Personal Update: After a journey of learnings of decades compressed in few years, I am moving on from Pantomath. As the saying goes ‘I am not sad that it is over. I am happy that it has happened'. Today, I enable myself to paint on my life’s canvas, a future the way I want to 🤞

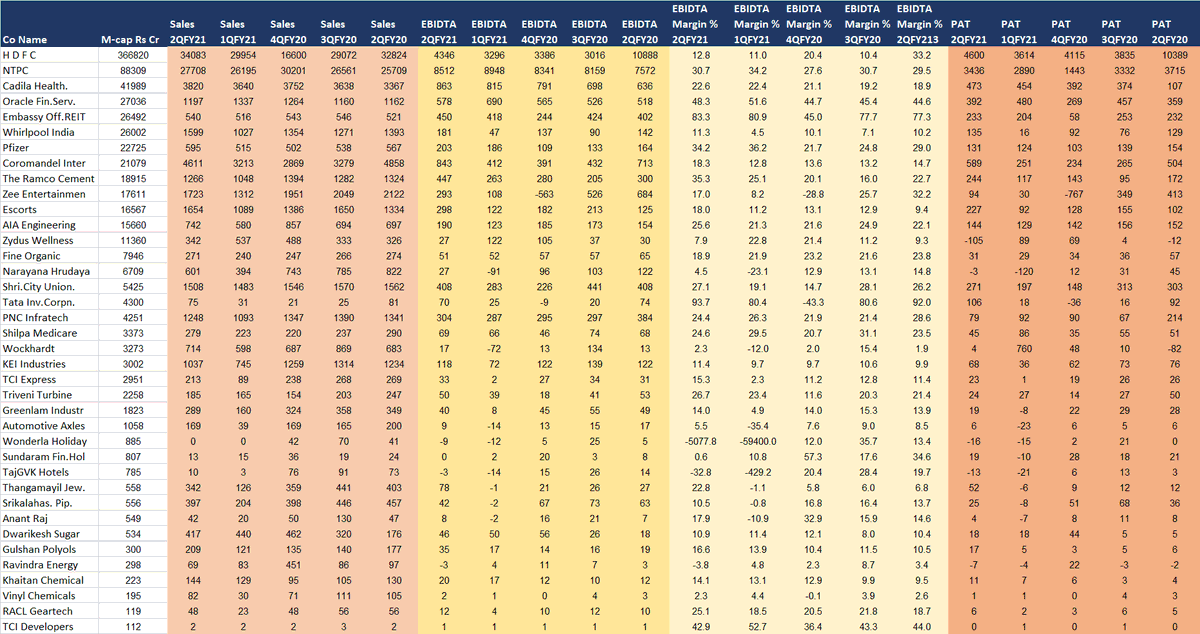

Happy to share the PMS performance which has done reasonably well…thanks to #APIs #Chemical #Platform businesses. Thank you @pantomath_group for giving me a chance.

I will take this opportunity to share a few key learnings over the last few years. There have been many, but a sharing the few which have helped me be a better investor....

Learning #1

Rejection is more important than selection (“kya nahin lena hain” is more imp than “kya lena hain”). The agony and financial pain of a wrong investment can be far higher than the joy of a successful one. Make ur own framework as a process & follow it religiously.

Rejection is more important than selection (“kya nahin lena hain” is more imp than “kya lena hain”). The agony and financial pain of a wrong investment can be far higher than the joy of a successful one. Make ur own framework as a process & follow it religiously.

Learning #2

“Focus on doing less mistakes rather than thinking about returns, money will be made on its own” (some “hope trades” or “bade-investor-ne-liya trades” or “big turnaround hoga” or “jaldi paisa banega trades” can take away all good things done in your portfolio)

“Focus on doing less mistakes rather than thinking about returns, money will be made on its own” (some “hope trades” or “bade-investor-ne-liya trades” or “big turnaround hoga” or “jaldi paisa banega trades” can take away all good things done in your portfolio)

- Learning #3

“Historical data is more important than any excel future projections” (Focus on finding “good companies” backed with historical data (good promoters, high roce, low debt, controlled working cap) rather than just doing excel projections on a co with no sound history

“Historical data is more important than any excel future projections” (Focus on finding “good companies” backed with historical data (good promoters, high roce, low debt, controlled working cap) rather than just doing excel projections on a co with no sound history

Learning #4

"In Value-investing, you will always make money slowly and steadily but surely”. It is okay to be in companies where stocks don’t move daily, and/or are not discussed on TV/social media. Keep the faith on data.

"In Value-investing, you will always make money slowly and steadily but surely”. It is okay to be in companies where stocks don’t move daily, and/or are not discussed on TV/social media. Keep the faith on data.

Learning #5

“Paisa jaldi kamana hain ya zyada” Choice is yours. Keep it simple & adhere to process always. A lot of money gets lost in being adventurous or buying things based on hearsay which gives faaltu ka loss. Stop this asap – and u will be amazed at the results that follow

“Paisa jaldi kamana hain ya zyada” Choice is yours. Keep it simple & adhere to process always. A lot of money gets lost in being adventurous or buying things based on hearsay which gives faaltu ka loss. Stop this asap – and u will be amazed at the results that follow

Learning #6

“Doing less is good for investment”. We are not rocket scientists, but ones who ride on a good corporates hard work. Find a great business run by a great businesswoman/man – track it - don’t make projections daily based on the stock price fluctuations

“Doing less is good for investment”. We are not rocket scientists, but ones who ride on a good corporates hard work. Find a great business run by a great businesswoman/man – track it - don’t make projections daily based on the stock price fluctuations

Learning #7

A lot of macros are not in our hand...it is good as a topic to chat but honestly we should focus on micros (valuations). You are here not to be "right or wrong" but to "make money". Valuations adds it all.

A lot of macros are not in our hand...it is good as a topic to chat but honestly we should focus on micros (valuations). You are here not to be "right or wrong" but to "make money". Valuations adds it all.

To my twitter family - Stay connected, because the journey of learning and investing continues unabated. I am fully charged up to do more & more research which is what I love.

🤗🤗🤗🤗

🤗🤗🤗🤗

• • •

Missing some Tweet in this thread? You can try to

force a refresh