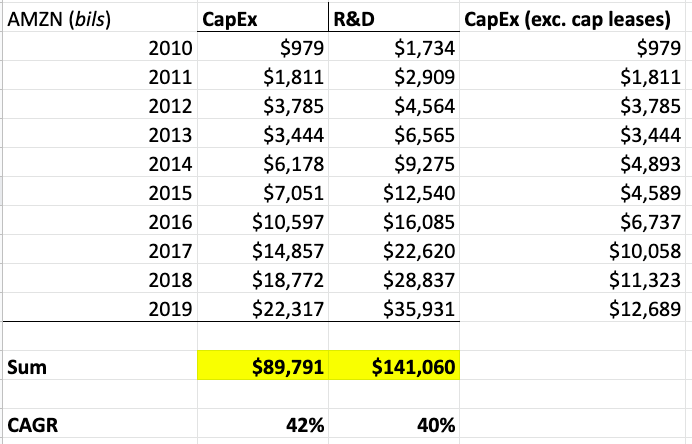

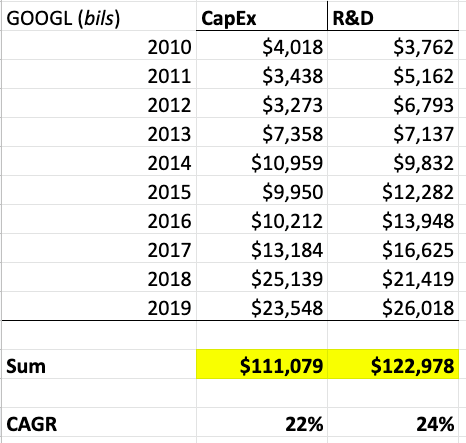

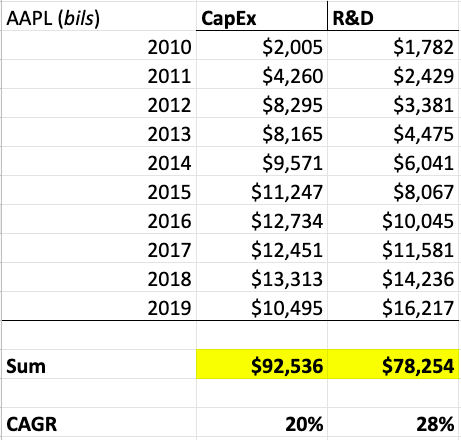

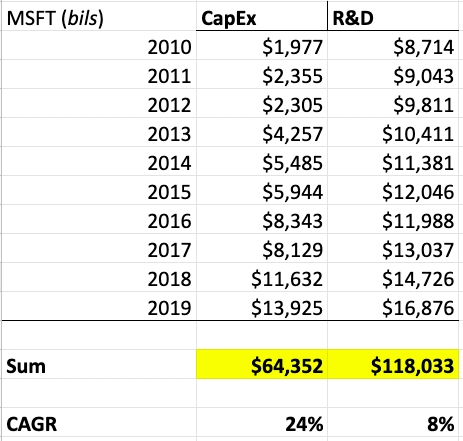

Guess how much Amazon, Alphabet, Apple, and Microsoft have spent on CapEx and R&D over the past decade?

💰 $818 billion 💰

Add Facebook in there and it's $915 billion

[THREAD]

💰 $818 billion 💰

Add Facebook in there and it's $915 billion

[THREAD]

Some clarifications:

1. All numbers are in billions

2. Source = annual reports

3. Years are 2010-2019

Let's dive right in...

1. All numbers are in billions

2. Source = annual reports

3. Years are 2010-2019

Let's dive right in...

Add that up and you get $915 billion.

And that's just CapEx and R&D.

So the top 5 big tech companies have invested nearly $1 trillion back into innovation over the past decade.

And that's just CapEx and R&D.

So the top 5 big tech companies have invested nearly $1 trillion back into innovation over the past decade.

If you total the amount of operating cash flow for the same period for all 5 companies, it's:

💰 $1.48 trillion 💰

For free cash flow:

💰 $1.03 trillion 💰

That means these 5 giants invested roughly 90% of their free cash flow into CapEx and R&D.

💰 $1.48 trillion 💰

For free cash flow:

💰 $1.03 trillion 💰

That means these 5 giants invested roughly 90% of their free cash flow into CapEx and R&D.

A few more observations:

1. Apple hauled in ~ 10x the amount of free cash flow vs. Amazon.

Apple = $486 billion

Amazon = $50 billion

Amazon did spend $60 billion more on CapEx+R&D but the scale of Apple is pretty unbelievable.

1. Apple hauled in ~ 10x the amount of free cash flow vs. Amazon.

Apple = $486 billion

Amazon = $50 billion

Amazon did spend $60 billion more on CapEx+R&D but the scale of Apple is pretty unbelievable.

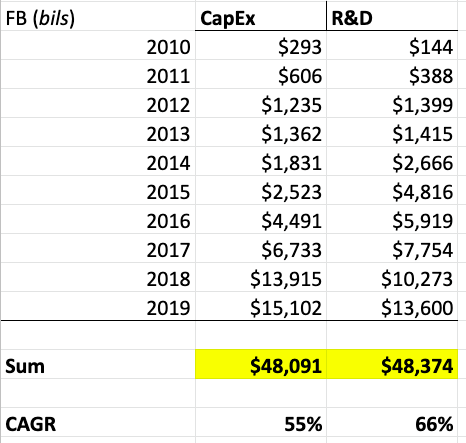

2. Facebook grew its CapEx+R&D from less than $440 million in 2010 to $28.7 billion in 2019.

That's a CAGR of nearly 60%.

That's a CAGR of nearly 60%.

3. Every one of these companies had a free cash flow conversion rate of over 100% (cumulative FCF/cumulative net income).

Alphabet was the lowest at 103%.

Alphabet was the lowest at 103%.

4. Amazon and Microsoft had the biggest disparity between R&D and CapEx spend.

Both of them had $50 billion more in R&D.

The next closest was Alphabet with $10 billion more.

Facebook was about the same for each.

Apple had $14 billion more in CapEx.

Both of them had $50 billion more in R&D.

The next closest was Alphabet with $10 billion more.

Facebook was about the same for each.

Apple had $14 billion more in CapEx.

5. The disparity was surprising in R&D vs. CapEx because AMZN and MSFT are the #1 and #2 in the cloud.

I would've guessed CapEx to be higher to build out all those data centers.

I would've guessed CapEx to be higher to build out all those data centers.

End/

The combined market caps for these 5 companies is now about $7 trillion.

That's equivalent to the GDPs of India, France, and Italy...COMBINED.

Just mind-blowing scale 🤯

The combined market caps for these 5 companies is now about $7 trillion.

That's equivalent to the GDPs of India, France, and Italy...COMBINED.

Just mind-blowing scale 🤯

• • •

Missing some Tweet in this thread? You can try to

force a refresh