1/

Get a cup of coffee.

In this thread, I'll help you understand the concept of "Look Through Earnings".

Get a cup of coffee.

In this thread, I'll help you understand the concept of "Look Through Earnings".

2/

Imagine that you're Mack, the truck driver.

You work, of course, for Lightning McQueen -- the world famous race car.

Your job is to transport Mr. McQueen across the country, to wherever his next race happens to be.

Imagine that you're Mack, the truck driver.

You work, of course, for Lightning McQueen -- the world famous race car.

Your job is to transport Mr. McQueen across the country, to wherever his next race happens to be.

3/

You work hard, and you take pride in your work.

After all, it is because of your efforts that Mr. McQueen always reaches his race venue safely, in time, well rested, and ready to win.

You work hard, and you take pride in your work.

After all, it is because of your efforts that Mr. McQueen always reaches his race venue safely, in time, well rested, and ready to win.

4/

Mr. McQueen appreciates all this. So he pays you well.

Your base salary is $100K per year. Plus, you get a percentage of Mr. McQueen's prize money every time he wins a race.

Last year was particularly good. Mr. McQueen won a lot of races. And you took home more than $250K.

Mr. McQueen appreciates all this. So he pays you well.

Your base salary is $100K per year. Plus, you get a percentage of Mr. McQueen's prize money every time he wins a race.

Last year was particularly good. Mr. McQueen won a lot of races. And you took home more than $250K.

5/

As your job involves many long hours of driving, you pass the time listening to podcasts.

Recently, you stumbled across some very nice investing podcasts -- Focused Compounding, Market Foolery, Motley Fool Money, Capital Allocators, DIY Investing, The Acquirers, etc.

As your job involves many long hours of driving, you pass the time listening to podcasts.

Recently, you stumbled across some very nice investing podcasts -- Focused Compounding, Market Foolery, Motley Fool Money, Capital Allocators, DIY Investing, The Acquirers, etc.

6/

These podcasts made you realize the importance of (1) saving part of your income, and (2) investing these savings in good businesses for the long term.

These podcasts made you realize the importance of (1) saving part of your income, and (2) investing these savings in good businesses for the long term.

7/

After all, your job isn't all that secure.

Who knows how many years of good racing Mr. McQueen has left?

Better you build a nest egg now, in case you need it later.

After all, your job isn't all that secure.

Who knows how many years of good racing Mr. McQueen has left?

Better you build a nest egg now, in case you need it later.

8/

So, about 2 years ago, you started diligently saving and investing.

You picked 4 large, well-known companies that you liked and admired: Costco, Google, Home Depot, and Starbucks.

And you bought their shares.

So, about 2 years ago, you started diligently saving and investing.

You picked 4 large, well-known companies that you liked and admired: Costco, Google, Home Depot, and Starbucks.

And you bought their shares.

9/

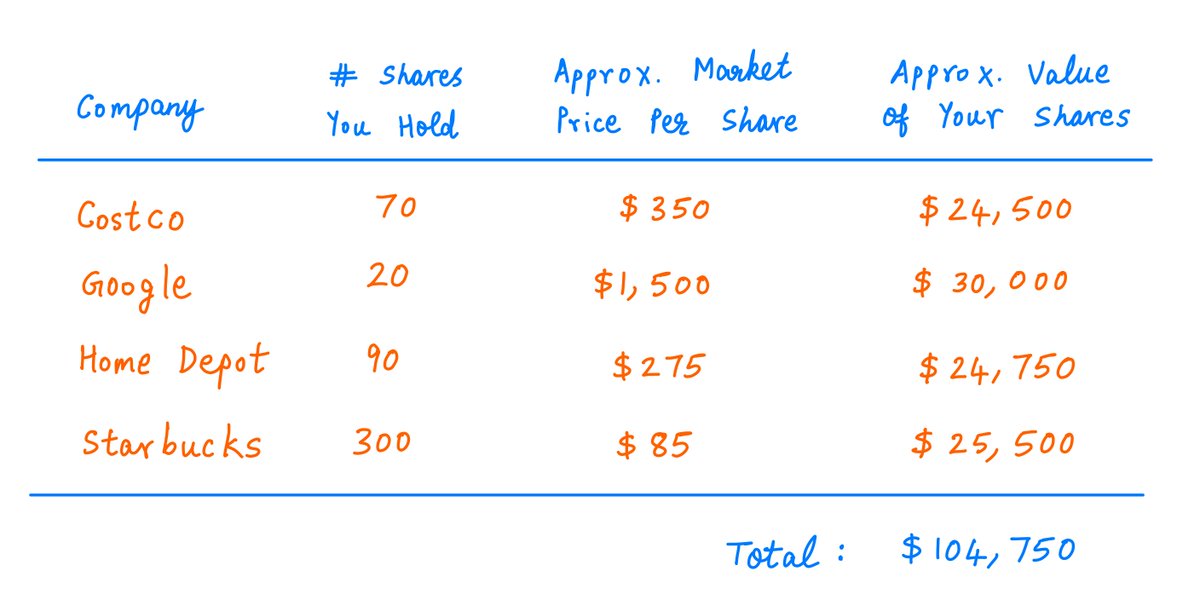

Over the last 2 years, as you saved more and accumulated more shares in these companies, your portfolio grew in value.

Now your portfolio is worth over $100K. Congrats on doing such a fine job saving and investing!

Here's your current portfolio:

Over the last 2 years, as you saved more and accumulated more shares in these companies, your portfolio grew in value.

Now your portfolio is worth over $100K. Congrats on doing such a fine job saving and investing!

Here's your current portfolio:

10/

The question is: how "good" is this portfolio? Will it do well over time?

If you simply held this portfolio -- unchanged -- for, say, the next 10 years, will you be happy with the result?

These, of course, are questions about the future. Nobody really knows the answers.

The question is: how "good" is this portfolio? Will it do well over time?

If you simply held this portfolio -- unchanged -- for, say, the next 10 years, will you be happy with the result?

These, of course, are questions about the future. Nobody really knows the answers.

11/

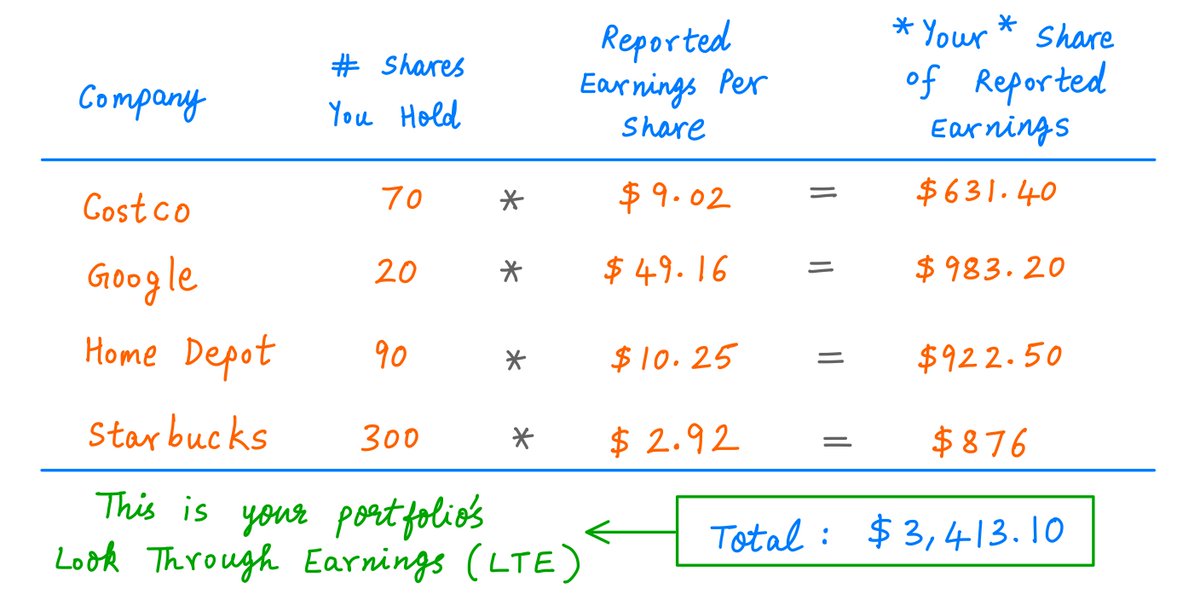

Look Through Earnings (LTE) is one way to understand your portfolio better -- so you can roughly predict how it will grow over time.

The idea is simple: each company in your portfolio (hopefully) earns a profit each year. LTE is *your* share of these profits.

Look Through Earnings (LTE) is one way to understand your portfolio better -- so you can roughly predict how it will grow over time.

The idea is simple: each company in your portfolio (hopefully) earns a profit each year. LTE is *your* share of these profits.

12/

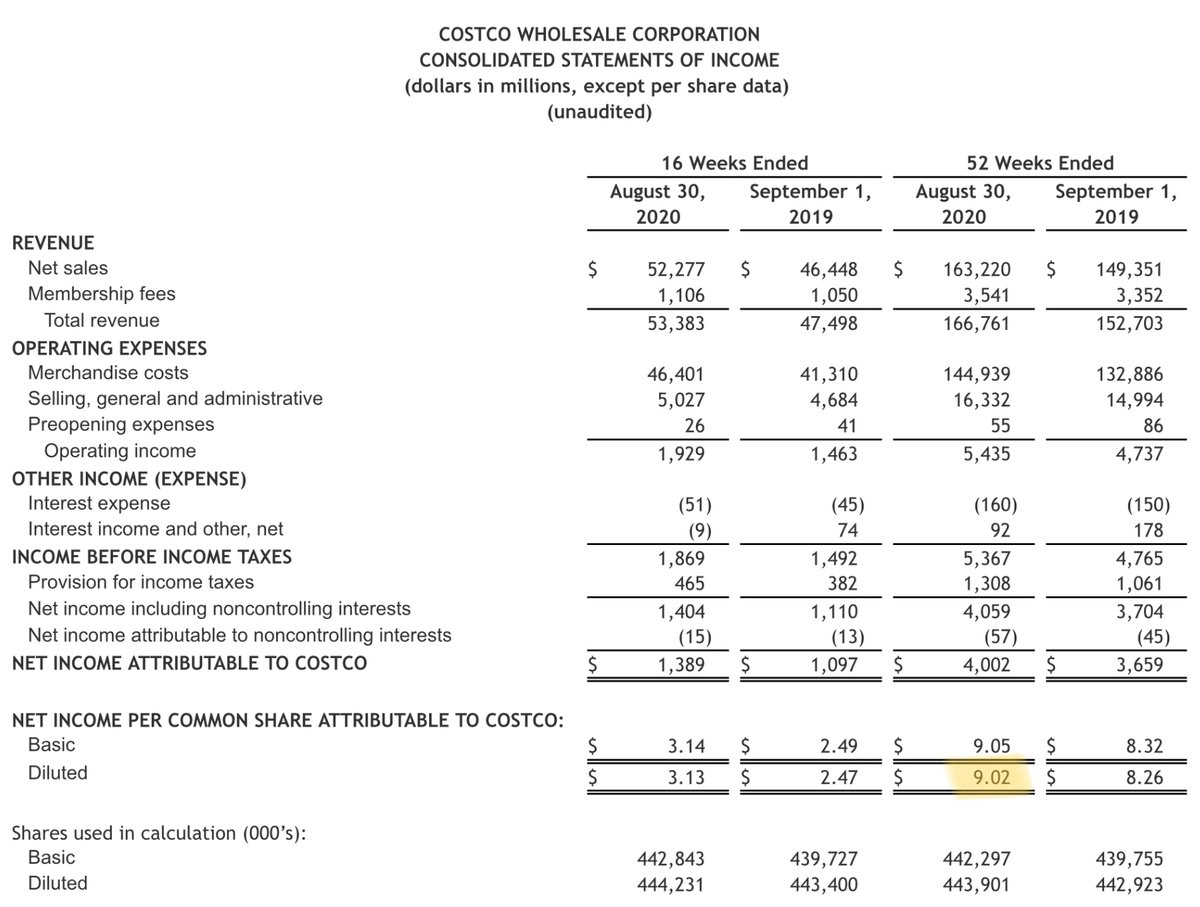

For example, just 2 days ago, Costco reported their earnings for the year ended Aug 30, 2020.

They said they earned $9.02 per share this year.

Since you own 70 shares of Costco, *your* share of these earnings is: (70 shares) * ($9.02 per share) = $631.40.

For example, just 2 days ago, Costco reported their earnings for the year ended Aug 30, 2020.

They said they earned $9.02 per share this year.

Since you own 70 shares of Costco, *your* share of these earnings is: (70 shares) * ($9.02 per share) = $631.40.

13/

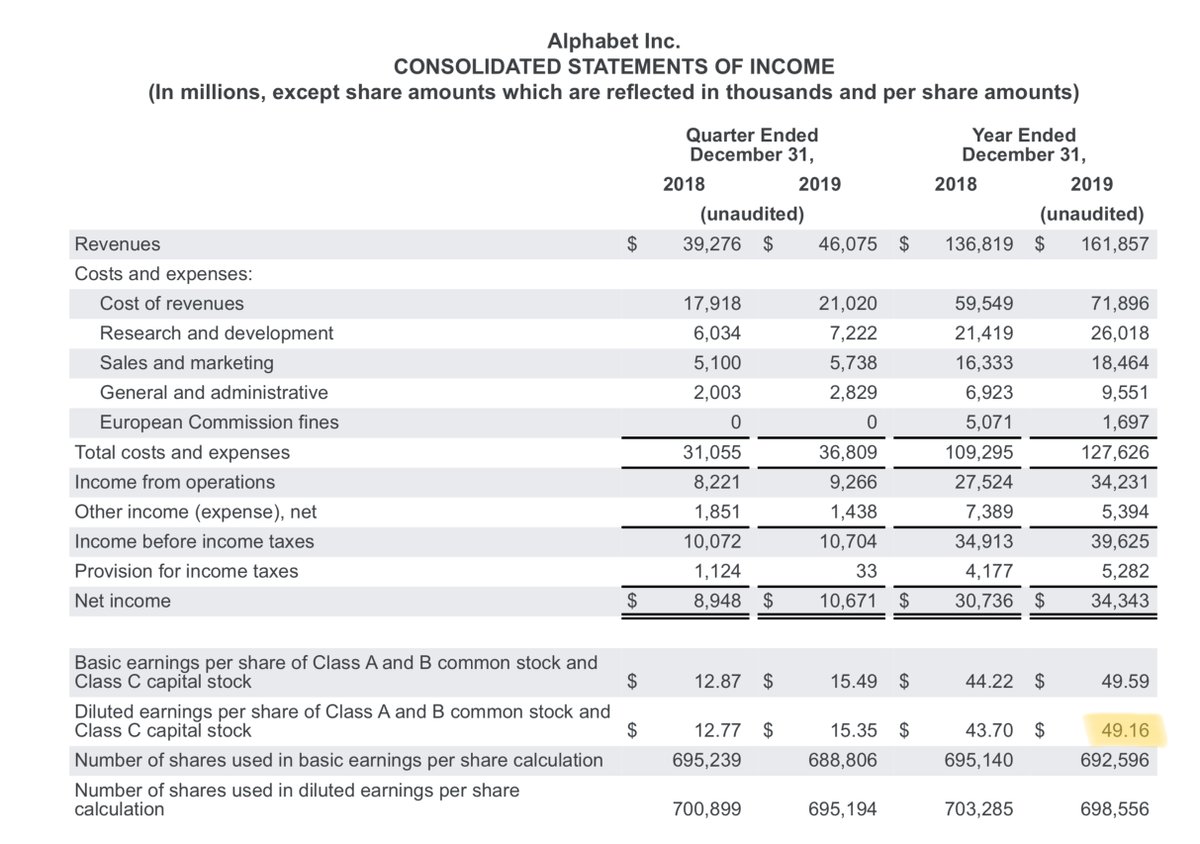

Similarly, if you look at Google's latest annual filings, they reported earning $49.16 per share for the year ended Dec 31, 2019.

You own 20 shares of Google. So *your* share of these earnings works out to: (20 shares) * ($49.16 per share) = $983.20.

Similarly, if you look at Google's latest annual filings, they reported earning $49.16 per share for the year ended Dec 31, 2019.

You own 20 shares of Google. So *your* share of these earnings works out to: (20 shares) * ($49.16 per share) = $983.20.

14/

Proceeding this way, you can calculate *your* share of each of your portfolio companies' earnings.

And if you add up all these, you get the Look Through Earnings (LTE) of the whole portfolio.

Like so:

Proceeding this way, you can calculate *your* share of each of your portfolio companies' earnings.

And if you add up all these, you get the Look Through Earnings (LTE) of the whole portfolio.

Like so:

15/

One interpretation of LTE goes like this.

Suppose every company in your portfolio decided to distribute *all* its earnings as dividends to shareholders.

Then, what's the total dividend amount you will receive in a year? That's your portfolio's LTE.

One interpretation of LTE goes like this.

Suppose every company in your portfolio decided to distribute *all* its earnings as dividends to shareholders.

Then, what's the total dividend amount you will receive in a year? That's your portfolio's LTE.

16/

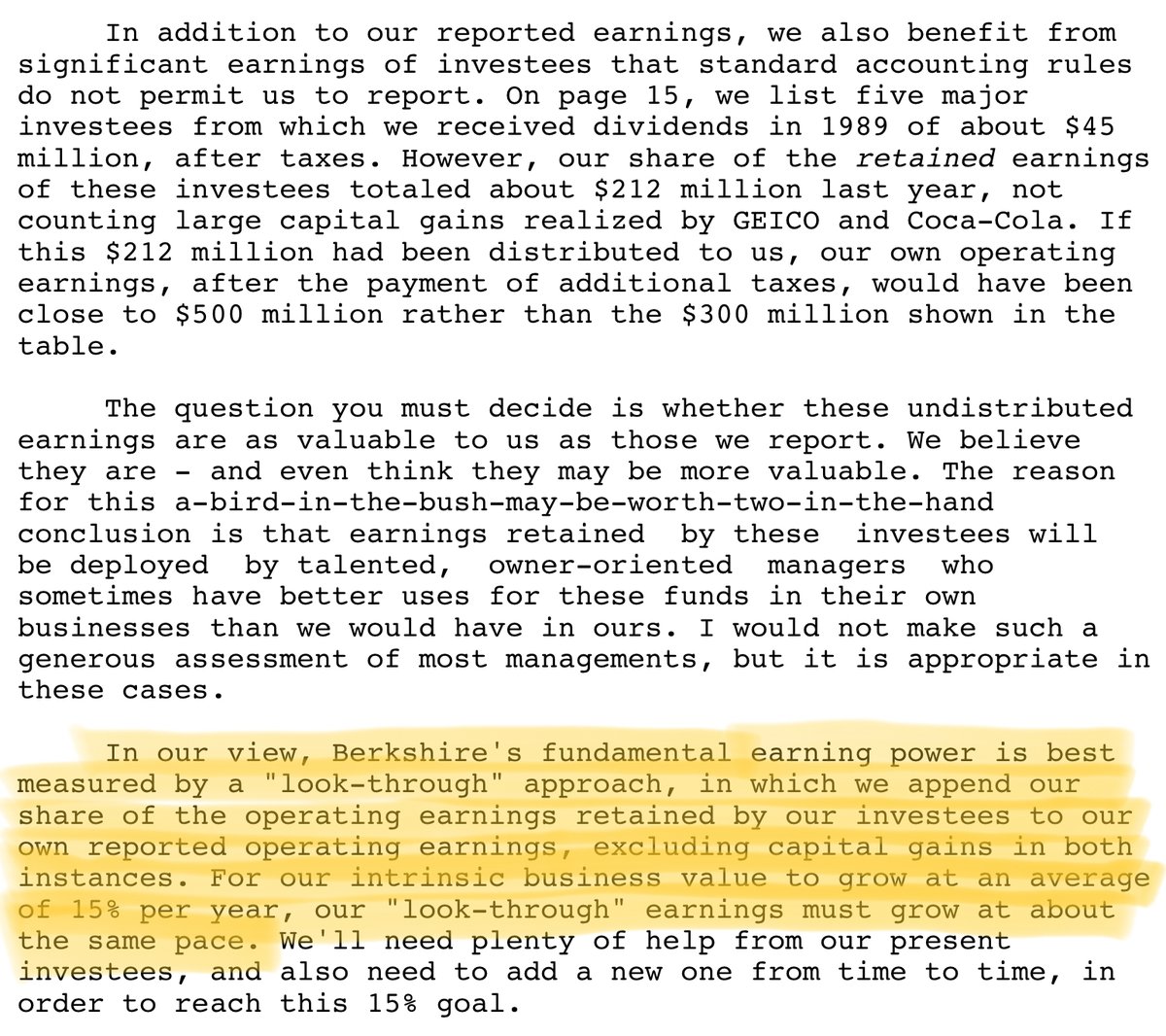

Buffett likes LTE a lot. He uses it as a yardstick for Berkshire's own portfolio.

In his shareholder letters, there are only a few topics he revisits again and again -- year after year.

Insurance float is one such topic. LTE is another.

For example, his 1989 letter says:

Buffett likes LTE a lot. He uses it as a yardstick for Berkshire's own portfolio.

In his shareholder letters, there are only a few topics he revisits again and again -- year after year.

Insurance float is one such topic. LTE is another.

For example, his 1989 letter says:

17/

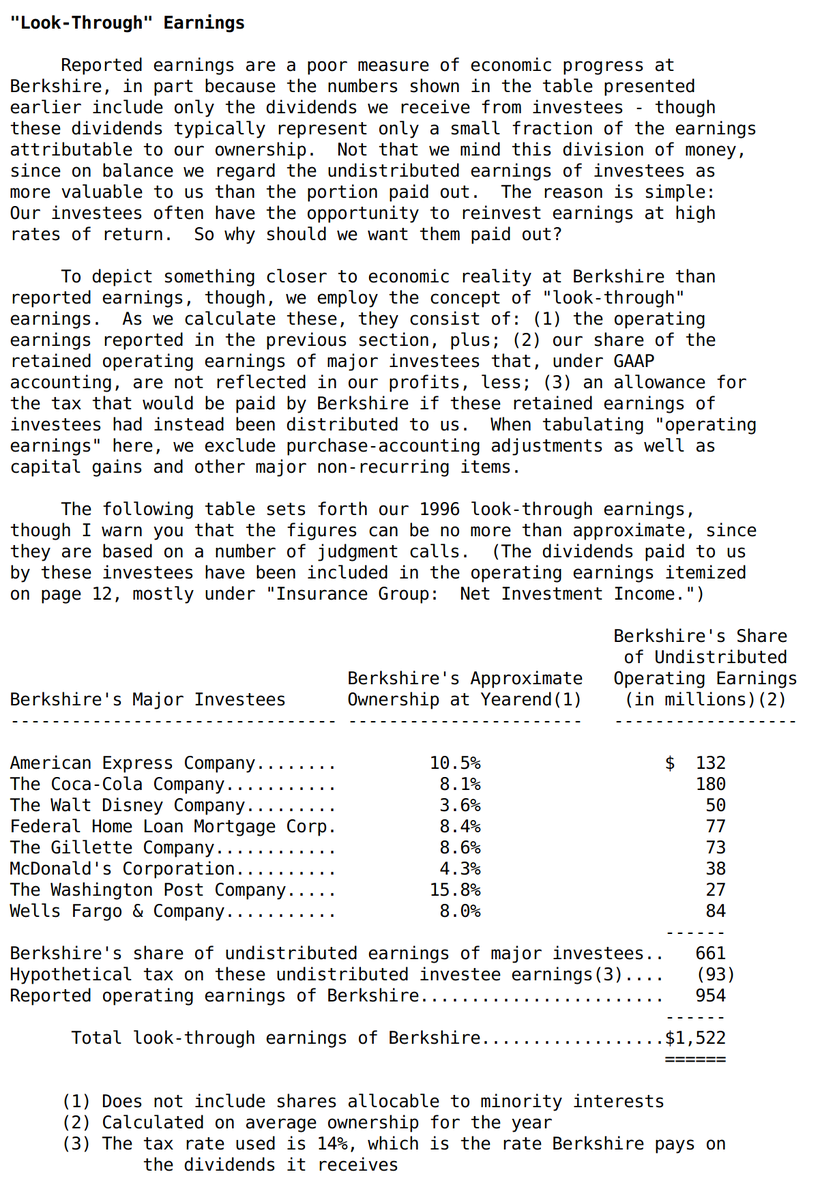

From 1989 to 2000, almost every shareholder letter that Buffett wrote had a section on LTE.

In fact, in many of these letters, there's a table showing how to calculate Berkshire's LTE -- much like our table above.

An example from the 1996 letter:

From 1989 to 2000, almost every shareholder letter that Buffett wrote had a section on LTE.

In fact, in many of these letters, there's a table showing how to calculate Berkshire's LTE -- much like our table above.

An example from the 1996 letter:

18/

One detail: if every portfolio company decided to distribute all its earnings as dividends, we'd have to pay additional taxes on these dividends.

Buffett's LTE calculations account for this. But our calculations don't. (I decided to keep things simple for this thread.)

One detail: if every portfolio company decided to distribute all its earnings as dividends, we'd have to pay additional taxes on these dividends.

Buffett's LTE calculations account for this. But our calculations don't. (I decided to keep things simple for this thread.)

19/

So far, we've seen how to calculate a portfolio's *current* LTE.

But the real question is: what will LTE look like in the *future*?

After all, 10 years from now, the portfolio's worth will depend on what its companies are earning *then*, not what they're earning *now*.

So far, we've seen how to calculate a portfolio's *current* LTE.

But the real question is: what will LTE look like in the *future*?

After all, 10 years from now, the portfolio's worth will depend on what its companies are earning *then*, not what they're earning *now*.

20/

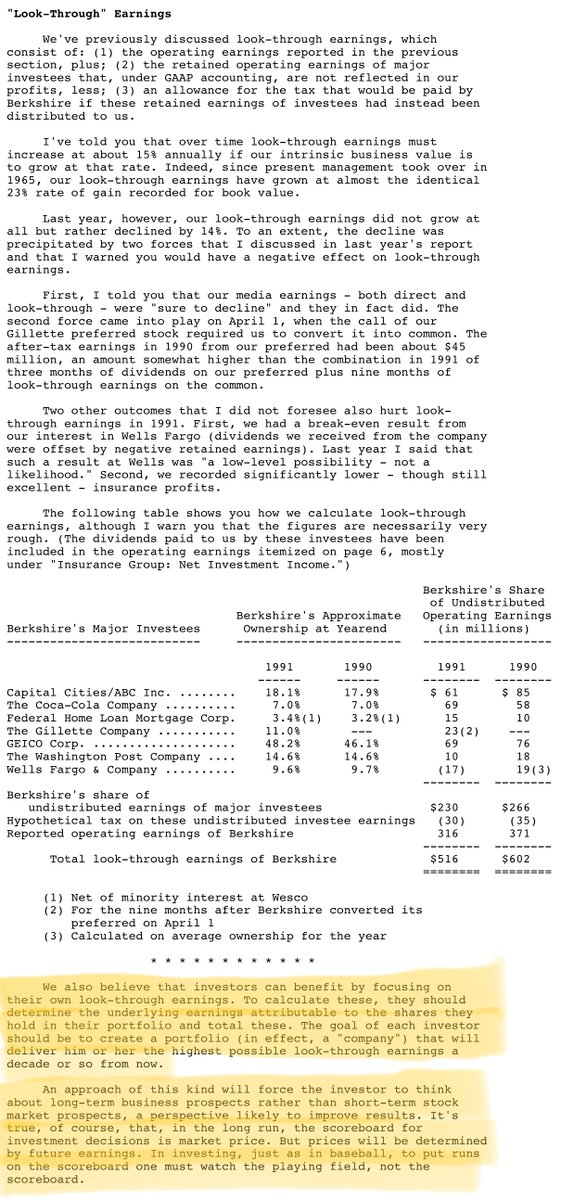

In his 1991 letter, Buffett suggests that we think about LTE "a decade or so" in the future.

By forcing us to think about the long-term earnings prospects of each company in our portfolio, this approach helps us form realistic expectations about future portfolio returns.

In his 1991 letter, Buffett suggests that we think about LTE "a decade or so" in the future.

By forcing us to think about the long-term earnings prospects of each company in our portfolio, this approach helps us form realistic expectations about future portfolio returns.

21/

So, how exactly do we form a view about a portfolio company's *future* earnings?

A simple mental model for this is "incremental return on retained earnings".

The easiest way to understand this is through an example.

So, how exactly do we form a view about a portfolio company's *future* earnings?

A simple mental model for this is "incremental return on retained earnings".

The easiest way to understand this is through an example.

22/

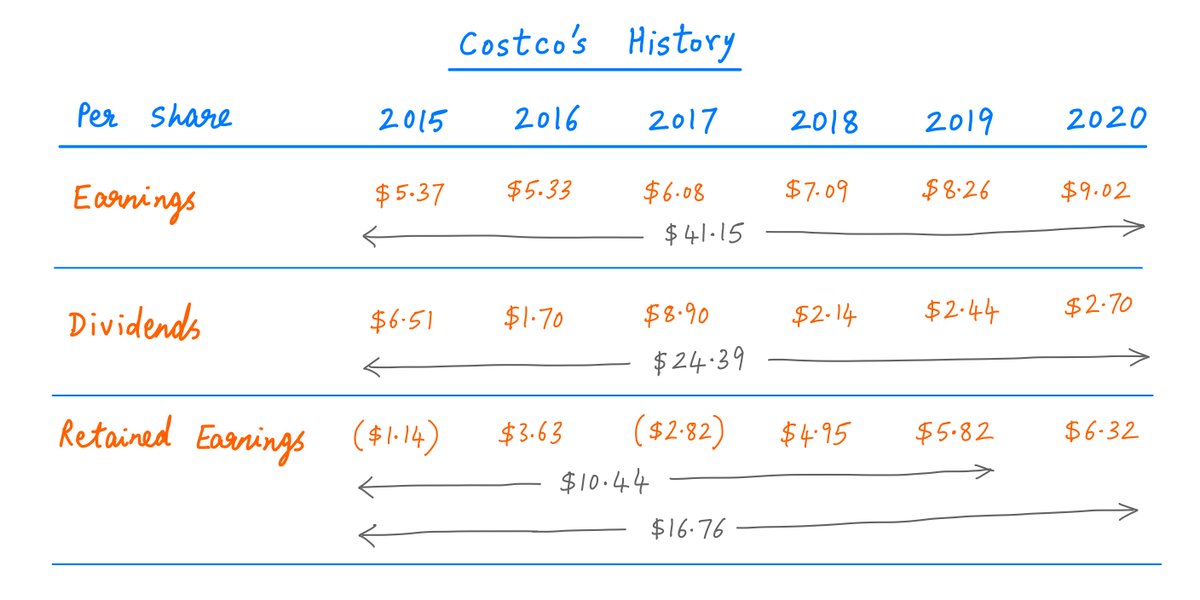

Let's take Costco -- one of our portfolio companies.

In 2015, Costco earned $5.37 per share.

By 2020, this had grown to $9.02 per share.

How was Costco able to achieve this $9.02 - $5.37 = $3.65 per share increase?

The answer is: retained earnings.

Let's take Costco -- one of our portfolio companies.

In 2015, Costco earned $5.37 per share.

By 2020, this had grown to $9.02 per share.

How was Costco able to achieve this $9.02 - $5.37 = $3.65 per share increase?

The answer is: retained earnings.

23/

From 2015 to 2019, Costco earned a total of $32.13 per share.

But it didn't return all this money back to shareholders as dividends.

In fact, it returned only $21.69.

What about the remaining $10.44?

From 2015 to 2019, Costco earned a total of $32.13 per share.

But it didn't return all this money back to shareholders as dividends.

In fact, it returned only $21.69.

What about the remaining $10.44?

24/

The remaining $10.44 is called "retained earnings".

It's the money that was earned by Costco, but not distributed to shareholders as dividends.

Instead, this retained earnings was reinvested back into the business -- to open new stores, invest in e-commerce, etc.

The remaining $10.44 is called "retained earnings".

It's the money that was earned by Costco, but not distributed to shareholders as dividends.

Instead, this retained earnings was reinvested back into the business -- to open new stores, invest in e-commerce, etc.

25/

And this $10.44 worth of reinvestment resulted in $3.65 worth of increase in per-share earnings.

In effect, Costco achieved a nearly 35% incremental return on the portion of its earnings that it elected to retain:

($3.65/$10.44) * 100 = 34.96%.

That's not bad at all!

And this $10.44 worth of reinvestment resulted in $3.65 worth of increase in per-share earnings.

In effect, Costco achieved a nearly 35% incremental return on the portion of its earnings that it elected to retain:

($3.65/$10.44) * 100 = 34.96%.

That's not bad at all!

26/

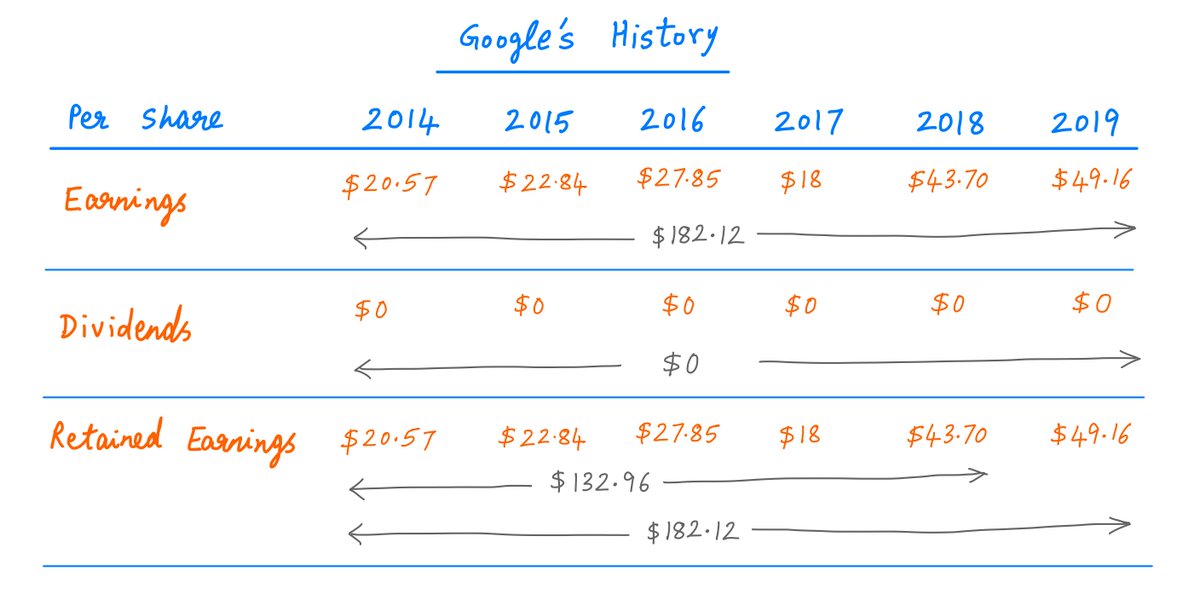

How did the other companies in our portfolio do?

Let's take Google. It grew earnings from $20.57 per share in 2014 to $49.16 per share in 2019.

But unlike Costco, Google decided to retain *all* of its earnings. It didn't pay a dime in dividends.

How did the other companies in our portfolio do?

Let's take Google. It grew earnings from $20.57 per share in 2014 to $49.16 per share in 2019.

But unlike Costco, Google decided to retain *all* of its earnings. It didn't pay a dime in dividends.

27/

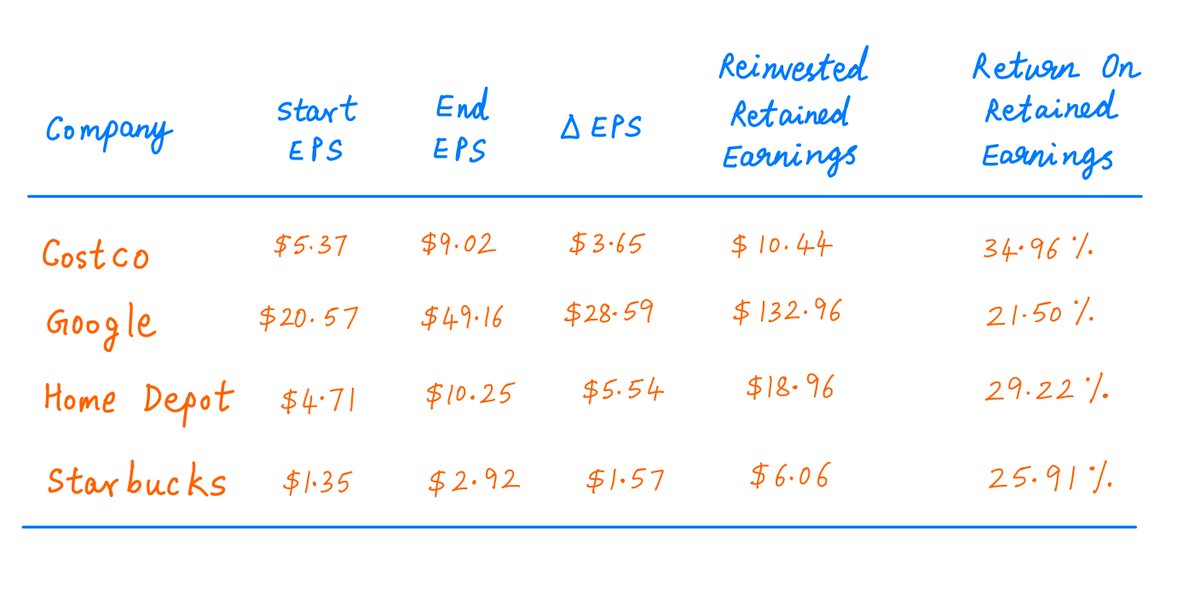

Repeating this analysis for all our portfolio companies, we see that Costco is the one that produced the greatest incremental return (34.96%) on retained earnings.

Google actually produced the *lowest* return (21.5%) -- even though it grew earnings the *fastest*.

Repeating this analysis for all our portfolio companies, we see that Costco is the one that produced the greatest incremental return (34.96%) on retained earnings.

Google actually produced the *lowest* return (21.5%) -- even though it grew earnings the *fastest*.

28/

Key lesson: Earnings growth alone doesn't tell you the whole story. You should also consider how much capital had to be reinvested back into the business (in the form of retained earnings) to produce this earnings growth -- and the incremental return earned on this capital.

Key lesson: Earnings growth alone doesn't tell you the whole story. You should also consider how much capital had to be reinvested back into the business (in the form of retained earnings) to produce this earnings growth -- and the incremental return earned on this capital.

29/

It's much easier to grow earnings quickly if you retain every penny and reinvest it all back into the business each year.

It's much harder to grow earnings at the same rate while distributing a big chunk of earnings each year to shareholders as dividends.

It's much easier to grow earnings quickly if you retain every penny and reinvest it all back into the business each year.

It's much harder to grow earnings at the same rate while distributing a big chunk of earnings each year to shareholders as dividends.

30/

Companies that pay out a big part of their earnings as dividends may only be able to grow earnings slowly.

But they may still achieve excellent incremental returns on retained earnings and reinvested capital.

In the long run, this can leave many shareholders better off.

Companies that pay out a big part of their earnings as dividends may only be able to grow earnings slowly.

But they may still achieve excellent incremental returns on retained earnings and reinvested capital.

In the long run, this can leave many shareholders better off.

31/

Here are the payout ratios of our 4 portfolio companies, based on how much money they earned and how much of it they distributed as dividends over the past 5 years:

Here are the payout ratios of our 4 portfolio companies, based on how much money they earned and how much of it they distributed as dividends over the past 5 years:

32/

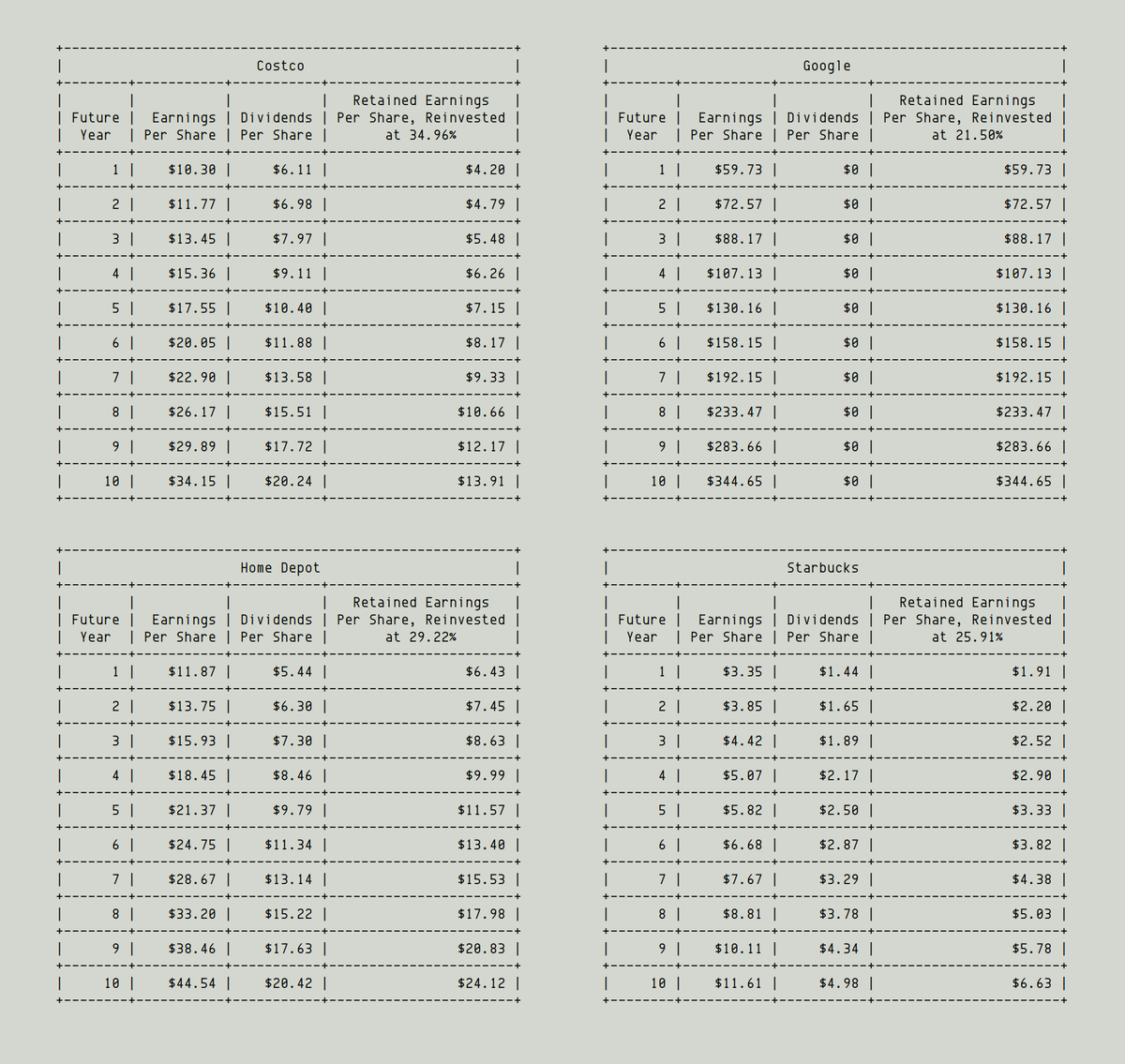

*If* we assume that (1) our portfolio companies will continue to earn the same incremental returns on retained earnings, and that (2) their payout ratios will remain the same, then we can do quick simulations to predict the future earnings of these companies:

*If* we assume that (1) our portfolio companies will continue to earn the same incremental returns on retained earnings, and that (2) their payout ratios will remain the same, then we can do quick simulations to predict the future earnings of these companies:

33/

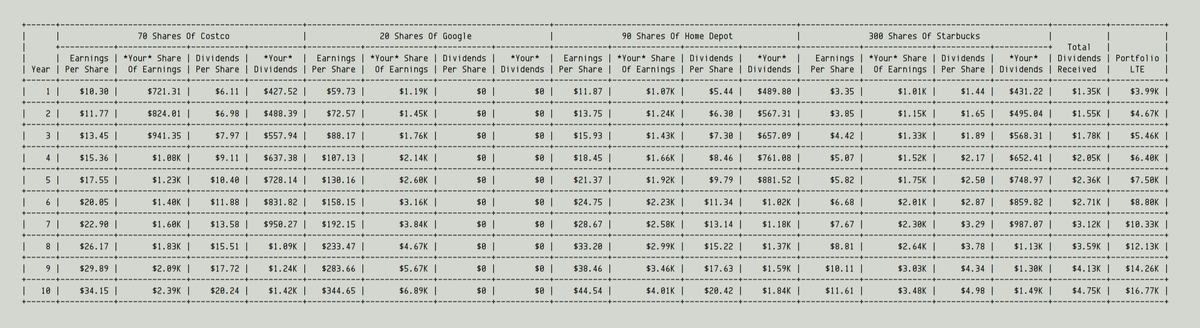

And this in turn can give us a rough idea of what the future LTE of our portfolio will be.

As the simulation below shows, we expect our portfolio's LTE to be about $16.77K a decade from now:

And this in turn can give us a rough idea of what the future LTE of our portfolio will be.

As the simulation below shows, we expect our portfolio's LTE to be about $16.77K a decade from now:

34/

Assuming that our portfolio companies will trade at about 20 times earnings a decade from now, that means our portfolio will be worth about $335K at that time.

Plus, we'll collect about $27K in dividends over the decade -- for a total annualized return of about 13.78%.

Assuming that our portfolio companies will trade at about 20 times earnings a decade from now, that means our portfolio will be worth about $335K at that time.

Plus, we'll collect about $27K in dividends over the decade -- for a total annualized return of about 13.78%.

35/

Of course, we've made several assumptions above that may or may not pan out.

Our portfolio companies may earn lower returns on retained earnings. Their payout ratios may change over time. Their earnings multiple may be 15 instead of 20 a decade from now.

Of course, we've made several assumptions above that may or may not pan out.

Our portfolio companies may earn lower returns on retained earnings. Their payout ratios may change over time. Their earnings multiple may be 15 instead of 20 a decade from now.

36/

So our portfolio's future performance may turn out either better or worse than our prediction here.

But the point is not to try and predict the future perfectly. That's a fool's errand.

So our portfolio's future performance may turn out either better or worse than our prediction here.

But the point is not to try and predict the future perfectly. That's a fool's errand.

37/

The idea, rather, is to think deeply about the long-term future of our portfolio companies.

To understand the factors that will drive company-level earnings and portfolio-level LTE.

And to reinforce the view that stocks are pieces of businesses, not pieces of paper.

The idea, rather, is to think deeply about the long-term future of our portfolio companies.

To understand the factors that will drive company-level earnings and portfolio-level LTE.

And to reinforce the view that stocks are pieces of businesses, not pieces of paper.

38/

At its core, LTE is an "aggregation" technique. We aggregate the earnings of individual holdings into a "portfolio level" earnings metric.

If you'd like to learn more about other aggregation techniques, I can recommend the 2019 Semper Augustus client letter.

At its core, LTE is an "aggregation" technique. We aggregate the earnings of individual holdings into a "portfolio level" earnings metric.

If you'd like to learn more about other aggregation techniques, I can recommend the 2019 Semper Augustus client letter.

39/

The letter clearly lays out the principles behind various kinds of portfolio aggregation, accompanied by detailed calculations and illuminating discussions on how to interpret such aggregation metrics (h/t @ChrisBloomstran).

Link: semperaugustus.com/clientletter

The letter clearly lays out the principles behind various kinds of portfolio aggregation, accompanied by detailed calculations and illuminating discussions on how to interpret such aggregation metrics (h/t @ChrisBloomstran).

Link: semperaugustus.com/clientletter

40/

If you're still with me, you clearly have extraordinary focus and determination. You will go far in investing -- and in life!

Thanks for your time. Enjoy your weekend!

/End

If you're still with me, you clearly have extraordinary focus and determination. You will go far in investing -- and in life!

Thanks for your time. Enjoy your weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh