I hope 25% won’t immediately unfollow me! But, hey, physics is beautiful, and history is fun, so let's start...

...with the history of light as a physical concept, because a very large part of what physics is today comes from studying light.

...with the history of light as a physical concept, because a very large part of what physics is today comes from studying light.

https://twitter.com/jeuasommenulle/status/1325450068980330497

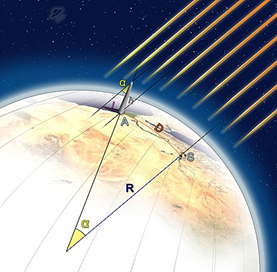

The early study of light was mostly geometric & about straight lines. Thales’s theorem proven (hum!) using the shadows of the great pyramid, Eratosthenes’ measurement of the Earth’s circumference using the shadows in Alexandria & Assouan: light rays contributed to progress.

But one phenomenon baffled scientists and philosophers for centuries: refraction. And they were right to be baffled because understanding refraction led to the discovery of one of the most important principles of physics…But let’s not get ahead of ourselves.

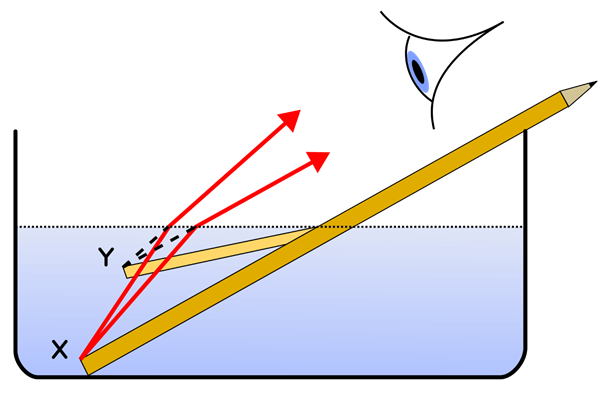

In case you forgot your high school class, refraction is what happens when something in water appears to be broken, as this pen.

The reason why it looks “broken” is simply because light rays (they’re not really “rays” but never mind) change course when they move in or out of the water (see drawing). Greek philosophers had already understood this, but they couldn’t solve two mysteries!

Mystery number 1: what is the equation giving the angle for the deviation?

Mystery number 2: why is there a deviation in the first place????

Mystery number 2: why is there a deviation in the first place????

It took centuries to make any progress.

In 773 an Indian delegation went to visit the calif of Bagdad, Al Mansour, and a geometry treatise was given as a precious gift.

It contributed to developing extensive scientific research in Bagdad!

In 773 an Indian delegation went to visit the calif of Bagdad, Al Mansour, and a geometry treatise was given as a precious gift.

It contributed to developing extensive scientific research in Bagdad!

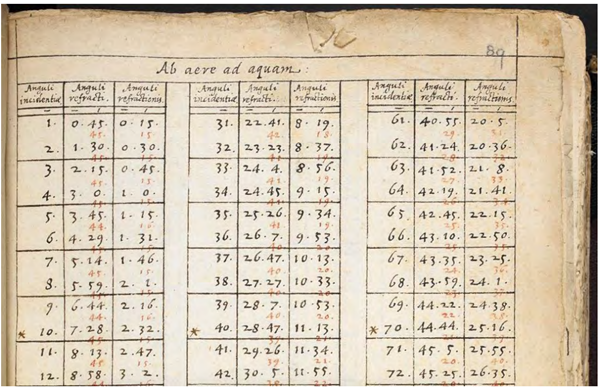

In 983, a mathematical genius, Ibn Sahl, wrote a book that included the first description of the law of refraction. This is the crucial excerpt from his manuscript. If the proof isn’t super clear, it’s ok. And this time don’t blame me for the blurry pics!

Unfortunately, Ibn Sahl was overshadowed by another later Arab genius, Ibn al-Haytham, a polymath who became known as the father of optics.

Ibn al-Haytham studied the eye and combined the mathematical rays of Euclid, the medical work of Galen to show that Aristotle was right and Pythagoras wrong: the light comes to the eye, not from the eye! (Yes, Pythagoras had some weird theories)

For reasons that are still unclear, Ibn al-Haytham did not use Ibn Sahl’s work and had his own law of refraction, but which was only valid for tiny angles. Because Ibn al-Haytham was so famous, his work came all the way to Europe and became a very early reference on optics.

Ibn Sahl’s work was totally forgotten… to the point that we had to wait for 1980 to realize that Ibn Sahl was the real inventor of the law of refraction!

In the meantime, three European scientists had been fighting for that honor!

In the meantime, three European scientists had been fighting for that honor!

Meet Thomas Harriot, one of the very first British scientists and an early explorer of the New World!

He began experimenting on refraction in the 1590s and probably discovered the law of refraction in 1602… but didn’t find any reason to write it down anywhere!

He began experimenting on refraction in the 1590s and probably discovered the law of refraction in 1602… but didn’t find any reason to write it down anywhere!

Instead, he kept writing to Kepler accurate estimates for refraction angles, which drove Kepler totally mad because he could not understand where the numbers were coming from!

When Harriot died from cancer in 1621, most of his work remained unpublished.

When Harriot died from cancer in 1621, most of his work remained unpublished.

In fact, when the Royal Society was founded in London, the first meetings were full of discussions about finding Harriot’s lost and mysterious papers!

You would think nobody else would be dumb enough to discover one of the most important laws of physics and forget to publish it? Hum. Willebrord Snellius started on Eratosthenes’ footsteps & was the first to reproduce his measurement of the circumference of the Earth in 1615.

Yes, European science hadn’t progressed much in 1500 years…

By doing some refraction experiments, Snell discovered the so-called sine law and the fact that every substance has a specific "refractive index” driving the angle of refraction. But he did not realize that this was so important and left it unpublished.

He had to wait a little less than Ibn Sahl’s to get his fame restored: Huygens, in Dioptrica published in… 1703, finally gave credit to Snell.

But the situation is a bit frustrating because none of them *explained* how they got to the sine law. It could be because they found it by pure guessing or because they didn’t publish their reasoning… we simply don’t know!

So, we are left with Descartes, the French philosopher, who was the first one to publish an actual “proof”. This is why French people call it the law of Snell-Descartes (forgetting poor Harriot, not to mention Ibn Sahl, a mere… 550 years before!)

But this is where it gets funny because Descarte’s proof was totally bogus. He probably did just like the others, found the law by guessing, and then did his best to come up with a theory. He got two ideas correct, though:

He realised that speed could be at the heart of the issue and that the frontier between air and water was key

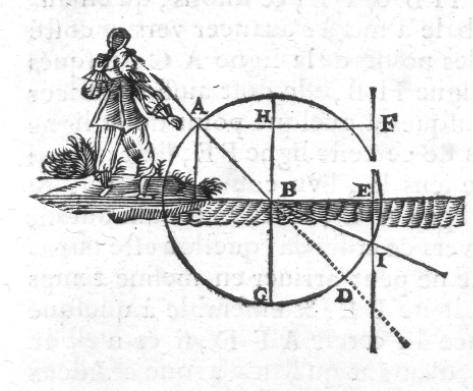

His idea was best expressed in this drawing: basically, he thought that at the exact frontier between air and water, the perpendicular component of the speed of light would change and this would trigger refraction.

The idea was not bad… but there were two tiny problems. The first one was that Descartes also believed… that light had an infinite speed! (A story for another thread.)

Yeah, mathematical rigor was not exactly the same back in the days. Infinite speed and... change in speed didn’t sound like a big contradiction!

But the second problem was what killed his theory. His equations worked only if the speed of light was *higher* in water. And someone didn’t agree with that *at all*.

This someone was probably the most famous amateur mathematician of all times and surely you’ve heard his name before: Pierre de Fermat, a French judge.

Fermat liked to tease & pretend that he had a very simple and elegant proof that x^+y^n=z^n had no integer solution for N>2. (But not enough space to write it down)

It took 350 years, hundreds of wrong proofs, thousands of frustrated mathematicians, and Andrew Wiles’ 500-page long proof to show that the theorem was correct!

Meanwhile, in the 1630s, Fermat was convinced that Descartes was wrong and that light was gong faster in the air than in water. Why was he convinced? Because he had found another way to prove “Descartes’s” law, but it required light to be faster in the air.

Why his proof rather than Descartes’s, then? I mean at the time, there was no way to measure the speed of light with that kind of accuracy. Fermat thought he was right simply because his proof had an exceptional beauty.

And honestly, he had a point.

And honestly, he had a point.

When Maupertuis generalized it in 1774 , he was so thrilled that he believed he had discovered proof of God’s existence, no less!

So what is this fantastic principle?

We now call it the “principle of least action” and this is how Fermat saw it: in simple words, Fermat discovered that light always takes the path that can be traversed in the least time.

We now call it the “principle of least action” and this is how Fermat saw it: in simple words, Fermat discovered that light always takes the path that can be traversed in the least time.

It is exactly as if light always knows how to get somewhere as quickly as possible, by the virtue of some magical knowledge!

It is easy to imagine how enthusiastic Fermat was when he discovered it.

It is easy to imagine how enthusiastic Fermat was when he discovered it.

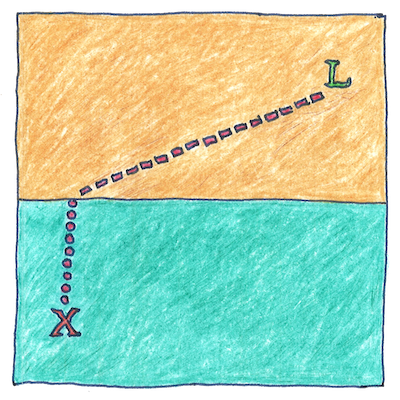

This idea is enough to explain the law of refraction because light will try to travel more in the “high-speed medium” and less in the “low-speed medium”.

Simple maths show that in this situation, the quickest path obeys the sine law.

Simple maths show that in this situation, the quickest path obeys the sine law.

In the drawing below, you can see that if you are in L and want to save someone drowning in X the safe strategy is not to run straight ahead to the water because you swim slowly!

It turned out Fermat had only rediscovered an idea posited by Heron of Alexandria, in the 1st century!

And that idea would turn out to be so interesting that it is now at the core of quantum mechanics and most of modern physics…

And that idea would turn out to be so interesting that it is now at the core of quantum mechanics and most of modern physics…

Ultimately, the law of refraction led to

i) the discovery of the principle of least action

ii) new research on the speed of light and

iii) Newton’s famous prism experiments!

Not bad, for a broken pencil. But far from over, as double refraction would soon puzzle scientists...

i) the discovery of the principle of least action

ii) new research on the speed of light and

iii) Newton’s famous prism experiments!

Not bad, for a broken pencil. But far from over, as double refraction would soon puzzle scientists...

That's for another week!

And here's the link to the next thread, about color, Newton's theory of light, double refraction, the first theory of light as a wave, and how the Vikings discovered America!

https://twitter.com/jeuasommenulle/status/1328016281384185856?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh