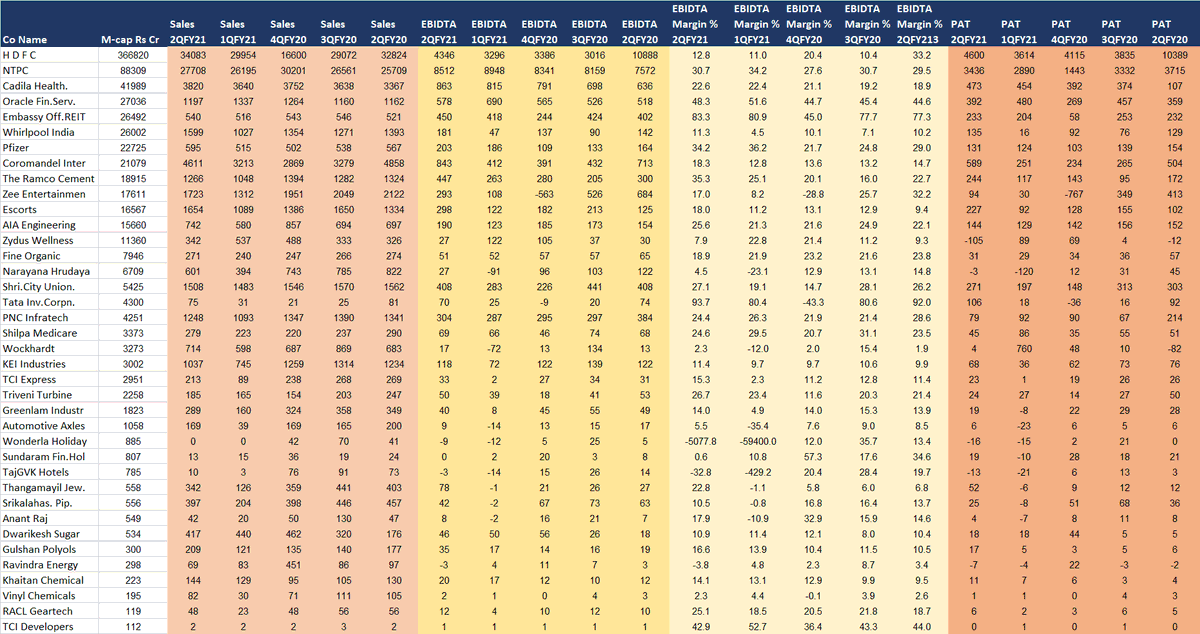

Results declared b/w 30th Oct - 1st Nov #excelgiri #resultsxray

PS: Use ur own wisdom, view on results can vary person to person. I am still learning

PS: Use ur own wisdom, view on results can vary person to person. I am still learning

Max Life: Solid results

VNB margins surprise

Market share improved to 11.1%, highest in decade

Clarity on axis-max deal

19% to to split in 3 ways

Axis Bank to acquire 9% stake in Max Life

Subsidiaries will jointly acquire 3%

Further, the group entities will acquire 7% later

VNB margins surprise

Market share improved to 11.1%, highest in decade

Clarity on axis-max deal

19% to to split in 3 ways

Axis Bank to acquire 9% stake in Max Life

Subsidiaries will jointly acquire 3%

Further, the group entities will acquire 7% later

Strong results + reasonable valuation

Motilal Oswal

M-cap 8230 cr

Total Revenue up 14% (broking up 40%)

Broking: Highest ever revenue & profit in Q2FY21

Reported pat up 108% at 296 cr (included mtm pat)

Operating pat up 33% at 123.3 cr

Net of investments, co has net cash

Motilal Oswal

M-cap 8230 cr

Total Revenue up 14% (broking up 40%)

Broking: Highest ever revenue & profit in Q2FY21

Reported pat up 108% at 296 cr (included mtm pat)

Operating pat up 33% at 123.3 cr

Net of investments, co has net cash

Jindal Stainless Ltd

Strong results + reasonable vals

M-cap 3048 cr; 1.2 p/b, 11% roce

Sales up 1% yoy, up 140% qoq

Sales vol surged 159% qoq, down 1% yoy

Ebidta up 8% yoy, up 440% qoq

EBITDA/ tonne at Rs. 15,293, up 13% Y-o-Y

Pat up 116% yoy, at 82 cr (last quarter loss 122 cr)

Strong results + reasonable vals

M-cap 3048 cr; 1.2 p/b, 11% roce

Sales up 1% yoy, up 140% qoq

Sales vol surged 159% qoq, down 1% yoy

Ebidta up 8% yoy, up 440% qoq

EBITDA/ tonne at Rs. 15,293, up 13% Y-o-Y

Pat up 116% yoy, at 82 cr (last quarter loss 122 cr)

Greenpanel Inds.

Strong results + reasonable vals

M-cap 900 cr

What a strong comeback

Sales up 17%, ebidta up 54%, pat up 385%

Sales at 225 cr vs 192 cr yoy, vs 90 cr qoq

Margins at 20.6% vs 15.6% yoy (loss in 1Q)

1.4x ttm pb

Strong results + reasonable vals

M-cap 900 cr

What a strong comeback

Sales up 17%, ebidta up 54%, pat up 385%

Sales at 225 cr vs 192 cr yoy, vs 90 cr qoq

Margins at 20.6% vs 15.6% yoy (loss in 1Q)

1.4x ttm pb

Intellect Design

Strong results + reasonable vals

M-cap 3165 cr

sales up 7.5% qoq, ebidta up 27% qoq, pat up 39% qoq

Ttm pe 24x, 2.7x pb

Global leader in Financial Technology for Banking, Insurance and other Financial Services.

Strong results + reasonable vals

M-cap 3165 cr

sales up 7.5% qoq, ebidta up 27% qoq, pat up 39% qoq

Ttm pe 24x, 2.7x pb

Global leader in Financial Technology for Banking, Insurance and other Financial Services.

IFB Ind

Strong results + reasonable vals

M-cap 2859 cr

Sales up 3.5%, ebidta up 63%, pat up 45%

Ebidta at 83 cr vs 51 cr

Margins at 11.2% vs 7.1%

Strong results + reasonable vals

M-cap 2859 cr

Sales up 3.5%, ebidta up 63%, pat up 45%

Ebidta at 83 cr vs 51 cr

Margins at 11.2% vs 7.1%

Rain Ind

Strong results + reasonable vals

Sales down 14% but ebidta up 45%, pat up 44%

11x ttm pe, pb 0.7x, 7% roce

Watch for growth in sales & improvement in roce

Strong results + reasonable vals

Sales down 14% but ebidta up 45%, pat up 44%

11x ttm pe, pb 0.7x, 7% roce

Watch for growth in sales & improvement in roce

Anup Eng

Strong results + reasonable vals

M-cap 611 cr

Sales up 40%, EBIDTA down 8%, PAT down 9%

14x ttm pe, 1.9x ttm pb, roce 20%

Order book up 25% to Rs.334 Cr as on 30th Sep 20

bseindia.com/xml-data/corpf…

Strong results + reasonable vals

M-cap 611 cr

Sales up 40%, EBIDTA down 8%, PAT down 9%

14x ttm pe, 1.9x ttm pb, roce 20%

Order book up 25% to Rs.334 Cr as on 30th Sep 20

bseindia.com/xml-data/corpf…

Nitin Spinners

Strong results + reasonable vals

M-cap 288 cr

Sales up 15%, ebidta up 58% at 55 cr vs 35 cr, margns at 13% vs 9.4%

Pat at 12 cr vs 1 cr

Strong results + reasonable vals

M-cap 288 cr

Sales up 15%, ebidta up 58% at 55 cr vs 35 cr, margns at 13% vs 9.4%

Pat at 12 cr vs 1 cr

Good results but expensive valuations

Relaxo: sales down 7%, ebidta up 21%, pat up 6.5%

Surprised across headline numbers

EBITDAM increased 520bps YoY to 22% (Ambit: 18.1%)

Expensive stock at 75x ttm pe

Relaxo: sales down 7%, ebidta up 21%, pat up 6.5%

Surprised across headline numbers

EBITDAM increased 520bps YoY to 22% (Ambit: 18.1%)

Expensive stock at 75x ttm pe

Good results but expensive valuations

Sheela Foam: sales up 22%, ebidta up 51%, pat up 18%

EBITDAM at 17.5% vs 14.2%

Expensive stock at 37xttm pe, 7x pb

Sheela Foam: sales up 22%, ebidta up 51%, pat up 18%

EBITDAM at 17.5% vs 14.2%

Expensive stock at 37xttm pe, 7x pb

Good results but expensive valuations

Hester Bios

Sales up 21%, ebidta up 43%, pat up 2.5%

50x ttm pe, 7x pb, 16% roce

Manufacturing of Poultry vaccines and Large Animal Vaccines and trading of Poultry and Large animal health products

Hester Bios

Sales up 21%, ebidta up 43%, pat up 2.5%

50x ttm pe, 7x pb, 16% roce

Manufacturing of Poultry vaccines and Large Animal Vaccines and trading of Poultry and Large animal health products

Good results but expensive valuations

Grindwell Norton: sales up 12%, ebidta up 44%, pat up 23%

Ebidta margin at 21.3% vs 16.6% yoy, vs 8.4% qoq

34x ttm pe, 21% roce

V solid co

Grindwell Norton: sales up 12%, ebidta up 44%, pat up 23%

Ebidta margin at 21.3% vs 16.6% yoy, vs 8.4% qoq

34x ttm pe, 21% roce

V solid co

Good results but run-up & inconsistent

Tanla Solutions

M-cap 4423 cr (stock up 10 times frm 52-week low)

Sales up 28% qoq, ebidta up 30% qoq, pat up 3.5% qoq

Margins at 16.7% vs 16.5% qoq

Inconsistent margins over last 5-6 years

March 2020 sales 1943 cr, 9% margins, 211 cr loss

Tanla Solutions

M-cap 4423 cr (stock up 10 times frm 52-week low)

Sales up 28% qoq, ebidta up 30% qoq, pat up 3.5% qoq

Margins at 16.7% vs 16.5% qoq

Inconsistent margins over last 5-6 years

March 2020 sales 1943 cr, 9% margins, 211 cr loss

Weak results

Just Dial

Sales down 31%, PAT down 38%

Paid campaigns down 15.2% YoY (was down 13.7% in Q1)

New listings continues to remain weak, down 70%

Conference call at 6PM IST

Axis Cap: Downgrade to SELL (from REDUCE) with DCF-based TP of Rs 550 (vs Rs 560 earlier)

Just Dial

Sales down 31%, PAT down 38%

Paid campaigns down 15.2% YoY (was down 13.7% in Q1)

New listings continues to remain weak, down 70%

Conference call at 6PM IST

Axis Cap: Downgrade to SELL (from REDUCE) with DCF-based TP of Rs 550 (vs Rs 560 earlier)

• • •

Missing some Tweet in this thread? You can try to

force a refresh