How voracious private equity firms plunder local authorities to make millions in profits from vulnerable children and young people in care (Thread) 1/

2/ You may never have heard of SSCP Spring Topco. It is a private company based in Jersey that is responsible for the lives of hundreds of children in care or with special needs in England.

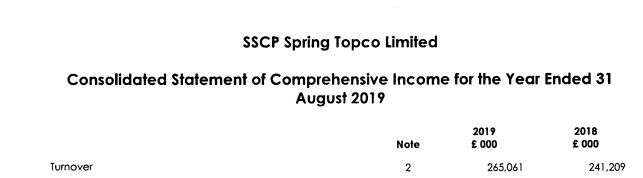

3/ It has been growing at a rapid pace, unchecked by regulatory authorities. Its latest accounts, just published, show it now rakes in more than £265 million a year from local authorities. £265 million.

4/ This company trades under many names, often claiming to be ‘local’ or ‘family run’. This is a deceit. They include National Fostering Agency, Pathway Care, Hillcrest and Options Autism. Different brands but all part of the same corporate scam.

5/ The business is structured to put as much distance as possible between the actual delivery of care and the ultimate owner, Stirling Square Capital Partners, a private equity firm that pays no tax & evades public scrutiny while screwing as much money as possible from taxpayers.

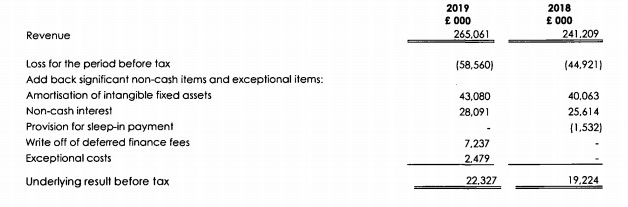

6/ SSCP earned profits of £22 million from foster care and children's homes last year. But this is where the real scandal of private ownership begins.

7/ Stirling Square treats children’s services like Wonga used to treat hard-up families. It makes most of its profits (untaxed) by lending millions of pounds to SSCP at usurious rates of interest.

8/ SSCP has been loaded with an extraordinary amount of debt (around £739m). Normally, this would be unsustainable. But in this case it is underwritten by taxpayers. What’s more, Stirling Square (and friends) hold much of the debt and charge SSCP fees for the privilege.

9/ This needs to be spelled out: SSCP pays massive interest charges and fees to its owners from money provided by local authorities for the care and support of vulnerable children.

13/ The annual accounts contain page after page of details like this. How this is legal defies belief. …te.company-information.service.gov.uk/company/092486…

14/ I know this all feels very technical. But, quite simply, it shows how millions of pounds are being syphoned off to tax havens instead of being spent on children and young people in care.

15/ Why do local authorities do it? Because they have little choice. To use the Wonga example again, they need the money today, not in one year or five years. They have nowhere else to go.

16/ Privatisation of children's services is bad for children, bad for families, bad for taxpayers.

It doesn't have to be this way.

It doesn't have to be this way.

17/ Meanwhile, the sharks at SSCP are preparing for another bumper year. The economic shock of COVID19 is an opportunity for them.

18/ Finally, when you see the Government 'consulting' @theNAFP and the Independent Children's Homes Association about children in care, this is what they are signing up to.

• • •

Missing some Tweet in this thread? You can try to

force a refresh