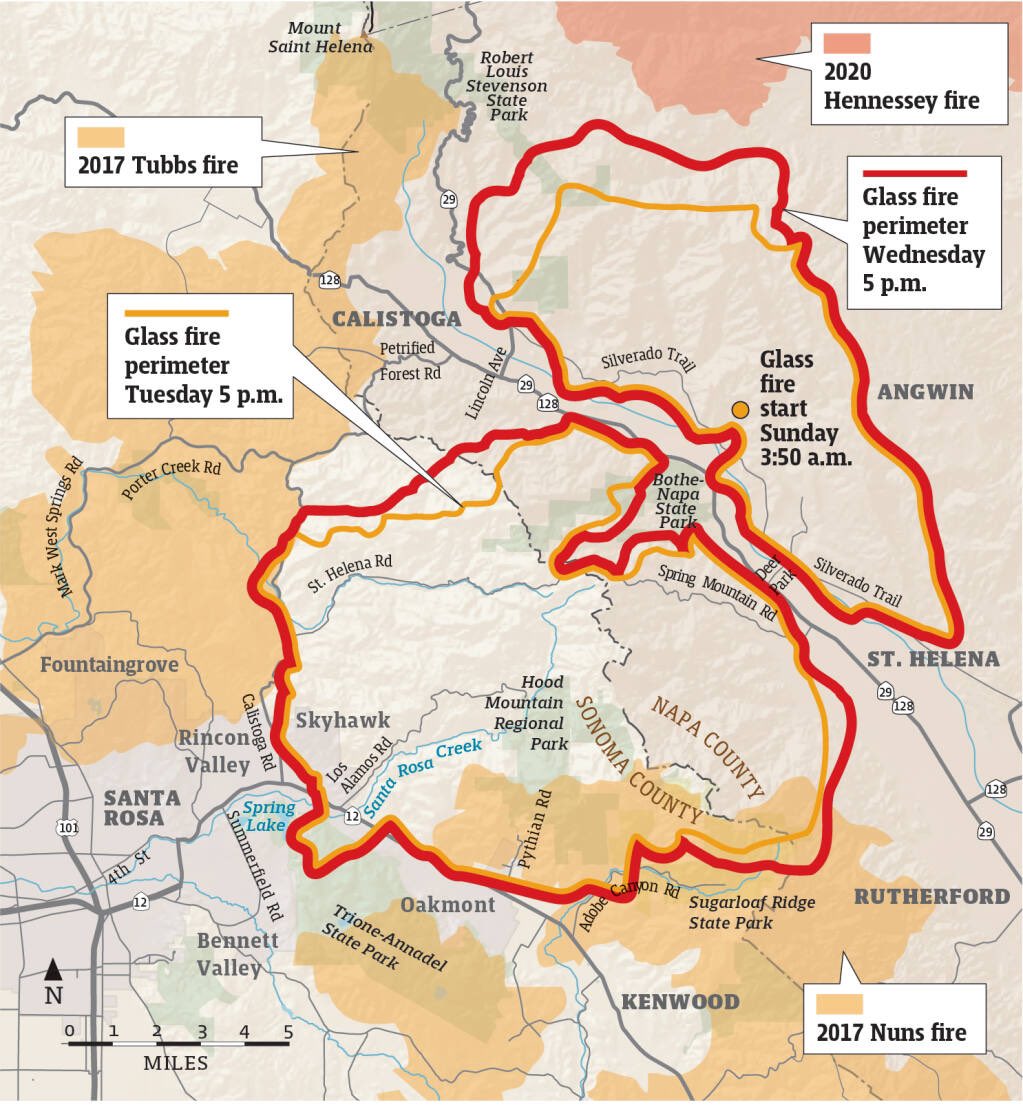

Since the #GlassFire broke out, there has been a lot of talk about it “threading the needle” between the Tubbs and Nuns fire scars. For those who believe that the last of the needles will be threaded in our region in the next three years, here’s my advice after our fire rebuild.

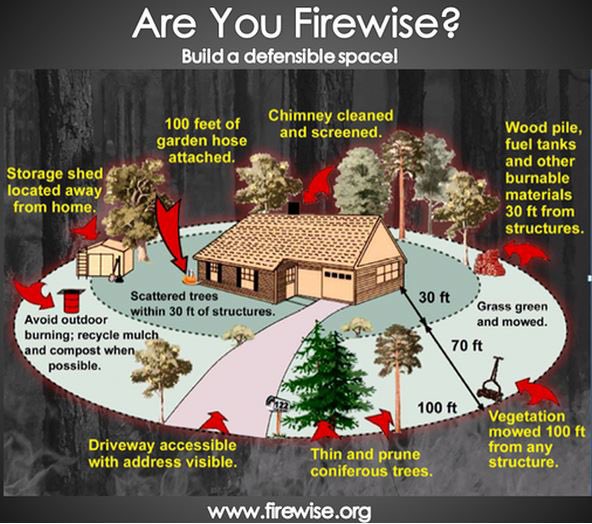

Create a real defensible space around your property. That includes saying goodbye to mulch. It is lighter fluid—the words of the firefighters as they watched our garage burn down. No trees, no plastic flower pots, no plastic chairs, no wood or plastic anything attached/against.

Make sure you have a damn good insurance policy that covers you up to $500-$600 per square foot on a rebuild. If you aren’t rebuilding a tract home along with dozens of others, you won’t be able to rebuild for under $400 per sq ft. That’s how expensive it is to build in SoCo.

Purchase a rider for your home insurance policy to cover potential shortfalls in coverage. Detached sheds, barns, gazebos and fences or retaining walls all fall under Other Structures, and it’s usually a tiny % of Dwelling A. I had $50k; cost $350k to rebuild my garage.

Learn how to defend your property. Become a volunteer firefighter. Watch training videos. Purchase all of the equipment. When it isn’t crazy-windy like Tubbs, these flames move slow and are manageable. There are not enough firefighter resources anymore. Rebuilding is pure hell.

The houses that survived Tubbs in our neighborhood had the following traits: 1. Retaining walls instead of wood fences, 2. No attics above or crawl space below; 3. No wood decks attached; 4. Concrete or metal roofs.

The only advice I have for homeowners who have wood houses with shingle roofs and wood decks attached is to have great insurance and/or learn how to defend if you don’t want to endure a rebuild. The costs of wildfire rebuilding in wine country are far greater than financial.

The health issues that many Tubbs fire survivors are struggling with has had the biggest toll. If I knew then what I know now, I never would have rebuilt. (I’m actually not finished; still rebuilding the garage and working on legal settlements from crappy construction.)

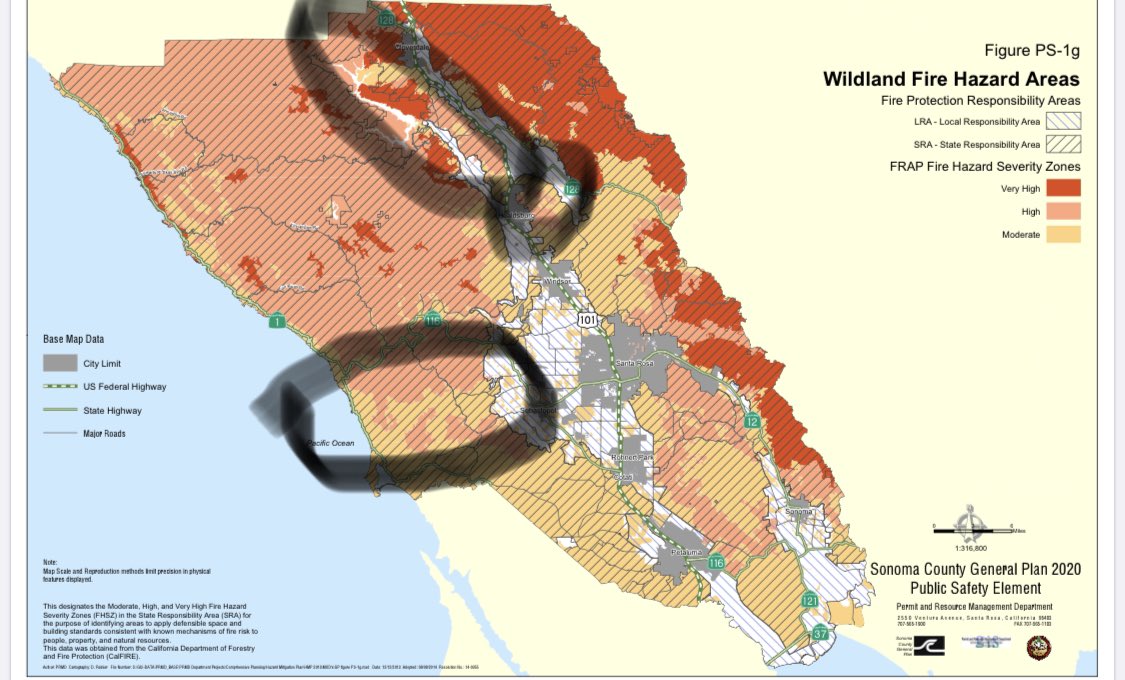

This isn’t a great map, but here are three of the “thread the needle” locations between Kincade and Walbridge and south that should be thinking of all of these things.

Lastly, if you can’t get the insurance coverage you need and you’re not interested in becoming a firefighter, consider selling and leaving the state. House sales are still booming. Take the money and run. I unfortunately can’t because my home is still under reconstruction.

Our home insurance quadrupled after Tubbs. We were able to get a new company to take us that ONLY DOUBLED our insurance rate. The max policy coverage for Dwelling A we’ve been able to get is approx $1m. It would cost $1.5m to rebuild our 3/2 2400 sq ft house again.

So, it’s been almost three years since Tubbs, we are almost rebuilt, and yet if another fire hit us tomorrow and destroyed our home, we would still be underinsured by $200k-$500k. Welcome to owning a home in today’s California.

• • •

Missing some Tweet in this thread? You can try to

force a refresh