1/ Notes from @rorysutherland episode at @InvestLikeBest

This episode was a reminder of Munger's latticework of mental models, and how much knowledge from other fields can actually be transferable to the world of investing.

This episode was a reminder of Munger's latticework of mental models, and how much knowledge from other fields can actually be transferable to the world of investing.

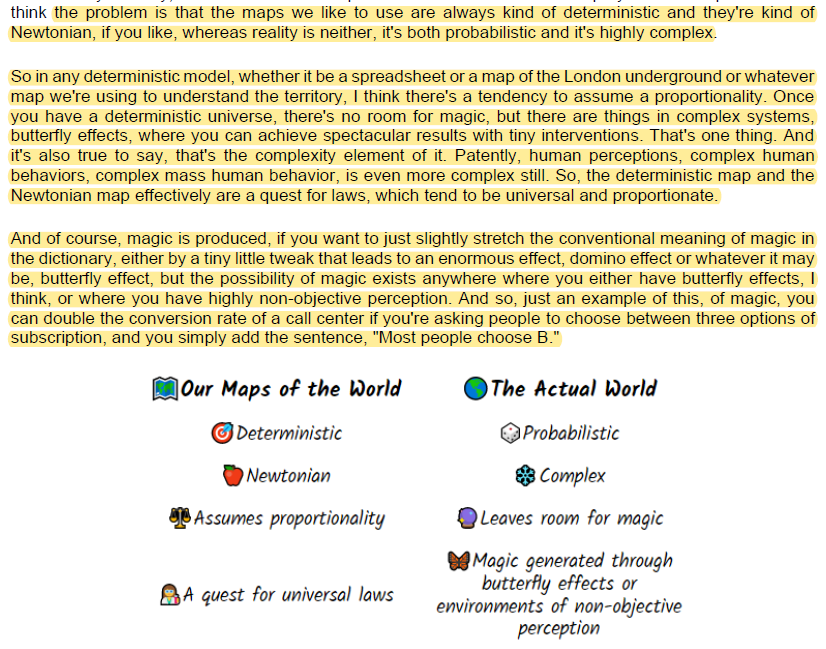

2/ "you can double the conversion rate of a call center if you're asking people to choose between three options of subscription, and you simply add the sentence, "Most people choose B."

This reminded me of NZS capital's complexity investing framework.

static1.squarespace.com/static/5ca38f3…

This reminded me of NZS capital's complexity investing framework.

static1.squarespace.com/static/5ca38f3…

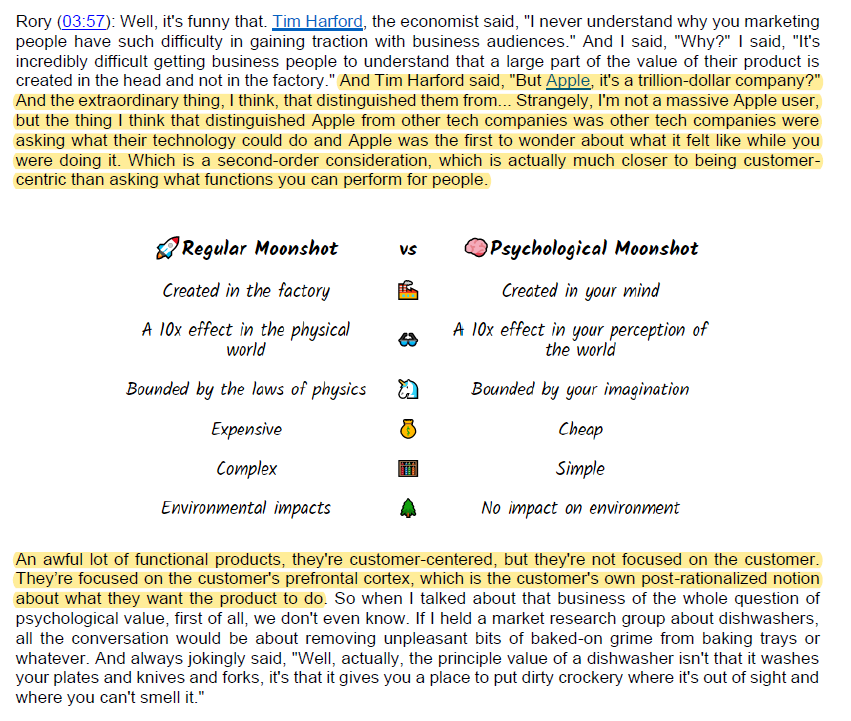

3/ "Apple was the first to wonder about what it felt like while you were doing it. Which is a second-order consideration, which is actually much closer to being customer-centric than asking what functions you can perform for people."

$AAPL

$AAPL

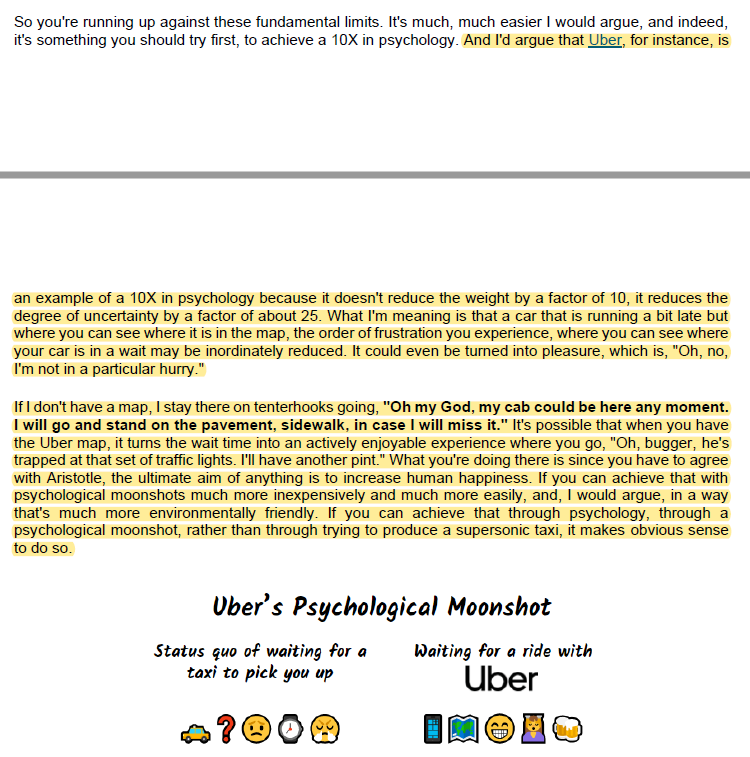

4/ Interesting observations on $Uber. No doubt, it's a much better product than what we had before, but I have my fair share of doubt.

mbi-deepdives.com/deep-dive-on-u…

mbi-deepdives.com/deep-dive-on-u…

5/ "Is Silicon Valley too engineer heavy? In that it's created a culture which would rather solve a problem through engineering than through psychology because your status derives from that."

6/ Pretty interesting set of examples why better, faster, cheaper may not always be the "good or true" idea

Red Bull, Zoom, Starbucks, Amazon Prime, Dyson, Five Guys

Red Bull, Zoom, Starbucks, Amazon Prime, Dyson, Five Guys

7/ "...designing for the disabled is a particularly good use of designer's time."

Reminded me of Taleb's piece on "The Dictatorship of the Small Minority"

medium.com/incerto/the-mo…

Reminded me of Taleb's piece on "The Dictatorship of the Small Minority"

medium.com/incerto/the-mo…

8/ "...I would argue that a large part of marketing needs to be both experimental and probabilistic. We shouldn't turn it into this optimization game, efficiency optimization game."

9/ "There's a game theoretic reason to be irrational, which is most of your competitors find it very, very easy to copy the rational things you do. They find it very, very hard for often for cultural reasons to copy the irrational things you do."

11/ "One of the great ideas you have is that to reach intelligent answers, you have to ask really dumb question."

Great explanation here to this counterintuitive statement.

Great explanation here to this counterintuitive statement.

End/ Episode link: investorfieldguide.com/rory-sutherlan…

Transcript link: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

Transcript link: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh