Investment Hack 🔍 🤫

Unlock the power of an ETF (Exchange Traded Fund)

For early investors, it can be hard to figure out WHAT to buy.

You know you like a few companies, but you don’t know if together they’re a good idea.

That’s where studying ETFs come in 👇🏻

Unlock the power of an ETF (Exchange Traded Fund)

For early investors, it can be hard to figure out WHAT to buy.

You know you like a few companies, but you don’t know if together they’re a good idea.

That’s where studying ETFs come in 👇🏻

Firstly, what’s an ETF:

Like index funds, ETFs are a fund of multiple stocks. Some have 100 holdings, some less or more. But they give you good diversity matching an index or sector.

Even for experienced investors they can be a great catch-all to passively invest.

👇🏻

Like index funds, ETFs are a fund of multiple stocks. Some have 100 holdings, some less or more. But they give you good diversity matching an index or sector.

Even for experienced investors they can be a great catch-all to passively invest.

👇🏻

There are 2 main types:

Passively managed (cheaper fees) — like $DGRO

Actively managed (more expense because they are closely managed with more buying/selling activity to try to increase the fund earnings) — like $ARKK

Passively managed (cheaper fees) — like $DGRO

Actively managed (more expense because they are closely managed with more buying/selling activity to try to increase the fund earnings) — like $ARKK

How to study them:

Google a high performing ETF that you have your eye on.

Search for: The ETF ticker symbol + Top Holdings

For example, $DGRO is one of my favorites focused on dividend growth stocks.

Google a high performing ETF that you have your eye on.

Search for: The ETF ticker symbol + Top Holdings

For example, $DGRO is one of my favorites focused on dividend growth stocks.

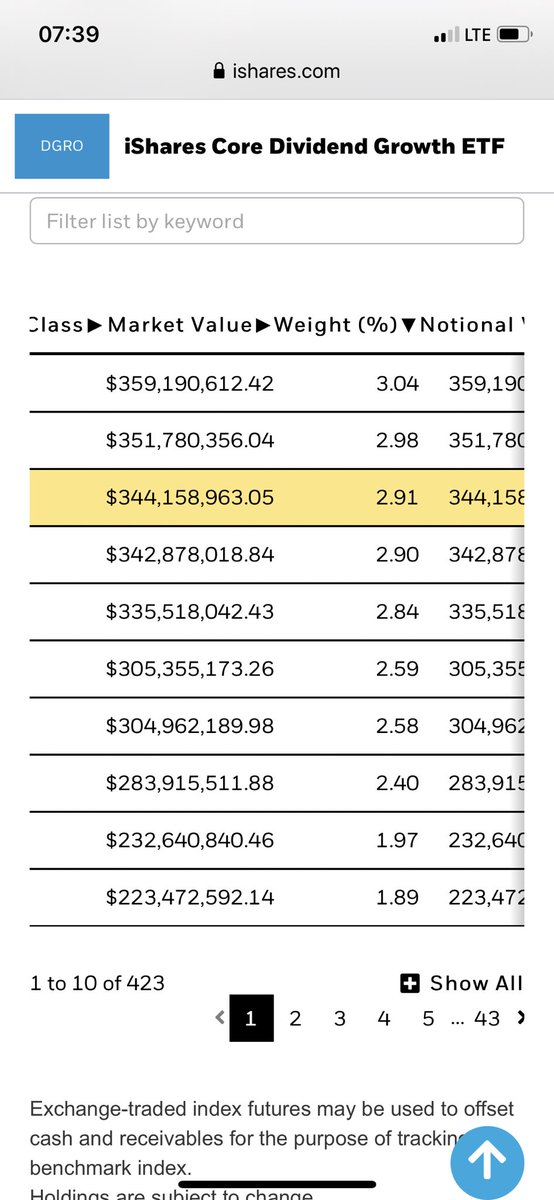

This will now unlock for you what stocks the fund holds 🔐

Look at the top 10-15 stocks a fund holds to understand how it is diversified and what the majority of its direction is controlled by.

With $DGRO, it’s names like Microsoft, Apple, Johnson and Johnson, Verizon, etc.

Look at the top 10-15 stocks a fund holds to understand how it is diversified and what the majority of its direction is controlled by.

With $DGRO, it’s names like Microsoft, Apple, Johnson and Johnson, Verizon, etc.

If you’re a beginner unsure what to invest in — this can be a great hack to pick a few individual stocks to study and potentially start with.

If the core holdings make a fund like $DGRO or $VOO successful, there’s a good chance they can work for the average investor.

If the core holdings make a fund like $DGRO or $VOO successful, there’s a good chance they can work for the average investor.

Holdings Weight 🧾

Another important thing to note is the weight of the top holdings. Some ETFs have stocks that make up 10% or more of the whole fund!

For $DGRO, the highest weight is $MSFT at about 3%.

If a fund is largely 1️⃣ or 2️⃣ stocks, it isn’t very diverse.

Another important thing to note is the weight of the top holdings. Some ETFs have stocks that make up 10% or more of the whole fund!

For $DGRO, the highest weight is $MSFT at about 3%.

If a fund is largely 1️⃣ or 2️⃣ stocks, it isn’t very diverse.

Why not just buy shares of the ETF, like $DGRO? You can!

However, ETFs generally comes with a management fee or “expense ratio”.

Before buying shares in an etf, google its ticket symbol + expense ratio to see.

However, ETFs generally comes with a management fee or “expense ratio”.

Before buying shares in an etf, google its ticket symbol + expense ratio to see.

In the case of $DGRO, it’s cheap!

For every $1000 you own in $DGRO, they charge you $0.80 cents a year.

Nothing huge.

But some ETFs can charge over a percent! That adds up and cuts into your gains.

For every $1000 you own in $DGRO, they charge you $0.80 cents a year.

Nothing huge.

But some ETFs can charge over a percent! That adds up and cuts into your gains.

So, if you study the top holdings of an ETF you like and the weight of each holding —

You have an option to just buy some of the top holdings and never pay an expense fee!

This can also just be a great tool to see what works for a potential “portfolio” that you might design.

You have an option to just buy some of the top holdings and never pay an expense fee!

This can also just be a great tool to see what works for a potential “portfolio” that you might design.

For example, another popular ETF $ARKK has 1️⃣ stock that makes up over 10% of its fund — and is a big part of its success.

$TSLA is 10% of the fund.

And the expense ratio is a big 0.75% ($7.50 for every $1000 you own).

$TSLA is 10% of the fund.

And the expense ratio is a big 0.75% ($7.50 for every $1000 you own).

Lastly, even if you just buy ETFs (they make up almost 50% of my portfolio because I’m lazy):

Still study the holdings, weight, and expense ratio.

You could be holding multiple ETFs that basically hold many of the same stocks — making them redundant.

And some could be pricey!

Still study the holdings, weight, and expense ratio.

You could be holding multiple ETFs that basically hold many of the same stocks — making them redundant.

And some could be pricey!

Or, you could be holding one charging you an insane amount for just a few stocks you could buy yourself.

ETFs are both a great investment tool 🔨 AND a great way to study investing 📚

Now that you know how to study them — GO forth, and research!

ETFs are both a great investment tool 🔨 AND a great way to study investing 📚

Now that you know how to study them — GO forth, and research!

• • •

Missing some Tweet in this thread? You can try to

force a refresh