Non-fungible tokens (NFTs) as an investment category are earning broader recognition catalyzed by NFT liquidity mining.

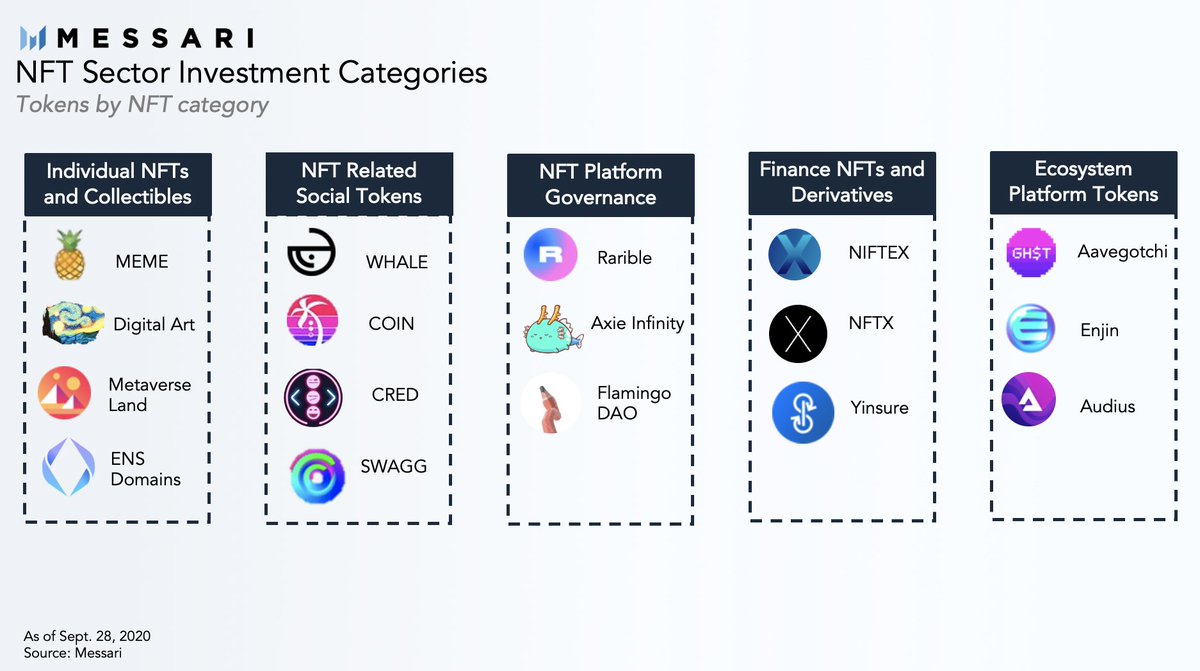

As investors search for venture scale returns in the NFT sector, each category will provide different opportunities and tradeoffs. Thread below 🧵

As investors search for venture scale returns in the NFT sector, each category will provide different opportunities and tradeoffs. Thread below 🧵

Investors like @AriDavidPaul, @WhaleShark_Pro, @ianjohnlee, & @jbrukh have shared great insights on the NFT landscape.

I’d like to expand on their mental models with a broad framework for how to categorize NFTs. messari.io/article/the-ar…

I’d like to expand on their mental models with a broad framework for how to categorize NFTs. messari.io/article/the-ar…

1️⃣ Individual NFTs and Collections

Ex: Axies, ENS domains, Trading Cards, Decentraland LAND, digital art

While individual NFTs may accrue notable value based on their utility or scarcity, this may not be the most effective strategy to capitalize on the growth of the NFT sector.

Ex: Axies, ENS domains, Trading Cards, Decentraland LAND, digital art

While individual NFTs may accrue notable value based on their utility or scarcity, this may not be the most effective strategy to capitalize on the growth of the NFT sector.

2️⃣ NFT Financial Products, Derivatives, and Indexes

Ex: NIFTEX, Yinsure, NFTX

Insurance, derivatives, and other financial products represent a massive market for NFTs and given the speculative nature of crypto is likely to be one of the more immediate use cases.

Ex: NIFTEX, Yinsure, NFTX

Insurance, derivatives, and other financial products represent a massive market for NFTs and given the speculative nature of crypto is likely to be one of the more immediate use cases.

3️⃣ NFT-Platform Governance Tokens

Ex: Rarible, Axie Infinity (upcoming), FlamingoDAO (LAO style)

Governance tokens are one of the most compelling ways to play the sector because they effectively represent an index of the NFTs on a certain platform.

Ex: Rarible, Axie Infinity (upcoming), FlamingoDAO (LAO style)

Governance tokens are one of the most compelling ways to play the sector because they effectively represent an index of the NFTs on a certain platform.

4️⃣ NFT-Related Social Tokens

Ex: , ,

Social tokens backed by NFTs or NFT adjacent categories remain unproven, but encouraging. As crypto moves the world into the “ownership economy”, users will be increasingly rewarded for the value they bring into communities.

Ex: , ,

Social tokens backed by NFTs or NFT adjacent categories remain unproven, but encouraging. As crypto moves the world into the “ownership economy”, users will be increasingly rewarded for the value they bring into communities.

5️⃣ NFT Platforms and Infrastructure

Ex: Aavegotchi (GHST), Enjin, Audius, Horizon

In the case of platforms, native protocol tokens will likely accrue more value than any individual items or event tokens, but NFTs can be an integral part of the respective platform ecosystems.

Ex: Aavegotchi (GHST), Enjin, Audius, Horizon

In the case of platforms, native protocol tokens will likely accrue more value than any individual items or event tokens, but NFTs can be an integral part of the respective platform ecosystems.

For a deeper analysis of each NFT category and its potential for venture scale returns, check out the full report!

As always thanks to @jpurd17, @WilsonWithiam, @RyanWatkins_, and @ericturnr for helping me frame my thoughts.

messari.io/article/the-ar…

As always thanks to @jpurd17, @WilsonWithiam, @RyanWatkins_, and @ericturnr for helping me frame my thoughts.

messari.io/article/the-ar…

• • •

Missing some Tweet in this thread? You can try to

force a refresh