A short thread on liberty and public health in the US, with snakes (guest appearance by a worm).

The rod of Asclepius, symbol of medicine –here on a CDC logo (l). Clinical parasitologist Rosemary Drisdelle thinks the rod might originally reference a treatment for the guinea worm –healers remove the worm from your leg by slowly winding its tail end around a match stick (r).

Public health has long been a factor in the expansion of government power: restricting the travel of goods and people, keeping the sick in their homes or sanitariums, mandates from pasteurization through sewage treatment to trash removal, wild animal control...

Which brings us to the Gadsden Flag, symbol of the fight against tyrannical government from the US Revolution. Public health has sometimes been used as an excuse to attack liberties & exclude or incarcerate ‘undesirable’ groups: prostitutes, homosexuals, foreigners, the poor...

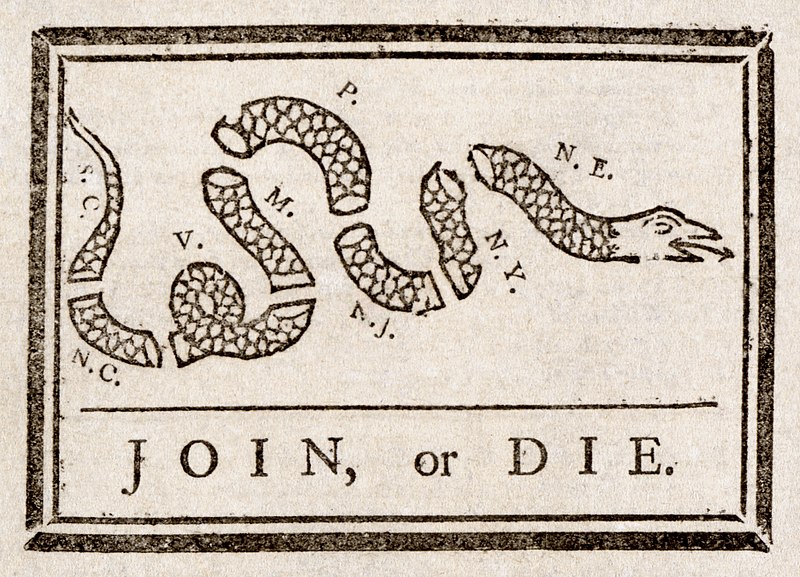

Ensuring public health while avoiding discrimination is at the heart of successful infectious disease response. And because infection crosses state and international borders, it takes federal leadership –as Franklin’s pre-revolutionary image has it, join or die.

The struggle to protect both health & liberty (& need for fed leadership) is illustrated by planes. We don’t want people packed together in 1 space for a long time. But for US, right now, what is the logic for tighter restrictions on international air travel than domestic travel?

In Covid-19 snakes have gone from early suspect source to unadvised experimental use as a prophylactic. Their real role is metaphorical...

... public health measures are vital to control disease (wear a mask, stop going to bars, social distance) but a dark history of liberty unnecessarily denied demands we should be constantly vigilant against their use as tools of discrimination. (/end).

• • •

Missing some Tweet in this thread? You can try to

force a refresh