Looks like the KuCoin hacker started using Uniswap to swap from shitcoins to ETH. Started with OCEAN. AFAIK this is the first time Uniswap is used following a hack

Steps:

1. From 0xeb....c23 to 0x1c...814 to 0x9e...E6b

2. 0x9e...E6b now slowly dumping OCEAN to ETH in 9 tx's

Steps:

1. From 0xeb....c23 to 0x1c...814 to 0x9e...E6b

2. 0x9e...E6b now slowly dumping OCEAN to ETH in 9 tx's

https://twitter.com/UnderTheBreach/status/1310125971664666624

All Uniswap transactions so far can be found here: etherscan.io/address/0x9e9d…

This will likely start crashing the price of most of the shitcoins the hacker holds. Be careful

This will likely start crashing the price of most of the shitcoins the hacker holds. Be careful

The hacker is doing the same from this address as well. Dumping in 10k OCEAN batches etherscan.io/address/0xeab5…

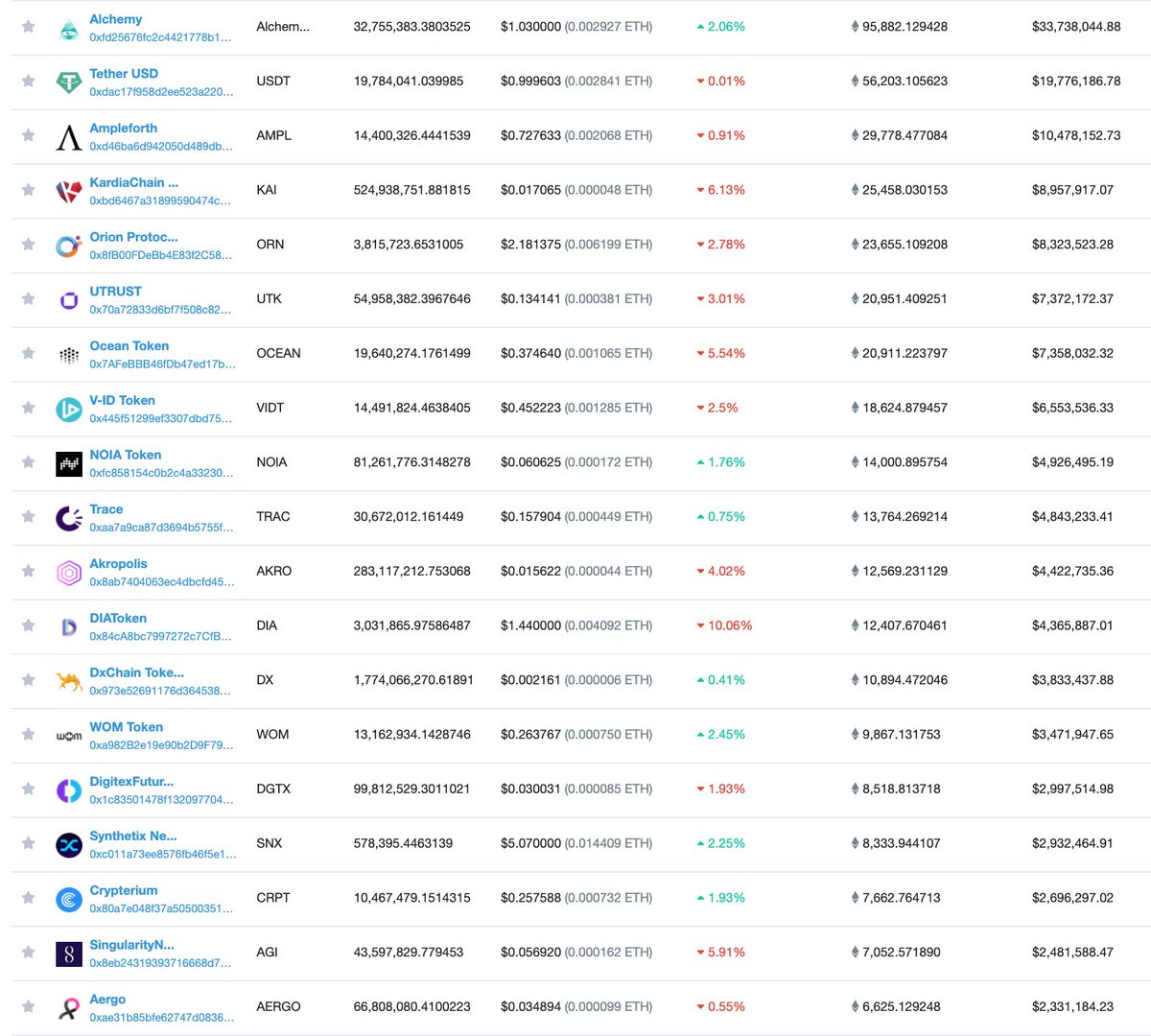

These are the ERC-20 tokens hacker has now sorted by USD value. Watching these closely as they can be next if Uniswap has liquid markets for some of them. Market participants might also front run then hacker and start dumping themselves. Some interesting dynamics playing out

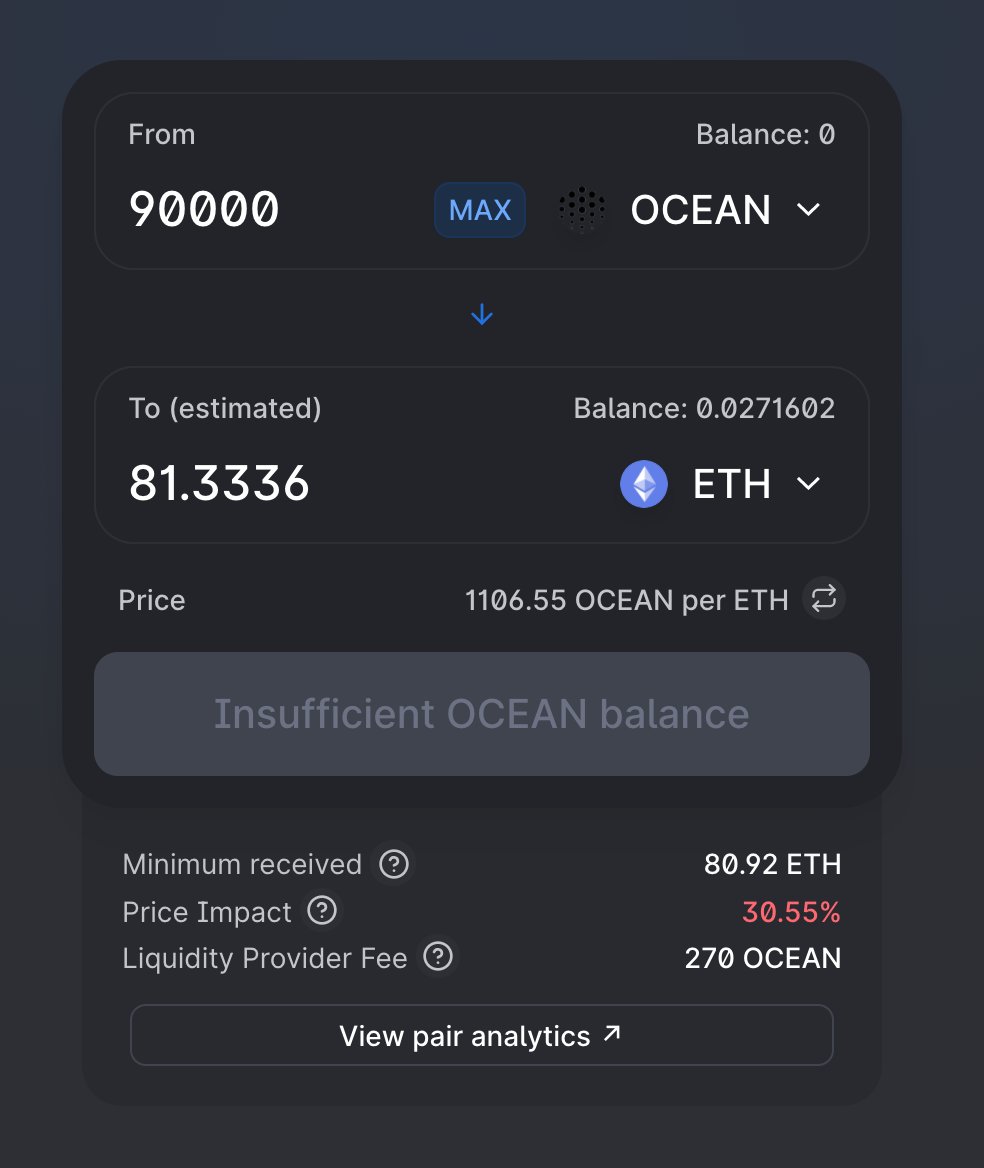

The hacker appeared to have stopped selling 20 minutes ago. He still has 90k OCEAN in one wallet. I think it's because the liquidity quickly dried up. In order to dump another 90k OCEAN on Uniswap, the price impact is 30%+. Might be smarter to wait until next dump

Watch this wallet closely if you want to see if he starts dumping some other shitcoin next. I don't really see why he'd stop at OCEAN etherscan.io/address/0xeb31…

Also if you think this is laundering, it's not. He's getting ETH for shitcoins and the ETH will be tainted just as the shitcoin was prior to the swap. Laundering starts when Tornado or some shady OTC desk is involved. Confusing the two is not smart

That being said, a high profile incident like this could bring Uniswap into regulators' spotlight. Especially if the swapping continues. Let's see

OCEAN liquidity providers will wake up very confused. That's for sure. Impermanent loss caused by an exchange hacker. Poetic

I think the smartest move the hacker might do is to find the most liquid futures market of the shitcoins he holds, go leverage short and dump the fuck out of everything he owns on Uniswap. Might still be connectable though, who knows

The OCEAN contract has now been paused.

https://twitter.com/oceanprotocol/status/1310154282575028227

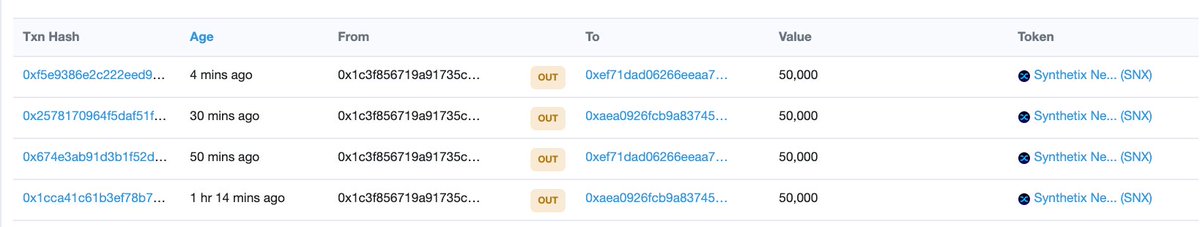

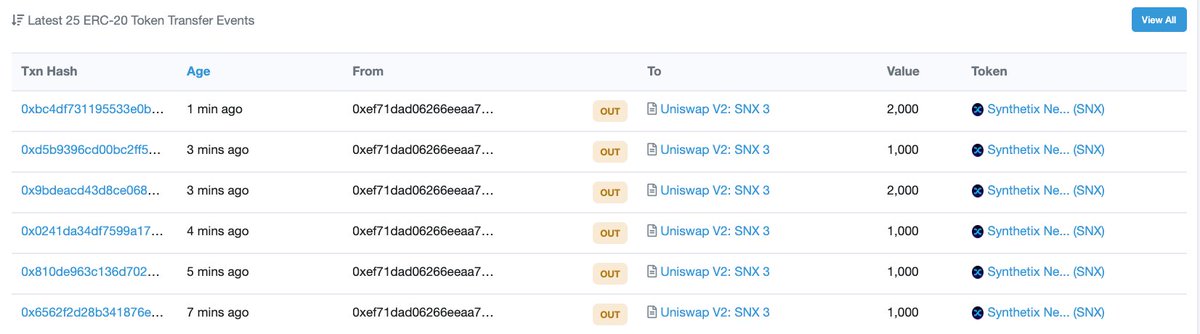

The hacker is now dumping Synthetix 🚨 🚨 etherscan.io/address/0xaea0…

And more etherscan.io/address/0xef71…

And now another $1.2 million SNX transferred to this address. Uniswap dumping might start there soon etherscan.io/tx/0xb2fdd1496…

Another 20k SNX already dumped in the last 10 minutes. Larger dump incoming, another 40k ready there to be sold imminently. If you LP SNX on Uniswap, co sider pulling liquidity until the dust settles etherscan.io/address/0xaea0…

More than 100k SNX has been sold on Uniswap already. The hacker still holds 470k SNX in his wallets. If he keeps selling, this is nowhere close to over.

And another 40k batch being dumped now. This will keep going on, I see no reason for the hacker to stop until there is liquidity. etherscan.io/address/0xef71…

Hacker just finished dumping the last batch and already sending 130k SNX more to sell. No intention to stop

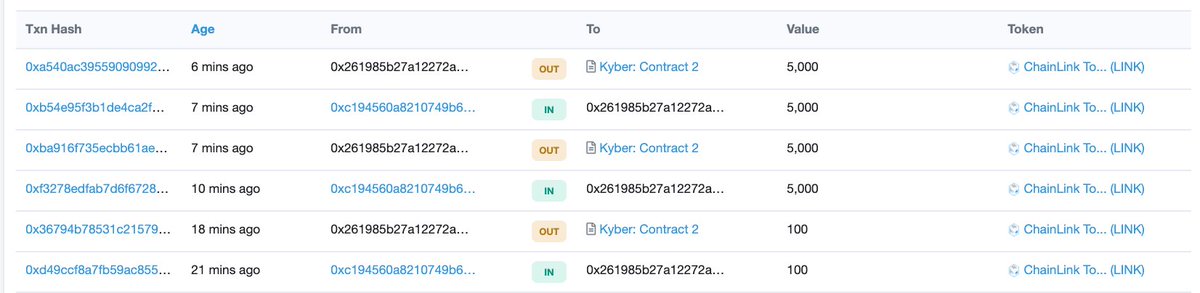

And we have a new development. Hacker now started dumping COMP on not only Uniswap but also Kyber 🚨🚨🚨

• • •

Missing some Tweet in this thread? You can try to

force a refresh