITDA=Sales-Cost and expenses.

EV/EBITDA tells, how much one is paying to buy the company compared to its profit.

It should be small right. Below 10 is considered good.

However, higher indicates you are paying High Like PE.

EBITDA=Sales-Cost and expenses.

EV/EBITDA tells, how much one is paying to buy the company compared to its profit.

It should be small right. Below 10 is considered good.

However, higher indicates you are paying High Like PE.

EV/EBITDA

Considers Debt also compared with PE. Therefore, professionals use EV/EBITDA than PE.

Among peers, if the company EV/EBITDA is less or less than average, then it is an undervalued company.

Considers Debt also compared with PE. Therefore, professionals use EV/EBITDA than PE.

Among peers, if the company EV/EBITDA is less or less than average, then it is an undervalued company.

EV/Sales,

The company total value compared to its sales in a year.

if it is 1, this means the company total value is just equal to the one-year sales figure.

If it is less than 1, just it may be undervalued.

If it is less than average of industry, it is good.

The company total value compared to its sales in a year.

if it is 1, this means the company total value is just equal to the one-year sales figure.

If it is less than 1, just it may be undervalued.

If it is less than average of industry, it is good.

Debt/EBITDA

Is the debt of the company with respect to profit. The lower it is better. Compared with peers. Ideally, it should be 0.

Is the debt of the company with respect to profit. The lower it is better. Compared with peers. Ideally, it should be 0.

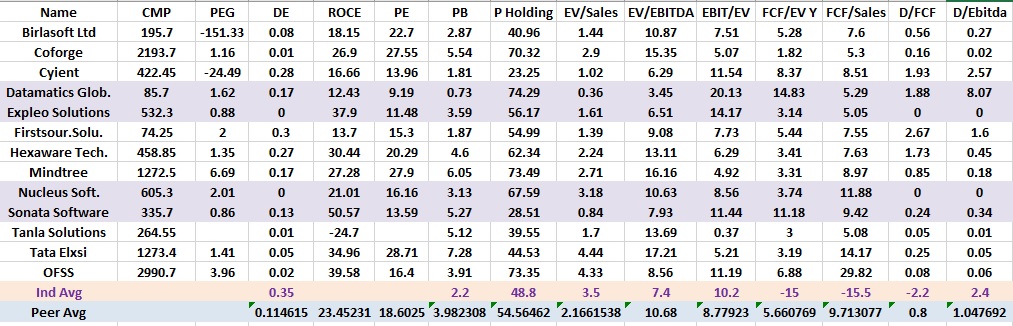

Now, let us do it for the companies given by our friends.

In screener.in, most of the ratios are not available in default. So, I created them.

In screener.in, most of the ratios are not available in default. So, I created them.

By looking at the companies, First look at

EBIT/EV to be high preferably more than 10.

Data Matics

Expleo

Cyient

Sonata

OFSS

are the choice.

EBIT/EV to be high preferably more than 10.

Data Matics

Expleo

Cyient

Sonata

OFSS

are the choice.

Then look at FCFYield preferably high, industry average(180 plus companies) is 10. Therefore, take the companies higher than this. Then we have two choices

Datamatics

Sonata

Datamatics

Sonata

Next look at FCF/Sales and Debt/EBITDA

clearly, Sonata is a winner here.

Next look at EV/EBITDA and EV/Sales.

Both Sonata and Datamatics are good. Less than the industry average.

Datamatics is hugely undervalued, the debt is the only concern.

clearly, Sonata is a winner here.

Next look at EV/EBITDA and EV/Sales.

Both Sonata and Datamatics are good. Less than the industry average.

Datamatics is hugely undervalued, the debt is the only concern.

Next look at conventional PE, PB, PEG, and ROCE all are pointing to

Datamatics,

the only problem is Debt/EBITDA is too high.

If you look at Sonata as an option, the Promoter Holding is only 28%.

Datamatics,

the only problem is Debt/EBITDA is too high.

If you look at Sonata as an option, the Promoter Holding is only 28%.

If you are an aggressive investor, and Debt is not a major concern as the company is the initial stages of expansion need funds.

Datamatics is a great option to look at.

If promoter holding is not an issue, then

Sonata software is a great choice.

Datamatics is a great option to look at.

If promoter holding is not an issue, then

Sonata software is a great choice.

If EBIT/EV to be less than 10 and FCFY to be less than 10

then

Expleo

Nucleus looking great

then

Expleo

Nucleus looking great

So, it depends on the investing style. As I am an aggressive investor, I will definitely keep.

Datamatics

Sonata

In my watchlist to buy at the correct price.

Datamatics

Sonata

In my watchlist to buy at the correct price.

If you are a defensive investor, then as per numbers

Nucleus

Expleo

OFSS is anyhow a blind choice for defensive guys.

Nucleus

Expleo

OFSS is anyhow a blind choice for defensive guys.

This is how one can do comparative fundamental analysis.

So, please do this sort of analysis to companies of your choice.

You will be more confident and have the conviction to hold.

So, please do this sort of analysis to companies of your choice.

You will be more confident and have the conviction to hold.

Cheers. Happy Investing😉

• • •

Missing some Tweet in this thread? You can try to

force a refresh