Another Bitcoin cycle means another wave of FUD in the form of red herrings, false claims & flawed arguments.

Some are due to ignorance, some are intentionally misleading and some are just pure lazy.

So, here are the most common BAD TAKES to be on the lookout for.

THREAD

Some are due to ignorance, some are intentionally misleading and some are just pure lazy.

So, here are the most common BAD TAKES to be on the lookout for.

THREAD

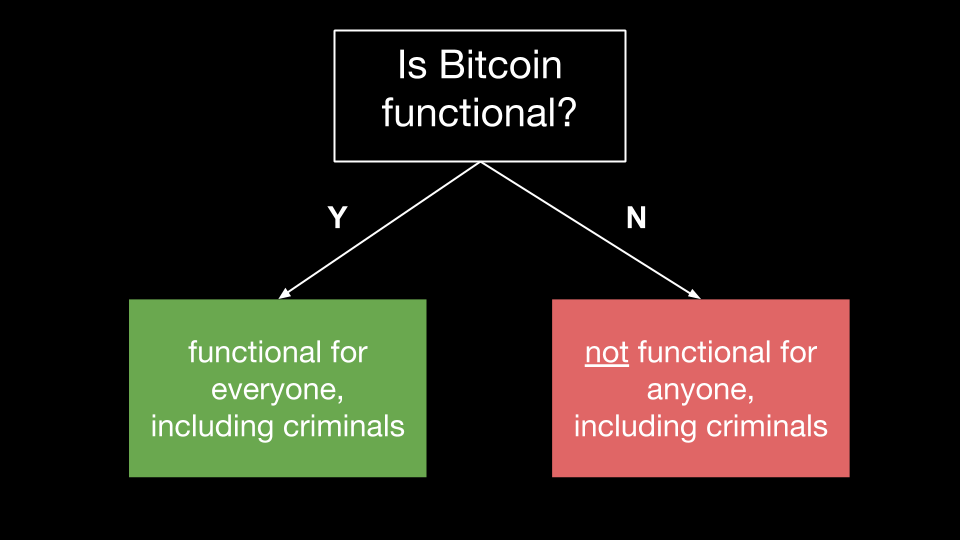

“There is nothing inherent about the tools used to facilitate crimes that makes them criminal in themselves. Despite criminal use, no one is calling for the ban of roads, the internet, mail, etc.” @parkeralewis

Bitcoin is Not for Criminals

bit.ly/2RUuXHq

Bitcoin is Not for Criminals

bit.ly/2RUuXHq

“It is logically inconsistent to form a view that bitcoin is sufficiently functional to be viable as a currency for criminals, while at the same time deny the implication that such a view would merely establish that bitcoin is functional for everyone.” @parkeralewis

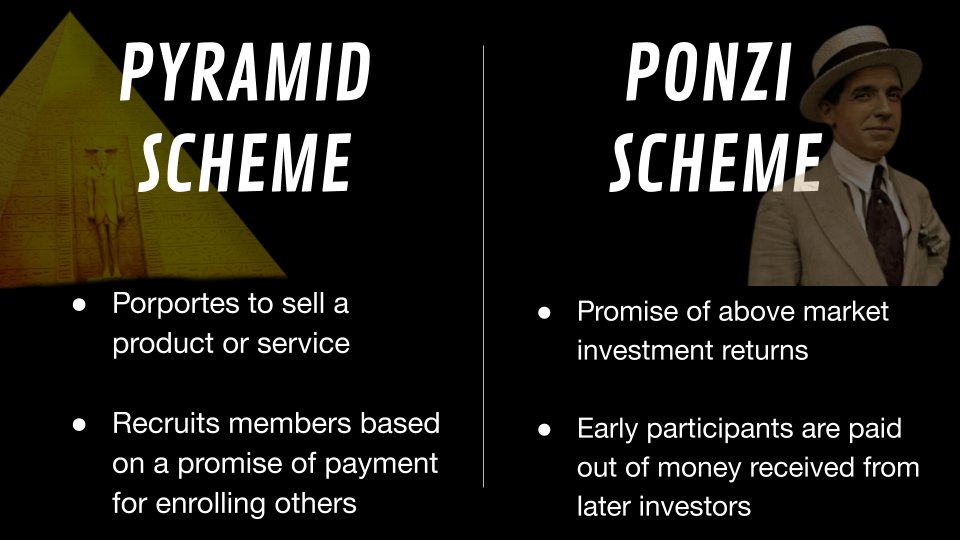

Calling Bitcoin a pyramid scheme or a ponzi lacks an understanding of both Bitcoin and the definitions of those terms.

Bitcoin is permissionless, there's no ‘membership’ element into which to recruit.

Additionally, there is no central authority from which promises can be made.

Bitcoin is permissionless, there's no ‘membership’ element into which to recruit.

Additionally, there is no central authority from which promises can be made.

"..bitcoin is not just beyond the control of governments, it functions without the coordination of any central third parties.

..the very attempts to ban bitcoin will accelerate its adoption and proliferation."

@parkeralewis

bit.ly/3kEEf6A

..the very attempts to ban bitcoin will accelerate its adoption and proliferation."

@parkeralewis

bit.ly/3kEEf6A

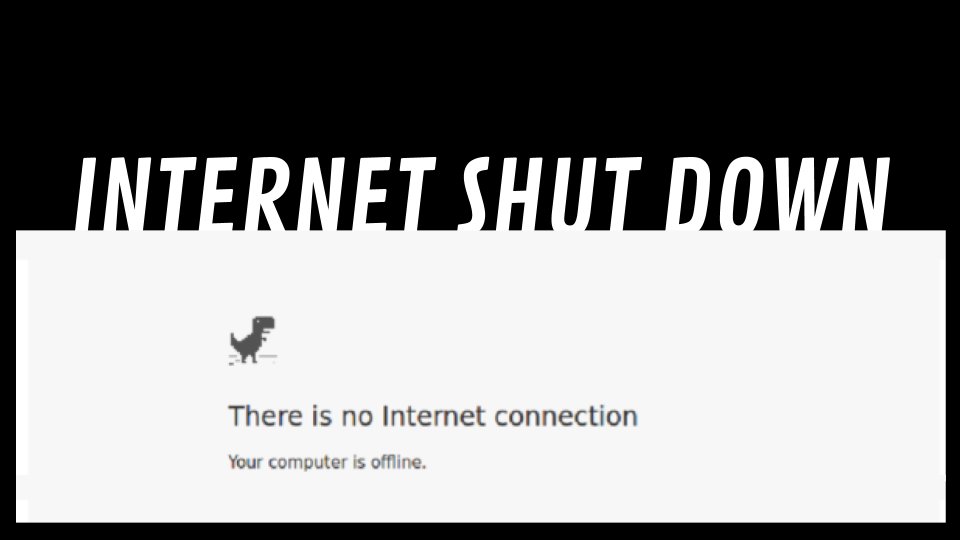

What about if access to the internet is lost?

Let’s look at the different methods one can use to interact with the Bitcoin network in the event of infrastructure failures, natural disasters or intentional outages.

Let’s look at the different methods one can use to interact with the Bitcoin network in the event of infrastructure failures, natural disasters or intentional outages.

Offline bitcoin tx options are becoming ever more accessible-

Satellite: bit.ly/32Vc2Cx by @nwoodfine

Radio: bit.ly/2Ex1nVm by @nvk

SMS :bit.ly/300t9Rs by @SamouraiWallet

Mesh: bit.ly/32Tbqxk by @notgrubles

Bearer Instruments: @OPENDIME

Satellite: bit.ly/32Vc2Cx by @nwoodfine

Radio: bit.ly/2Ex1nVm by @nvk

SMS :bit.ly/300t9Rs by @SamouraiWallet

Mesh: bit.ly/32Tbqxk by @notgrubles

Bearer Instruments: @OPENDIME

When a bank gets robbed we don’t say the dollar (as a currency) was hacked.

When a jeweler is robbed we don't say gold (as an element) was hacked.

Bitcoin’s network resilience comes from being economically & logistically infeasible to attack, even at the scale of state actors.

When a jeweler is robbed we don't say gold (as an element) was hacked.

Bitcoin’s network resilience comes from being economically & logistically infeasible to attack, even at the scale of state actors.

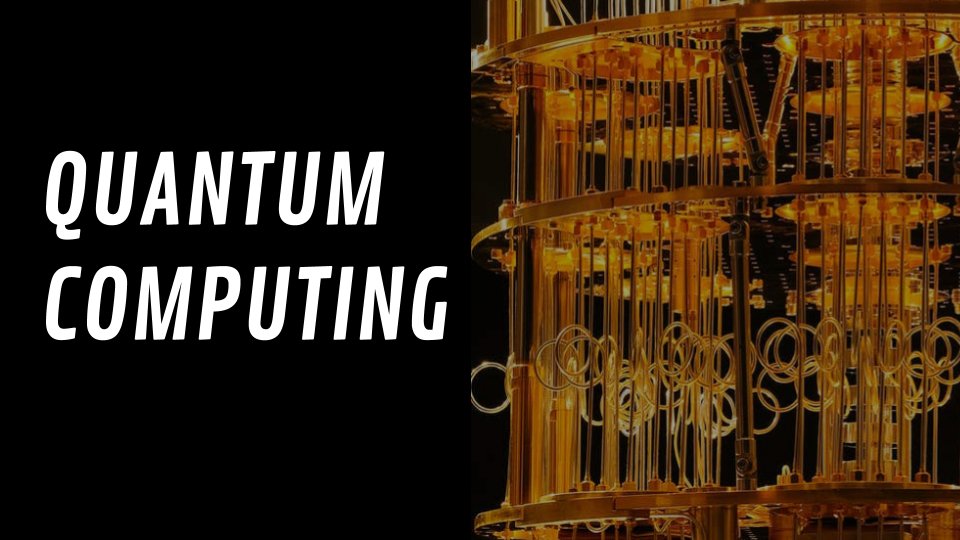

“As of 2019, the largest general-purpose quantum computers have fewer than 100 qubits, have impractically-high error rates, and can operate only in..temperatures near absolute zero. Attacking Bitcoin keys would require around 1500 qubits.” -Bitcoin Wiki

bit.ly/3ctqZ1Y

bit.ly/3ctqZ1Y

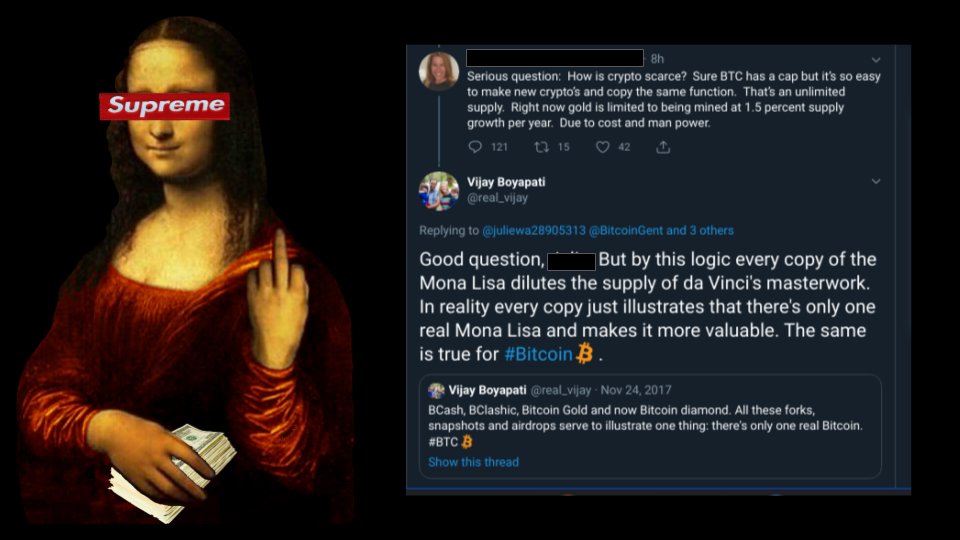

Bitcoin is an open source protocol for transferring value.

Anyone can copy it.

But you cannot take all of the developers, miners & hash power, users, node operators or suite of products and services with you.

Anyone can copy it.

But you cannot take all of the developers, miners & hash power, users, node operators or suite of products and services with you.

A succinct explanation from @real_vijay on how duplication can serve to reinforce scarcity.

“Ultimately, bitcoin is backed by something, and it’s the only thing that backs any money: the credibility of its monetary properties.” - @parkeralewis

Bitcoin is Not Backed by Nothing:

bit.ly/2G3G8eg

Bitcoin is Not Backed by Nothing:

bit.ly/2G3G8eg

Charlie Munger is right about most things. But he’s wrong about this.

Munger fails to see that Bitcoin is a monetary Schelling Point.

Altering the supply cap would ensure that the resulting fork is neither valued nor considered ‘Bitcoin’ by network participants.

Munger fails to see that Bitcoin is a monetary Schelling Point.

Altering the supply cap would ensure that the resulting fork is neither valued nor considered ‘Bitcoin’ by network participants.

"Volatility is the natural function of price discovery as bitcoin advances down the path of its monetization event..

If an asset is volatile, it does not mean that asset will be an ineffective store of value." -@parkeralewis

Bitcoin Is Not Too Volatile

bit.ly/3iZqv5R

If an asset is volatile, it does not mean that asset will be an ineffective store of value." -@parkeralewis

Bitcoin Is Not Too Volatile

bit.ly/3iZqv5R

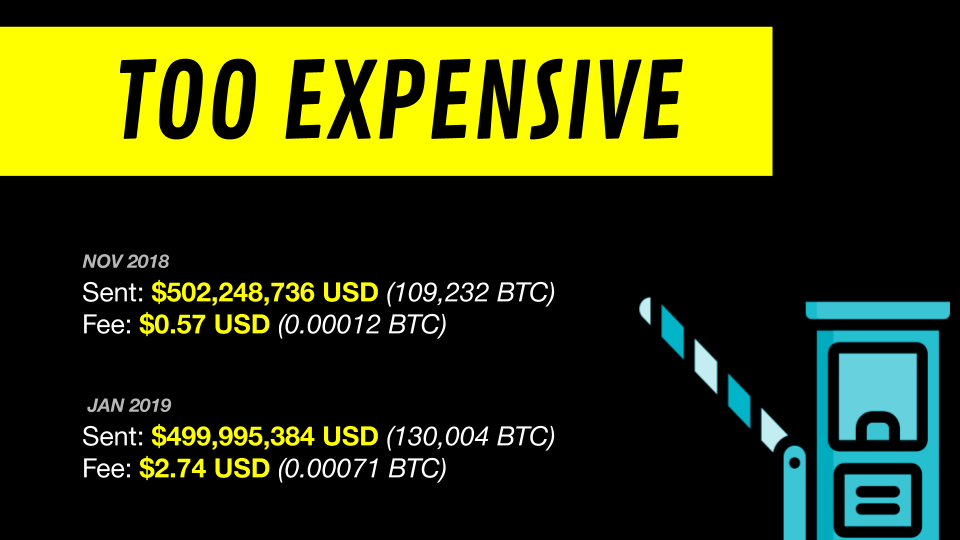

“Bitcoin is money free of counterparty risk, and its network can offer final settlement of large volume payments within minutes. Bitcoin can thus best be compared to settlement payments between central banks and large financial institutions” -@Saifedean

bit.ly/363dB35

bit.ly/363dB35

“Many people, when decrying Bitcoin...presume that someone, somewhere is being deprived of electricity because of this rapacious asset.” @nic__carter bit.ly/3crtZMb

“Bitcoin does not waste energy — it consumes energy waste.” @_ConnerBrown_

bit.ly/2ZXIbrh

“Bitcoin does not waste energy — it consumes energy waste.” @_ConnerBrown_

bit.ly/2ZXIbrh

"There has never been an example of a $100bn monster digital network that was vanquished once it got to that dominate position.

All you gotta do is see that chart, ..think about the dynamic and the network effect and you’re like- this has already won.”

-@michael_saylor

All you gotta do is see that chart, ..think about the dynamic and the network effect and you’re like- this has already won.”

-@michael_saylor

"Bitcoin is not competing with Visa.. bitcoin is competing with the dollar, euro, yen and gold as money..

..the proper comparison would be between bitcoin and the Fed as currency issuer and as a clearing mechanism."

@parkeralewis

Bitcoin is Not Too Slow

bit.ly/2RTrb0M

..the proper comparison would be between bitcoin and the Fed as currency issuer and as a clearing mechanism."

@parkeralewis

Bitcoin is Not Too Slow

bit.ly/2RTrb0M

• • •

Missing some Tweet in this thread? You can try to

force a refresh