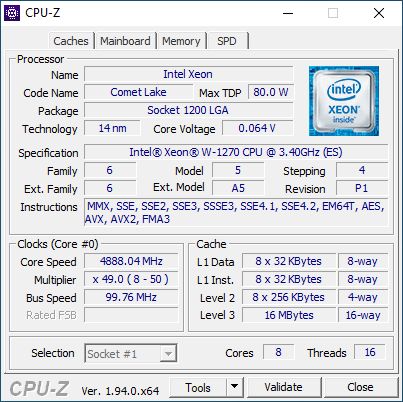

#CPUOverload 46

💻 Intel Xeon W-1270

🔎 Comet Lake

💰 $362

🍏 8 Cores / 16 Threads

▶ 3400 MHz Base

⏩ 5000 MHz Turbo

📝 16 L3 Cache

🔥 80 W

📊 anandtech.com/bench/product/…

💻 Intel Xeon W-1270

🔎 Comet Lake

💰 $362

🍏 8 Cores / 16 Threads

▶ 3400 MHz Base

⏩ 5000 MHz Turbo

📝 16 L3 Cache

🔥 80 W

📊 anandtech.com/bench/product/…

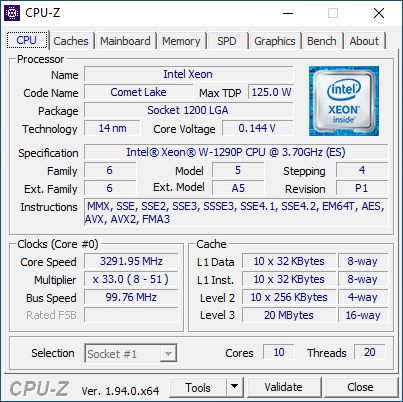

#CPUOverload 47

💻 Intel Xeon W-1290P

🔎 Comet Lake

💰 $539

🍏 10 Cores / 20 Threads

▶ 3700 MHz Base

⏩ 5300 MHz Turbo

📝 20 L3 Cache

🔥 125 W

📊 anandtech.com/bench/product/…

💻 Intel Xeon W-1290P

🔎 Comet Lake

💰 $539

🍏 10 Cores / 20 Threads

▶ 3700 MHz Base

⏩ 5300 MHz Turbo

📝 20 L3 Cache

🔥 125 W

📊 anandtech.com/bench/product/…

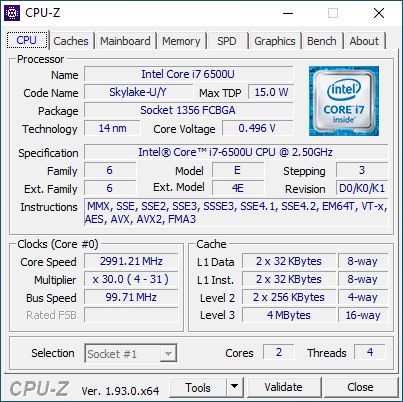

#CPUOverload 48

💻 Intel Core i7-6500U

🔎 Skylake

💰 $393

🍏 2 Cores / 4 Threads

▶ 2500 MHz Base

⏩ 3100 MHz Turbo

📝 4 MB L3 Cache

🔥 15 W

💻 GIGABYTE BRIX

📊 anandtech.com/bench/product/…

🎁 geni.us/Bench2020-BRIX

💻 Intel Core i7-6500U

🔎 Skylake

💰 $393

🍏 2 Cores / 4 Threads

▶ 2500 MHz Base

⏩ 3100 MHz Turbo

📝 4 MB L3 Cache

🔥 15 W

💻 GIGABYTE BRIX

📊 anandtech.com/bench/product/…

🎁 geni.us/Bench2020-BRIX

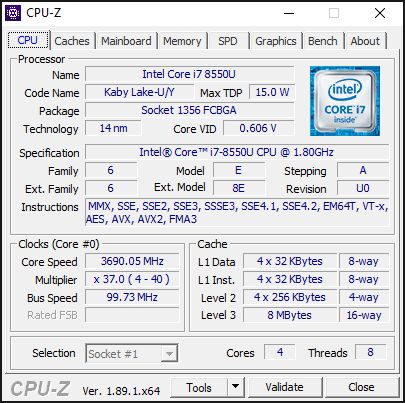

#CPUOverload 49

💻 Intel Core i7-8550U

🔎 Kaby-R

💰 $409

🍏 4 Cores / 8 Threads

▶ 1800 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 15 W

💻 Huawei Matebook X Pro 2019

📊 anandtech.com/bench/product/…

🎁 geni.us/Bench2020-Mate…

💻 Intel Core i7-8550U

🔎 Kaby-R

💰 $409

🍏 4 Cores / 8 Threads

▶ 1800 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 15 W

💻 Huawei Matebook X Pro 2019

📊 anandtech.com/bench/product/…

🎁 geni.us/Bench2020-Mate…

#CPUOverload 50

💻 Apple M1

🔎 FireStorm/IceStorm

💰 $899 (16 GB)

🍏 4 Cores + 4 Cores

▶ 1850 MHz IceStorm

⏩ 3200 MHz FireStorm

📝 12 MB L2 Cache

🔥 20 W TDP? (27-31 W Peak)

💻 Mac Mini 2020

📊 anandtech.com/bench/product/…

📝 anandtech.com/show/16252/mac…

🎁 geni.us/Bench2020-8GBA…

💻 Apple M1

🔎 FireStorm/IceStorm

💰 $899 (16 GB)

🍏 4 Cores + 4 Cores

▶ 1850 MHz IceStorm

⏩ 3200 MHz FireStorm

📝 12 MB L2 Cache

🔥 20 W TDP? (27-31 W Peak)

💻 Mac Mini 2020

📊 anandtech.com/bench/product/…

📝 anandtech.com/show/16252/mac…

🎁 geni.us/Bench2020-8GBA…

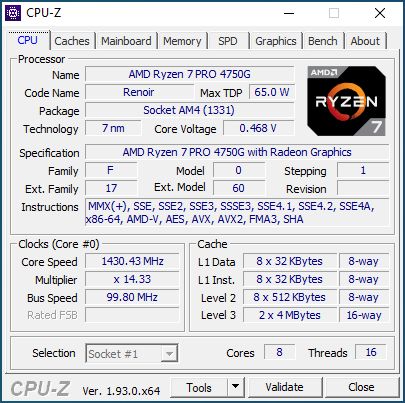

#CPUOverload 51

💻 AMD Ryzen 7 Pro 4750G

🔎 Zen2 + Vega

💰 $349

🍏 8 Cores / 16 Threads

▶ 3600 MHz Base

⏩ 4400 MHz Turbo

📝 8 L3 Cache

🔥 65 W

📊 anandtech.com/bench/product/…

📝 anandtech.com/show/16308/tes…

💻 AMD Ryzen 7 Pro 4750G

🔎 Zen2 + Vega

💰 $349

🍏 8 Cores / 16 Threads

▶ 3600 MHz Base

⏩ 4400 MHz Turbo

📝 8 L3 Cache

🔥 65 W

📊 anandtech.com/bench/product/…

📝 anandtech.com/show/16308/tes…

#CPUOverload 52

💻 AMD Ryzen 5 Pro 4650G

🔎 Zen2 + Vega

💰 $245

🍏 6 Cores / 12 Threads

▶ 3700 MHz Base

⏩ 4200 MHz Turbo

📝 8 MB L3 Cache

🔥 65 W

📊 anandtech.com/bench/product/…

📝 anandtech.com/show/16308/tes…

💻 AMD Ryzen 5 Pro 4650G

🔎 Zen2 + Vega

💰 $245

🍏 6 Cores / 12 Threads

▶ 3700 MHz Base

⏩ 4200 MHz Turbo

📝 8 MB L3 Cache

🔥 65 W

📊 anandtech.com/bench/product/…

📝 anandtech.com/show/16308/tes…

#CPUOverload 53

💻 AMD Ryzen 3 Pro 4350G

🔎 Zen2 + Vega

💰 $259

🍏 4 Cores / 8 Threads

▶ 3500 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 65 W

📊 anandtech.com/bench/product/…

📝 anandtech.com/show/16308/tes…

💻 AMD Ryzen 3 Pro 4350G

🔎 Zen2 + Vega

💰 $259

🍏 4 Cores / 8 Threads

▶ 3500 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 65 W

📊 anandtech.com/bench/product/…

📝 anandtech.com/show/16308/tes…

#CPUOverload 54

💻 Intel Celeron N3350

🔎 Apollo Lake

💰 $107

🍏 2 Cores / 2 Threads

▶ 1100 MHz Base

⏩ 2400 MHz Turbo

📝 2 MB L2 Cache

🔥 6 W SDP

💻 CODA Spirit Laptop (9W)

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-N3350 #affiliatelink

💻 Intel Celeron N3350

🔎 Apollo Lake

💰 $107

🍏 2 Cores / 2 Threads

▶ 1100 MHz Base

⏩ 2400 MHz Turbo

📝 2 MB L2 Cache

🔥 6 W SDP

💻 CODA Spirit Laptop (9W)

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-N3350 #affiliatelink

#CPUOverload 55

💻 AMD Athlon 5370

🔎 Jaguar (AM1)

💰 OEM

🍏 4 Cores / 4 Threads

▶ 2200 MHz Base

📝 4 MB L2 Cache

🔥 25 W

⌚ Feb 2016

📊 anandtech.com/bench/product/…

💻 AMD Athlon 5370

🔎 Jaguar (AM1)

💰 OEM

🍏 4 Cores / 4 Threads

▶ 2200 MHz Base

📝 4 MB L2 Cache

🔥 25 W

⌚ Feb 2016

📊 anandtech.com/bench/product/…

#CPUOverload 56

💻 Intel Xeon D-1540

🔎 Broadwell-DE

💰 $581

🍏 8 Cores / 16 Threads

▶ 2000 MHz Base

⏩ 2600 MHz Turbo

📝 12 MB L3 Cache

🔥 45 W

⌚ March 2015

📊 anandtech.com/bench/product/…

💻 Intel Xeon D-1540

🔎 Broadwell-DE

💰 $581

🍏 8 Cores / 16 Threads

▶ 2000 MHz Base

⏩ 2600 MHz Turbo

📝 12 MB L3 Cache

🔥 45 W

⌚ March 2015

📊 anandtech.com/bench/product/…

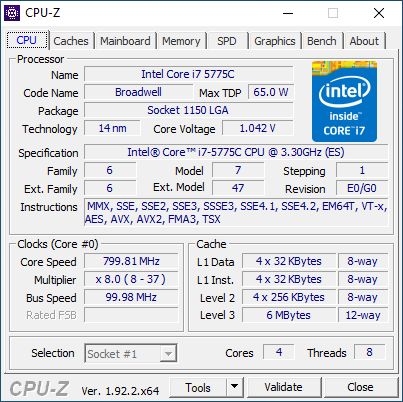

#CPUOverload 57

💻 Intel Core i7-5775C

🔎 Broadwell

💰 $377

🍏 4 Cores / 8 Threads

▶ 3300 MHz Base

⏩ 3700 MHz Turbo

📝 128 MB L4 Cache

🔥 65 W

⌚ June 2015

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-5775C #affiliatelink

💻 Intel Core i7-5775C

🔎 Broadwell

💰 $377

🍏 4 Cores / 8 Threads

▶ 3300 MHz Base

⏩ 3700 MHz Turbo

📝 128 MB L4 Cache

🔥 65 W

⌚ June 2015

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-5775C #affiliatelink

#CPUOverload 58

💻 Intel Core i5-5675C

🔎 Broadwell

💰 $277

🍏 4 Cores / 4 Threads

▶ 3100 MHz Base

⏩ 3600 MHz Turbo

📝 128 MB L4 Cache

🔥 65 W

⌚ June 2015

📊 anandtech.com/bench/product/…

💻 Intel Core i5-5675C

🔎 Broadwell

💰 $277

🍏 4 Cores / 4 Threads

▶ 3100 MHz Base

⏩ 3600 MHz Turbo

📝 128 MB L4 Cache

🔥 65 W

⌚ June 2015

📊 anandtech.com/bench/product/…

#CPUOverload 59

💻 AMD Ryzen 5 2600

🔎 Zen+ Pinnacle Ridge

💰 $199

🍏 6 Cores / 12 Threads

▶ 3400 MHz Base

⏩ 3900 MHz Turbo

📝 16 MB L3 Cache

🔥 65 W

⌚ April 2018

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-r526… #affiliatelink

💻 AMD Ryzen 5 2600

🔎 Zen+ Pinnacle Ridge

💰 $199

🍏 6 Cores / 12 Threads

▶ 3400 MHz Base

⏩ 3900 MHz Turbo

📝 16 MB L3 Cache

🔥 65 W

⌚ April 2018

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-r526… #affiliatelink

#CPUOverload 60

💻 AMD A9-9820

🔎 Jaguar

💰 OEM

🍏 8 Cores / 8 Threads

▶ 2350 MHz Base

📝 4 MB L2 Cache

🔥 120 W (?)

⌚ 2013

🕹 Microsoft Xbox One APU

💻 Chuwi Aerobox

📊 anandtech.com/bench/product/…

💻 AMD A9-9820

🔎 Jaguar

💰 OEM

🍏 8 Cores / 8 Threads

▶ 2350 MHz Base

📝 4 MB L2 Cache

🔥 120 W (?)

⌚ 2013

🕹 Microsoft Xbox One APU

💻 Chuwi Aerobox

📊 anandtech.com/bench/product/…

#CPUOverload 61

💻 Intel Pentium Dual Core E6500

🔎 Core / Wolfdale-3M

💰 $75

🍏 2 Cores / 2 Threads

▶ 2933 MHz Base

📝 2 MB L2 Cache

🔥 65 W

⌚ August 2009

📊 anandtech.com/bench/product/…

💻 Intel Pentium Dual Core E6500

🔎 Core / Wolfdale-3M

💰 $75

🍏 2 Cores / 2 Threads

▶ 2933 MHz Base

📝 2 MB L2 Cache

🔥 65 W

⌚ August 2009

📊 anandtech.com/bench/product/…

#CPUOverload 62

💻 Intel Pentium G3258

🔎 Haswell

💰 $72

🍏 2 Cores / 4 Threads

▶ 3200 MHz Base

📝 3 MB L3 Cache

🔥 53 W

⌚ June 2014

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-G3258 #affiliatelink

💻 Intel Pentium G3258

🔎 Haswell

💰 $72

🍏 2 Cores / 4 Threads

▶ 3200 MHz Base

📝 3 MB L3 Cache

🔥 53 W

⌚ June 2014

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-G3258 #affiliatelink

#CPUOverload 63

💻 Intel Core i7-6700

🔎 Skylake

💰 $303

🍏 4 Cores / 8 Threads

▶ 3400 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 65 W

⌚ September 2015

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-i767… #affiliatelink

💻 Intel Core i7-6700

🔎 Skylake

💰 $303

🍏 4 Cores / 8 Threads

▶ 3400 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 65 W

⌚ September 2015

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-i767… #affiliatelink

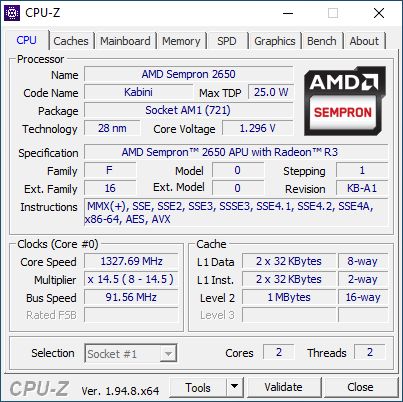

#CPUOverload 64

💻 AMD Sempron 2850

🔎 Jaguar

💰 $31

🍏 2 Cores / 2 Threads

➡ 1450 MHz Base

📝 1 MB L2 Cache

🔥 25 W

⌚ April 2014

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-Semp… #affiliatelink

💻 AMD Sempron 2850

🔎 Jaguar

💰 $31

🍏 2 Cores / 2 Threads

➡ 1450 MHz Base

📝 1 MB L2 Cache

🔥 25 W

⌚ April 2014

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-Semp… #affiliatelink

#CPUOverload 65

💻 Intel Core i5-4570S

🔎 Haswell

💰 $195

🍏 4 Cores / 4 Threads

➡ 2900 MHz Base

⏩ 3600 MHz Turbo

📝 6 MB L3 Cache

🔥 65 W

⌚ June 2013

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-i5-4… #affiliatelink

💻 Intel Core i5-4570S

🔎 Haswell

💰 $195

🍏 4 Cores / 4 Threads

➡ 2900 MHz Base

⏩ 3600 MHz Turbo

📝 6 MB L3 Cache

🔥 65 W

⌚ June 2013

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2020-i5-4… #affiliatelink

#CPUOverload 66

💻 AMD Sempron 3850

🔎 Jaguar

💰 $36

🍏 4 Cores / 4 Threads

➡ 1300 MHz Base

📝 2 MB L2 Cache

🔥 25 W

⌚ April 2014

📊 anandtech.com/bench/product/…

💻 AMD Sempron 3850

🔎 Jaguar

💰 $36

🍏 4 Cores / 4 Threads

➡ 1300 MHz Base

📝 2 MB L2 Cache

🔥 25 W

⌚ April 2014

📊 anandtech.com/bench/product/…

#CPUOverload 67

💻 AMD Athlon 5150

🔎 Jaguar

💰 $45

🍏 4 Cores / 4 Threads

➡ 1600 MHz Base

📝 2 MB L2 Cache

🔥 25 W

⌚ April 2014

📊 anandtech.com/bench/product/…

💻 AMD Athlon 5150

🔎 Jaguar

💰 $45

🍏 4 Cores / 4 Threads

➡ 1600 MHz Base

📝 2 MB L2 Cache

🔥 25 W

⌚ April 2014

📊 anandtech.com/bench/product/…

#CPUOverload 68

💻 AMD Athlon 5350

🔎 Jaguar

💰 $55

🍏 4 Cores / 4 Threads

➡ 2050 MHz Base

📝 2 MB L2 Cache

🔥 25 W

⌚ April 2014

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-Athl… #affiliatelink

💻 AMD Athlon 5350

🔎 Jaguar

💰 $55

🍏 4 Cores / 4 Threads

➡ 2050 MHz Base

📝 2 MB L2 Cache

🔥 25 W

⌚ April 2014

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-Athl… #affiliatelink

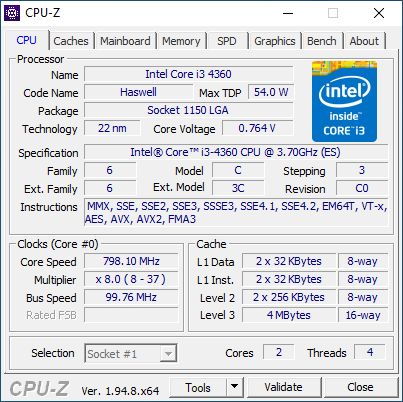

#CPUOverload 69

💻 Intel Core i3-4360

🔎 Haswell

💰 $149 / $157

🍏 2 Cores / 4 Threads

➡ 3700 MHz Base

📝 4 MB L3 Cache

🔥 54 W

⌚ May 2014

📊 anandtech.com/bench/product/…

💻 Intel Core i3-4360

🔎 Haswell

💰 $149 / $157

🍏 2 Cores / 4 Threads

➡ 3700 MHz Base

📝 4 MB L3 Cache

🔥 54 W

⌚ May 2014

📊 anandtech.com/bench/product/…

#CPUOverload 70

💻 Intel Core i5-4690

🔎 Haswell

💰 $213 / $224

🍏 4 Cores / 4 Threads

➡ 3500 MHz Base

⏩ 3900 MHz Turbo

📝 6 MB L3 Cache

🔥 84 W

⌚ May 2014

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-i5-4… #affiliatelink

💻 Intel Core i5-4690

🔎 Haswell

💰 $213 / $224

🍏 4 Cores / 4 Threads

➡ 3500 MHz Base

⏩ 3900 MHz Turbo

📝 6 MB L3 Cache

🔥 84 W

⌚ May 2014

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-i5-4… #affiliatelink

#CPUOverload 71

💻 Intel Core i5-6600

🔎 Skylake

💰 $213 / $224

🍏 4 Cores / 4 Threads

➡ 3300 MHz Base

⏩ 3900 MHz Turbo

📝 6 MB L3 Cache

🔥 65 W

⌚ September 2015

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-i5-6… #affiliatelink

💻 Intel Core i5-6600

🔎 Skylake

💰 $213 / $224

🍏 4 Cores / 4 Threads

➡ 3300 MHz Base

⏩ 3900 MHz Turbo

📝 6 MB L3 Cache

🔥 65 W

⌚ September 2015

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-i5-6… #affiliatelink

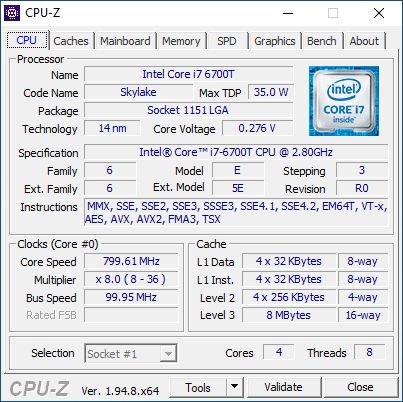

#CPUOverload 72

💻 Intel Core i7-6700T

🔎 Skylake

💰 $303

🍏 4 Cores / 8 Threads

➡ 2800 MHz Base

⏩ 3600 MHz Turbo

📝 8 MB L3 Cache

🔥 35 W

⌚ September 2015

📊 anandtech.com/bench/product/…

💻 Intel Core i7-6700T

🔎 Skylake

💰 $303

🍏 4 Cores / 8 Threads

➡ 2800 MHz Base

⏩ 3600 MHz Turbo

📝 8 MB L3 Cache

🔥 35 W

⌚ September 2015

📊 anandtech.com/bench/product/…

#CPUOverload 73

💻 Intel Core i5-6600T

🔎 Skylake

💰 $213

🍏 4 Cores / 4 Threads

➡ 2700 MHz Base

⏩ 3500 MHz Turbo

📝 6 MB L3 Cache

🔥 35 W

⌚ September 2015

📊 anandtech.com/bench/product/…

💻 Intel Core i5-6600T

🔎 Skylake

💰 $213

🍏 4 Cores / 4 Threads

➡ 2700 MHz Base

⏩ 3500 MHz Turbo

📝 6 MB L3 Cache

🔥 35 W

⌚ September 2015

📊 anandtech.com/bench/product/…

#CPUOverload 74

💻 Intel Xeon E3-1271 v3

🔎 Haswell

💰 $339

🍏 4 Cores / 8 Threads

➡ 3600 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 82 W

⌚ May 2014

📊 anandtech.com/bench/product/…

💻 Intel Xeon E3-1271 v3

🔎 Haswell

💰 $339

🍏 4 Cores / 8 Threads

➡ 3600 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 82 W

⌚ May 2014

📊 anandtech.com/bench/product/…

#CPUOverload 75

💻 Intel Core i7-4790

🔎 Haswell

💰 $312

🍏 4 Cores / 8 Threads

➡ 3600 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 84 W

⌚ May 2014

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-i747… #affiliatelink

💻 Intel Core i7-4790

🔎 Haswell

💰 $312

🍏 4 Cores / 8 Threads

➡ 3600 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 84 W

⌚ May 2014

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-i747… #affiliatelink

#CPUOverload 76

💻 Intel Celeron G1850

🔎 Haswell

💰 $52

🍏 2 Cores / 2 Threads

➡ 2900 MHz Base

⏩ No Turbo

📝 2 MB L3 Cache

🔥 53 W

⌚ May 2014

📊 anandtech.com/bench/product/…

💻 Intel Celeron G1850

🔎 Haswell

💰 $52

🍏 2 Cores / 2 Threads

➡ 2900 MHz Base

⏩ No Turbo

📝 2 MB L3 Cache

🔥 53 W

⌚ May 2014

📊 anandtech.com/bench/product/…

#CPUOverload 77

💻 AMD Ryzen 3 3100

🔎 Zen 2 Matisse

💰 $99

🍏 4 Cores / 8 Threads

➡ 3600 MHz Base

⏩ 3900 MHz Turbo

📝 16 MB L3 Cache

🔥 65 W

⌚ May 2020

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-R331… #affiliatelink

💻 AMD Ryzen 3 3100

🔎 Zen 2 Matisse

💰 $99

🍏 4 Cores / 8 Threads

➡ 3600 MHz Base

⏩ 3900 MHz Turbo

📝 16 MB L3 Cache

🔥 65 W

⌚ May 2020

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-R331… #affiliatelink

#CPUOverload 78

💻 Intel Core i5-6500

🔎 Skylake

💰 $192 / $202

🍏 4 Cores / 4 Threads

➡ 3200 MHz Base

⏩ 3600 MHz Turbo

📝 6 MB L3 Cache

🔥 65 W

⌚ September 2015

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-i565… #affiliatelink

💻 Intel Core i5-6500

🔎 Skylake

💰 $192 / $202

🍏 4 Cores / 4 Threads

➡ 3200 MHz Base

⏩ 3600 MHz Turbo

📝 6 MB L3 Cache

🔥 65 W

⌚ September 2015

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-i565… #affiliatelink

#CPUOverload 79

💻 Intel Pentium G3240

🔎 Haswell

💰 $64

🍏 2 Cores / 2 Threads

➡ 3100 MHz Base

⏩ No Turbo

📝 3 MB L3 Cache

🔥 53W

⌚ May 2014

📊 anandtech.com/bench/product/…

💻 Intel Pentium G3240

🔎 Haswell

💰 $64

🍏 2 Cores / 2 Threads

➡ 3100 MHz Base

⏩ No Turbo

📝 3 MB L3 Cache

🔥 53W

⌚ May 2014

📊 anandtech.com/bench/product/…

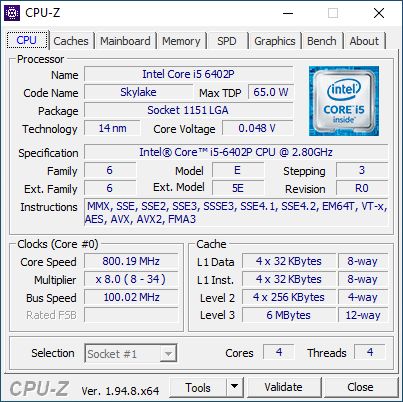

#CPUOverload 80

💻 Intel Core i5-6402P

🔎 Skylake

💰 $182

🍏 4 Cores / 4 Threads

➡ 2800 MHz Base

⏩ 3400 MHz Turbo

📝 6 MB L3 Cache

🔥 65 W

⌚ December 2015

📊 anandtech.com/bench/product/…

💻 Intel Core i5-6402P

🔎 Skylake

💰 $182

🍏 4 Cores / 4 Threads

➡ 2800 MHz Base

⏩ 3400 MHz Turbo

📝 6 MB L3 Cache

🔥 65 W

⌚ December 2015

📊 anandtech.com/bench/product/…

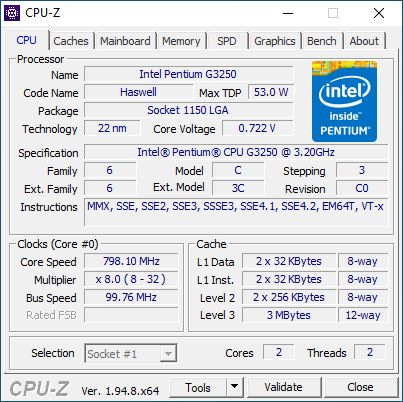

#CPUOverload 81

💻 Intel Pentium G3250

🔎 Haswell

💰 $64

🍏 2 Cores / 2 Threads

➡ 3200 MHz Base

⏩ No Turbo

📝 3 MB L3 Cache

🔥 53 W

⌚ July 2014

📊 anandtech.com/bench/product/…

💻 Intel Pentium G3250

🔎 Haswell

💰 $64

🍏 2 Cores / 2 Threads

➡ 3200 MHz Base

⏩ No Turbo

📝 3 MB L3 Cache

🔥 53 W

⌚ July 2014

📊 anandtech.com/bench/product/…

#CPUOverload 82

💻 Intel Core i5-6500T

🔎 Skylake

💰 $192

🍏 4 Cores / 4 Threads

➡ 2500 MHz Base

⏩ 3100 MHz Turbo

📝 6 MB L3 Cache

🔥 35 W

⌚ September 2015

📊 anandtech.com/bench/product/…

💻 Intel Core i5-6500T

🔎 Skylake

💰 $192

🍏 4 Cores / 4 Threads

➡ 2500 MHz Base

⏩ 3100 MHz Turbo

📝 6 MB L3 Cache

🔥 35 W

⌚ September 2015

📊 anandtech.com/bench/product/…

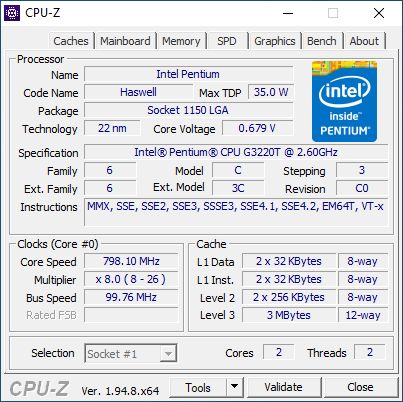

#CPUOverload 83

💻 Intel Pentium G3220T

🔎 Haswell

💰 $64

🍏 2 Cores / 2 Threads

➡ 2600 MHz Base

⏩ No Turbo

📝 3 MB L3 Cache

🔥 35 W

⌚ September 2013

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-Leno… #affiliatelink

💻 Intel Pentium G3220T

🔎 Haswell

💰 $64

🍏 2 Cores / 2 Threads

➡ 2600 MHz Base

⏩ No Turbo

📝 3 MB L3 Cache

🔥 35 W

⌚ September 2013

📊 anandtech.com/bench/product/…

💰 geni.us/Bench2021-Leno… #affiliatelink

#CPUOverload 84

💻 Intel Xeon E3-1281 v3

🔎 Haswell

💰 $612

🍏 4 Cores / 8 Threads

➡ 3700 MHz Base

⏩ 4100 MHz Base

📝 8 MB L3 Cache

🔥 82 W

⌚ May 2014

📊 anandtech.com/bench/product/…

💻 Intel Xeon E3-1281 v3

🔎 Haswell

💰 $612

🍏 4 Cores / 8 Threads

➡ 3700 MHz Base

⏩ 4100 MHz Base

📝 8 MB L3 Cache

🔥 82 W

⌚ May 2014

📊 anandtech.com/bench/product/…

#CPUOverload 85

💻 Intel Pentium G3470

🔎 Haswell

💰 $86

🍏 2 Cores / 2 Threads

➡ 3600 MHz Base

⏩ No Turbo

📝 3 MB L3 Cache

🔥 53 W

⌚ March 2015

📊 anandtech.com/bench/product/…

💻 Intel Pentium G3470

🔎 Haswell

💰 $86

🍏 2 Cores / 2 Threads

➡ 3600 MHz Base

⏩ No Turbo

📝 3 MB L3 Cache

🔥 53 W

⌚ March 2015

📊 anandtech.com/bench/product/…

#CPUOverload 86

💻 Intel Core i3-6300T

🔎 Skylake

💰 $138 / $147

🍏 2 Cores / 4 Threads

➡ 3300 MHz Base

⏩ No Turbo

📝 4 MB L3 Cache

🔥 35 W

⌚ September 2015

📊 anandtech.com/bench/product/…

💻 Intel Core i3-6300T

🔎 Skylake

💰 $138 / $147

🍏 2 Cores / 4 Threads

➡ 3300 MHz Base

⏩ No Turbo

📝 4 MB L3 Cache

🔥 35 W

⌚ September 2015

📊 anandtech.com/bench/product/…

#CPUOverload 87

💻 Intel Xeon E3-1276 v3

🔎 Haswell

💰 $339 / $350

🍏 4 Cores / 8 Threads

➡ 3600 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 84 W

⌚ May 2014

📊 anandtech.com/bench/product/…

💻 Intel Xeon E3-1276 v3

🔎 Haswell

💰 $339 / $350

🍏 4 Cores / 8 Threads

➡ 3600 MHz Base

⏩ 4000 MHz Turbo

📝 8 MB L3 Cache

🔥 84 W

⌚ May 2014

📊 anandtech.com/bench/product/…

#CPUOverload 88

💻 AMD FireFlight

🔎 Zen + 24 CU Vega

💰 Discontinued

🍏 4 Cores / 8 Threads

➡ 3000 MHz Base

⏩ No Turbo

📝 4 MB L3 Cache

🔥 100 W ?

⌚ August 2018

💻 Subor Z+ Console

📊 anandtech.com/bench/product/…

💻 AMD FireFlight

🔎 Zen + 24 CU Vega

💰 Discontinued

🍏 4 Cores / 8 Threads

➡ 3000 MHz Base

⏩ No Turbo

📝 4 MB L3 Cache

🔥 100 W ?

⌚ August 2018

💻 Subor Z+ Console

📊 anandtech.com/bench/product/…

#CPUOverload 89

💻 AMD Ryzen 5 5600X

🔎 Zen 3, Vermeer

💰 $299 SEP

🍏 6 Cores / 12 Threads

➡ 3700 MHz Base

⏩ 4600 MHz Boost

📝 32 MB L3 Cache

🔥 65 W

⌚ November 2020

📊 anandtech.com/bench/product/…

💰 geni.us/5600X #affiliatelink

💻 AMD Ryzen 5 5600X

🔎 Zen 3, Vermeer

💰 $299 SEP

🍏 6 Cores / 12 Threads

➡ 3700 MHz Base

⏩ 4600 MHz Boost

📝 32 MB L3 Cache

🔥 65 W

⌚ November 2020

📊 anandtech.com/bench/product/…

💰 geni.us/5600X #affiliatelink

#CPUOverload 90

💻 AMD Ryzen 7 5800X

🔎 Zen 3, Vermeer

💰 $449 SEP

🍏 8 Cores / 12 Threads

➡ 3800 MHz Base

⏩ 4700 MHz Turbo

📝 32 MB L3 Cache

🔥 105 W

⌚ November 2020

📊 anandtech.com/bench/product/…

💰 geni.us/5800X #affiliatelink

💻 AMD Ryzen 7 5800X

🔎 Zen 3, Vermeer

💰 $449 SEP

🍏 8 Cores / 12 Threads

➡ 3800 MHz Base

⏩ 4700 MHz Turbo

📝 32 MB L3 Cache

🔥 105 W

⌚ November 2020

📊 anandtech.com/bench/product/…

💰 geni.us/5800X #affiliatelink

#CPUOverload 91

💻 AMD Ryzen 9 5900X

🔎 Zen 3, Vermeer

💰 $549 SEP

🍏 12 Cores / 24 Threads

➡ 3700 MHz Base

⏩ 4800 MHz Boost

📝 64 MB L3 Cache

🔥 105 W

⌚ November 2020

📊 anandtech.com/bench/product/…

💰 geni.us/5900X #affiliatelink

💻 AMD Ryzen 9 5900X

🔎 Zen 3, Vermeer

💰 $549 SEP

🍏 12 Cores / 24 Threads

➡ 3700 MHz Base

⏩ 4800 MHz Boost

📝 64 MB L3 Cache

🔥 105 W

⌚ November 2020

📊 anandtech.com/bench/product/…

💰 geni.us/5900X #affiliatelink

#CPUOverload 92

💻 AMD Ryzen 9 5950X

🔎 Zen 3, Vermeer

💰 $799 SEP

🍏 16 Cores / 32 Threads

➡ 3400 MHz Base

⏩ 4900 MHz Boost

📝 64 MB L3 Cache

🔥 105 W

⌚ November 2020

📊 anandtech.com/bench/product/…

💰 geni.us/5950X #affiliatelink

💻 AMD Ryzen 9 5950X

🔎 Zen 3, Vermeer

💰 $799 SEP

🍏 16 Cores / 32 Threads

➡ 3400 MHz Base

⏩ 4900 MHz Boost

📝 64 MB L3 Cache

🔥 105 W

⌚ November 2020

📊 anandtech.com/bench/product/…

💰 geni.us/5950X #affiliatelink

#CPUOverload 93

💻 AMD Threadripper Pro 3995WX

🔎 Zen 2, Castle Peak

💰 $5490

🍏 64 Cores / 128 Threads

➡ 2700 MHz Base

⏩ 4200 MHz Boost

📝 256 MB L3 Cache

🔥 280 W

⌚ July 2020

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-3995WX #affiliatelink

💻 AMD Threadripper Pro 3995WX

🔎 Zen 2, Castle Peak

💰 $5490

🍏 64 Cores / 128 Threads

➡ 2700 MHz Base

⏩ 4200 MHz Boost

📝 256 MB L3 Cache

🔥 280 W

⌚ July 2020

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-3995WX #affiliatelink

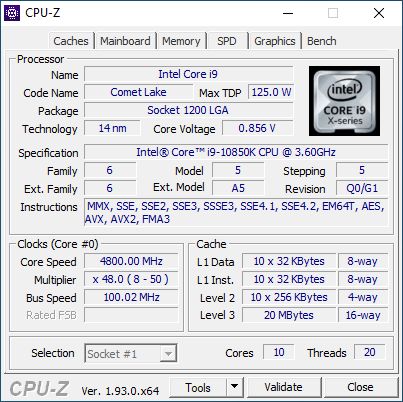

#CPUOverload 94

💻 Intel Core i9-10850K

🔎 Comet Lake

💰 $464

🍏 10 Cores / 20 Threads

➡ 3600 MHz Base

⏩ 5100 MHz Boost

📝 20 MB L3 Cache

🔥 125 W

⌚ July 2020

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i9-10850K #affiliatelink

💻 Intel Core i9-10850K

🔎 Comet Lake

💰 $464

🍏 10 Cores / 20 Threads

➡ 3600 MHz Base

⏩ 5100 MHz Boost

📝 20 MB L3 Cache

🔥 125 W

⌚ July 2020

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i9-10850K #affiliatelink

#CPUOverload 95

💻 Intel Core i7-10700

🔎 Comet Lake

💰 $335

🍏 8 Cores / 16 Threads

➡ 2900 MHz Base

⏩ 4800 MHz Boost

📝 16 MB L3 Cache

🔥 65 W

⌚ April 2020

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i7-10700 #affiliatelink

💻 Intel Core i7-10700

🔎 Comet Lake

💰 $335

🍏 8 Cores / 16 Threads

➡ 2900 MHz Base

⏩ 4800 MHz Boost

📝 16 MB L3 Cache

🔥 65 W

⌚ April 2020

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i7-10700 #affiliatelink

#CPUOverload 96

💻 Intel Core i7-8700K

🔎 Coffee Lake

💰 $359 / $370

🍏 6 Cores / 12 Threads

➡ 3700 MHz Base

⏩ 4700 MHz Turbo

📝 12 MB L3 Cache

🔥 95 W

⌚ September 2017

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i78700K #affiliatelink

💻 Intel Core i7-8700K

🔎 Coffee Lake

💰 $359 / $370

🍏 6 Cores / 12 Threads

➡ 3700 MHz Base

⏩ 4700 MHz Turbo

📝 12 MB L3 Cache

🔥 95 W

⌚ September 2017

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i78700K #affiliatelink

#CPUOverload 97

💻 Intel Core i7-9700K

🔎 Coffee Lake Refresh

💰 $374

🍏 8 Cores / 8 Threads

➡ 3600 MHz Base

⏩ 4900 MHz Turbo

📝 12 MB L3 Cache

🔥 95 W

⌚ October 2018

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i79700K #affiliatelink

💻 Intel Core i7-9700K

🔎 Coffee Lake Refresh

💰 $374

🍏 8 Cores / 8 Threads

➡ 3600 MHz Base

⏩ 4900 MHz Turbo

📝 12 MB L3 Cache

🔥 95 W

⌚ October 2018

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i79700K #affiliatelink

#CPUOverload 98

💻 Intel Core i9-9900K

🔎 Coffee Lake Refresh

💰 $488 / $499

🍏 8 Cores / 16 Threads

➡ 3600 MHz Base

⏩ 5000 MHz Thubo

📝 16 MB L3 Cache

🔥 95 W

⌚ October 2018

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i99900K #affiliatelink

💻 Intel Core i9-9900K

🔎 Coffee Lake Refresh

💰 $488 / $499

🍏 8 Cores / 16 Threads

➡ 3600 MHz Base

⏩ 5000 MHz Thubo

📝 16 MB L3 Cache

🔥 95 W

⌚ October 2018

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i99900K #affiliatelink

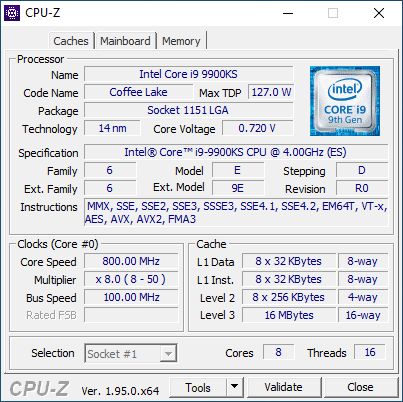

#CPUOverload 99

💻 Intel Core i9-9900KS

🔎 Coffee Lake Refresh

💰 $513

🍏 8 Cores / 16 Threads

➡ 4000 MHz Base

⏩ 5000 MHz Turbo

📝 16 MB L3 Cache

🔥 127 W

⌚ October 2019

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i99900KS #affiliatelink

💻 Intel Core i9-9900KS

🔎 Coffee Lake Refresh

💰 $513

🍏 8 Cores / 16 Threads

➡ 4000 MHz Base

⏩ 5000 MHz Turbo

📝 16 MB L3 Cache

🔥 127 W

⌚ October 2019

📊 anandtech.com/bench/product/…

💰 geni.us/Bench-i99900KS #affiliatelink

• • •

Missing some Tweet in this thread? You can try to

force a refresh