1/

Get a cup of coffee.

In this thread, let's talk snowballs.

Snowballs are super fun! And they can teach us so much about life, about things that grow over time, their rates of growth, compounding, etc.

Get a cup of coffee.

In this thread, let's talk snowballs.

Snowballs are super fun! And they can teach us so much about life, about things that grow over time, their rates of growth, compounding, etc.

2/

Snowballs are often used as a metaphor for compounding.

A snowball starts small at the top of a hill. As it rolls downhill, it picks up speed and grows in size. This is like money compounding over time.

For example, here's Buffett's famous "snowball quote":

Snowballs are often used as a metaphor for compounding.

A snowball starts small at the top of a hill. As it rolls downhill, it picks up speed and grows in size. This is like money compounding over time.

For example, here's Buffett's famous "snowball quote":

3/

There's even a famous book about Buffett with "snowball" in the title.

The book's theme is similar to the quote above: the process of compounding is like a snowball that grows over time as it rolls downhill.

Link: amazon.com/Snowball-Warre…

There's even a famous book about Buffett with "snowball" in the title.

The book's theme is similar to the quote above: the process of compounding is like a snowball that grows over time as it rolls downhill.

Link: amazon.com/Snowball-Warre…

4/

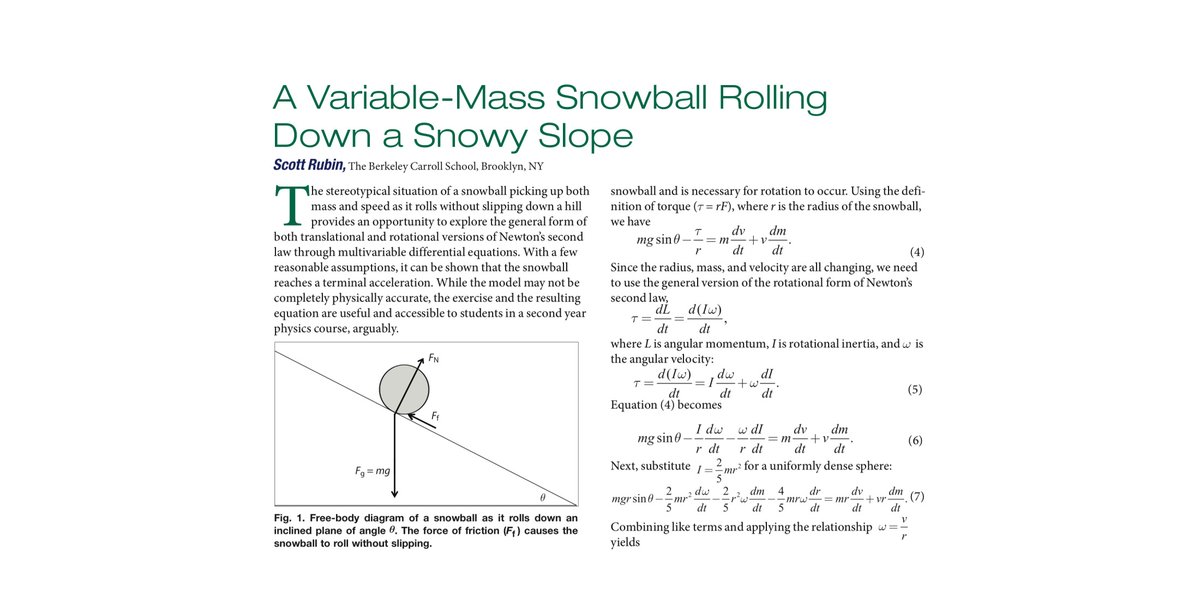

Clearly, snowballs rolling downhill are worthy objects of study.

So let's dive into their physics!

Luckily for us, in 2019, Scott Rubin published a paper analyzing such snowballs -- in a journal called "The Physics Teacher".

All we need to do is understand this paper.

Clearly, snowballs rolling downhill are worthy objects of study.

So let's dive into their physics!

Luckily for us, in 2019, Scott Rubin published a paper analyzing such snowballs -- in a journal called "The Physics Teacher".

All we need to do is understand this paper.

5/

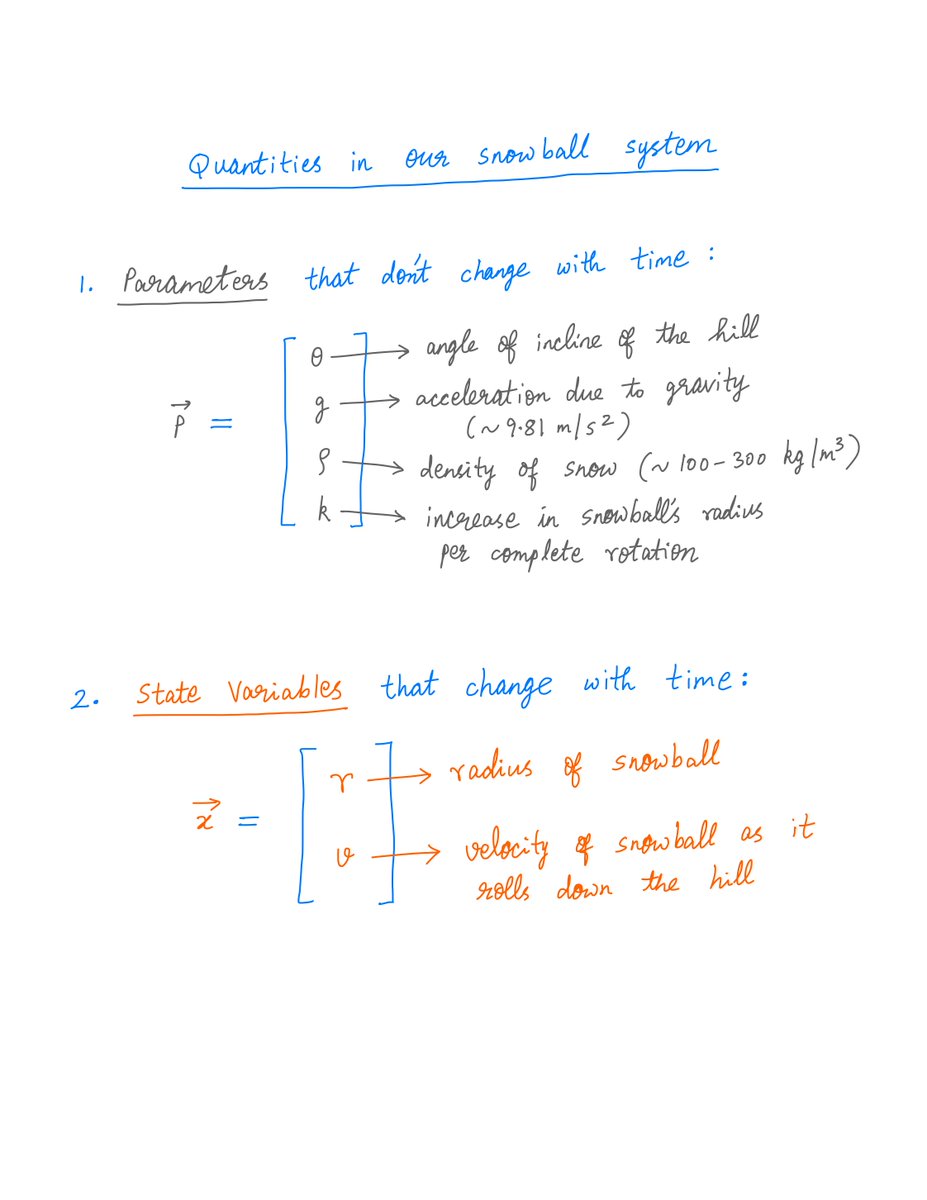

We begin by identifying 2 kinds of quantities in our "snowball system":

1. "Parameters" that don't change with time (eg, the hill's angle of incline), and

2. "State Variables" that *do* change with time (eg, the snowball's radius and velocity).

We begin by identifying 2 kinds of quantities in our "snowball system":

1. "Parameters" that don't change with time (eg, the hill's angle of incline), and

2. "State Variables" that *do* change with time (eg, the snowball's radius and velocity).

6/

We then derive other useful quantities from our parameters and state variables.

Such "derived" quantities include our snowball's mass, its moment of inertia, angular momentum, etc.

This all follows from basic math and physics (eg, the formula for the volume of a sphere).

We then derive other useful quantities from our parameters and state variables.

Such "derived" quantities include our snowball's mass, its moment of inertia, angular momentum, etc.

This all follows from basic math and physics (eg, the formula for the volume of a sphere).

7/

Then we write the "laws of motion" for our snowball.

These are based on various physics principles -- like how a system behaves when subject to torque, Newton's second law, how our snowball accumulates snow as it rolls, etc.

Note: this requires some knowledge of calculus.

Then we write the "laws of motion" for our snowball.

These are based on various physics principles -- like how a system behaves when subject to torque, Newton's second law, how our snowball accumulates snow as it rolls, etc.

Note: this requires some knowledge of calculus.

8/

Finally, we tie everything together by creating a system of "differential equations".

These equations describe how our snowball's radius and velocity evolve over time -- as it rolls downhill.

Finally, we tie everything together by creating a system of "differential equations".

These equations describe how our snowball's radius and velocity evolve over time -- as it rolls downhill.

9/

The beauty of our differential equations is:

Given our snowball's state (ie, its radius and velocity) at any *one* time, our differential equations allow us to predict its state at any *future* time.

The beauty of our differential equations is:

Given our snowball's state (ie, its radius and velocity) at any *one* time, our differential equations allow us to predict its state at any *future* time.

10/

All we need to know is the snowball's initial radius -- when it's at the top of the hill and just starting to roll down.

Just from this, we can calculate our snowball's entire trajectory -- its radius, mass, velocity, momentum, etc., at *every* point on its journey.

All we need to know is the snowball's initial radius -- when it's at the top of the hill and just starting to roll down.

Just from this, we can calculate our snowball's entire trajectory -- its radius, mass, velocity, momentum, etc., at *every* point on its journey.

11/

How exactly do we calculate all this?

Well, there are standard algorithms to simulate differential equations on a computer.

And our snowball's differential equations are fairly simple. So it's not hard to write a program that simulates a snowball rolling downhill.

How exactly do we calculate all this?

Well, there are standard algorithms to simulate differential equations on a computer.

And our snowball's differential equations are fairly simple. So it's not hard to write a program that simulates a snowball rolling downhill.

12/

In fact, I've written such a program.

That's how I created the snowball GIF at the top of this thread -- by simulating the differential equations describing our snowball.

Here are some sample plots produced by this program:

In fact, I've written such a program.

That's how I created the snowball GIF at the top of this thread -- by simulating the differential equations describing our snowball.

Here are some sample plots produced by this program:

13/

The key thing to note here is that the snowball's acceleration -- ie, the rate at which its speed increases -- seems to level off with time:

The key thing to note here is that the snowball's acceleration -- ie, the rate at which its speed increases -- seems to level off with time:

14/

The paper above by Scott Rubin demonstrates that this must hold true for all snowballs obeying our differential equations: their accelerations must eventually go flat.

And that's a problem -- because it contradicts our nice "snowballs = compounding" metaphor.

The paper above by Scott Rubin demonstrates that this must hold true for all snowballs obeying our differential equations: their accelerations must eventually go flat.

And that's a problem -- because it contradicts our nice "snowballs = compounding" metaphor.

15/

Why?

Because, if acceleration flatlines, it means our snowball's *velocity* eventually grows only *linearly* with time.

Which means *radius* also grows only linearly.

And that means our snowball's mass and volume grow only cubically with time. *NOT* exponentially!

Why?

Because, if acceleration flatlines, it means our snowball's *velocity* eventually grows only *linearly* with time.

Which means *radius* also grows only linearly.

And that means our snowball's mass and volume grow only cubically with time. *NOT* exponentially!

16/

When we think of *compounding*, we think of our money growing *exponentially* with time.

Whereas the amount of snow in our snowball grows *far* more slowly -- only *polynomially* with time.

Over time, exponential growth *always* beats polynomial growth. Hands down.

When we think of *compounding*, we think of our money growing *exponentially* with time.

Whereas the amount of snow in our snowball grows *far* more slowly -- only *polynomially* with time.

Over time, exponential growth *always* beats polynomial growth. Hands down.

17/

So here's the sad truth:

Snowballs rolling downhill grow over time (in radius, mass, volume, and speed).

But they don't *compound*.

Compounding requires *exponential* growth. Snowballs only exhibit *polynomial* growth, which is much slower.

So here's the sad truth:

Snowballs rolling downhill grow over time (in radius, mass, volume, and speed).

But they don't *compound*.

Compounding requires *exponential* growth. Snowballs only exhibit *polynomial* growth, which is much slower.

18/

Therefore, my humble request to the FinTwit community:

Please stop using snowballs as a metaphor for compounding.

Buffett was clearly straying outside his circle of competence when he used this metaphor.

Therefore, my humble request to the FinTwit community:

Please stop using snowballs as a metaphor for compounding.

Buffett was clearly straying outside his circle of competence when he used this metaphor.

19/

To learn more about differential equations -- like the snowball system we analyzed above -- I highly recommend the work of Prof. Strogatz (@stevenstrogatz).

His book, Infinite Powers, brings to life the magic of calculus and differential equations. amazon.com/Infinite-Power…

To learn more about differential equations -- like the snowball system we analyzed above -- I highly recommend the work of Prof. Strogatz (@stevenstrogatz).

His book, Infinite Powers, brings to life the magic of calculus and differential equations. amazon.com/Infinite-Power…

20/

If you're somewhat more mathematically inclined, Prof. Strogatz has another gem of a book for you: Non-Linear Dynamics and Chaos. amazon.com/Nonlinear-Dyna…

If you're somewhat more mathematically inclined, Prof. Strogatz has another gem of a book for you: Non-Linear Dynamics and Chaos. amazon.com/Nonlinear-Dyna…

21/

I also want to give a shout out to Grant Sanderson (@3blue1brown). I used Grant's Manim library to animate the snowball in the first tweet of this thread.

Grant makes beautiful videos explaining math concepts -- like exponential growth and pandemics:

I also want to give a shout out to Grant Sanderson (@3blue1brown). I used Grant's Manim library to animate the snowball in the first tweet of this thread.

Grant makes beautiful videos explaining math concepts -- like exponential growth and pandemics:

22/

If you're still with me, I cannot thank you enough!

I started writing these long form Twitter threads in April this year. It's been an amazing journey -- and I've been completely blown away by your kindness and encouragement.

Take care. Stay safe. See you in 2021!

/End

If you're still with me, I cannot thank you enough!

I started writing these long form Twitter threads in April this year. It's been an amazing journey -- and I've been completely blown away by your kindness and encouragement.

Take care. Stay safe. See you in 2021!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh