1/11 Okay, MEV is coming

MEV is a consequence of the fact that miners (pool operators) have the right to choose the tx order in a block.

They can be the first to:

- execute arbitrage

- get access to token offerings

- perform liquidation

Plus, they may not pay a fee for this.

MEV is a consequence of the fact that miners (pool operators) have the right to choose the tx order in a block.

They can be the first to:

- execute arbitrage

- get access to token offerings

- perform liquidation

Plus, they may not pay a fee for this.

2/11 As far as I know before, this was mainly used only for free distribution of rewards to miners. In this case, at the beginning of the transaction block, transactions are made to the pool miners, and only then all transactions, in order of decreasing gas price.

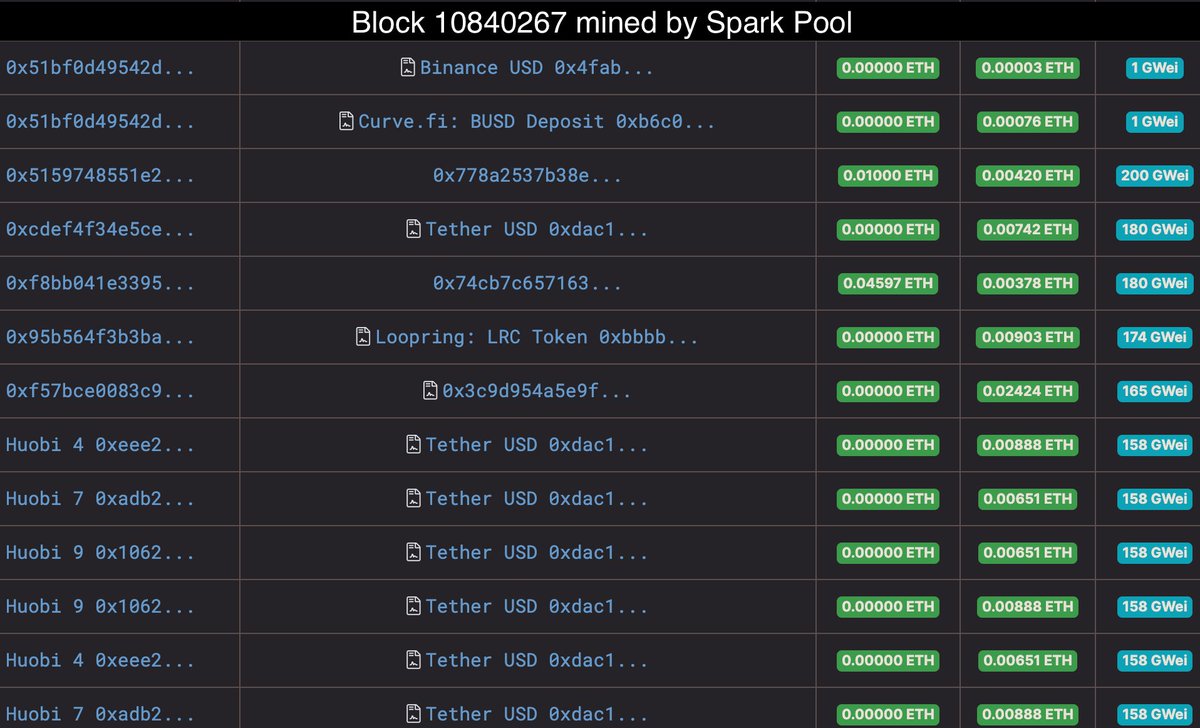

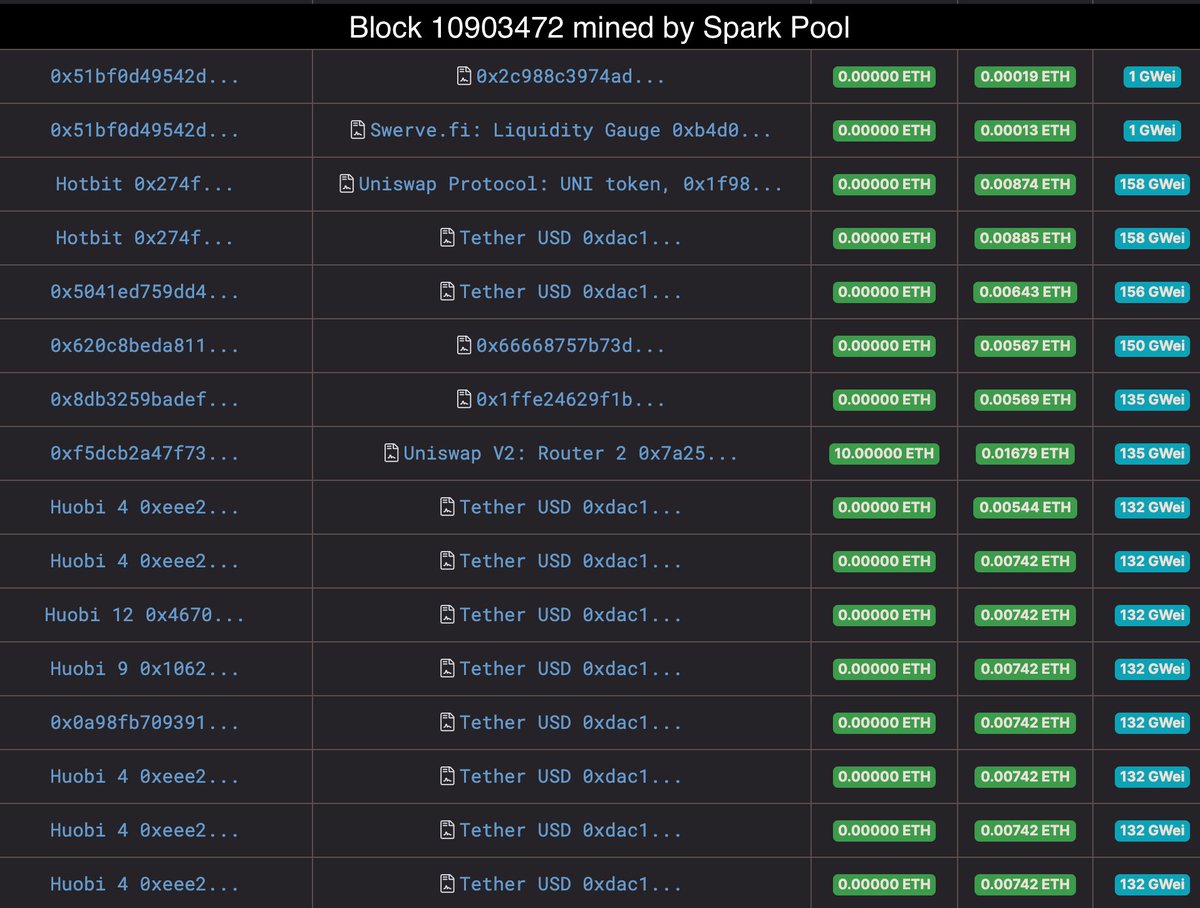

3/11 However, the DeFi boom led to the fact that more often, txs with not the highest gas price began to be the first in blocks. In some Spark Pool blocks, the first places in the block were occupied by txs from some address, although the price for gas in them was ~1 gwei.

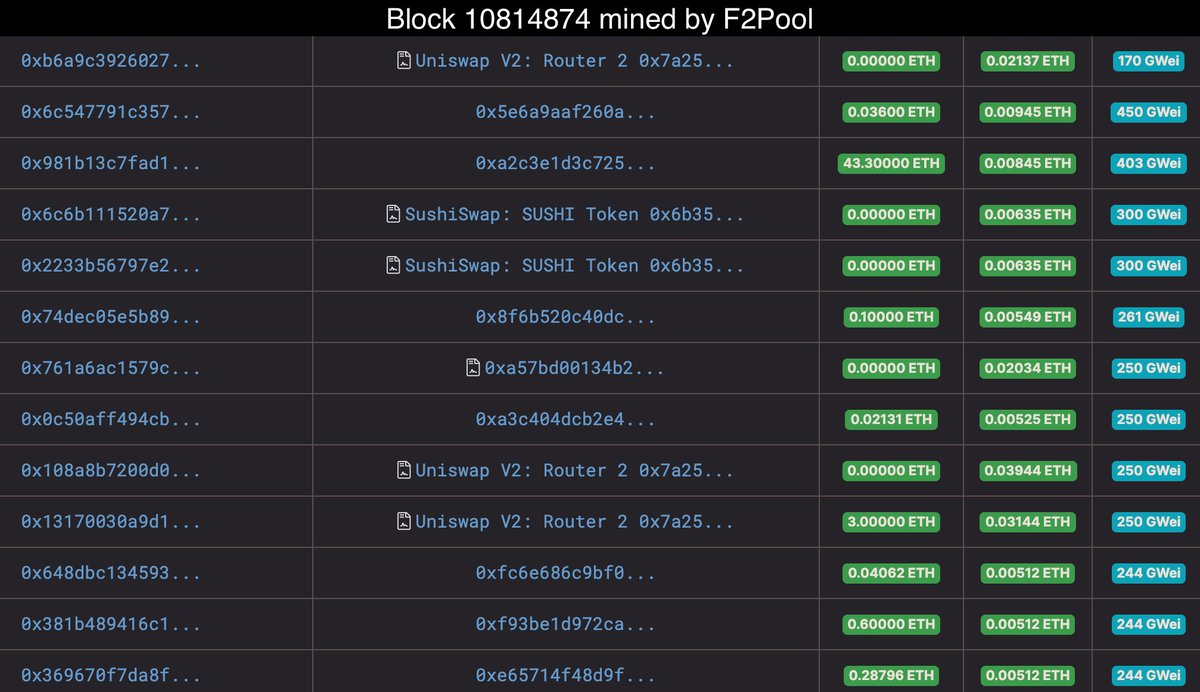

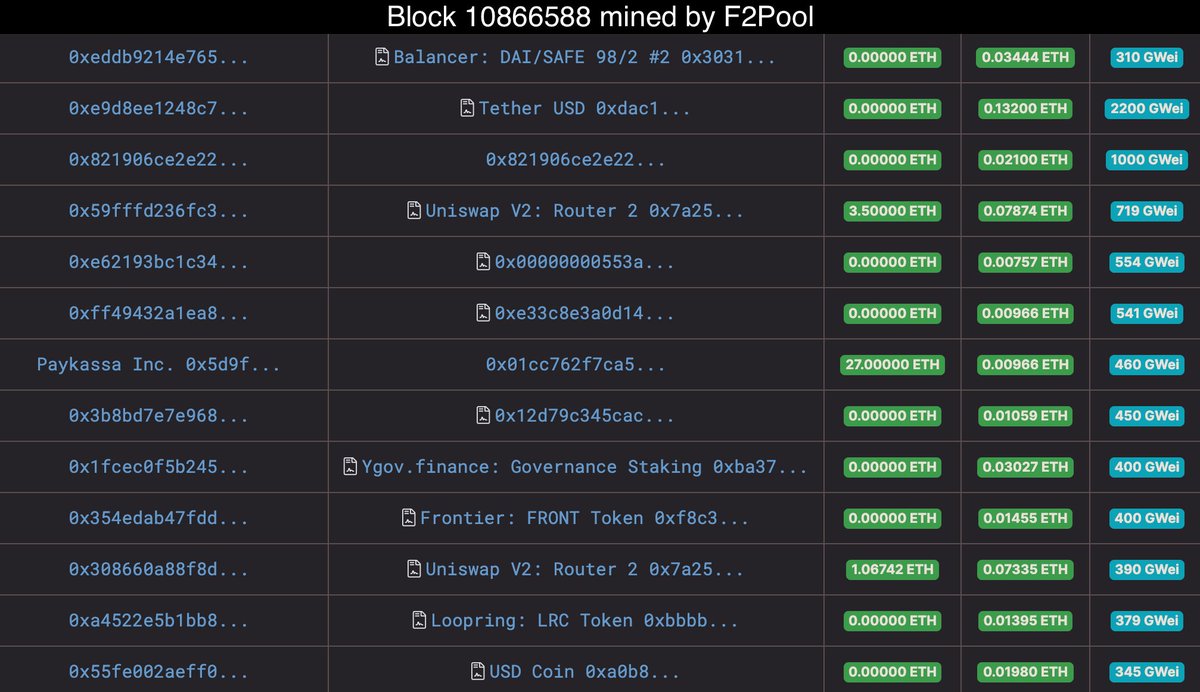

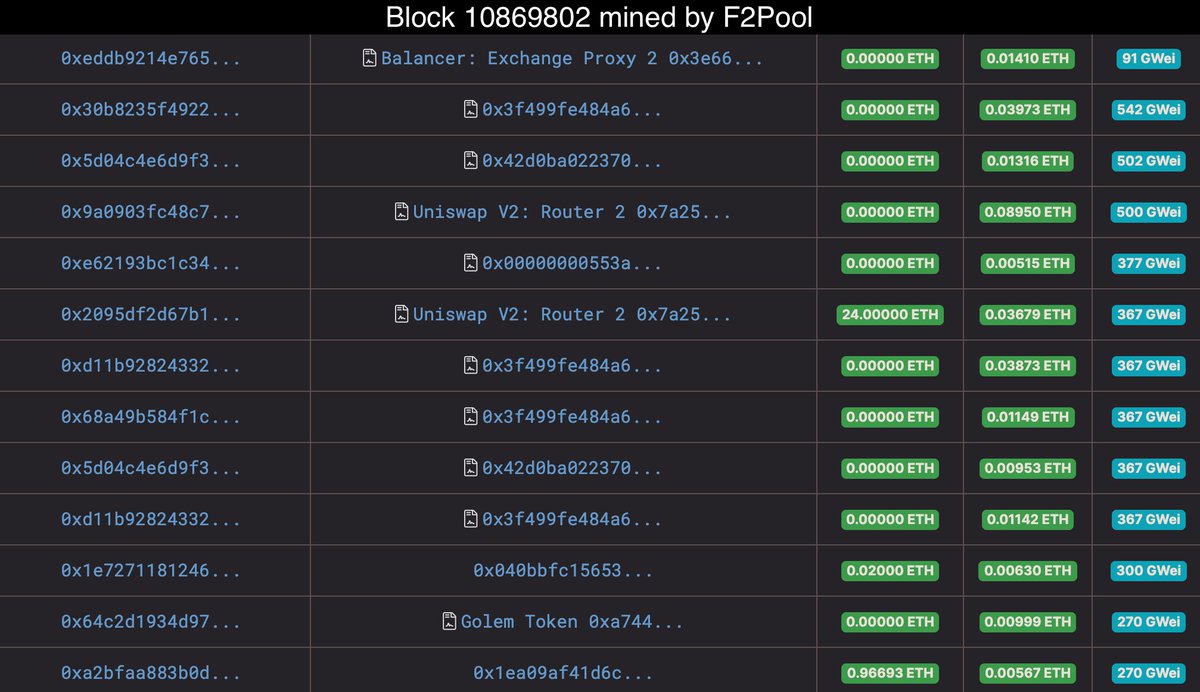

4/11 Similar things can be seen with F2Pool. Txs of some accounts were suspiciously often appearing first of all in blocks, while their gas price was lower than that of other txs. These txs are often token swaps, which could lead to frontrunning users and extracting MEVs.

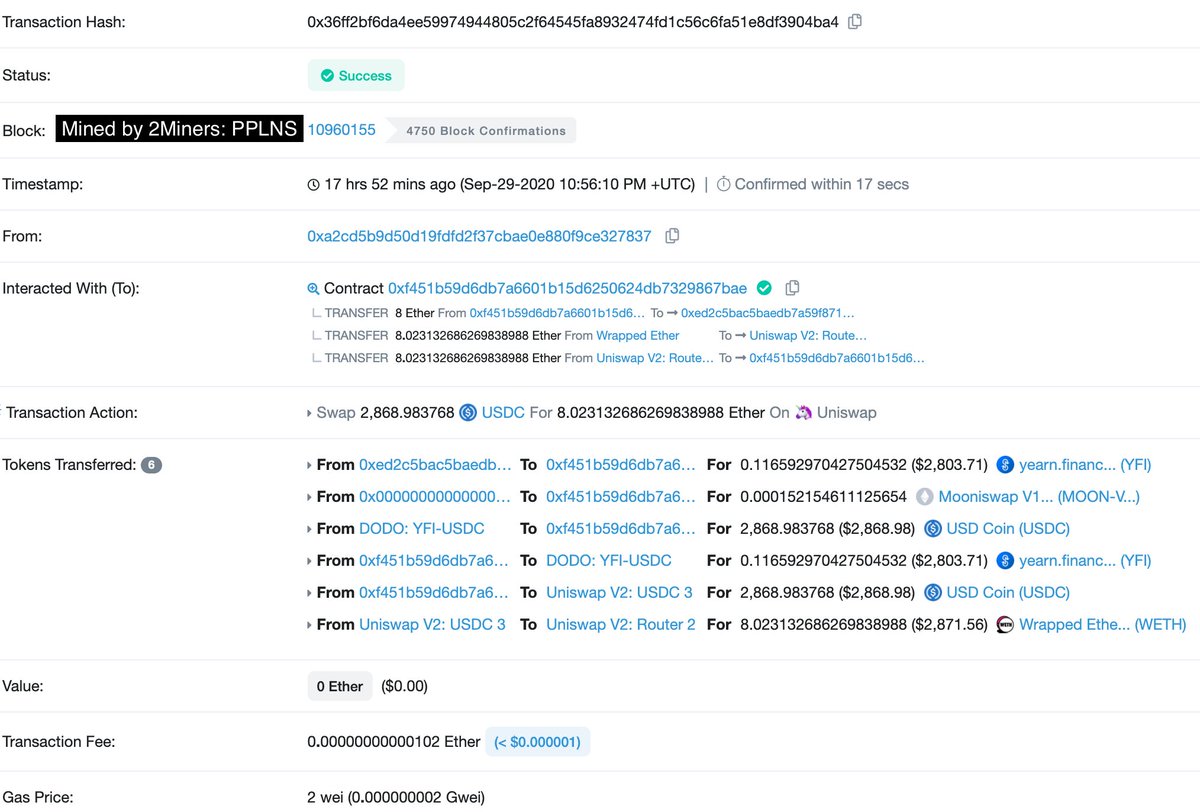

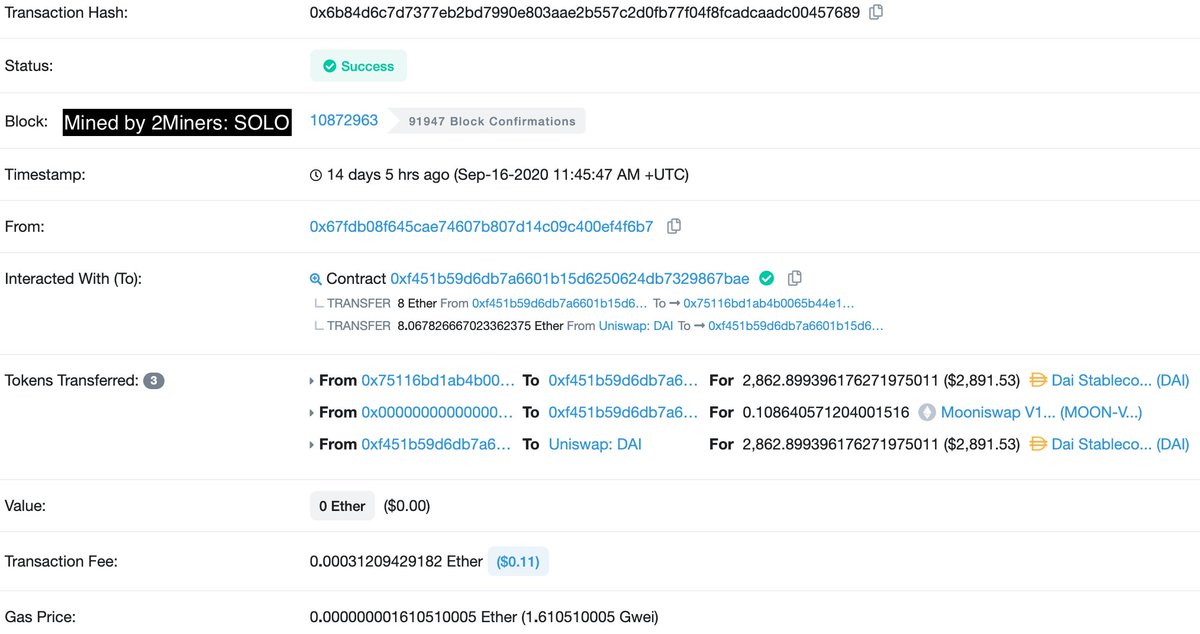

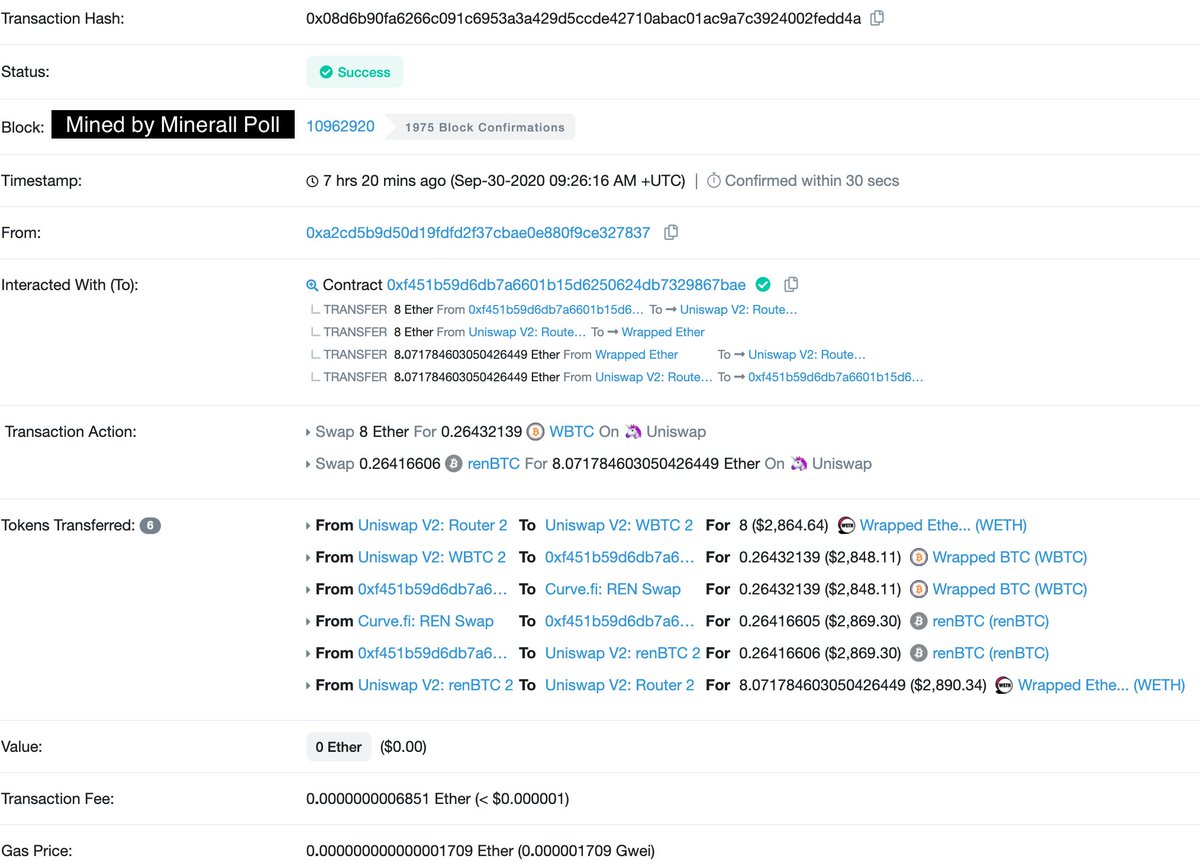

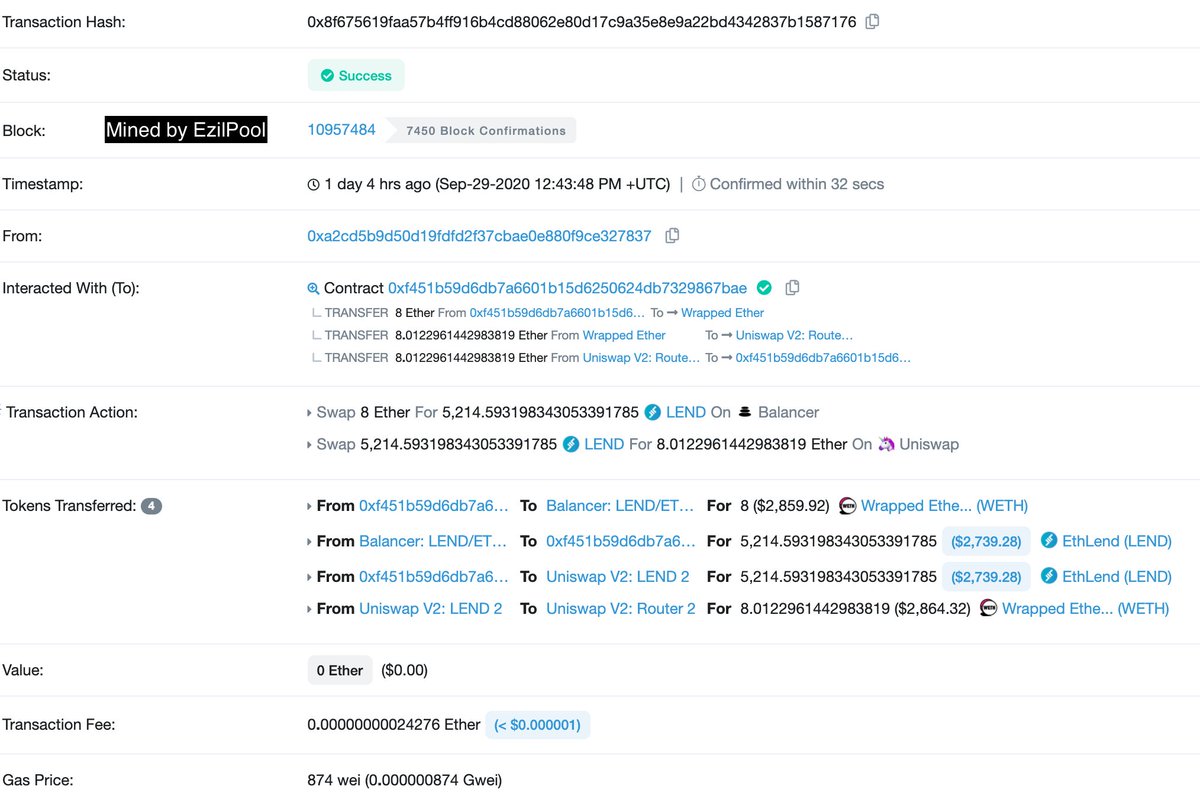

5/11 Now let’s move on to the explicit MEV, which is expressed in the priority execution of arbitrage transactions for a fraction of a gwei. Four pools (2Miners: SOLO and PPLNS, Minerall Pool, EzilPool), which have mined about 2.5% of blocks in the last week, participate in it.

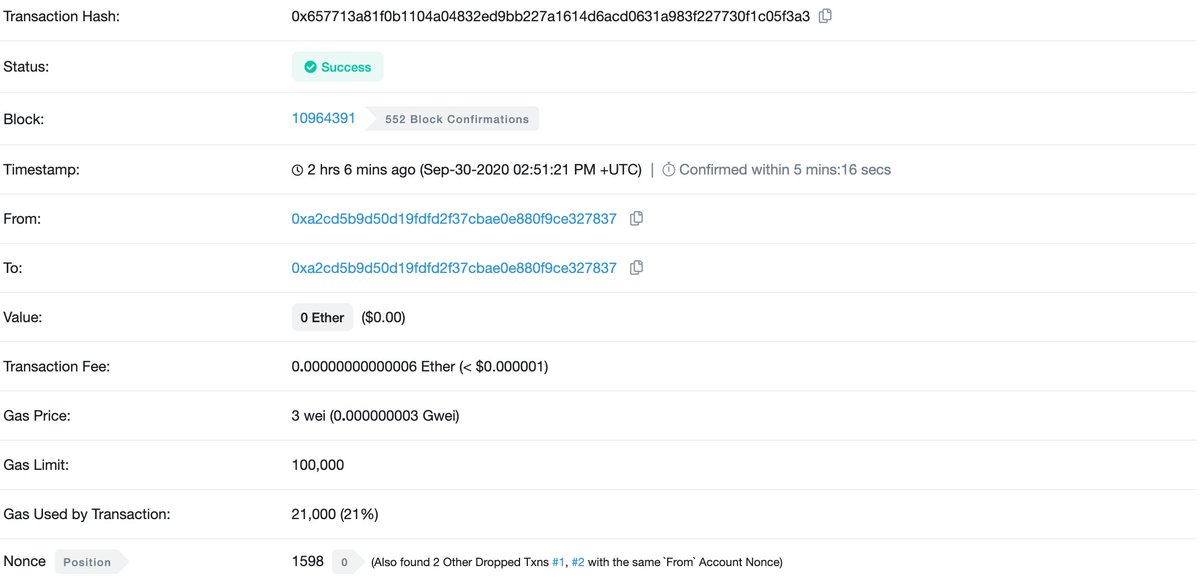

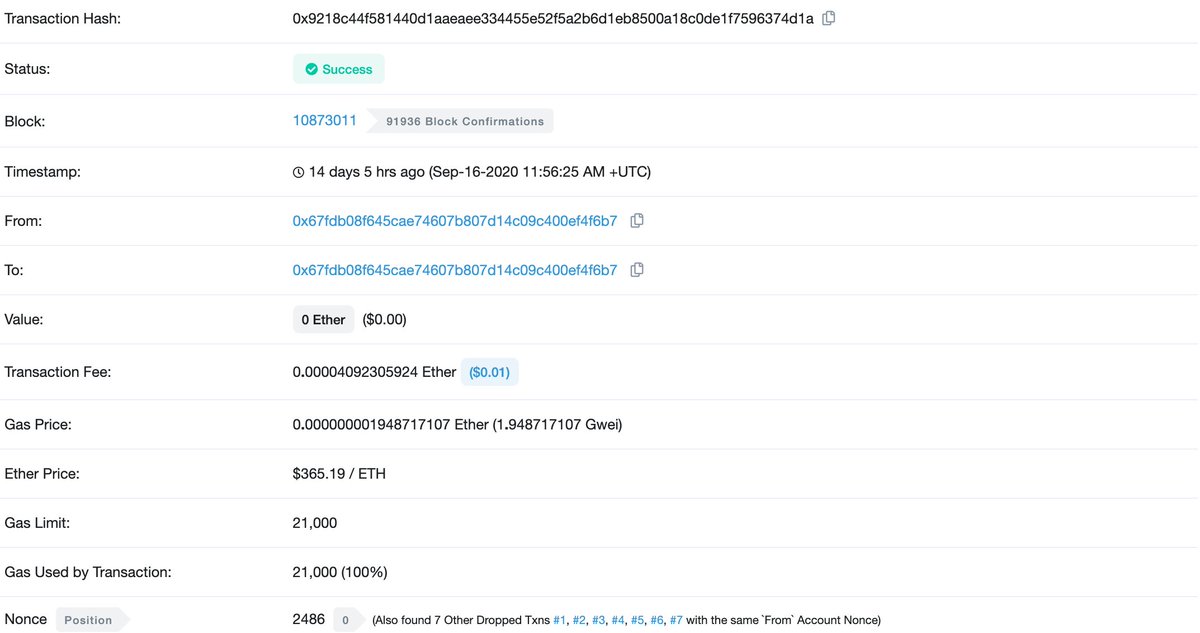

6/11 Each of these pools allows txs from two addresses (0xa2c + 0x67f) linked by one arb contract (0xf45) to be executed before all other users’ txs. If the arb opportunity has already disappeared, then the tx is replaced with a tx to oneself, so as not to waste gas in the block.

7/11 The most interesting thing is that each of the txs rarely gives more than a hundred dollars and it would often be more profitable to add another user’ tx. Instead, however, these pools are taking away cheap arb opportunities that everyone else could only take at a loss.

8/11 Hence, there are the following options:

- collusion between pool operators or the ownership of these pools in fact to one person

- someone was able to negotiate with these pools and pays them for a priority place in the block

- collusion between pool operators or the ownership of these pools in fact to one person

- someone was able to negotiate with these pools and pays them for a priority place in the block

9/11 This raises serious concerns anyway, because miners may start extracting MEVs more often and on a large scale. Proposed options to combat this, such as MEV auctions, have yet to be implemented. This creates fears about the possible future of Ethereum.

10/11 At best, miners extracting MEV will make markets more efficient for end users. In addition, miners may be the best keepers, which will not lead to a new Black Thursday. At worst, miners can compete for large MEVs, which can lead to re-org and reduce network security.

11/11 There are already services that give txs more privacy and speed them up, such as bloXroute and Spark Pool’s Taichi Network. The latest service also recently helped to rescue 10 million. Such projects can be helpful if the process of buying a place in the block is open.

• • •

Missing some Tweet in this thread? You can try to

force a refresh