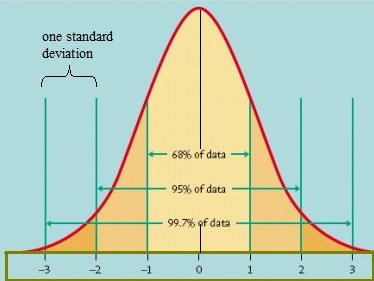

Some of you may wonder why I follow the standard deviation levels. After years of trading and looking at and paying for many different services, I have found the most reliable level is the 1 standard deviation level based on implied volatility(Historic is good to know also).

This is because most option models are based on it as a large part of determining values. If there were a better model option traders would use it. If option prices were to high relative to the market's volatility eventually no one would buy them because they would always lose.

And if option prices were to cheap no one would ever write them because they would always lose. So what does the model do? It prices them in a way where buyers and sellers both perceive fair value of opportunity. The price levels produce a statistical distribution.

That distribution is for the main part influenced by expected price movement, Volatility. And the fairest price works out to be 1 SD . Option writers have more risk so the implied volatility is always higher than historic because they need to be paid for taking that risk.

Buyers are willing to pay more because they have a higher expectation of movement then the seller does at the time of the trade.

Which brings me back to what 1 SD means. When I look at it on a daily basis

I expect it to be the upper and lower levels of movement. If those levels are exceeded to often Volatility goes up and the 1 SD levels increase.

I expect it to be the upper and lower levels of movement. If those levels are exceeded to often Volatility goes up and the 1 SD levels increase.

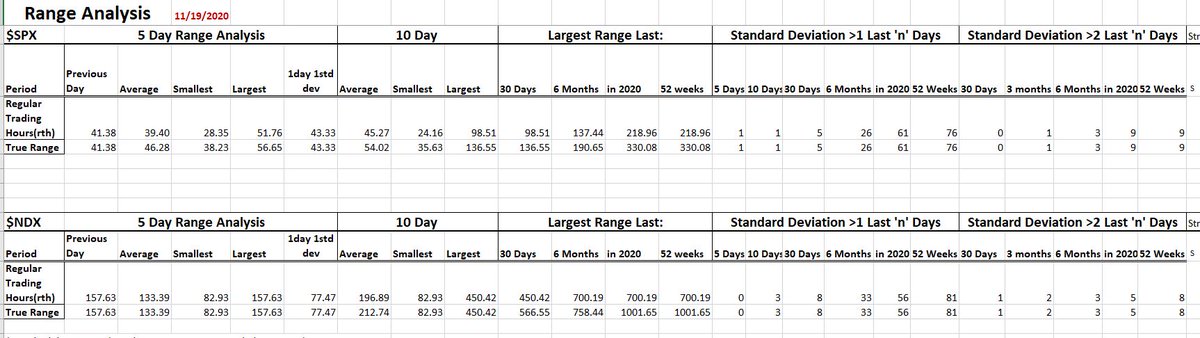

Look at the 1 and 2 SD stats Look at the 5 day range analysis and compare it to the 1 day 1SD amount.

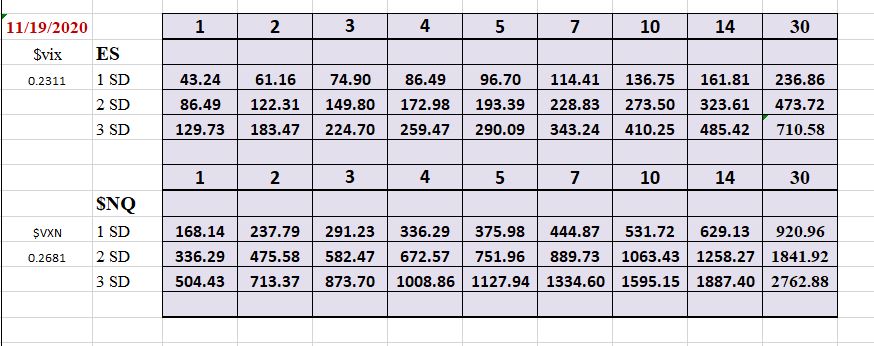

I put out these tables, lets look at one. $ES $NQ I use the $VIX and $VXN levels of volatility( not going into the reasons now, I know they are usually higher than IV). These tables show what a 1SD move is for the number of associated days out. For instance November 25th is.....

is 5 days from now. looking at the 5 day 1 SD level in the ES I can expect the market to be 96.70 pts up or down from where it is today 68% of the time

And then can make a determination about how I may want to position an option trade in relation to my view of the market. Its that simple lol.

• • •

Missing some Tweet in this thread? You can try to

force a refresh