1/ The US–China trade war thrust the semiconductor industry back into the geopolitical spotlight. But this time was different.

My latest

piie.com/publications/w…

My latest

piie.com/publications/w…

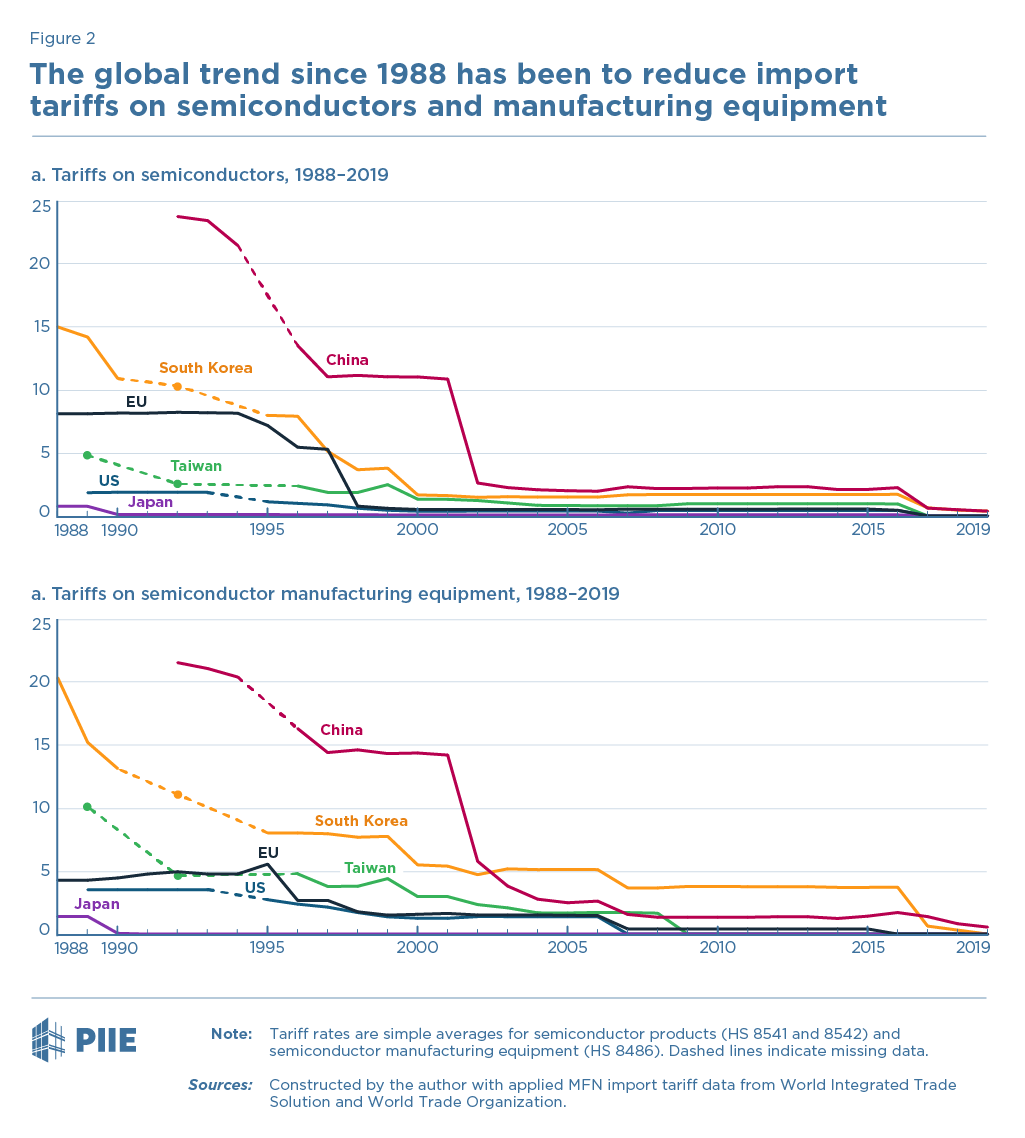

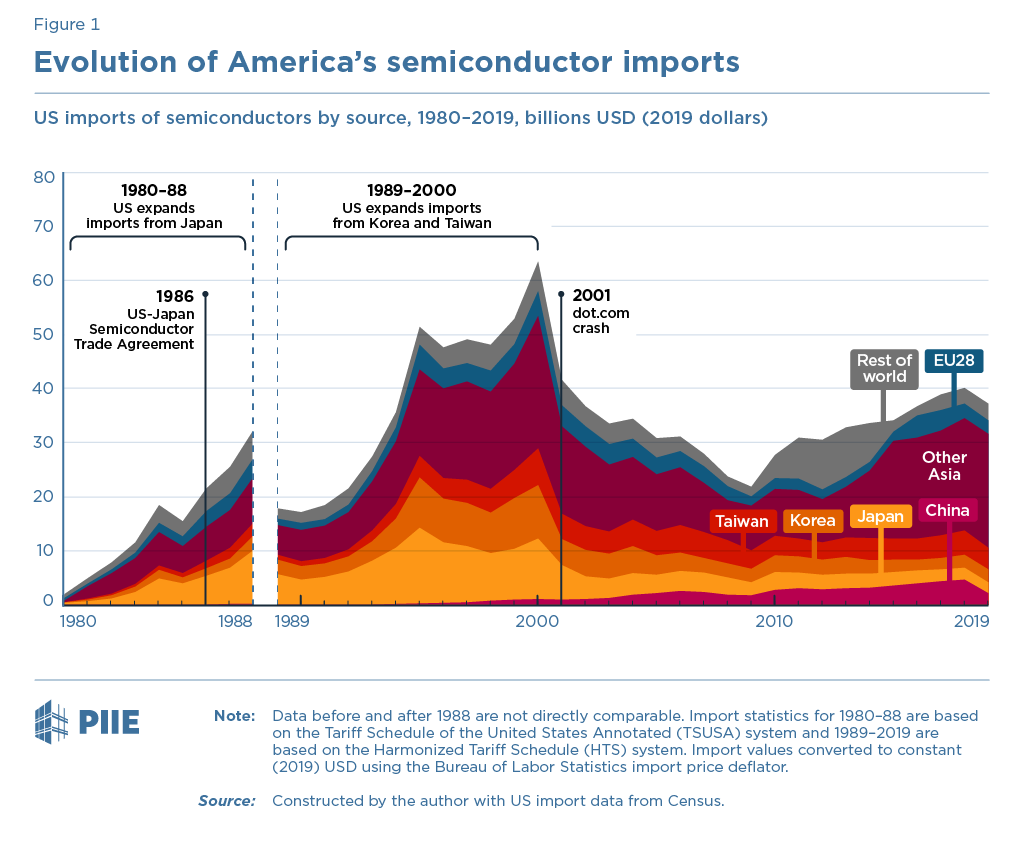

2/ The 1980s began a period in which semiconductors were central to major trade conflicts. First Japan and a Section 301 investigation.

Japan agreed to “purchase commitments” and export restraints. The US even imposed retaliatory tariffs.

Sounds similar to today…or does it?

Japan agreed to “purchase commitments” and export restraints. The US even imposed retaliatory tariffs.

Sounds similar to today…or does it?

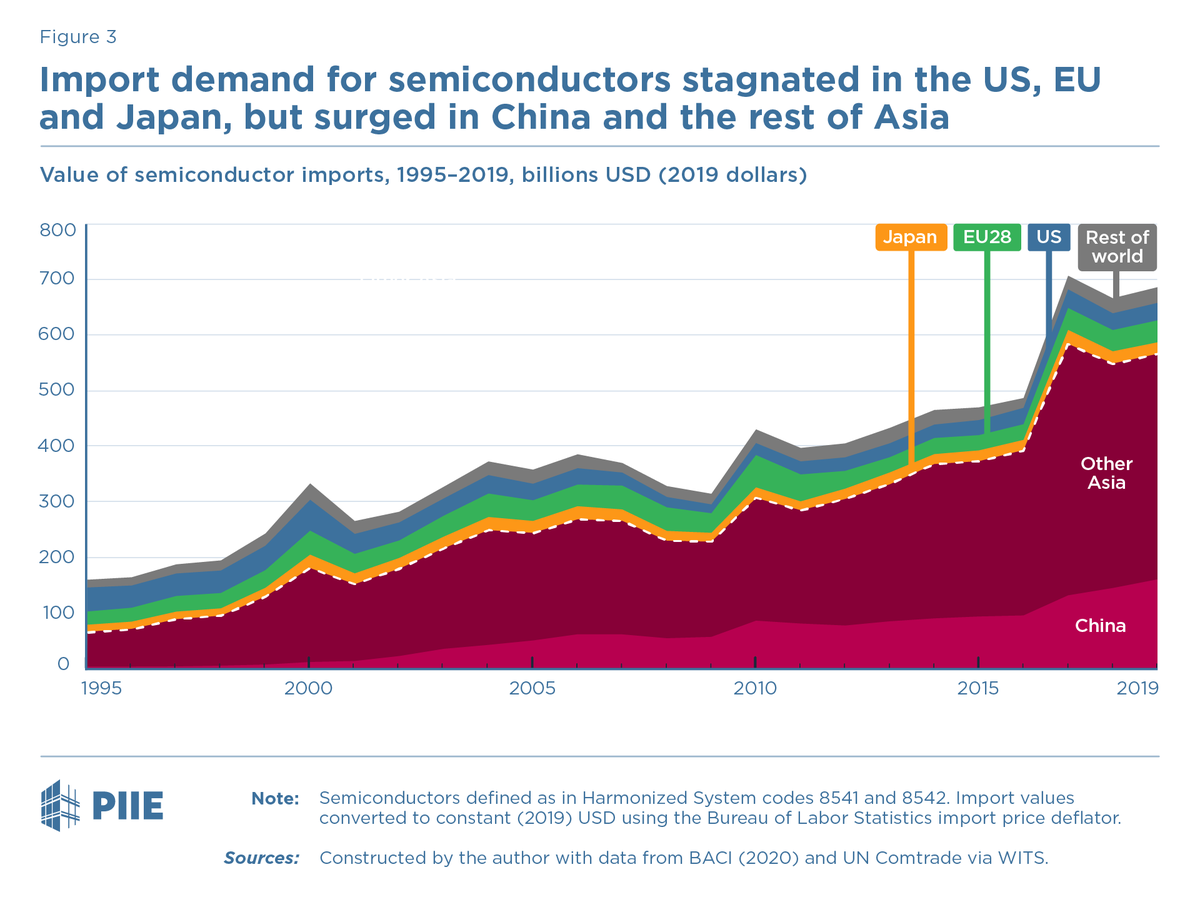

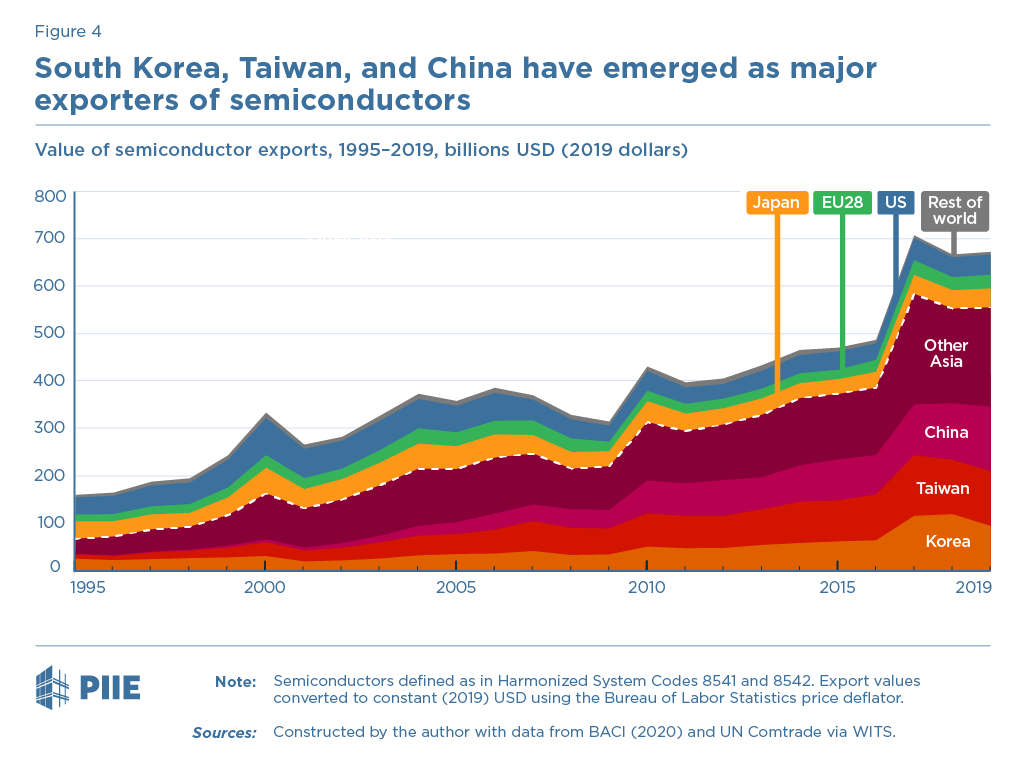

4/ Over time, import demand for semiconductors surged in China especially.

It stagnated in the United States, EU and even Japan - the source of the 1980s conflict...

It stagnated in the United States, EU and even Japan - the source of the 1980s conflict...

5/ Companies in South Korea and Taiwan emerged as MAJOR exporters of semiconductors. This led to some conflicts with the United States in the 1990s and early 2000s.

But temperatures cooled, and the trade conflicts subsided for a while...

But temperatures cooled, and the trade conflicts subsided for a while...

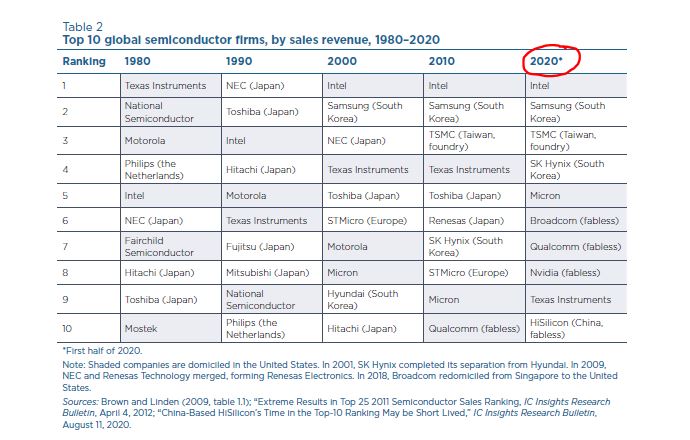

6/ And in 2020, American semiconductor companies continued to play a major (MAJOR!) role. Even though they were often not exporting finished semiconductors from the United States.

It was often NOT through foreign direct investment either…

It was often NOT through foreign direct investment either…

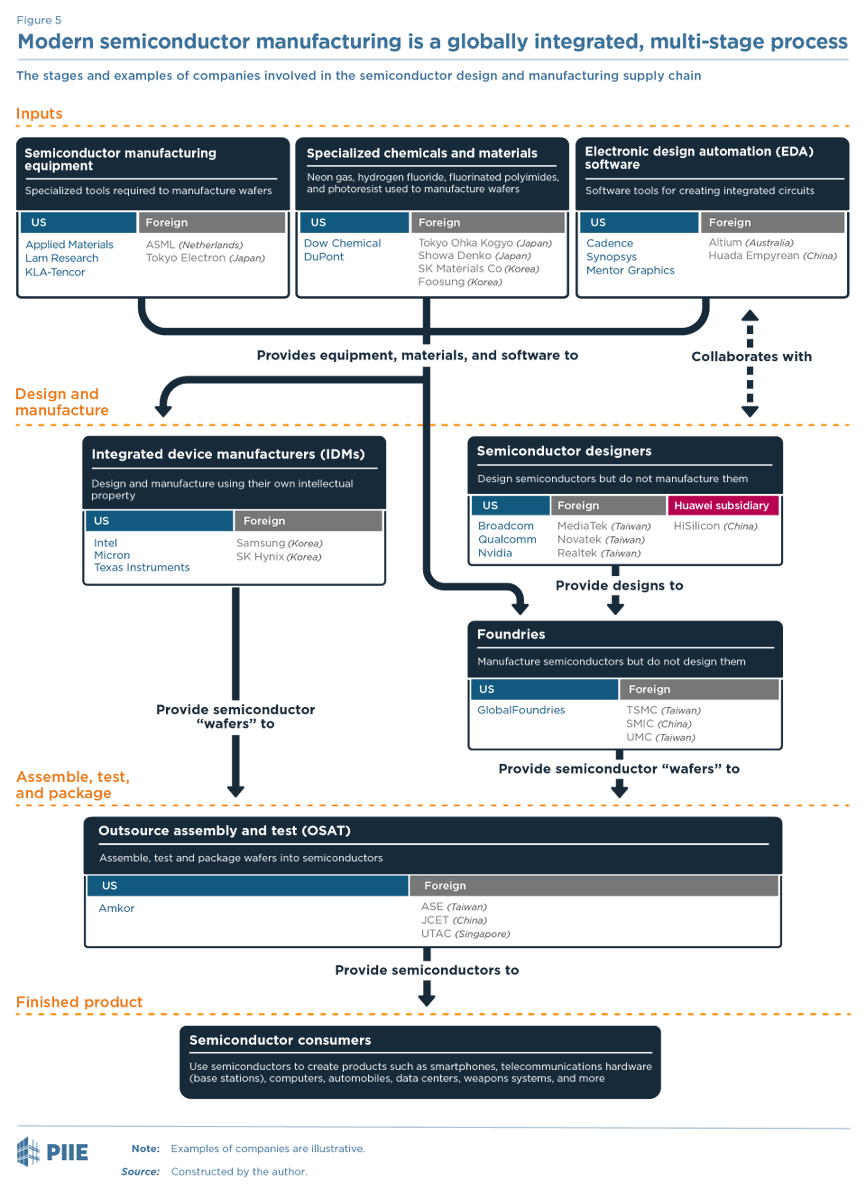

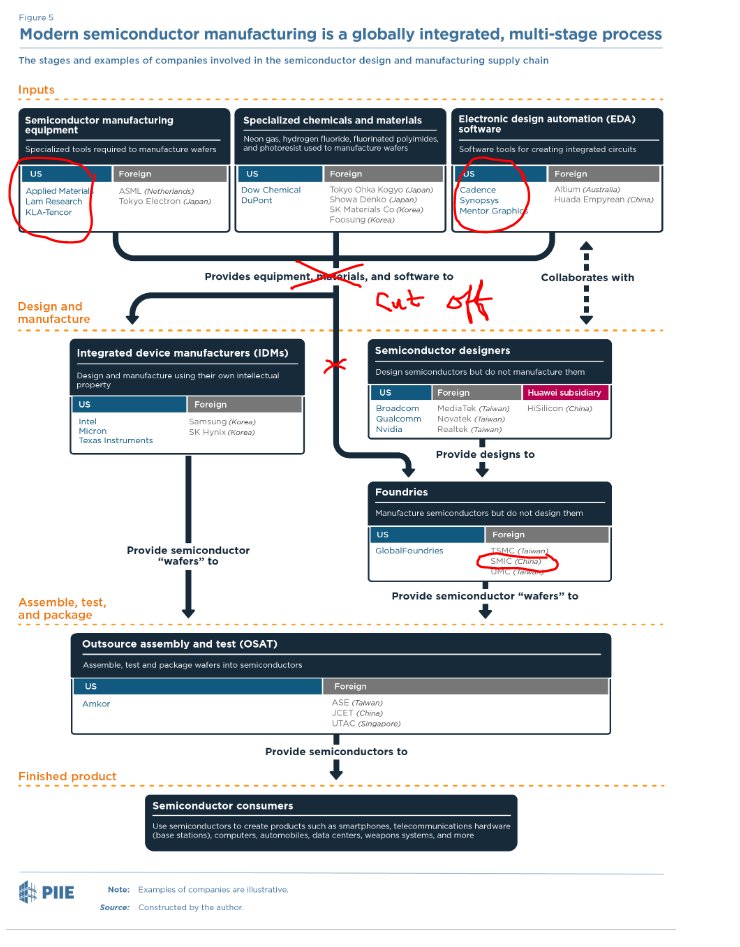

7/ HOW American companies led was often due to the newish "fabless-foundry" business model.

US semiconductor designers come up with the idea and hold the intellectual property, but they contract out the physical manufacturing of the chips to a fab like TSMC in Taiwan...

US semiconductor designers come up with the idea and hold the intellectual property, but they contract out the physical manufacturing of the chips to a fab like TSMC in Taiwan...

8/ OK, back to policy. Today's US-China Trade War!!!

2018: US tariffs on semiconductors under Section 301

2019: US export controls on semiconductors targeting Huawei…

But those didn't work, because Huawei could just buy semiconductors from Taiwan or S Korea instead...

2018: US tariffs on semiconductors under Section 301

2019: US export controls on semiconductors targeting Huawei…

But those didn't work, because Huawei could just buy semiconductors from Taiwan or S Korea instead...

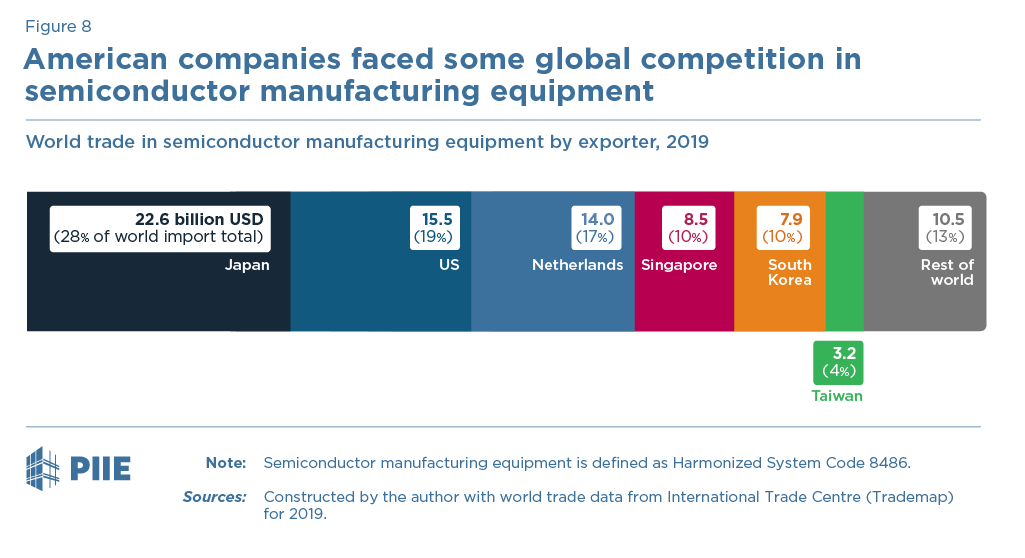

9/ US-China Trade War (cont)

2020: US export controls round II. Now on semiconductor equipment targeting suppliers in Taiwan or S Korea that might sell to Huawei.

But that made US equipment suppliers worried they would someday find themselves "designed out" to competitors...

2020: US export controls round II. Now on semiconductor equipment targeting suppliers in Taiwan or S Korea that might sell to Huawei.

But that made US equipment suppliers worried they would someday find themselves "designed out" to competitors...

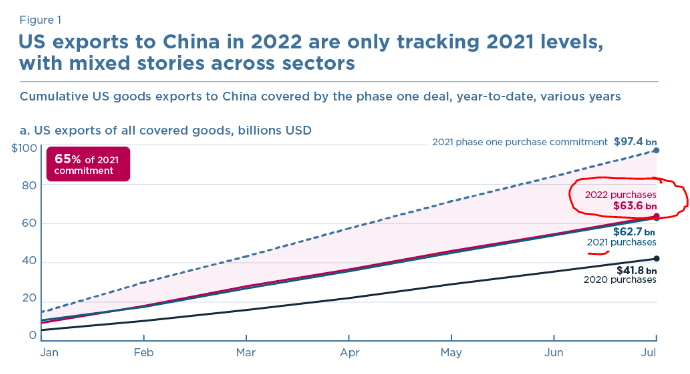

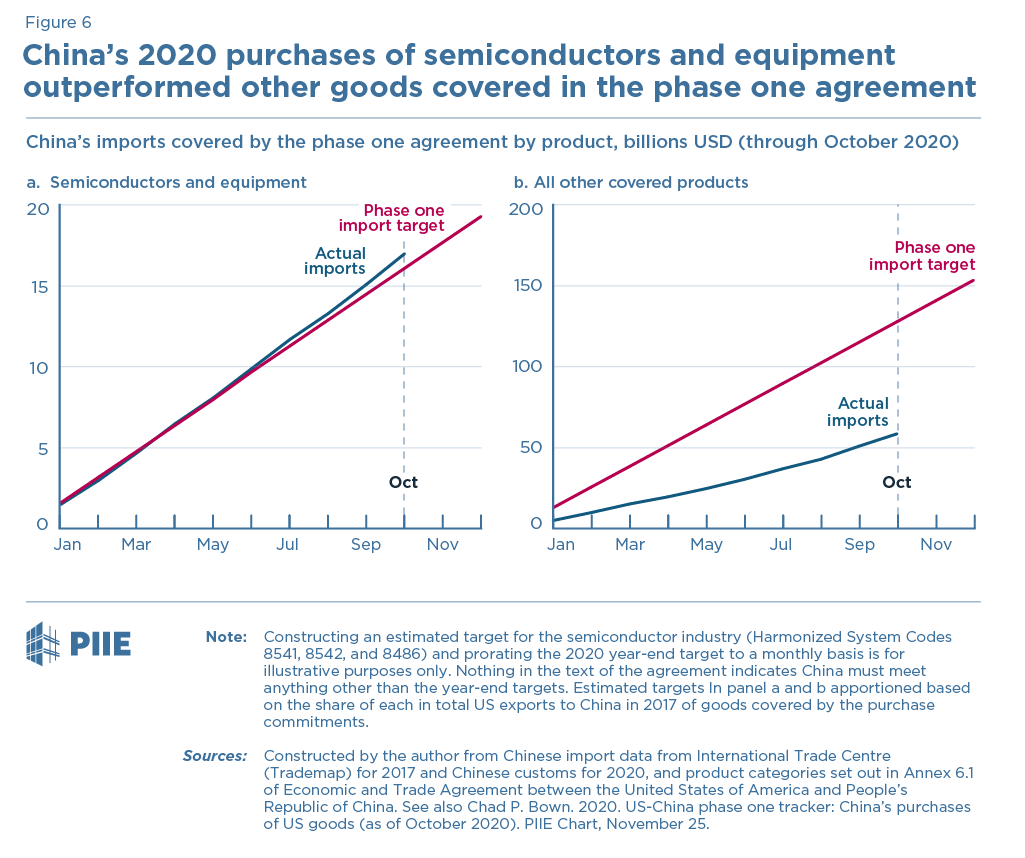

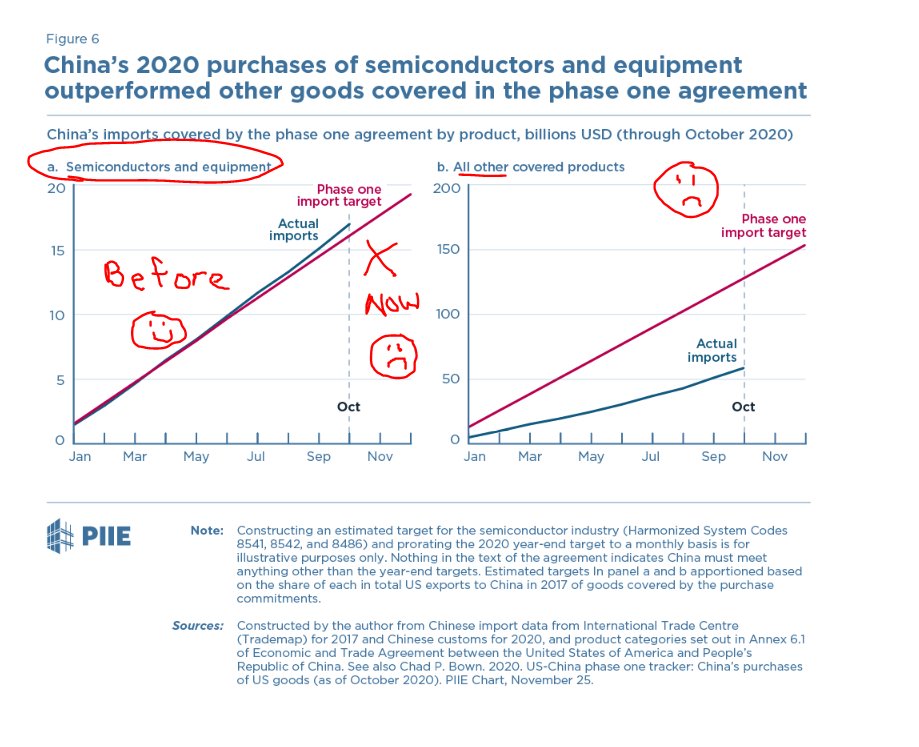

10/ But for now - through Oct 2020 - China has been hoarding imports of semiconductors & tools. One of the few sectors keeping pace with Trump’s Phase One agreement targets.

(But purchase commitments AND export bans on the same product are clearly NOT sustainable US policy...)

(But purchase commitments AND export bans on the same product are clearly NOT sustainable US policy...)

11/ Making sense of the modern US-China conflict requires explaining the industry’s starting point, the US–Japan fracas of the 1980s, as well as how the sector and policy evolved over the intervening period.

My latest tries to do just that. ENDS /

piie.com/publications/w…

My latest tries to do just that. ENDS /

piie.com/publications/w…

Also, this may be one of THE BEST papers about the political economy of trade policy ever (EVER!) written. I re-read it for my project, and got lost in its glorious detail for 2 days...

@D_A_Irwin. 1996. “Trade Policies and the Semiconductor Industry” 👉🏾nber.org/books-and-chap…

@D_A_Irwin. 1996. “Trade Policies and the Semiconductor Industry” 👉🏾nber.org/books-and-chap…

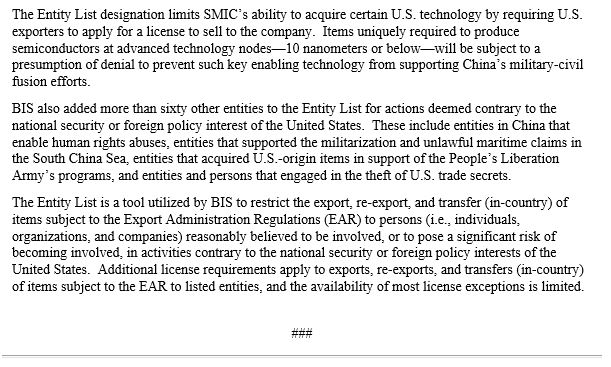

UPDATE:

On Friday, Trump announces addition of SMIC – a massive Chinese manufacturer of semiconductors – to “Entity List.”

This means US semiconductor equipment & software companies can no longer send SMIC exports without a license.

This is BIG.

On Friday, Trump announces addition of SMIC – a massive Chinese manufacturer of semiconductors – to “Entity List.”

This means US semiconductor equipment & software companies can no longer send SMIC exports without a license.

This is BIG.

China is a major manufacturer of semiconductors. American companies sell it A LOT of equipment (and software), so steps to CUT it OFF from receiving INPUTS have big implications.

Trump administration cutting off US exports of semiconductor equipment to SMIC makes it HARDER to reach the purchase commitment targets in the US-China Phase One agreement...

• • •

Missing some Tweet in this thread? You can try to

force a refresh