I am still trying to make sense of the #FinCEN files & believe me it’s not easy. Yesterday I tweeted abt some specific stories I could find, & so far I haven’t changed my mind: apart maybe from the details on the DB Mirror trades, I don’t see anything significant *and* new.

But what about the actual files, now? Unfortunately, ICIJ only published 4508 items, 35bn$, so around 2% of the total. We’re missing a big chunk (not sure why, tbh. ICIJ says it’s because the rest has not enough details.) Let’s assume it’s representative – what does it tell us?

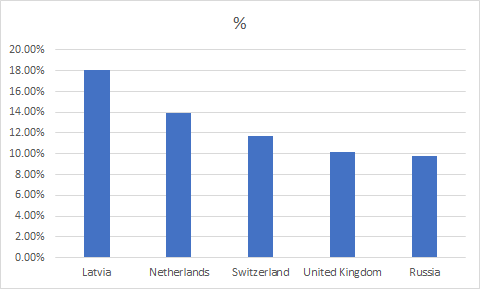

First obvious question: where is money going to and from where? Let’s chart the countries with more than 5% of the transactions.

It probably won't surprise you: the money is coming from mostly Russian connected countries… but the Dutch should also worry you a bit. (in case you weren’t already aware of this – and you should).

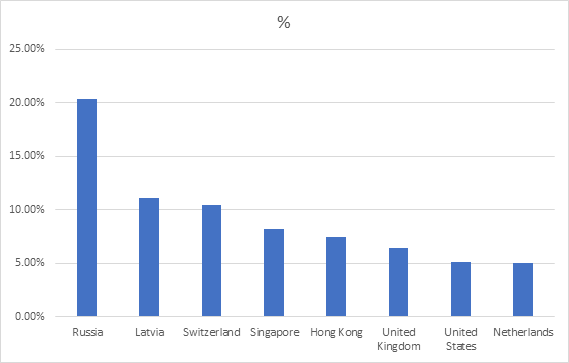

Where is it going ? Well, its' going to… Russian connected countries 😊 ! But with an extra Asian touch. Don’t worry, it’s traveling a bit, because only 5bn out of 35.7bn (13.8%) stays in the same country.

I guess this is (slightly) comforting, simply because most of this is very well known and has already been sanctioned or flagged by authorities. Latvia has been well known for being the Russian place of choice to launder money.

The second big and important question is this: who filed the reports? That’s actually very interesting because reading the press can be misleading: banks did file the reports, but in the vast majority of cases, a bank did not file about itself, but about another bank!

What does it mean? Do they rat at each other? What about the banks that did not file a report but were reported? Are they in trouble? It's not that simple, unfortunately. Here’s why.

Just three banks reported 90% of the amounts in the file: BNY (66% !), DB (17%) and JPM (7%). Clearly this tells us that we have access to a small subsample of SARs and most probably only SARs done as correspondent banks. This is certainly a bias from the source of the leaks.

And btw banks acting as correspondent banks have very different KYC/AML requirements. In practice, what we *don’t* have, is the info on whether the banks involved in the transactions filed a similar report in the US or in their local jurisdictions.

As the US involves a tiny bit of the amounts (3% out, 5% in) those reports have not necessarily been filed with US authorities. Hence, we’re missing a very big part of the puzzle: what did the banks do? I mean the ones actually making the payments.

Additionally, we have zero context about the payments. Were they legit or not, why were the reports made, etc. I would just say this: the “pain threshold” for a correspondent bank to make a report is higher than for the bank itself, because, they have lighter AML requirements.

So, all else being equal, the transactions should be worse than your average SAR. But that is not proof of anything important, especially as the press stories we’ve had are mostly about specific cases which are rather old. (but with extra juicy details.)

On a bank by bank basis, now , can we tell anything ? (Is it always deutsche?) It is not that easy to get a full picture, because some banks have 10 different names in there and the links are not always easily done.

So what I’ve been looking for is well known banks doing recent trades with horrible banks, i.e. banks that have since then been reported for huge AML failures (and sometimes made bankrupt because of this), or that operates in very high risk jurisdictions

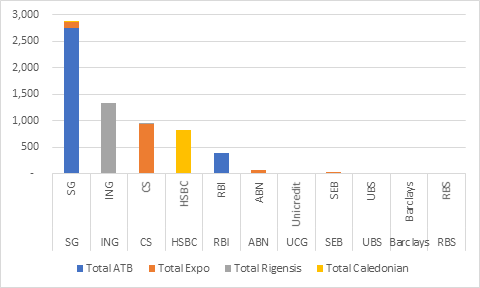

Looking at payer banks, I would flag as the “bad guys” the following banks: Amsterdam Trade Bank (owned by Alfa), the biggest payer in the sample (3bn$+), AS Expobank (a Latvian bank privately owned and connected to Deripaska flows),

Rigensis Bank (a Latvian specialist in non resident clients which has been fined for lax AML policies) and Caledonian Bank, a Cayman bank that is now bust after US authorities came after it for ML, all with more than 1bn$ each in the database.

Looking at payee banks, I’d flag again Rigensis, Caledonian and Bank Soyus, all with 500m+. Unsurprisingly we’re seeing more transaction from dodgy bank to “reputable banks” than the other way round. (Although “reputable” can be debated in some cases. 🤣)

One special feature I’ll discuss later is Rosbank, which is SG’s Russian unit and appears very high in both payer and payee.

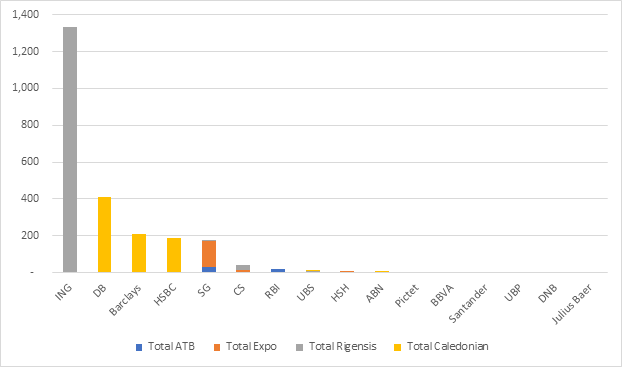

Who did business with those guys? The chart below is the sum of transfers from those banks to large listed EU banks that I could flag (again, I could be wrong with the names, see above.)

More on SG later.

Let’s look at the other way round: who’s been paying to the banks I mentioned above? Well, ING, DB (1st payer to Caledonian… the Cayman bank that went bust because of ML…#It’salwaydeutsche), Barclays, HSBC, SG… clearly an overlap with the previous list!

What about SG, then? How come it’s so high in the charts and we’re not reading anything in the press?

Well, it’s mostly because of one payment: 2,721,000,000$ from ATB, the Alfa subsidiary controlled by oligarch Fridman, to Rosbank. The transaction was reported by BNY on August 8th 2011.

I don't know what it's about, but it's not impossible that this is connected with the TNK-BP saga from 2011… But as a journalist, this is one cash transfer I’d love to investigate!

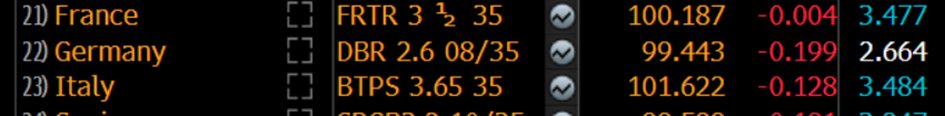

While we’re at it, which transaction are really “mammoth transfers” in the database? SG’s one is the biggest, but there is also a report from JPM about a transfer from JPM to… Deutsche UK for 1bn$.

Amusingly, Deutsche returned the favor with a report on a 800m$ transfer from Gazprombank (Switzerland) to JPM ! Good atmosphere and team spirit there!

One of the shadiest deals is probably a report from BNY about a 300m$ transfer from Expobank to Rigensis. I’m not surprised a compliance officer got nervous there!

That’s all, folks. Remember however the important caveat / disclaimer I was making: without knowing the details of each trade, it’s extremely hard to know if any law was broken, by whom, and if any of this is new or old facts.

The best we can get from this imho is a kind of “heatmap” identifying the banks that are obviously taking risks, willingly or not, on the AML side!

And a last piece of advice: as @RudyHavenstein would say, if you're stealing money, steal at least 1bn$, or you could be in trouble 😉

(note to my compliance officer: this was a joke.)

(note to my compliance officer: this was a joke.)

I probably should have tagged @ICIJorg since they provided the raw data to do this analysis

• • •

Missing some Tweet in this thread? You can try to

force a refresh