2021 PF Thread:

Nice to have a positive start, up 2.91% weekly/YTD. 16 up, 9 down

⭐️ #BRWM #IPX #MRCH #QTX #RCH #SPSY

🐶 None >5%

Exited #III for a 64% gain to buy two shiny new things (positions still under construction). I also top sliced some #RCH

RNS #IPX #RCH 👇

Nice to have a positive start, up 2.91% weekly/YTD. 16 up, 9 down

⭐️ #BRWM #IPX #MRCH #QTX #RCH #SPSY

🐶 None >5%

Exited #III for a 64% gain to buy two shiny new things (positions still under construction). I also top sliced some #RCH

RNS #IPX #RCH 👇

#IPX First quarter AuM up by 20% to £24bn. The shares are highly rated but the tailwind of ESG and scalability of their funds puts them in a sweet spot.

#RCH An ahead of expectations TU. Great news but it's a crowded trade and I top sliced around 20% of my holding

#RCH An ahead of expectations TU. Great news but it's a crowded trade and I top sliced around 20% of my holding

A weak Friday leaves the PF down 1.1% weekly and +1.77% YTD. 8 up, 15 down, 2 unch

⭐️ EKF, FNX

🐶 BRWM, FDM, GAW, JIM, RCH

Exit: QTX

New: CEY, FNX, UPGS

RNS: QTX, GAMA, GAW, EKF, AAZ, POLR - comments 👇

⭐️ EKF, FNX

🐶 BRWM, FDM, GAW, JIM, RCH

Exit: QTX

New: CEY, FNX, UPGS

RNS: QTX, GAMA, GAW, EKF, AAZ, POLR - comments 👇

#QTX In line but reduced forward guidance - maybe that's just conservative but on a high valuation, I prefer to watch from the side for now.

#GAMA Slightly ahead and raised guidance ✅

#GAW Outstanding interims 🙌

#EKF Materially ahead, raised guidance 🙌

More 👇

#GAMA Slightly ahead and raised guidance ✅

#GAW Outstanding interims 🙌

#EKF Materially ahead, raised guidance 🙌

More 👇

#AAZ $100m revenues and ~$39m cash plus 3 restored CAs, one of which is larger than Gedabek 👀

#POLR +55% AuM, largely performance related ✅

New holdings. I rarely buy recent IPOs but FNX could be a high quality compounder 🤞 CEY and UPGS are both value plays. Good w/e all 🍷

#POLR +55% AuM, largely performance related ✅

New holdings. I rarely buy recent IPOs but FNX could be a high quality compounder 🤞 CEY and UPGS are both value plays. Good w/e all 🍷

PF up 7.53% weekly (+9.44% YTD). 13 up, 12 down

⭐️ AAZ, KETL

🐶 IGG, UPGS

No trades. AAZ did the heaving lifting by re-announcing last weeks' news but with some mouth watering numbers. News from KETL, SPT, CEY, EMIS was ✅ but IGG acq ❌

Thought for the week 👇 Now🍷🍷

⭐️ AAZ, KETL

🐶 IGG, UPGS

No trades. AAZ did the heaving lifting by re-announcing last weeks' news but with some mouth watering numbers. News from KETL, SPT, CEY, EMIS was ✅ but IGG acq ❌

Thought for the week 👇 Now🍷🍷

Just to keep the thread up to date, I have made a small portfolio adjustment today, exiting IGG (I just can’t get comfortable with the new direction of travel) and replacing it with SLP in which I am a bit late to the party, perhaps 🤷🏻♂️ Q2 update this week I believe 🤞

This week’s market moves have prompted me into a little more trading than anticipated. I have exited UPGS & CEY both approaching my SL on initial purchases (as was SLP where I opted to average down). Also, topped up BRWM, FNX, GAW, KETL, SPT and (cough) AAZ 😜

PF down 3.83% weekly (+5.25% YTD). 2 up, 22 down, 2 unch

⭐️ None >5%

🐶 AVST, BRWM, EKF, HFEL, IPX, SPT, SLP

Exit: IGG, UPGS, CEY

New: SLP

Adds: SPT, AAZ, BRWM, GAW, FNX, KETL

RNS: KETL, FDM, FNX, SLP - all ✅

On weeks like this, it is good to remember 👇

Now 🍷 & ⚽️🍒

⭐️ None >5%

🐶 AVST, BRWM, EKF, HFEL, IPX, SPT, SLP

Exit: IGG, UPGS, CEY

New: SLP

Adds: SPT, AAZ, BRWM, GAW, FNX, KETL

RNS: KETL, FDM, FNX, SLP - all ✅

On weeks like this, it is good to remember 👇

Now 🍷 & ⚽️🍒

PF up 2.75% weekly (+8.14% YTD). 19 up, 3 down, 2 unch

⭐️ AVST, RCH, JIM, KETL

🐶 None >5%

A quiet week with news from SMS (slightly ahead) and SPSY (project acceleration) being the only interruptions to a blissfully dull week

Enjoy your w/e folks 🍷

⭐️ AVST, RCH, JIM, KETL

🐶 None >5%

A quiet week with news from SMS (slightly ahead) and SPSY (project acceleration) being the only interruptions to a blissfully dull week

Enjoy your w/e folks 🍷

PF down 0.2% weekly (+7.92% YTD). 14 up, 6 down, 4 unch

⭐️ FNX, RCH, SPT, SLP

🐶 AAZ

AAZ the main drag on what was otherwise a positive week with no meaningful RNS announcements among PF holdings, no trades and no divis 💤

Enjoy your w/e folks 🍷

⭐️ FNX, RCH, SPT, SLP

🐶 AAZ

AAZ the main drag on what was otherwise a positive week with no meaningful RNS announcements among PF holdings, no trades and no divis 💤

Enjoy your w/e folks 🍷

PF down 1.3% weekly (+6.52% YTD). 6 up, 16 down, 2 unch

⭐️ BRWM

🐶 EKF, GAW, SMS, SPSY, SPT

No trades and no significant news 💤

Enjoy your w/e folks 🍷

⭐️ BRWM

🐶 EKF, GAW, SMS, SPSY, SPT

No trades and no significant news 💤

Enjoy your w/e folks 🍷

PF down 1.7% weekly (+4.71% YTD). 6 up, 16 down, 2 unch

⭐️ None >5%

🐶 IPX, VFEM

Exit: HINT, FDM

New: BERI, FXPO

Sliced: BRWM

Add: VFEM, AAZ

RNS: Interims from FNX & SLP both ✅

Divis: HFEL, SUPR, HINT, FDM

A choppy week! Enjoy your w/e folks 🍷

⭐️ None >5%

🐶 IPX, VFEM

Exit: HINT, FDM

New: BERI, FXPO

Sliced: BRWM

Add: VFEM, AAZ

RNS: Interims from FNX & SLP both ✅

Divis: HFEL, SUPR, HINT, FDM

A choppy week! Enjoy your w/e folks 🍷

PF down 3.1% weekly (+1.47% YTD). 12 up, 8 down, 2 unch

⭐️ SMS

🐶 AAZ

Exit: AVST, RCH

Add: AAZ, VFEM, EMIS, FNX, FXPO, GAMA, SPT

RNS: AAZ, RCH, SUPR, AVST, GAMA, SMS, BRWM, SPT

Mr Market reminding me who's boss and pointing out the flaw in my strategy 😤

Enjoy your w/e folks🍷

⭐️ SMS

🐶 AAZ

Exit: AVST, RCH

Add: AAZ, VFEM, EMIS, FNX, FXPO, GAMA, SPT

RNS: AAZ, RCH, SUPR, AVST, GAMA, SMS, BRWM, SPT

Mr Market reminding me who's boss and pointing out the flaw in my strategy 😤

Enjoy your w/e folks🍷

PF up 4.03% weekly (+5.5% YTD). 17 up, 3 down, 2 unch

⭐️ AAZ, FXPO, JIM

🐶 None >5%

No trades. Excellent FY results from JIM and SPT along with a special dividend from AAZ.

Enjoy your w/e folks 🍷

⭐️ AAZ, FXPO, JIM

🐶 None >5%

No trades. Excellent FY results from JIM and SPT along with a special dividend from AAZ.

Enjoy your w/e folks 🍷

PF up 2.73% weekly (+8.43% YTD). 13 up, 6 down, 3 unch

⭐️ AAZ, FXPO, FNX

🐶 EKF

Top sliced some BRWM & SLP to top up FXPO, SMS, FNX

Dividends this week from MRCH & JIM

RNS: Excellent FY results from SMS, FXPO & EMIS along with a brief TU from GAW

Enjoy your w/e folks 🍷

⭐️ AAZ, FXPO, FNX

🐶 EKF

Top sliced some BRWM & SLP to top up FXPO, SMS, FNX

Dividends this week from MRCH & JIM

RNS: Excellent FY results from SMS, FXPO & EMIS along with a brief TU from GAW

Enjoy your w/e folks 🍷

PF down 0.78% weekly (+7.58% YTD). 10 up, 11 down, 1 unch

⭐️ EKF, GAMA, SPSY

🐶 SLP

Exited FXPO in favour of new holding RIO plus small top ups of VFEM and AAZ

Divi: FNX

RNS: Solid FY results/outlook from SPSY, GAMA, KETL ✅

Enjoy your w/e folks 🍷

⭐️ EKF, GAMA, SPSY

🐶 SLP

Exited FXPO in favour of new holding RIO plus small top ups of VFEM and AAZ

Divi: FNX

RNS: Solid FY results/outlook from SPSY, GAMA, KETL ✅

Enjoy your w/e folks 🍷

PF down 0.35% weekly (+7.21% YTD). 13 up, 6 down, 3 unch

⭐️ EKF, IPX

🐶 JIM

Trades: Exited BERI in favour of new holding EDIN and top sliced a few EKF

RNS: Encouraging interims from BVXP✅ and outstanding FY results/outlook from EKF 🙌

Enjoy your long w/e folks 🍷

⭐️ EKF, IPX

🐶 JIM

Trades: Exited BERI in favour of new holding EDIN and top sliced a few EKF

RNS: Encouraging interims from BVXP✅ and outstanding FY results/outlook from EKF 🙌

Enjoy your long w/e folks 🍷

PF up 2.8% weekly (+10.21% YTD & ATH). 19 up, 1 down, 2 unch

⭐️ BRWM, GAMA, IPX, JIM, KETL, SLP

🐶 None >5%

Trades: None

Divi: VFEM, SLP

RNS: Excellent progress from IPX with AuM now £30bn 🙌

Enjoy your w/e folks🍷

ICYMI: My Q1 PF review 👇shareknowledge.blog/2021/04/05/the…

⭐️ BRWM, GAMA, IPX, JIM, KETL, SLP

🐶 None >5%

Trades: None

Divi: VFEM, SLP

RNS: Excellent progress from IPX with AuM now £30bn 🙌

Enjoy your w/e folks🍷

ICYMI: My Q1 PF review 👇shareknowledge.blog/2021/04/05/the…

PF down 0.6% weekly (+9.55% YTD). 14 up, 6 down, 2 unch

⭐️ IPX, JIM, RIO

🐶 AAZ

No Trades or Divis

RNS: A disappointing Q1 update from AAZ (somewhat expected) and decent AuM progress from POLR

Enjoy your w/e folks 🍷

⭐️ IPX, JIM, RIO

🐶 AAZ

No Trades or Divis

RNS: A disappointing Q1 update from AAZ (somewhat expected) and decent AuM progress from POLR

Enjoy your w/e folks 🍷

PF up 1.83% weekly (+11.56% YTD). 14 up, 8 down

⭐️ AAZ, SPT

🐶 None >5%

Trades: None

Divi: BERI (no longer held) & BVXP

RNS: RIO✅ AAZ✅ SPSY✅ HFEL✅

Enjoy your w/e folks 🍷

⭐️ AAZ, SPT

🐶 None >5%

Trades: None

Divi: BERI (no longer held) & BVXP

RNS: RIO✅ AAZ✅ SPSY✅ HFEL✅

Enjoy your w/e folks 🍷

PF down 1.02% weekly (+10.41% YTD). 8 up, 13 down, 1 unch

⭐️ FNX, IPX

🐶 EKF, SPSY

Trades: None

Divi: SMS, SPT, GAW

RNS: Updates from SPT (Q1)✅ and SLP (Q3)✅ were the only interruptions to my observation of paint drying 💤

Enjoy your w/e folks 🍷

⭐️ FNX, IPX

🐶 EKF, SPSY

Trades: None

Divi: SMS, SPT, GAW

RNS: Updates from SPT (Q1)✅ and SLP (Q3)✅ were the only interruptions to my observation of paint drying 💤

Enjoy your w/e folks 🍷

PF up 1.45% weekly (+12.01% YTD & ATH). 14 up, 8 down

⭐️ AAZ, BRWM, RIO, SLP

🐶 JIM

Trades: None

Divi: BRWM

RNS: Nothing significant 💤

Enjoy your w/e folks 🍷

⭐️ AAZ, BRWM, RIO, SLP

🐶 JIM

Trades: None

Divi: BRWM

RNS: Nothing significant 💤

Enjoy your w/e folks 🍷

PF down 0.74% weekly (+11.19% YTD). 8 up, 12 down, 2 unch

⭐️ None >5%

🐶 EKF, RIO

Trades: Exited VFEM in favour of new holding EAT plus top-ups to EDIN & JIM

Divi: EMIS

RNS: A 16% Q increase in dividend for JIM was the highlight of another quiet week

Enjoy your w/e folks 🍷

⭐️ None >5%

🐶 EKF, RIO

Trades: Exited VFEM in favour of new holding EAT plus top-ups to EDIN & JIM

Divi: EMIS

RNS: A 16% Q increase in dividend for JIM was the highlight of another quiet week

Enjoy your w/e folks 🍷

PF up 3.42% weekly (+14.99% YTD & ATH). 11 up, 8 down, 3 unch

⭐️ AAZ, EKF, GAMA

🐶 FNX, JIM, SLP

Trades: Exited RIO in favour of POLY (commodity switch). Top sliced SLP to top up EAT, SPT, FNX

Divi: MRCH, SUPR

RNS: EKF, AAZ, GAW, SMS, GAMA - all ✅

Enjoy your w/e folks 🍷

⭐️ AAZ, EKF, GAMA

🐶 FNX, JIM, SLP

Trades: Exited RIO in favour of POLY (commodity switch). Top sliced SLP to top up EAT, SPT, FNX

Divi: MRCH, SUPR

RNS: EKF, AAZ, GAW, SMS, GAMA - all ✅

Enjoy your w/e folks 🍷

PF up 0.84% weekly (+15.95% YTD). 12 up, 10 down, 2 unch

⭐️ IPX

🐶 FNX

Reduced: BRWM

Add: JIM

Exit: SLP

New: AEWU, RECI, PGH

Divi: EDIN, HFEL

RNS: TU from KETL✅ Interims from IPX🙌 & FY results from EDIN✅

Enjoy your BH w/e folks 🍷☀️😎

⭐️ IPX

🐶 FNX

Reduced: BRWM

Add: JIM

Exit: SLP

New: AEWU, RECI, PGH

Divi: EDIN, HFEL

RNS: TU from KETL✅ Interims from IPX🙌 & FY results from EDIN✅

Enjoy your BH w/e folks 🍷☀️😎

PF down 1.37% weekly (+14.37% YTD). 14 up, 9 down, 1 unch

⭐️ JIM

🐶 AAZ, FNX

Trades: Top sliced a few JIM to top up FNX & PGH

Divi: KETL

RNS: None 💤

Enjoy your w/e folks 🍷☀️😎

⭐️ JIM

🐶 AAZ, FNX

Trades: Top sliced a few JIM to top up FNX & PGH

Divi: KETL

RNS: None 💤

Enjoy your w/e folks 🍷☀️😎

PF up 0.37% weekly (+14.79% YTD). 11 up, 12 down, 1 unch

⭐️ FNX

🐶 EKF

Trades: None

Divi: JIM

RNS: None 💤

Enjoy your w/e folks ☀️⚽️🍻

⭐️ FNX

🐶 EKF

Trades: None

Divi: JIM

RNS: None 💤

Enjoy your w/e folks ☀️⚽️🍻

PF down 2.14% weekly (+12.34% YTD). 6 up, 18 down

⭐️ IPX

🐶 BRWM, JIM

No trades. No divis. No news 💤

Enjoy your w/e folks 🍷⚽️🏴

⭐️ IPX

🐶 BRWM, JIM

No trades. No divis. No news 💤

Enjoy your w/e folks 🍷⚽️🏴

PF down 0.31% weekly (+11.98% YTD). 15 up, 8 down, 1 unch

⭐️ None >5%

🐶 FNX

FY report from RECI ✅ plus divis from GAMA & BRWM were the only items troubling the scorers this week. No trades

Enjoy your w/e folks 🍷

⭐️ None >5%

🐶 FNX

FY report from RECI ✅ plus divis from GAMA & BRWM were the only items troubling the scorers this week. No trades

Enjoy your w/e folks 🍷

PF up 0.27% weekly (+12.28% YTD). 10 up, 9 down, 5 unch

⭐️ POLR

🐶 None >5%

Trades: None

Divi: SPSY

RNS: AAZ✅ POLR👏

ICYMI: I penned a Q2 portfolio review 👇 Enjoy your w/e folks 🍻⚽️🏴shareknowledge.blog/2021/07/01/cof…

⭐️ POLR

🐶 None >5%

Trades: None

Divi: SPSY

RNS: AAZ✅ POLR👏

ICYMI: I penned a Q2 portfolio review 👇 Enjoy your w/e folks 🍻⚽️🏴shareknowledge.blog/2021/07/01/cof…

PF down 0.4% weekly (+11.84% YTD). 12 up, 12 down

⭐️ and 🐶 No movements >5%

Trades: None

Divi: GAW

RNS: IPX and POLR increased AuM during the June quarter by 15% and 9%, respectively ✅

Enjoy your w/e folks 🍻⚽️🏴

⭐️ and 🐶 No movements >5%

Trades: None

Divi: GAW

RNS: IPX and POLR increased AuM during the June quarter by 15% and 9%, respectively ✅

Enjoy your w/e folks 🍻⚽️🏴

It has been a while (thankfully) since I had to engage my stop-loss-decide policy. Fonix Mobile (FNX) breached that level today and I decided to buy more - a risky game though! TU (full year) at the end of the month and they were ahead at the interims stage 🤞

PF down 0.79% weekly (+10.95% YTD). 9 up, 12 down, 3 unch

⭐️ GAMA, JIM

🐶 FNX, SPSY

Top sliced a few POLR to top up FNX

Divi: IPX

RNS: EMIS (slightly ahead)✅ GAMA (upper end)✅ AAZ (in line)✅ JIM (interims ahead and special divi of 8.5p announced today)🙌

Enjoy your w/e🍷

⭐️ GAMA, JIM

🐶 FNX, SPSY

Top sliced a few POLR to top up FNX

Divi: IPX

RNS: EMIS (slightly ahead)✅ GAMA (upper end)✅ AAZ (in line)✅ JIM (interims ahead and special divi of 8.5p announced today)🙌

Enjoy your w/e🍷

PF up 0.39% weekly (+11.38% YTD). 8 up, 14 down, 3 unch

⭐️ JIM

🐶 None >5%

Exit: POLY

Top slice: JIM

New: STB, EPIC

RNS: SPSY (Aeris update), EKF (in line with recently upgraded), FNX (comfortably in line), KETL (in line), PGH (recovering), STB (disposal)✅

Good w/e🍷

⭐️ JIM

🐶 None >5%

Exit: POLY

Top slice: JIM

New: STB, EPIC

RNS: SPSY (Aeris update), EKF (in line with recently upgraded), FNX (comfortably in line), KETL (in line), PGH (recovering), STB (disposal)✅

Good w/e🍷

PF up 3.44% weekly (+15.22% YTD). 17 up, 5 down, 3 unch

⭐️ AAZ, IPX, JIM, STB, KETL

🐶 None >5%

Trades: None

Divis: SMS, AAZ, EDIN, RECI, EAT, POLR - making July biggest payout month & now 60% of 2021 f/cast

RNS: GAW (FY results)🙌 SMS (in line TU)✅

Enjoy your w/e folks 🍷

⭐️ AAZ, IPX, JIM, STB, KETL

🐶 None >5%

Trades: None

Divis: SMS, AAZ, EDIN, RECI, EAT, POLR - making July biggest payout month & now 60% of 2021 f/cast

RNS: GAW (FY results)🙌 SMS (in line TU)✅

Enjoy your w/e folks 🍷

PF up 1.8% weekly (+17.29% YTD & ATH). 19 up, 4 down, 3 unch

⭐️ EKF, FNX, JIM, PGH, STB

🐶 None >5%

Top sliced IPX, KETL, SUPR for New holding REC and top ups to STB, RECI, GAMA

Divi: JIM

RNS: Interims from SPT✅ and STB🙌

Enjoy your w/e folks 🍷

⭐️ EKF, FNX, JIM, PGH, STB

🐶 None >5%

Top sliced IPX, KETL, SUPR for New holding REC and top ups to STB, RECI, GAMA

Divi: JIM

RNS: Interims from SPT✅ and STB🙌

Enjoy your w/e folks 🍷

PF up 1.35% weekly (+18.86% YTD). 13 up, 8 down, 5 unch

⭐️ EMIS, PGH, SPT

🐶 FNX, JIM

No trades. No Divis. No News.

Enjoy your w/e folks 🍷

⭐️ EMIS, PGH, SPT

🐶 FNX, JIM

No trades. No Divis. No News.

Enjoy your w/e folks 🍷

PF down 0.63% weekly (+18.12% YTD). 12 up, 15 down, 1 unch

⭐️ BVXP, REC, SPSY

🐶 BRWM, PGH

Trades: Exited HFEL. New starter positions in BMPG, VWRL and my first SPAC $CENH which should become $ARQQ early next month

Divi: MRCH, SUPR

RNS: AAZ (Zafar JORC) ✅

Enjoy your w/e 🍷

⭐️ BVXP, REC, SPSY

🐶 BRWM, PGH

Trades: Exited HFEL. New starter positions in BMPG, VWRL and my first SPAC $CENH which should become $ARQQ early next month

Divi: MRCH, SUPR

RNS: AAZ (Zafar JORC) ✅

Enjoy your w/e 🍷

PF down 0.63% weekly (+17.37% YTD). 17 up, 11 down, 2 unch

⭐️ None >5%

🐶 IPX

Exit: BRWM

New: APAX, IHR, SMIF

Divi: HFEL (no longer held)

RNS: AAZ (H1 Explo Report)✅ SMS (Contract Win & Battery Project Secured)✅ EPIC (Acquisition @ 10% yield)✅

Enjoy your BH w/e folks 🍷

⭐️ None >5%

🐶 IPX

Exit: BRWM

New: APAX, IHR, SMIF

Divi: HFEL (no longer held)

RNS: AAZ (H1 Explo Report)✅ SMS (Contract Win & Battery Project Secured)✅ EPIC (Acquisition @ 10% yield)✅

Enjoy your BH w/e folks 🍷

PF up 0.3% weekly (+17.72% YTD). 14 up, 12 down, 4 unch

⭐️ FNX

🐶 REC, STB, $CENH

No trades. No news. Divis from AEWU, EPIC

Enjoy your w/e folks 🍷

⭐️ FNX

🐶 REC, STB, $CENH

No trades. No news. Divis from AEWU, EPIC

Enjoy your w/e folks 🍷

PF down 0.07% weekly (+17.64% YTD). 11 up, 13 down, 6 unch

⭐️ APAX, SMS, SPSY

🐶 BVXP, EKF, GAMA, REC

No Trades

Divi: JIM, RECI

RNS: SPSY interims✅ GAMA interims✅ EMIS interims✅ $CENH became $ARQQ and ⬆️75% on debut week🙌

I leave you with a final s/shot from old Stocko 🍷

⭐️ APAX, SMS, SPSY

🐶 BVXP, EKF, GAMA, REC

No Trades

Divi: JIM, RECI

RNS: SPSY interims✅ GAMA interims✅ EMIS interims✅ $CENH became $ARQQ and ⬆️75% on debut week🙌

I leave you with a final s/shot from old Stocko 🍷

Some significant PF rebalancing this week.

Exit: SMS (valuation/conviction)

Reduced: AAZ by ~50% (reducing concentration risk)

Adds: $ARQQ, IHR, SMIF, VWRL, REC, RECI, EPIC, FNX, PGH, BMPG, AEWU, EAT, STB

New: HONY, ASTO, $SSSS

Will post updated PF graphic after market close

Exit: SMS (valuation/conviction)

Reduced: AAZ by ~50% (reducing concentration risk)

Adds: $ARQQ, IHR, SMIF, VWRL, REC, RECI, EPIC, FNX, PGH, BMPG, AEWU, EAT, STB

New: HONY, ASTO, $SSSS

Will post updated PF graphic after market close

PF down 0.89% weekly (+16.59% YTD). 12 up, 16 down, 4 unch

⭐️ EKF, PGH, REC, ARQQ

🐶 GAW, GAMA

Trades: See previous Tweet 👆

Divi: GAW, APAX, SPT

RNS: EKF Interims✅ GAW TU✅

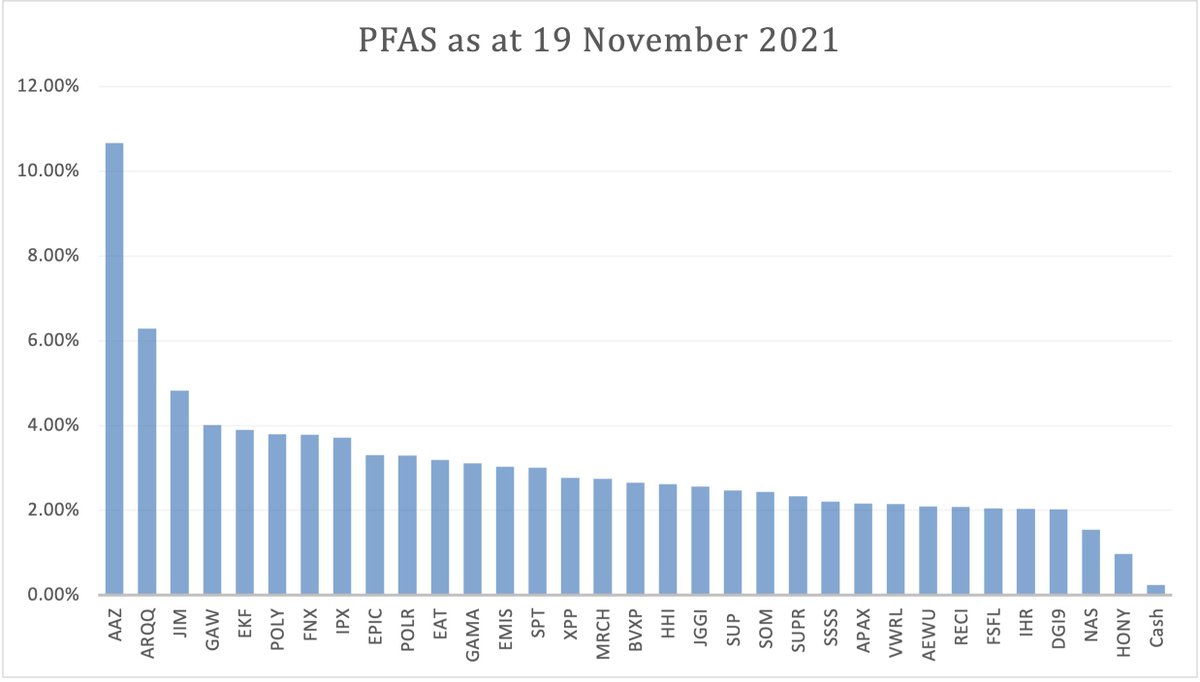

PF moving towards a more balanced profile👇 Enjoy your w/e folks🍷

⭐️ EKF, PGH, REC, ARQQ

🐶 GAW, GAMA

Trades: See previous Tweet 👆

Divi: GAW, APAX, SPT

RNS: EKF Interims✅ GAW TU✅

PF moving towards a more balanced profile👇 Enjoy your w/e folks🍷

PF down 0.23% weekly (+16.33% YTD). 6 up, 22 down, 4 unch

⭐️ $ARQQ

🐶 None >5%

RNS: PGH (interims)✅ KETL (interims)✅ SUPR (FY)✅ FNX (FY)✅ AAZ (interims)✅

Trades: 3 straight swaps (tweaking)

Exit: EDIN, BMPG, STB

New: HHI, JGGI, TATE

Have a great w/e folks🍷

⭐️ $ARQQ

🐶 None >5%

RNS: PGH (interims)✅ KETL (interims)✅ SUPR (FY)✅ FNX (FY)✅ AAZ (interims)✅

Trades: 3 straight swaps (tweaking)

Exit: EDIN, BMPG, STB

New: HHI, JGGI, TATE

Have a great w/e folks🍷

PF down 2.51% weekly (+13.41% YTD). 4 up, 18 down, 10 unch

⭐️ AAZ

🐶 GAW, IPX, POLR, SPSY, SPT, KETL, $ARQQ

Exited: PGH & TATE in favour of New: DGI9, FSFL

Divi: HONY, EPIC, SMIF, STB (no longer held)

RNS: EKF (Acquisition)✅ AAZ (New CAs)🙌

Enjoy your w/e folks🍷

⭐️ AAZ

🐶 GAW, IPX, POLR, SPSY, SPT, KETL, $ARQQ

Exited: PGH & TATE in favour of New: DGI9, FSFL

Divi: HONY, EPIC, SMIF, STB (no longer held)

RNS: EKF (Acquisition)✅ AAZ (New CAs)🙌

Enjoy your w/e folks🍷

PF down 1.9% weekly (+11.25% YTD). 8 up, 18 down, 6 unch

⭐️ FNX

🐶 AAZ, APAX, IPX, REC, KETL, ARQQ

Top sliced FNX, KETL and topped up EPIC, VWRL, REC (tweaking only)

Divi: VWRL, KETL

RNS: IPX (AuM up 84% FY)✅

ICYMI: my Q3 PF review👇 shareknowledge.blog/2021/10/05/new…

⭐️ FNX

🐶 AAZ, APAX, IPX, REC, KETL, ARQQ

Top sliced FNX, KETL and topped up EPIC, VWRL, REC (tweaking only)

Divi: VWRL, KETL

RNS: IPX (AuM up 84% FY)✅

ICYMI: my Q3 PF review👇 shareknowledge.blog/2021/10/05/new…

PF up 0.43% weekly (+11.73% YTD). 21 up, 4 down, 7 unch

⭐️ GAW, IPX, POLR, SPT, KETL

🐶 ARQQ

Exited REC in favour of new holding POLY. Top sliced a few AAZ & FNX and topped up POLR & ARQQ

RNS: SPSY (ahead)✅ AAZ (in line)✅ POLR (ahead)✅

Enjoy your w/e folks🍷

⭐️ GAW, IPX, POLR, SPT, KETL

🐶 ARQQ

Exited REC in favour of new holding POLY. Top sliced a few AAZ & FNX and topped up POLR & ARQQ

RNS: SPSY (ahead)✅ AAZ (in line)✅ POLR (ahead)✅

Enjoy your w/e folks🍷

PF up 1.04% weekly (+12.89% YTD). 16 up, 11 down, 5 unch

⭐️ AAZ, POLY, ARQQ

🐶 BVXP

Exited: KETL

New: XPP

Top Slice: HONY

Top Up: AAZ, POLY, VWRL

Divi: GAMA

RNS: BVXP (slight miss), POLY (new mine opening ahead of schedule), JGGI merging with SCIN

Enjoy your w/e folks 🍷

⭐️ AAZ, POLY, ARQQ

🐶 BVXP

Exited: KETL

New: XPP

Top Slice: HONY

Top Up: AAZ, POLY, VWRL

Divi: GAMA

RNS: BVXP (slight miss), POLY (new mine opening ahead of schedule), JGGI merging with SCIN

Enjoy your w/e folks 🍷

PF down 0.44% weekly (+12.39% YTD). 11 up, 15 down, 6 unch

⭐️ ARQQ, SSSS

🐶 AAZ, GAW

Exit: SMIF, ASTO

New: SOM, SUP

Top Slice: SPSY

Top Up: GAW

No RNS of any significance and divis from EPIC, EAT & SMIF

Enjoy your w/e folks🍷

⭐️ ARQQ, SSSS

🐶 AAZ, GAW

Exit: SMIF, ASTO

New: SOM, SUP

Top Slice: SPSY

Top Up: GAW

No RNS of any significance and divis from EPIC, EAT & SMIF

Enjoy your w/e folks🍷

PF x3 weeks up 3.82% (+16.68% YTD)

⭐️ FNX, IPX, JIM, JGGI, POLY, ARQQ

🐶 SSSS

Exit: SPSY

New: NAS

Top Up: SUP, SOM, GAW

No major RNS but 1/4 of PF paying divis during the period - AAZ, EMIS, GAW, MRCH, BVXP, SUPR, IHR, AEWU

All set for the final push of 2021👇 Good w/e all🍷

⭐️ FNX, IPX, JIM, JGGI, POLY, ARQQ

🐶 SSSS

Exit: SPSY

New: NAS

Top Up: SUP, SOM, GAW

No major RNS but 1/4 of PF paying divis during the period - AAZ, EMIS, GAW, MRCH, BVXP, SUPR, IHR, AEWU

All set for the final push of 2021👇 Good w/e all🍷

PF down 1.37% weekly (+15.09% YTD). 2 up, 28 down, 2 unch

⭐️ ARQQ

🐶 AAZ, BVXP, EKF, FNX, GAMA, POLY, SOM, SPT, SSSS

Top Slice: ARQQ +200% in 3 months since IPO 🙌

Top Up: NAS, SOM, GAW, AAZ, POLY, POLR

Divi: FSFL

RNS: Interims from POLR✅ & RECI✅

Enjoy your w/e folks🍷

⭐️ ARQQ

🐶 AAZ, BVXP, EKF, FNX, GAMA, POLY, SOM, SPT, SSSS

Top Slice: ARQQ +200% in 3 months since IPO 🙌

Top Up: NAS, SOM, GAW, AAZ, POLY, POLR

Divi: FSFL

RNS: Interims from POLR✅ & RECI✅

Enjoy your w/e folks🍷

PF up 1.15% weekly (+16.41% YTD). 18 up, 10 down, 4 unch

⭐️ FNX

🐶 None >5%

Top Up: POLR

Divi: FNX, EPIC, EKF

RNS: IPX FY results were outstanding 🙌

Enjoy your w/e folks🍷

⭐️ FNX

🐶 None >5%

Top Up: POLR

Divi: FNX, EPIC, EKF

RNS: IPX FY results were outstanding 🙌

Enjoy your w/e folks🍷

PF down 1.44% weekly (+14.73% YTD). 18 up, 12 down, 2 unch

⭐️ IPX, SOM, SUP

🐶 ARQQ

Exit: NAS

New: PEY

Divi: JIM

RNS: SUP interims✅ SOM t/u✅ GAW t/u✅ and ARQQ have entered the Cognitive City space🤷♂️

Enjoy your w/e folks🍷

⭐️ IPX, SOM, SUP

🐶 ARQQ

Exit: NAS

New: PEY

Divi: JIM

RNS: SUP interims✅ SOM t/u✅ GAW t/u✅ and ARQQ have entered the Cognitive City space🤷♂️

Enjoy your w/e folks🍷

PF down 2.28% weekly (+12.11% YTD). 6 up, 20 down, 6 unch

⭐️ None >5%

🐶 AAZ, IPX, ARQQ

No Trades

No Divis

RNS: Maiden FY results from ARQQ which were more of a sales pitch than any serious financials (one Q of trading)

Enjoy your w/e folks🍷

⭐️ None >5%

🐶 AAZ, IPX, ARQQ

No Trades

No Divis

RNS: Maiden FY results from ARQQ which were more of a sales pitch than any serious financials (one Q of trading)

Enjoy your w/e folks🍷

PF up 3.79% weekly (+16.36% YTD). 25 up, 8 down

⭐️ AAZ, EPIC, FNX, SOM, SUP, ARQQ, SSSS

🐶 None >5%

Top sliced POLY to start a new position in BMY

Divi: DGI9

RNS: EPIC FY Results✅ AAZ Strategic Deal✅

Have a great Xmas everyone 🎅🧨🥂

⭐️ AAZ, EPIC, FNX, SOM, SUP, ARQQ, SSSS

🐶 None >5%

Top sliced POLY to start a new position in BMY

Divi: DGI9

RNS: EPIC FY Results✅ AAZ Strategic Deal✅

Have a great Xmas everyone 🎅🧨🥂

PF up 0.6% weekly (+17.06% YTD pending US close). 13 up, 9 down, 11 unch

⭐️ SUP

🐶 None >5%

Exited HHI & JGGI in favour of new holdings MONY & PAY plus top ups to GAW & BMY

Divis: VWRL, RECI, EPIC & SSSS (pending)

RNS: None

Closing PF👇

I wish you all a happy and healthy NY🍷

⭐️ SUP

🐶 None >5%

Exited HHI & JGGI in favour of new holdings MONY & PAY plus top ups to GAW & BMY

Divis: VWRL, RECI, EPIC & SSSS (pending)

RNS: None

Closing PF👇

I wish you all a happy and healthy NY🍷

@threadreaderapp unroll please

• • •

Missing some Tweet in this thread? You can try to

force a refresh