Okay, first things first: let's take criminal tax fraud off the table, shall we? (A friend requested that I not skimp on the GIFs, so also, let's do this in a GIF-heavy thread.) #TrumpTaxReturns 1/

I get that looking to criminal tax fraud is attractive; we've enjoyed using it to prosecute crimes we know about but, for whatever reason, can't prosecute at least since Al Capone. 2/

But here's the thing: criminal tax prosecutions are hard. Like, really hard. 3/

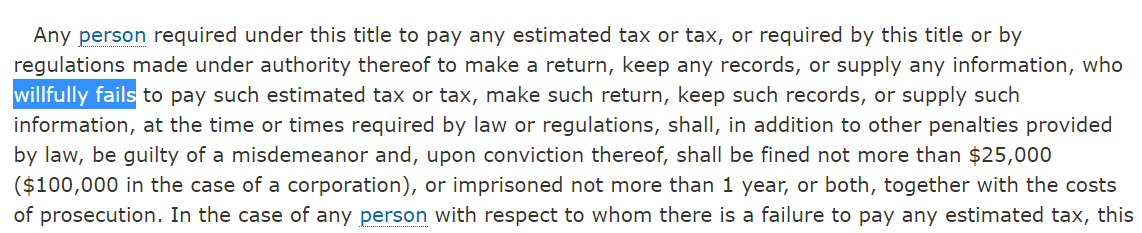

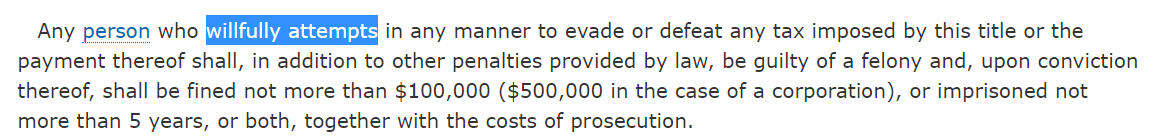

There are two main criminal tax provisions that could possibly apply: a misdemeanor 7203 or a felony 7201.

And a caveat: while I took a criminal tax class in my (abortive) LLM days, I was a transactional person, so I don't have a lot of experience here. 3/

And a caveat: while I took a criminal tax class in my (abortive) LLM days, I was a transactional person, so I don't have a lot of experience here. 3/

Misdemeanor: law.cornell.edu/uscode/text/26… 4/

Felony: law.cornell.edu/uscode/text/26… 5/

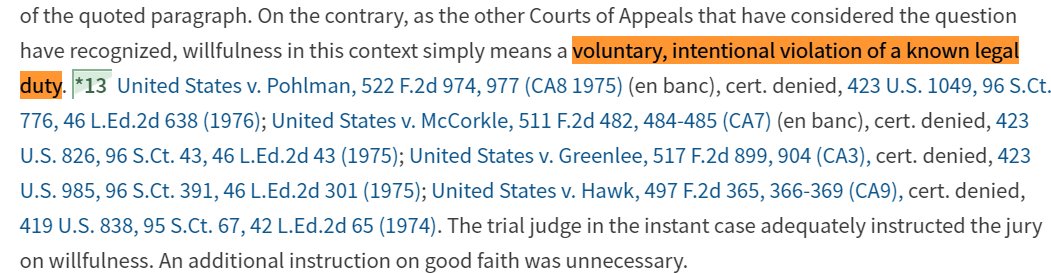

Notice something? Each of the criminal statutes includes the word "willfully." In fancy-pants lawyer speak, we call that a mens rea requirements. 6/

So to be guilty of either criminal activity, Trump would necessarily have "willfully" avoided or evaded tax.

So what does "willful" mean? 7/

So what does "willful" mean? 7/

The Supreme Court has held that "willful" means "a voluntary, intentional violation of a known legal duty" (US v. Pomponio).

That turns out to be a pretty high standard. 8/

That turns out to be a pretty high standard. 8/

In short, that means that criminal conviction won't happen where a taxpayer carelessly makes a mistake. (That's good, right? Like, we all carelessly make mistakes.)

And it won't happen even where a taxpayer aggressively ambiguous legal issues in their own favor. 9/

And it won't happen even where a taxpayer aggressively ambiguous legal issues in their own favor. 9/

But it goes even further: even a really stupid belief, if sincerely held, shields you from criminal tax prosecution. In Cheek, the Supreme Court held that a tax protestor who claimed that he truly sincerely believed that the law didn't tax wages didn't commit a crime. 10/

I cannot emphasize enough how dumb that belief is. 11/

Now did Trump willfully violate the tax law?

Of course it's possible. But he almost certainly can say that the tax law is complicated and he relied on experts and he sincerely believed that he was doing the right thing. 12/

Of course it's possible. But he almost certainly can say that the tax law is complicated and he relied on experts and he sincerely believed that he was doing the right thing. 12/

That won't protect him from back taxes and interest if he violated the tax law. It may or may not protect him from civil penalties.

But it could arguably protect him from criminal conviction. 13/

But it could arguably protect him from criminal conviction. 13/

There's a lot in the @nytimes story. But without a lot more than we have, I suspect that he won't be prosecuted for felony or misdemeanor tax crimes. #TrumpTaxReturns 14/14

aggressively *resolves* ambiguous legal issues

Hey @AnnalisaTalking, does this work?

• • •

Missing some Tweet in this thread? You can try to

force a refresh