HIGHWAY ROBBERY Long thread

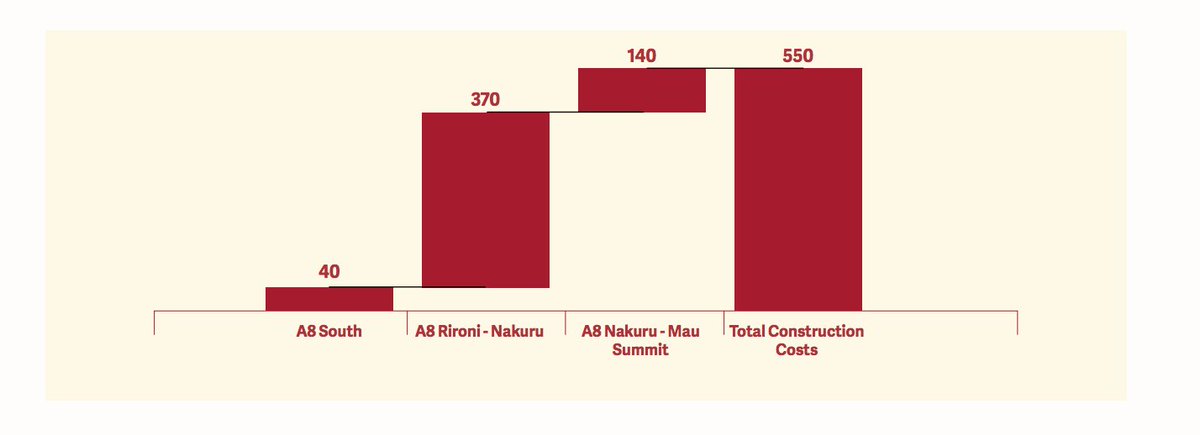

As per project information memorandum (IM) dated 2016, the Government estimated cost of Nbi-Nku-Mau Summit at US$550m as shown. The contracted cost is reported at Sh180b ($1.7b) at current exchange rate. 1/13

As per project information memorandum (IM) dated 2016, the Government estimated cost of Nbi-Nku-Mau Summit at US$550m as shown. The contracted cost is reported at Sh180b ($1.7b) at current exchange rate. 1/13

https://twitter.com/NziokaWaita/status/1310858272262496256

The contracted cost of the 215km is reported at Sh180b ($1.7b), an eye popping Sh837m ($8m) per km, believe it or not, way more than the SGR ($6m/km). Dualling the 21km Athi River- Machakos Junction cost Sh5.3b, or Sh252m ($2.5m) per km.

This rate is similar to the per km cost of the $550m estimate in the project IM. Engineers and QSs need to educate us on why it is costing 3 times + as much to upgrade a similar road, more so when long stretches of the road are on flat open uninhabited terrain.

At this cost, investors would expect a dollar return of at least 12 percent, which inclusive of operational and maintenance cost a gross revenue of at least 15 percent, plus a sinking fund to pay off the debt say over 20 years. That works out to Sh36b per year or Sh98m per day.

The average daily traffic (ADT) as per the project brief, on the busiest section (Nbi-Nku) was 40k vehicles. The hurdle rate tariff at this traffic level is Sh2400 ($24) per vehicle. For PSVs, that is the fare for 4 passengers i.e just about 30% of the revenue of a 14 seater.

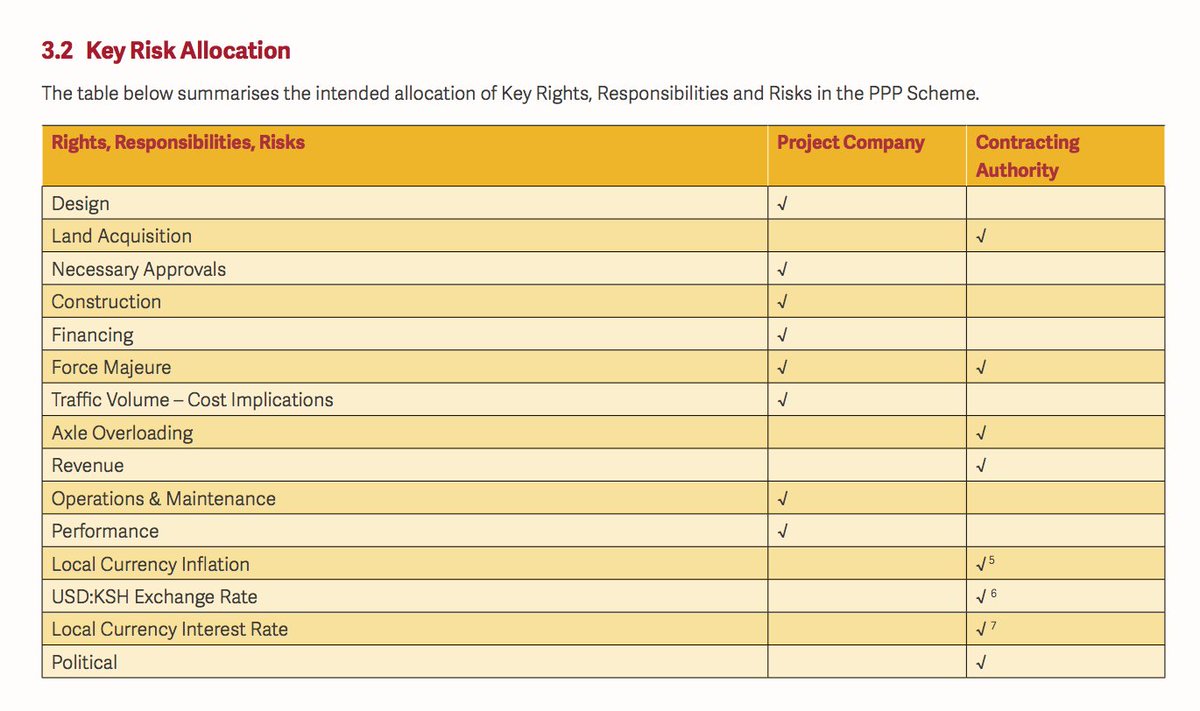

Of course, by the time its completed, the shilling may have weakened. The exchange rate risk and domestic interest risk (if the investors borrows locally) as well as total revenue risk falls on the Government. In fact the investor bears no risk at all, as shown.

Essentially, the investor is a bondholder guaranteed a fantastic equity premium for doing a project that the government could finance more cheaply. What do I mean? If Government goes to the Eurobond market now to build a public toll road it could borrow 10 year money at 8%.

Assuming, implausibly of course, that road costs Sh180b, the Government’s required revenue to pay interest is Sh14.4b a year, which, working with 40k vehicles translates to a tariff of Sh990 ($9 per vehicle).

The government does not need to factor in maintenance cost since we pay fuel levy for that. It also does not need a sinking fund because Governments, as perpetual entities, can and alway roll over their bonds.

But as noted the road is unlikely to cost anywhere near that much. Even if we provide for 10% cost escalation from 2016 and provide for another three years to completion, we are looking at $1b(Sh108b).

The hurdle rate of 12% calculated at the inflated $1.7 now becomes a guaranteed return of 22 percent-no sweat. The kickbacks for that? If we borrowed the $1b to build a public toll road, the interest cost on that works out to a tariff of Sh550 per vehicle.

Do the math, close to Sh2,000 per vehicle per day going to private pockets for something we could do publicly? As I keep saying, finance is the new extractive industry. 13/13

• • •

Missing some Tweet in this thread? You can try to

force a refresh