@retheauditors @premnsikka @alexralph 1/ The curious case of Grandmaster Flash + The Liverpool Motley Crew. In 2019 TheTimes wrote of the notorious “SKW Investments/Imperium Enterprises” pensions liberation “scheme”, chess grandmaster Simon Williams + chess club chum the …

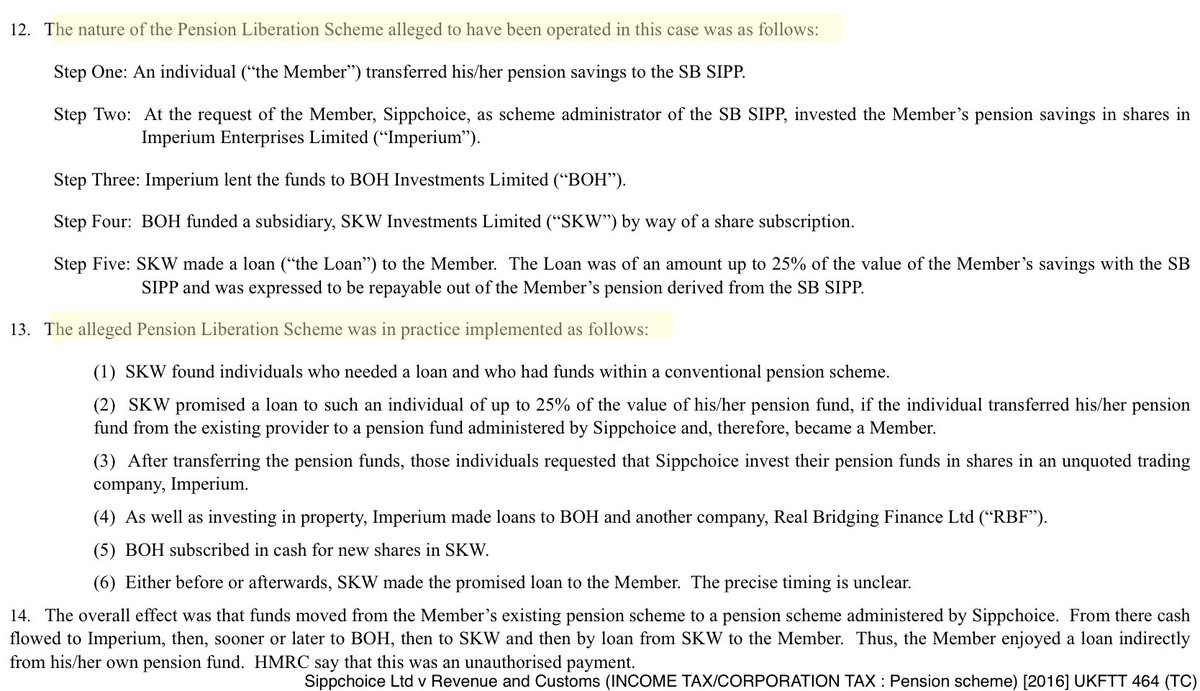

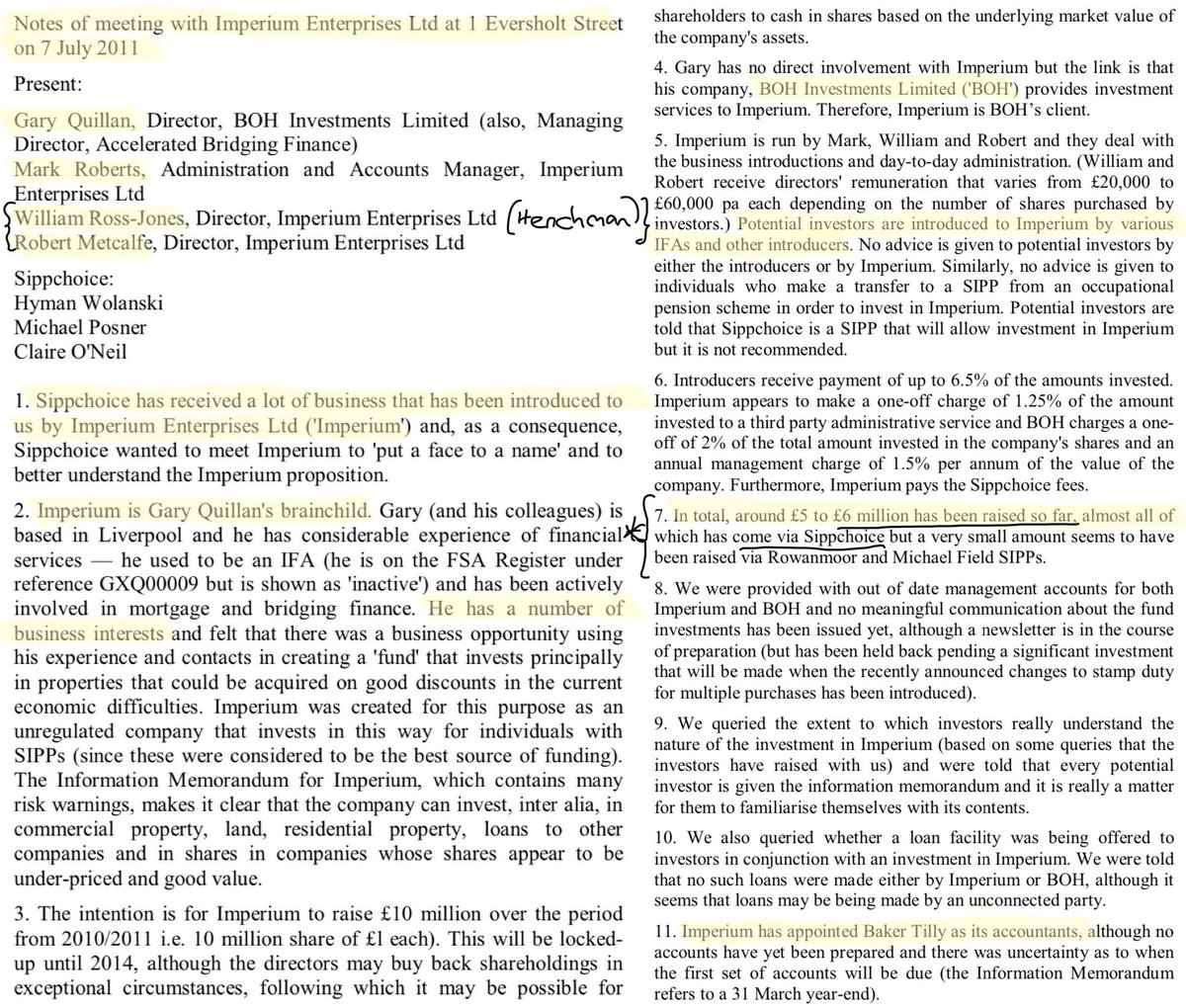

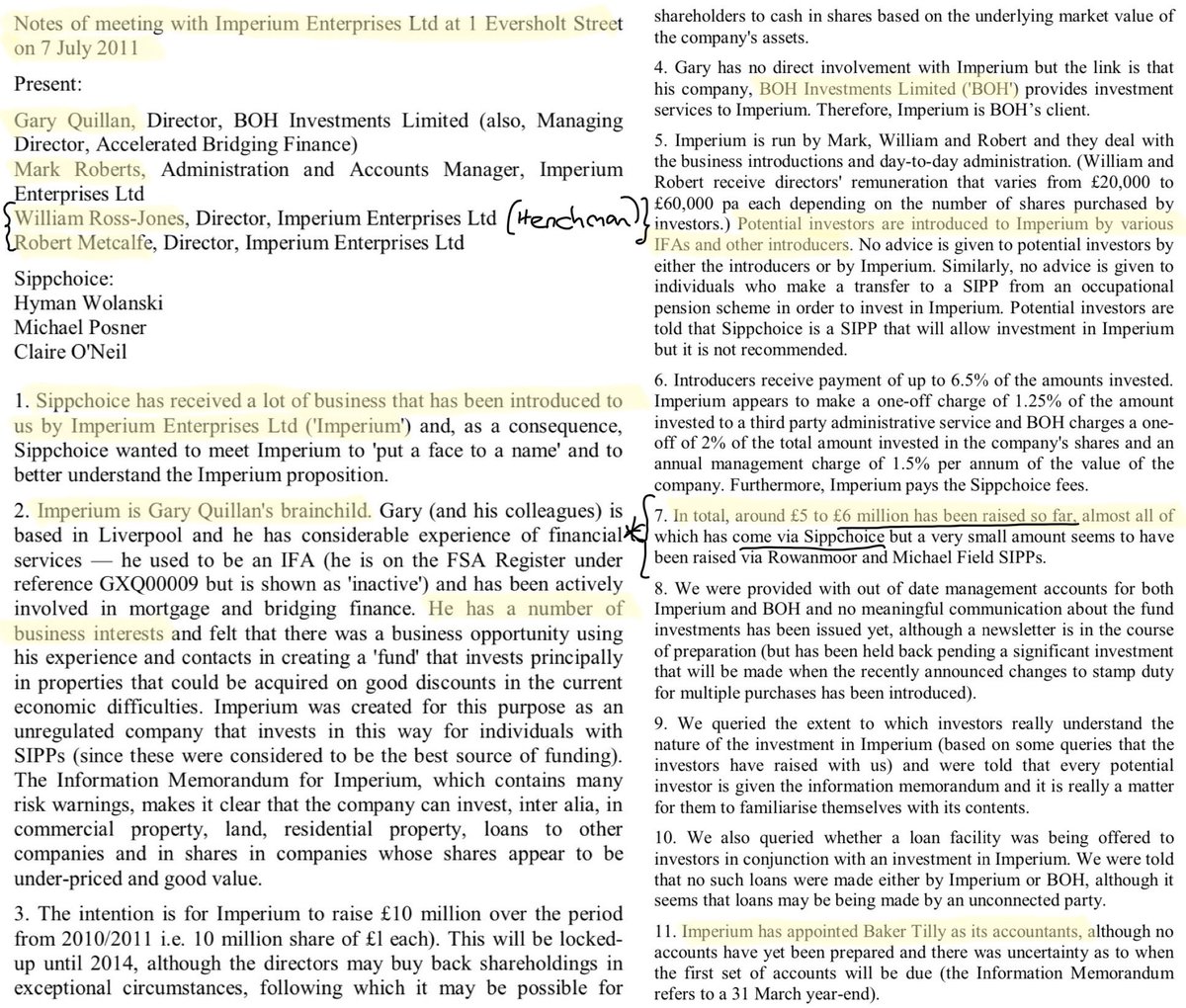

2/ infamous FSA/FCA IFA Gary Quillan & associates pulling the strings. The SIPPChoice vs HMRC (The tax aspects of the “scheme”) case fleshes out the basics + leads in to yet another case study in FSA/FCA gross regulatory failure, with hundreds of victims both SIPPshitted + …

3/ + facing tax whilst vast amounts were snaffled in “fees” bailii.org/uk/cases/UKFTT… . The court case points to a secretive web that operated both inside & outside of the FSA/FCA’s pitifully small porous regulatory perimeter. Key figures highlighted in the case included ..

4/ FSA/FCA IFA Gary Quillan, Robert John Metcalfe (allegedly a struck off solicitor), henchman William Ross-Jones, “admin/accounts manager” Mark Roberts + SIPP provider “SIPP choice”. Although the court case didn’t pick up on it, the charges are relevant, the initial charge ..

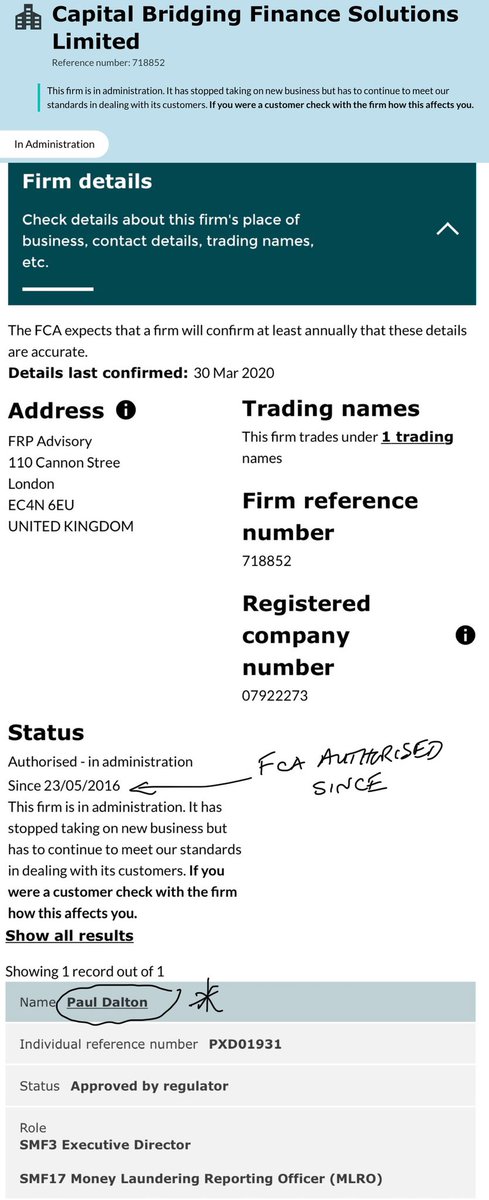

5/ being from a Gibraltar based SPV + later charges from the FCA auth. Capital Bridging Finance Solutions Ltd “CBFS” (now in administration). This wasn’t Mr Quillan’s first rodeo however as he was banned as a director for his japery in a remarkably similar op - the …

6/ KJK Investments Ltd/GLoans Ltd “scheme”, this time with its reported his brother in law running main borrower “Gloans Ltd” & other borrowers being related parties including SKW Investments. ftadviser.com/pensions/2019/… AND ftadviser.com/2015/06/23/reg… AND yourmoney.com/retirement/mul… …

7/ The SIPP providers in this case were C&P SIPP, notorious GPC SIPP ftadviser.com/pensions/2020/…, + notorious HD SIPP ftadviser.com/2013/07/04/pen…. Hundreds of victims again were SIPPshitted + taxed. Amongst a web of their property/finance SPV’s run out of 16 Crosby Rd North, Waterloo ..

8/ Liverpool was Mr Quillan’s Property 4 Students Ltd. The share register boasted an eclectic mix of SPV’s along with (from the start) Michael Thomas Hennigan (also a director of Accelerated Bridging Finance Ltd + shared the same name/D.O.B. as a former UK chess champion).

9/ Along with Mr Quillan as a director was Mark Roberts + as company secretary (+ a founder shareholder) Mr Quillan’s FSA IFA colleague of many years Andrew Simon John Sweeney also a director of infamous minibond op Privilege Wealth Plc run by the notorious Brett Jolly …

10/ thisismoney.co.uk/money/experts/…, the uber notorious Renwick Haddow’s protege

https://twitter.com/ianbeckett/status/1146909923932037121. Robert Metcalfe’s (allegedly entwined with the activities of the Liverpool Motley Crew) solicitors SRA disciplinary tribunal makes unpleasant reading, scribd.com/document/47708… ..

11/ s1.2 outlines off-plan student accommodation transactions which were “dubious, risky or bore the hallmarks of fraudulent financial arrangements” and it gets far worse from there. Party to the SKW/Imperium “scheme” was CBFS whose head honcho was Liverpool Motley Crew-mate ..

12/ FCA auth. Paul Dalton. Throughout Mr Metcalfe’s SRA disciplinary tribunal record numerous references are made to a “PD” the “sole director of CBFS” “a bridging finance company” + “PD”’s alleged widespread activities in the law firm allegedly entwined in the activities …

13/ of the Liverpool Motley Crew. The SRA tribunal reports(s 22.1) Mr Metcalfe was “best-friends” with “GQ”. The Liverpool Motley Crew just as with the LCF crew (incl. John Russell-Murphy & his Grosvenor Motley Crew), Blackmore Crew etc … after the effort of chasing marks …

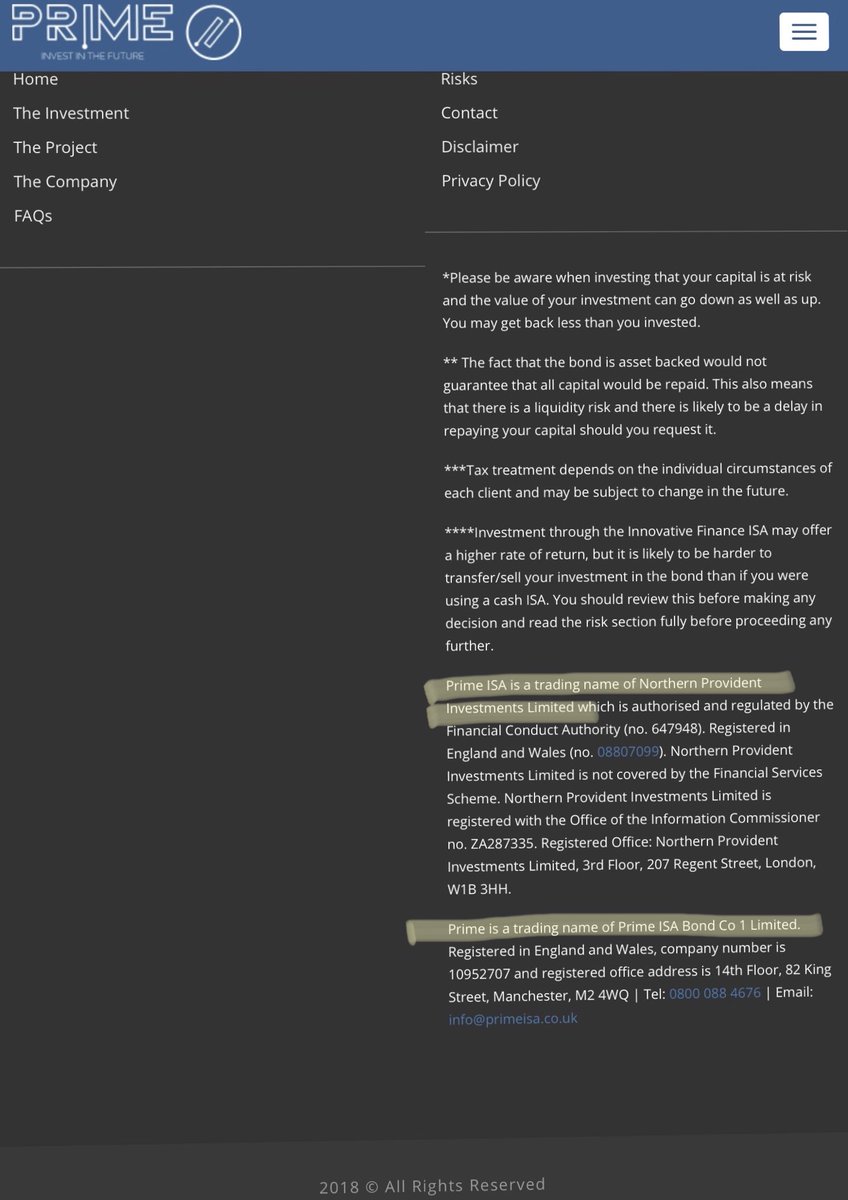

14/ , boiler rooms, lassoing tame FCA IFA’s/SIPP providers etc saw it was time for the FCA’s “easy street” - strapping on Captain Careless & his Scroogle Crew + dancing down the FCA’s red carpet in to FCA minibond mayhem. In 2019 we pondered just how many other notorious …

15/ “minibond” schemes the infamous FCA IFA group “Northern Provident Investments” had a hand in

https://twitter.com/ianbeckett/status/1200172203549036544AND

https://twitter.com/ianbeckett/status/1210975972205453312. It turns out they had teamed up as well with the Liverpool Motley Crew’s Messrs Paul Dalton & Mark Roberts for the …

16/ Capital Bridge 9% IFISA bonds (aka First NorthBridge bonds) scribd.com/document/47707… - in effect a cash funnel to CBFS + the Liverpool Motley Crew’s activities. Notoriously CBFS was involved in Bury FC with tales of offshore loans, secret 40% upfront loan “commissions”, …

17/ theguardian.com/football/2018/… . Astonishingly it’s reported that around 1/5 of the total lending of collapsed P2P lender #Lendy was to companies controlled by then Bury FC owner Stewart Day bit.ly/3cpnUQ9 AND examinerlive.co.uk/news/west-york…

+ it’s further reported that CBFS ..

+ it’s further reported that CBFS ..

18/ was involved additionally in lending to Stewart Day’s companies. Continuing to plug in to the networks that operate both inside & outside of the FCA’s pitifully small porous regulatory perimeter the Liverpool Motley Crew spat out the “Capital Innovative Finance 9% …

19/ Fixed Rate Bonds” with the assistance of Messrs Goldsmith & Ferguson’s (lillywhiteuae.com/the-group) …

20/ “Audacia Capital (Ireland) plc whose offshore fingerprints frequently turn up in peddled bonds. It’s alleged Messrs Goldsmith &/or Ferguson were linked to notorious Blackmore “schemes” redd-monitor.org/2020/07/14/gre… before messrs Nunn & McCreesh danced ..

21/ down the FCA’s red carpet in to FCA minibond mayhem hand in IFISA hand with Northern Provident Investments - just like the Liverpool Motley Crew & “Buzz” from Blackmore’s chum Daron Lee (former CEO along with “Buzz” on the board of XCap Securities Plc - still in special …

22/22 administration) When predictably CBFS was put in to administration the whole pyramid imploded collapsing the Capital Bridge IFISA bonds + one would expect the Capital Innovative Finance Bonds to likely default in due course .. meanwhile the FCA sleep at the wheel.

• • •

Missing some Tweet in this thread? You can try to

force a refresh