Motilal Oswal Focused 25 Fund - A fund with the power of focus and stability of large caps.

A thread on why you should consider it as an investment option -

A thread on why you should consider it as an investment option -

(1/10)

When you are not focused, you see stars like others, but when you are focused, you see constellations. Similarly, focused approach in investing helps identify hidden winners. Presenting Motilal Oswal Focused 25 Fund.

When you are not focused, you see stars like others, but when you are focused, you see constellations. Similarly, focused approach in investing helps identify hidden winners. Presenting Motilal Oswal Focused 25 Fund.

(2/10)

The focused stock-picking approach has helped us identify companies in their early stages, and ride on their growth cycle.

The focused stock-picking approach has helped us identify companies in their early stages, and ride on their growth cycle.

(3/10)

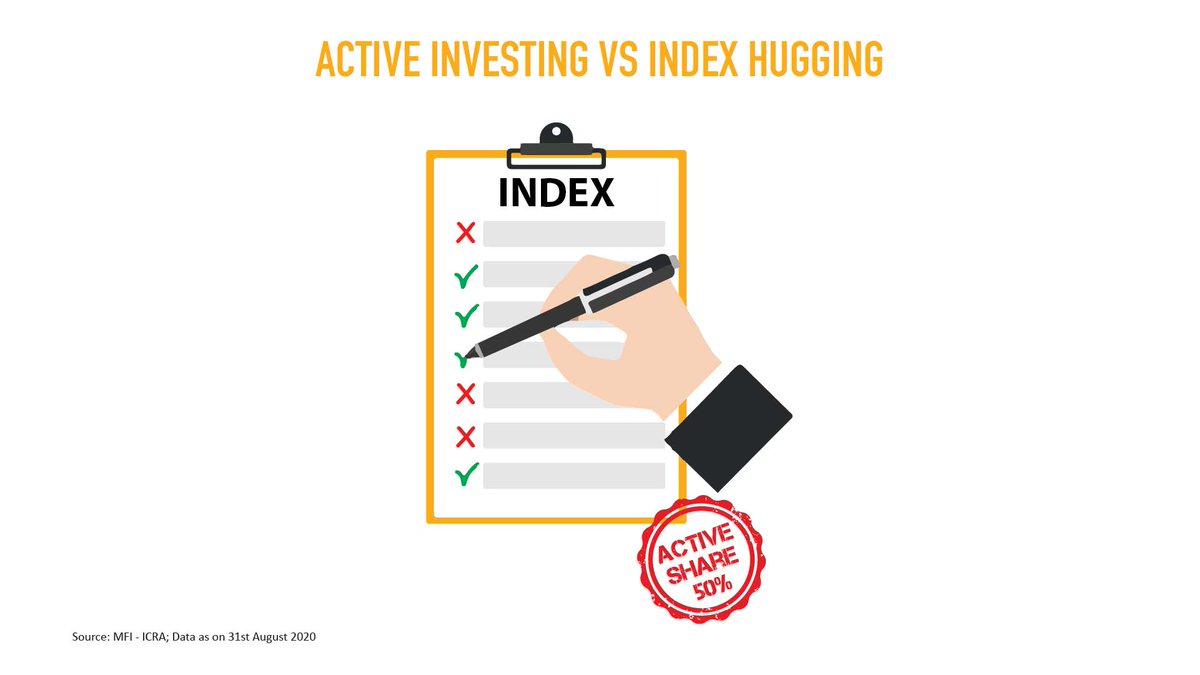

A true to its label active fund, F25 has low overlap with its benchmark - Nifty TRI, and a relatively higher “Active Share” of 49.5% (as on 31st August 2020). This is the result of a focused approach in stock picking.

A true to its label active fund, F25 has low overlap with its benchmark - Nifty TRI, and a relatively higher “Active Share” of 49.5% (as on 31st August 2020). This is the result of a focused approach in stock picking.

(4/10)

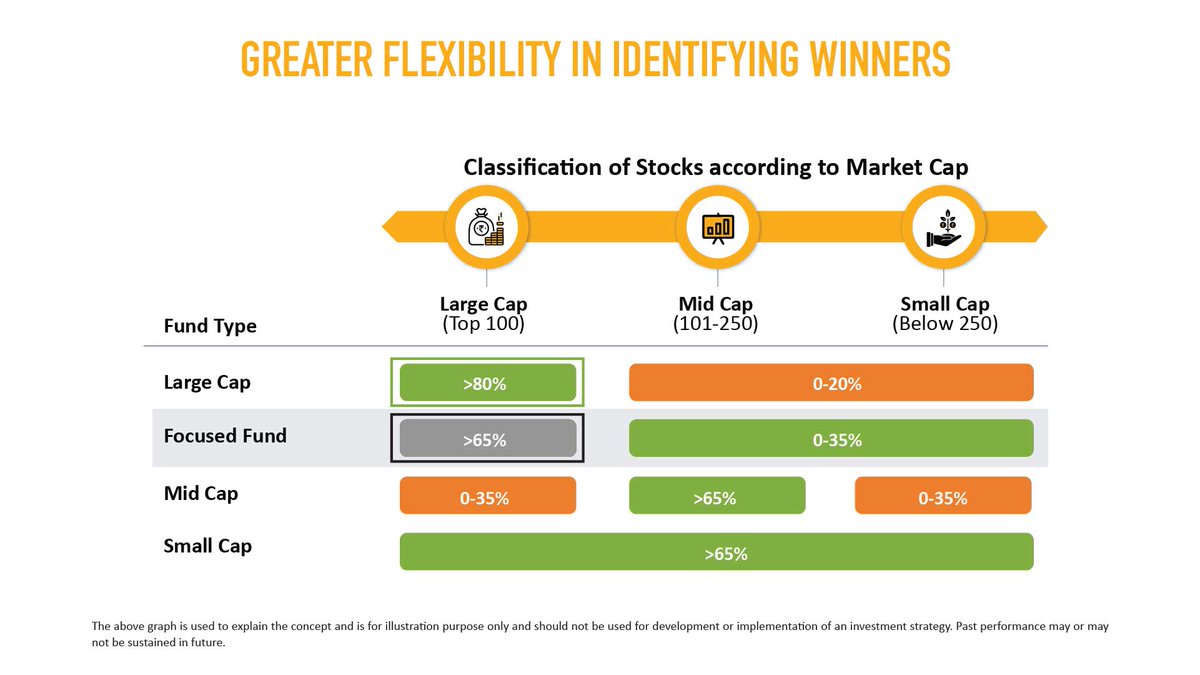

While Large-cap category funds have the restriction to invest a minimum of 80% in large-cap stocks that are top 100 stocks by market cap; in contrast, focused Large-cap funds like F25 have the flexibility as the min allocation to a seg that the fund intends to focus is 65%

While Large-cap category funds have the restriction to invest a minimum of 80% in large-cap stocks that are top 100 stocks by market cap; in contrast, focused Large-cap funds like F25 have the flexibility as the min allocation to a seg that the fund intends to focus is 65%

(5/10)

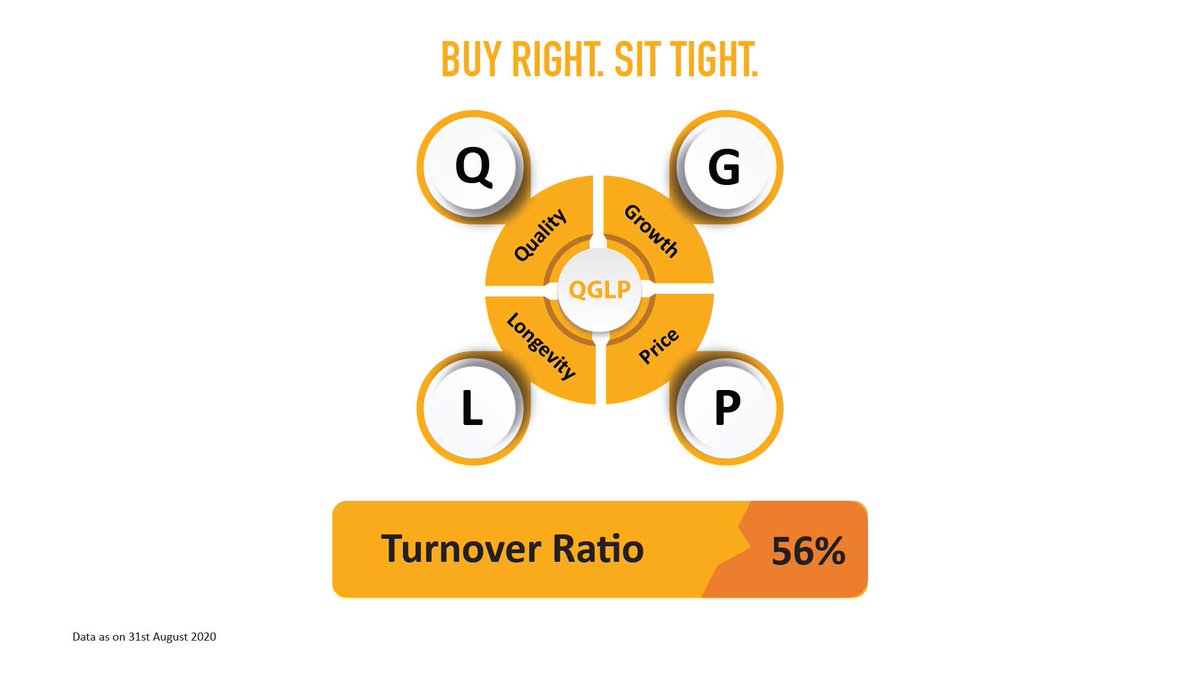

We use our unique QGLP stock-picking methodology to Buy Right, i.e. Quality in management & company, Growth in earnings & ROE, companies with a sustainable competitive advantage, and available at a reasonable price.

Contd...

We use our unique QGLP stock-picking methodology to Buy Right, i.e. Quality in management & company, Growth in earnings & ROE, companies with a sustainable competitive advantage, and available at a reasonable price.

Contd...

(5/10) Contd...

This combined with a low portfolio churn ratio of 56% helps Sit Tight to unlock the true potential of Multi-Baggers.

This combined with a low portfolio churn ratio of 56% helps Sit Tight to unlock the true potential of Multi-Baggers.

(6/10)

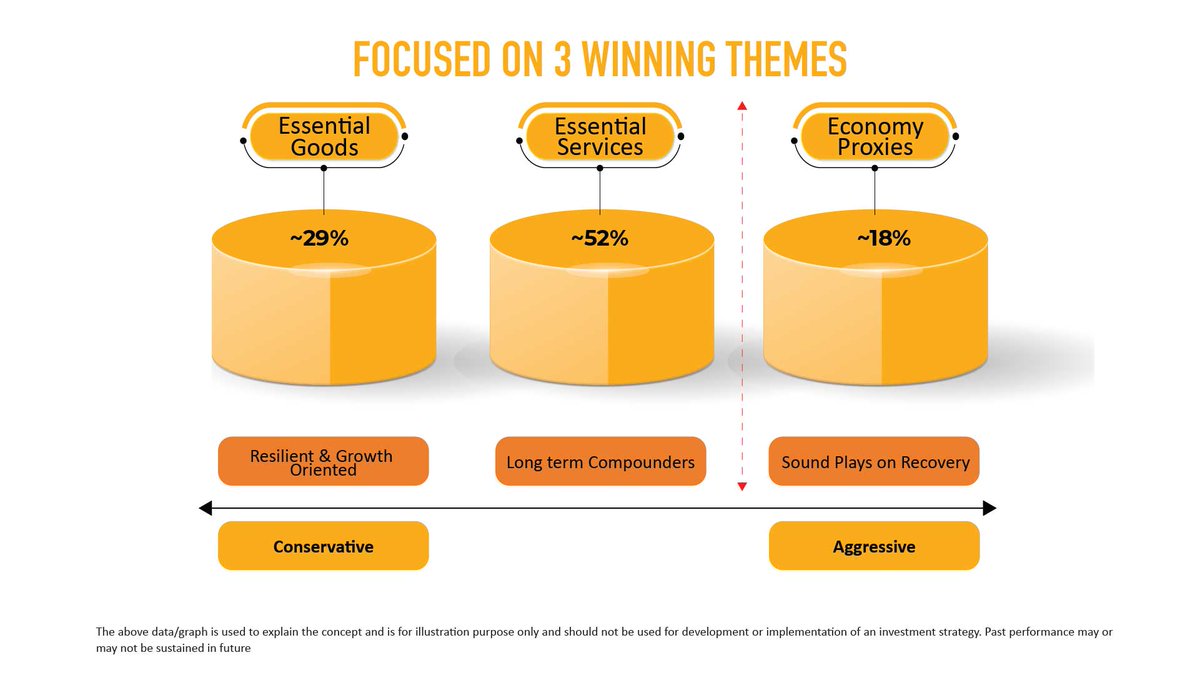

The current portfolio of F25 focuses on 3 themes: Essential Goods, Essential Services and Economic Proxies.

The current portfolio of F25 focuses on 3 themes: Essential Goods, Essential Services and Economic Proxies.

(7/10)

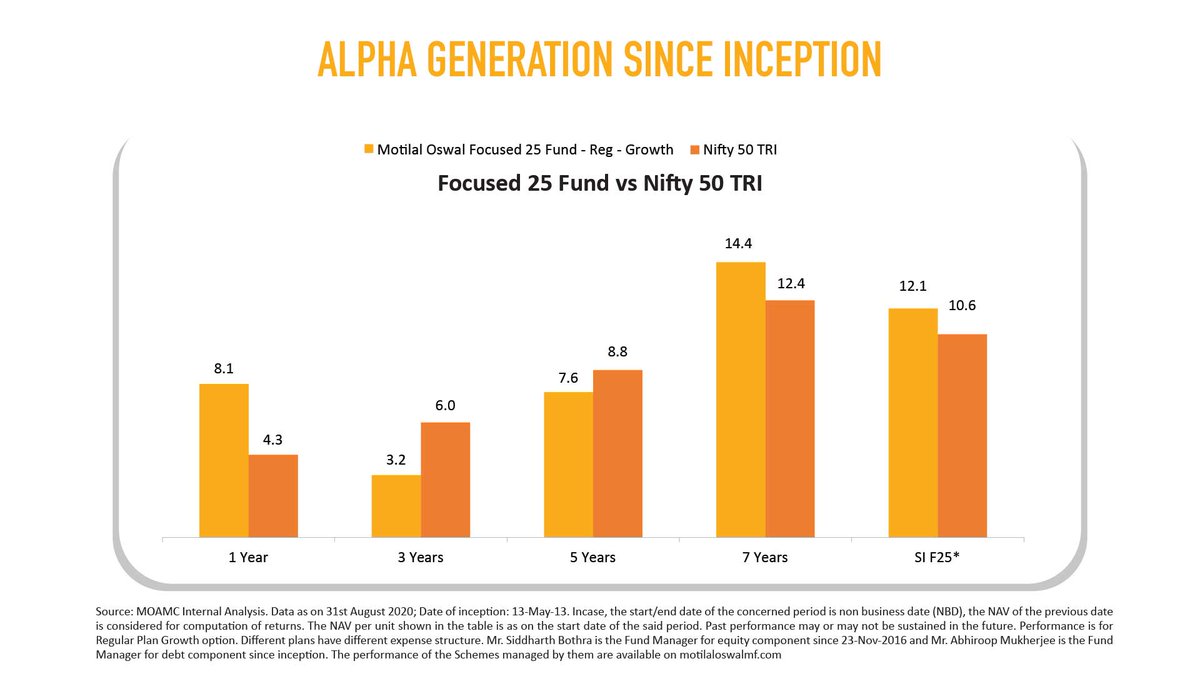

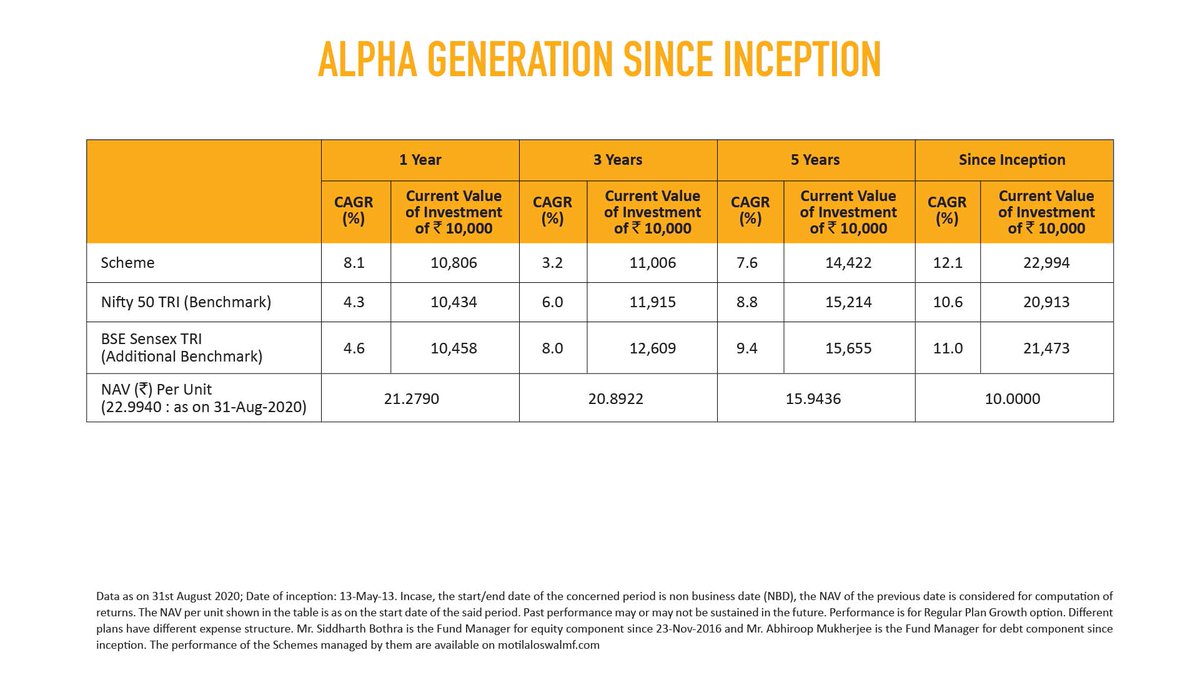

This focused approach has helped the fund to outperform its benchmark by 3.8% in 1-year and 1.5% (CAGR) since inception.

This focused approach has helped the fund to outperform its benchmark by 3.8% in 1-year and 1.5% (CAGR) since inception.

(8/10)

Invest now in Motilal Oswal Focused 25 Fund and reap the benefits of a focused portfolio.

To invest, click 👉bit.ly/34dMpw3

Invest now in Motilal Oswal Focused 25 Fund and reap the benefits of a focused portfolio.

To invest, click 👉bit.ly/34dMpw3

• • •

Missing some Tweet in this thread? You can try to

force a refresh