Yes Bank’s additional Tier 1 bonds, written off. Lakshmi Villas Banks Tier 2 bonds, written off. Understand what & why of ATI and Tier 2 bonds in this thread.

Do ‘re-tweet’ and help us benefit more investors (1/n)

Do ‘re-tweet’ and help us benefit more investors (1/n)

As a bank, you are in the business of borrowing & lending where the difference in the rate is the banks profit. So if the bank borrows under savings account, current account, FD etc at an average of 6% & lends at 8%, the difference of 2% is the banks profit. (2/n)

But there is a problem here,

If 100 is borrowed by the bank & 100 is lent & assuming there is a 10% NPA, the deposit holders will lose 10% of their deposits which is not a good sign and RBI surely does not like it (3/n)

If 100 is borrowed by the bank & 100 is lent & assuming there is a 10% NPA, the deposit holders will lose 10% of their deposits which is not a good sign and RBI surely does not like it (3/n)

To avoid this, banks r expected to invest their own capital + raise risk capital from the market. Risk capital is when the investor knows there is capital/investment risk like Equity & AT1 bonds etc. (4/n)

So now if 80% is deposits & assuming 20% is risk capital & 10% NPA takes place, the 10% will be a loss borne by the risk capital holders/investors & not the deposit holders. That’s the basic premise of running a bank. (5/n)

What is this risk capital requirement 4 the banks?

Banks r expected to maintain a minimum 11.5% capital adequacy ratio (CAR). This means that vs the lending the banks do, the banks will have to maintain a minimum 11.5% capital to be able to manage any NPA situation. (6/n)

Banks r expected to maintain a minimum 11.5% capital adequacy ratio (CAR). This means that vs the lending the banks do, the banks will have to maintain a minimum 11.5% capital to be able to manage any NPA situation. (6/n)

The riskier the lending the bank does, the lower will the CAR ratio become and hence higher the need to raise more capital. This is to make sure banks don't lent recklessly and if they do, they need to keep bringing in more capital (7/n)

The 11.5% CAR is broken down as below,

1.Tier 1 Capital – requirement is 9.5%

a)Common Equity Tier 1 - requirement is 8%

b)Additional Tier 1 - requirement is 1.5%

2.Tier 2 Capital requirement is 2% (8/n)

1.Tier 1 Capital – requirement is 9.5%

a)Common Equity Tier 1 - requirement is 8%

b)Additional Tier 1 - requirement is 1.5%

2.Tier 2 Capital requirement is 2% (8/n)

(1) Tier 1 capital – requirement is 9.5% & further broken down into 2,

a. Common Equity Tier 1 capital – This is the capital mainly raised by issuing shares. This includes shareholders equity + Reserves & Surplus. Minimum requirement is 8% (9/n)

a. Common Equity Tier 1 capital – This is the capital mainly raised by issuing shares. This includes shareholders equity + Reserves & Surplus. Minimum requirement is 8% (9/n)

b. Additional Tier 1 capital – This is the capital raised by issuing perpetual bonds/AT1 bonds (Yes Bank case). This can form part of the remaining 1.5% requirement (9.5% - 8%) (10/n)

If the bank keeps making losses, this capital will be at risk and will keep coming down and hence more capital will need to be raised either by selling equity of the bank or by issuing AT1 bonds (11/n)

(2) Tier II capital – Requirement is 2%

This is raised by issuing Tier 2 bonds (Lakshmi Villas Bank). In case of liquidation of a bank, this capital will be at risk. (12/n)

This is raised by issuing Tier 2 bonds (Lakshmi Villas Bank). In case of liquidation of a bank, this capital will be at risk. (12/n)

Whats the risk in AT1 bonds?

First lets understand how does the AT1 bond work – Here’s an older thread on the same -

First lets understand how does the AT1 bond work – Here’s an older thread on the same -

https://twitter.com/kirtan0810/status/1235933007833370625?s=09(13/n)

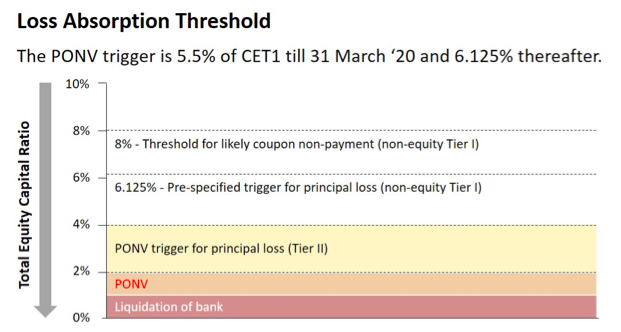

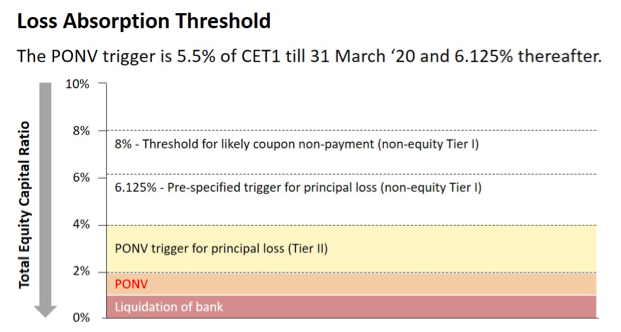

a. Banks can skip paying the coupon if either, the bank is making losses & does nt have reserves 2 pay 4m or the banks common equity tier 1 capital falls below the minimum 8% requirement. This will nt b considered a default neither does it get accumulated 2b paid next year(14/n)

(b) Banks will write off the principal if the common equity tier 1 capital falls below 6.125% (15/n)

Whats the risk in Tier 2 bonds (Lakshmi Villas Banks case)?

Banks can write off Tier 2 bonds if the common equity tier 1 capital falls below 4% (16/n)

Banks can write off Tier 2 bonds if the common equity tier 1 capital falls below 4% (16/n)

Suggestion to investors?

These products are not FD replacement. They are meant for sophisticated investors who understand the risk and can track the CAR, CET1 and profitability ratios of the banks. Don’t get carried away with the higher yields they offer. (17/18)

These products are not FD replacement. They are meant for sophisticated investors who understand the risk and can track the CAR, CET1 and profitability ratios of the banks. Don’t get carried away with the higher yields they offer. (17/18)

For a detailed analysis, please click the link to read our article by @stepbystep888. And do re-tweet if you like the content :)

fpa.edu.in/blog/perpetual… (**End**)

fpa.edu.in/blog/perpetual… (**End**)

• • •

Missing some Tweet in this thread? You can try to

force a refresh