I recently bought health insurance for few family members. The kind of person I'm, this meant an uncontrollable spiral into research

I read through at-least

- 15 policy documents,

- handbooks+circulars published by IRDAI (the regulatory authority),

- and several blogs

I read through at-least

- 15 policy documents,

- handbooks+circulars published by IRDAI (the regulatory authority),

- and several blogs

Though I didn't particularly enjoy the verbose obfuscations that policy documents are, I ended up learning a lot about what to look for while buying Health Insurance

I will share some of my observations, hoping that it helps those who don't enjoy reading policy wordings as much as I do

**10 things to remember while buying health insurance**

**10 things to remember while buying health insurance**

1. Room charges - If you are in Bangalore, the average room rent for a single room is ~8k/day.

Now the fun part

The room rent across major Insurers is generally capped to 1% of Sum Insured(SI) per day; which means if your SI is 5 lakh, the insurer WON'T pay more than 5k/day

Now the fun part

The room rent across major Insurers is generally capped to 1% of Sum Insured(SI) per day; which means if your SI is 5 lakh, the insurer WON'T pay more than 5k/day

Note - SI is the industry jargon for insurance cover

ICU room charges are generally capped to 2% of SI; which means if your SI is 5 lakh, the insurer will NOT pay more than 10k/day

If you have had experience with ICU charges, 10k/day is nothing for ICU

ICU room charges are generally capped to 2% of SI; which means if your SI is 5 lakh, the insurer will NOT pay more than 10k/day

If you have had experience with ICU charges, 10k/day is nothing for ICU

**What I did - I had 2 options, either increase my cover/SI from 5 lakh to say 10 lakh, or look for a policy that puts no limit on room/ICU charges and pays at actuals. I chose former

2. Proportionate charges - This one is my favourite!

Say you have a SI of 5 lakh, and you had opted for a room within admissible range (5k/day)

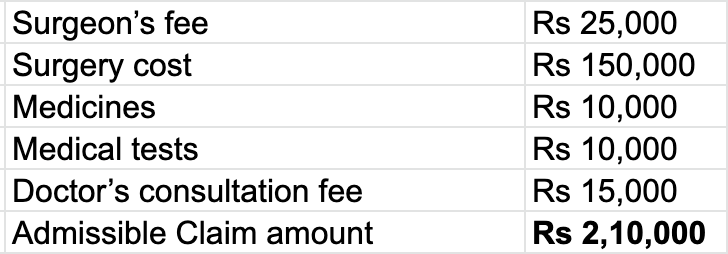

Imagine on the day of discharge, you are presented with the final bill as shown

Say you have a SI of 5 lakh, and you had opted for a room within admissible range (5k/day)

Imagine on the day of discharge, you are presented with the final bill as shown

Now imagine a scenario where you took a room worth 8k/day, thinking you would pay the 3k out of your own pockets - This is what you will see on the day of discharge

Each of the line items gets reduced in "proportion" of (5/8) = (admissible/actual room rent)

Each of the line items gets reduced in "proportion" of (5/8) = (admissible/actual room rent)

You might wonder if this is fair, but hospitals generally anchor all expenses according to the room chosen

Tragic and funny

Tragic and funny

3. Co-Pay - NEVER. EVER. BUY. A. POLICY. WITH. CO-PAY.

You need to be very careful about Co-pay especially if you are buying Insurance for Senior citizens, or folks with critical illness

You need to be very careful about Co-pay especially if you are buying Insurance for Senior citizens, or folks with critical illness

Co-pay is a cost sharing model

What that means is, if your admissible claim amount is say 3 lakh, for a Co-pay of 10%, you will have to put up 30k; if claim amount is 5 lakh, you will have to put up 50k. You get the idea

What that means is, if your admissible claim amount is say 3 lakh, for a Co-pay of 10%, you will have to put up 30k; if claim amount is 5 lakh, you will have to put up 50k. You get the idea

**What I did - Looked for Insurers who charged a higher premium but had no conditions for Co-pay. The rationale is simple - It's easy for me to pay a higher premium(known) rather than a fixed percentage of an unknown cost associated with a major medical emergency

4. Waiting period - Let's say someone you know is suffering from Diabetes.

Unfortunate as it is, when she buys an insurance, she CAN'T claim any costs towards hospitalisations@Diabetes till she has waited for at-least <x> years from the time of purchasing the insurance

Unfortunate as it is, when she buys an insurance, she CAN'T claim any costs towards hospitalisations@Diabetes till she has waited for at-least <x> years from the time of purchasing the insurance

Remember, there can't be any breaks in the <x> years, it needs to be continuous

Also, the waiting period differs across diseases & Insurers

**What I did - I looked for a policy that gave me 2 years as waiting period; most insurers give a standard 4 year waiting period

Also, the waiting period differs across diseases & Insurers

**What I did - I looked for a policy that gave me 2 years as waiting period; most insurers give a standard 4 year waiting period

Avoid 4 years if you can, that's 2 more years of you paying the premium without enjoying any coverage

**Make a list of all the pre-existing diseases(PED)/critical diseases specific to the person being insured and factor in the waiting period for those specific diseases

**Make a list of all the pre-existing diseases(PED)/critical diseases specific to the person being insured and factor in the waiting period for those specific diseases

5. Don't quit your job without this - If you are insured by your employer, that's called Group Insurance. Group Insurance policies are structured differently than Individual insurances (also called Retail insurance)

Imagine that you worked at a company for say ~4 years and had your parents & yourself insured as part of the Group insurance policy. One day, you experience the proverbial itch and decide to quit to start another company

All good. Now remember, most Group Insurance policies come with a standard 48 months/4 years "waiting period" clause

This means, the day I exit my org, the policy expires. Worst, the reverse countdown that had started on my waiting period gets reset!

This means, the day I exit my org, the policy expires. Worst, the reverse countdown that had started on my waiting period gets reset!

Which means, if I buy another policy now, I will have to observe the respective waiting period again to be able to claim for those specific diseases

Fortunately, there's an easy way to tackle this

Fortunately, there's an easy way to tackle this

**Before quitting your job, raise a request with your TPA/People partners to port/migrate your Group Insurance policy to an Individual one. As per IRDAI's circular, as long as you raise the request in time, your "waiting period" credit is transferrable to any other policy!

I can't stress this enough - DON'T FORGET TO Port/Migrate before quitting your job, especially if your parents are also insured as part of it

**Porting - Moving to a new Insurer

Migration - Moving to a new policy within the same Insurer

**Porting - Moving to a new Insurer

Migration - Moving to a new policy within the same Insurer

6. Avoid Family floaters with elderly - A family floater is a single policy that covers multiple members of the same family.

So say for a family of 3 (1 kid, husband and wife), the total SI could be 5 lakh, which can be claimed by any of the 3 members

So say for a family of 3 (1 kid, husband and wife), the total SI could be 5 lakh, which can be claimed by any of the 3 members

Here's the catch - the eldest person in the policy is the primary policyholder by design

On demise of the primary policyholder, the policy ceases to exist for all other members, and they have to buy a new policy at the existing market rates

On demise of the primary policyholder, the policy ceases to exist for all other members, and they have to buy a new policy at the existing market rates

**Depending on your own family config, buy a separate health insurance for Senior citizens or for members who are suffering from critical illness.

7. Cumulative Bonus(CB) - In simple words, your Sum Insured increases by some amount for every claim less year, i.e. you are rewarded for being healthy

Many Insurers reward you a 5% CB for every claim free year though I did see policies going as high as 25%

Many Insurers reward you a 5% CB for every claim free year though I did see policies going as high as 25%

Say for a given year, if your SI was 5 lakh, and you didn't claim anything, when you renew the policy next year, the SI will become 5.25 lakh = 5 lakh +(5% of 5 lakh)

% of CB is important if you are buying insurance early on and also if you are fit. Why?

% of CB is important if you are buying insurance early on and also if you are fit. Why?

Because it progressively gives more cover with no additional increase in premium, though there's an upper cap on the total % of CB you get

8. Buy a Top-up - Think of it like an additional cover that kicks in only after a threshold called "deductible"

Say you have an individual insurance with cover of 5 lakh. If you get hospitalised for a medical emergency, and your total expense was 8 lakh, you will have to pay...

Say you have an individual insurance with cover of 5 lakh. If you get hospitalised for a medical emergency, and your total expense was 8 lakh, you will have to pay...

...the remaining 3 lakh out of your own pocket

Now say everything remains the same, in addition, you also had a top-up policy with a deductible of 5 lakh.

This time, the remaining 3 lakh (claim amount above deductible) will be covered by your top-up policy

Now say everything remains the same, in addition, you also had a top-up policy with a deductible of 5 lakh.

This time, the remaining 3 lakh (claim amount above deductible) will be covered by your top-up policy

The advantage of top-up is that it increases your potential SI at a lower cost, though it can only be used one time, i.e. for a single instance of hospitalisation

**What I did - Bought a top-up with deductible equal to the SI of my base insurance policy --> Which means where the coverage of my base insurance policy ends, the coverage of my top-up policy begins

9. Preferred Provider Network (PPN) - Ensure that major hospitals around you (say radius of 2-5 kms) are covered under your policy's PPN

If the hospital isn't a part of PPN, it means you can't avail the "cashless" mode- that is, the Insurer directly settles your medical bills with the Hospital

ALWAYS go for policies that have "cashless" mode & ALWAYS check for hospitals around you that are included in the PPN.

ALWAYS go for policies that have "cashless" mode & ALWAYS check for hospitals around you that are included in the PPN.

10. Spend time reading the CIS (Customer Information Sheet) because there are more than 10 things you need to know before buying health insurance

All policies are published with a corresponding CIS, where the Insurer goes into finer details about what to expect as a customer

All policies are published with a corresponding CIS, where the Insurer goes into finer details about what to expect as a customer

The CIS wordings are 100% standardised across all Insurers; basically it gets easy once you have read 1/2 of them

**Please remember that these tweets have no professional standing, so please do your own research :)

**Please remember that these tweets have no professional standing, so please do your own research :)

So the engagement on this thread was 🔥

I knew there was a problem, but wasn't sure it would be this widespread!

A common request many had was to create a blog/checklist for easy reference and sharing

So here it is simplify.healthcare

Retweet for good karma!

I knew there was a problem, but wasn't sure it would be this widespread!

A common request many had was to create a blog/checklist for easy reference and sharing

So here it is simplify.healthcare

Retweet for good karma!

🚨Free tool to help you decide which Insurer to choose🚨

Many folks were asking which Insurer did I choose. To help them decide, I've created another Interactive dashboard here

coda.io/@vinay-mimani/…

Many folks were asking which Insurer did I choose. To help them decide, I've created another Interactive dashboard here

coda.io/@vinay-mimani/…

You can look at 6 qualities across all Indian Insurers(Health) and play around

You can either

- Look for a Single Insurer,

- Compare b/w Multiple Insurers and even

- Compare Insurers across Sectors (Public, Private, Standalone)

You can either

- Look for a Single Insurer,

- Compare b/w Multiple Insurers and even

- Compare Insurers across Sectors (Public, Private, Standalone)

The source of the data is from a handbook published by IBAI (Insurance Broker Association of India) for FY18-19

blog.securenow.in/wp-content/upl…

I've used simpler terms to describe jargons like Claims Repudiation ratio, etc - Definitions are available on the dashboard itself

blog.securenow.in/wp-content/upl…

I've used simpler terms to describe jargons like Claims Repudiation ratio, etc - Definitions are available on the dashboard itself

• • •

Missing some Tweet in this thread? You can try to

force a refresh