1/

Get a cup of coffee.

Let's talk about the Birthday Paradox.

This is a simple exercise in probability.

But from it, we can learn so much about life.

About strategic problem solving.

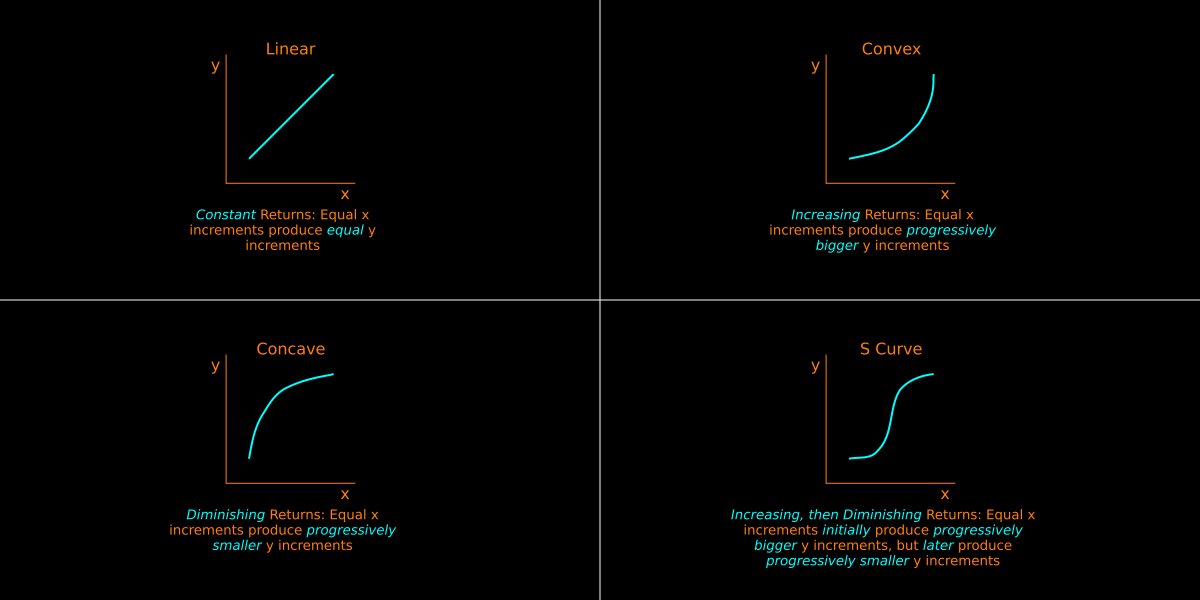

About non-linear thinking -- convexity, concavity, S curves, etc.

So let's dive in!

Get a cup of coffee.

Let's talk about the Birthday Paradox.

This is a simple exercise in probability.

But from it, we can learn so much about life.

About strategic problem solving.

About non-linear thinking -- convexity, concavity, S curves, etc.

So let's dive in!

2/

Suppose we came across a "30 under 30" Forbes list.

The list features 30 highly accomplished people.

What are the chances that at least 2 of these 30 share the same birthday?

Same birthday means they were born on the same day (eg, Jan 5). But not necessarily the same year.

Suppose we came across a "30 under 30" Forbes list.

The list features 30 highly accomplished people.

What are the chances that at least 2 of these 30 share the same birthday?

Same birthday means they were born on the same day (eg, Jan 5). But not necessarily the same year.

3/

What if it was a "40 under 40" list?

Or a "50 under 50" list?

Or in general: if we put M people on a list, what are the chances that *some* 2 of them will share the same birthday?

What if it was a "40 under 40" list?

Or a "50 under 50" list?

Or in general: if we put M people on a list, what are the chances that *some* 2 of them will share the same birthday?

4/

Clearly, this is an exercise in probability.

To solve it, we'll assume 3 things:

1. No Feb 29 birthdays,

2. Each person on our list is *equally likely* to be born on any one of the other 365 days (Jan 1 to Dec 31), and

3. The birthdays are all independent of each other.

Clearly, this is an exercise in probability.

To solve it, we'll assume 3 things:

1. No Feb 29 birthdays,

2. Each person on our list is *equally likely* to be born on any one of the other 365 days (Jan 1 to Dec 31), and

3. The birthdays are all independent of each other.

5/

Another way to state the problem:

We have M people, and a 365-sided fair die.

Each person is allowed to roll the die once -- and is thereby assigned a number between 1 and 365 (both inclusive).

What are the chances that *some* 2 people will get assigned the same number?

Another way to state the problem:

We have M people, and a 365-sided fair die.

Each person is allowed to roll the die once -- and is thereby assigned a number between 1 and 365 (both inclusive).

What are the chances that *some* 2 people will get assigned the same number?

6/

Clearly, as the number of people (M) increases, so does the likelihood that *some* 2 of them will share the same birthday.

For example, suppose we have just 2 people on our list. That is, M=2. There's only a "1 in 365" (~0.27%) chance that they'll share the same birthday.

Clearly, as the number of people (M) increases, so does the likelihood that *some* 2 of them will share the same birthday.

For example, suppose we have just 2 people on our list. That is, M=2. There's only a "1 in 365" (~0.27%) chance that they'll share the same birthday.

7/

But suppose we have 366 people (ie, M = 366).

Clearly, they can't *all* have different birthdays. There are only 365 days to go around. (Remember: no Feb 29 birthdays.)

So, there's a 100% chance that *some* 2 of them will share the same birthday.

But suppose we have 366 people (ie, M = 366).

Clearly, they can't *all* have different birthdays. There are only 365 days to go around. (Remember: no Feb 29 birthdays.)

So, there's a 100% chance that *some* 2 of them will share the same birthday.

8/

So, as M goes from 2 to 366, our probability of encountering "birthday buddies" goes from ~0.27% to 100%.

At what point do you think the probability crosses 50%? 75%? 90%? 99%?

So, as M goes from 2 to 366, our probability of encountering "birthday buddies" goes from ~0.27% to 100%.

At what point do you think the probability crosses 50%? 75%? 90%? 99%?

9/

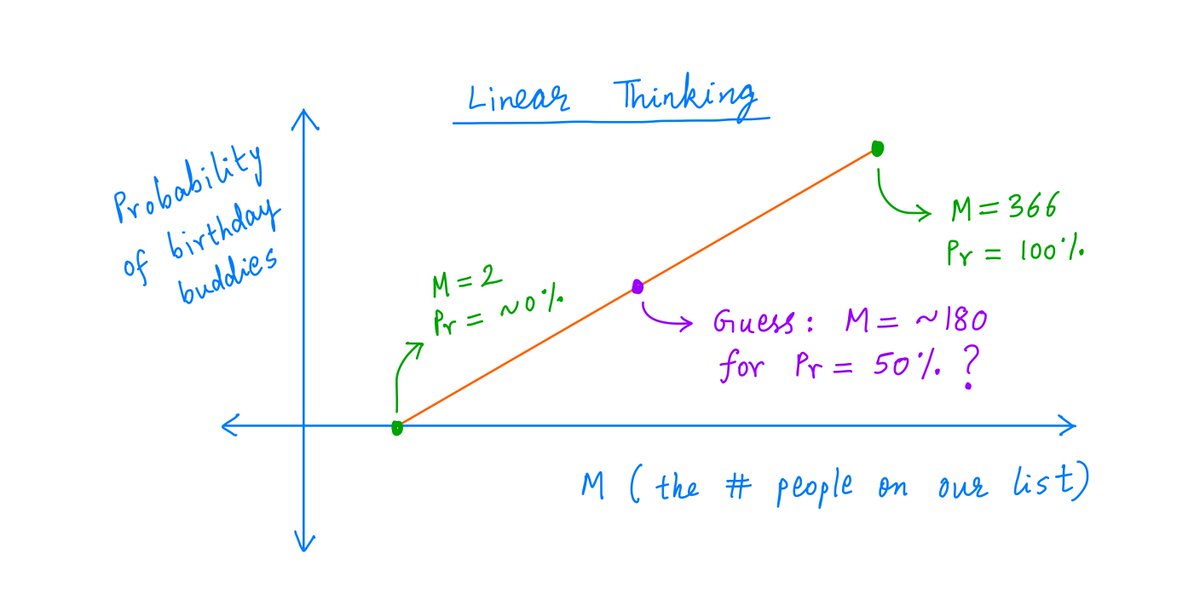

When asked questions like this, most people's first reaction is to *think linearly*.

At M = 2, the probability of birthday buddies is ~0%. By the time M = 366, it's 100%.

So the 50% mark should be crossed roughly halfway between 2 and 366, right? Say, at M = 180 or so?

When asked questions like this, most people's first reaction is to *think linearly*.

At M = 2, the probability of birthday buddies is ~0%. By the time M = 366, it's 100%.

So the 50% mark should be crossed roughly halfway between 2 and 366, right? Say, at M = 180 or so?

10/

The right answer, it turns out, is just M = 23.

We need just 23 people on the list to give us a more than 50% chance of encountering birthday buddies.

That's the Birthday Paradox.

Our intuition, based on *linear thinking*, often misguides us in probabilistic settings.

The right answer, it turns out, is just M = 23.

We need just 23 people on the list to give us a more than 50% chance of encountering birthday buddies.

That's the Birthday Paradox.

Our intuition, based on *linear thinking*, often misguides us in probabilistic settings.

11/

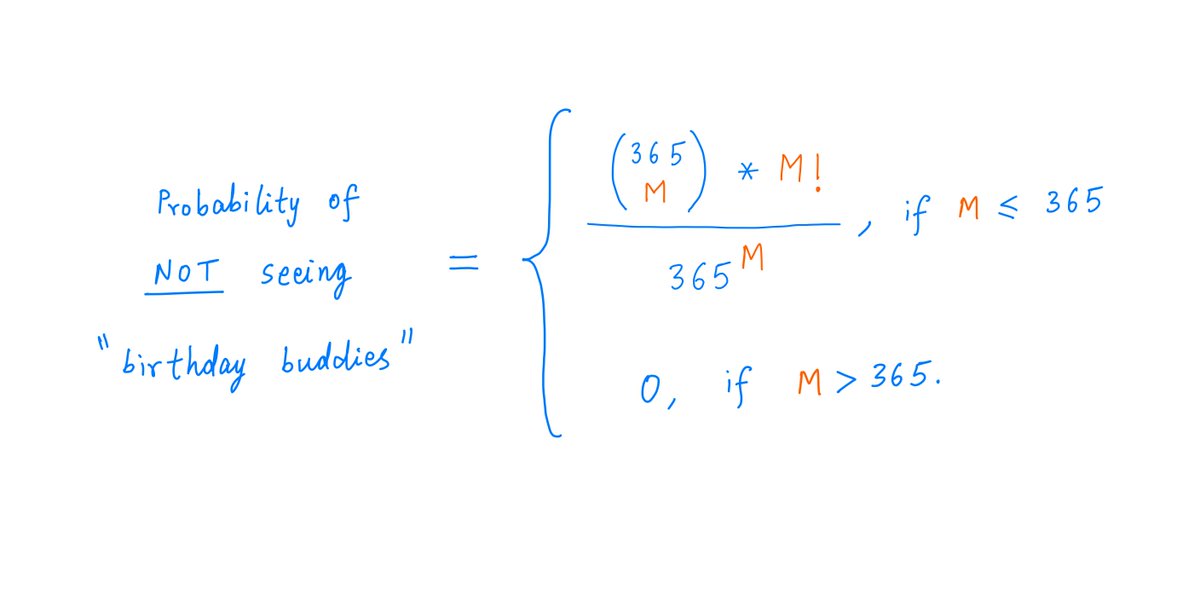

Charlie Munger's "Invert, Always Invert" mantra comes in handy when analyzing the birthday paradox.

Instead of asking "what's the probability of encountering birthday buddies", it's *much* easier to work out the probability of *not* encountering them.

Charlie Munger's "Invert, Always Invert" mantra comes in handy when analyzing the birthday paradox.

Instead of asking "what's the probability of encountering birthday buddies", it's *much* easier to work out the probability of *not* encountering them.

12/

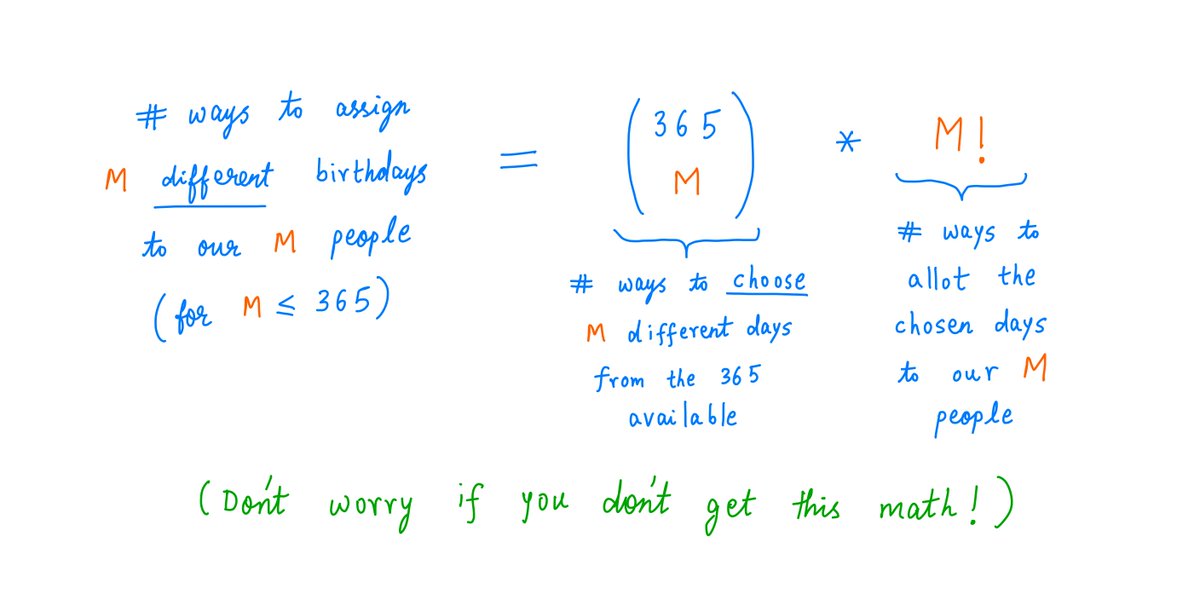

It's quite simple. If we *don't* want birthday buddies, we have to hope that *all* M people on our list have different birthdays.

This is like rolling a 365-sided die M times, and getting a different number each time.

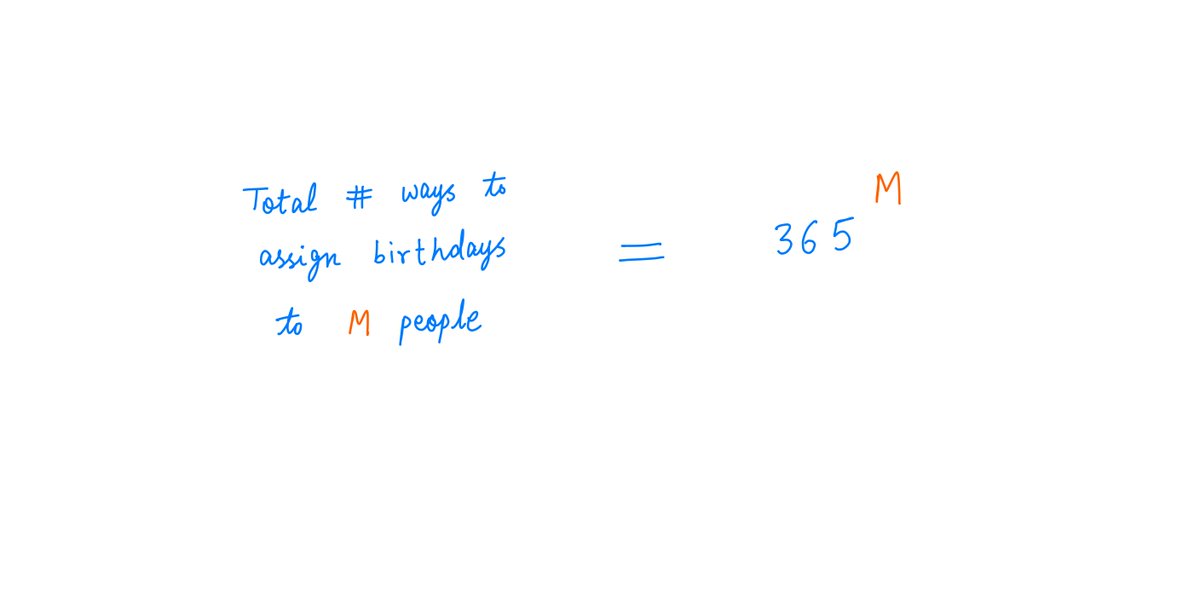

Here's the number of ways that can happen:

It's quite simple. If we *don't* want birthday buddies, we have to hope that *all* M people on our list have different birthdays.

This is like rolling a 365-sided die M times, and getting a different number each time.

Here's the number of ways that can happen:

14/

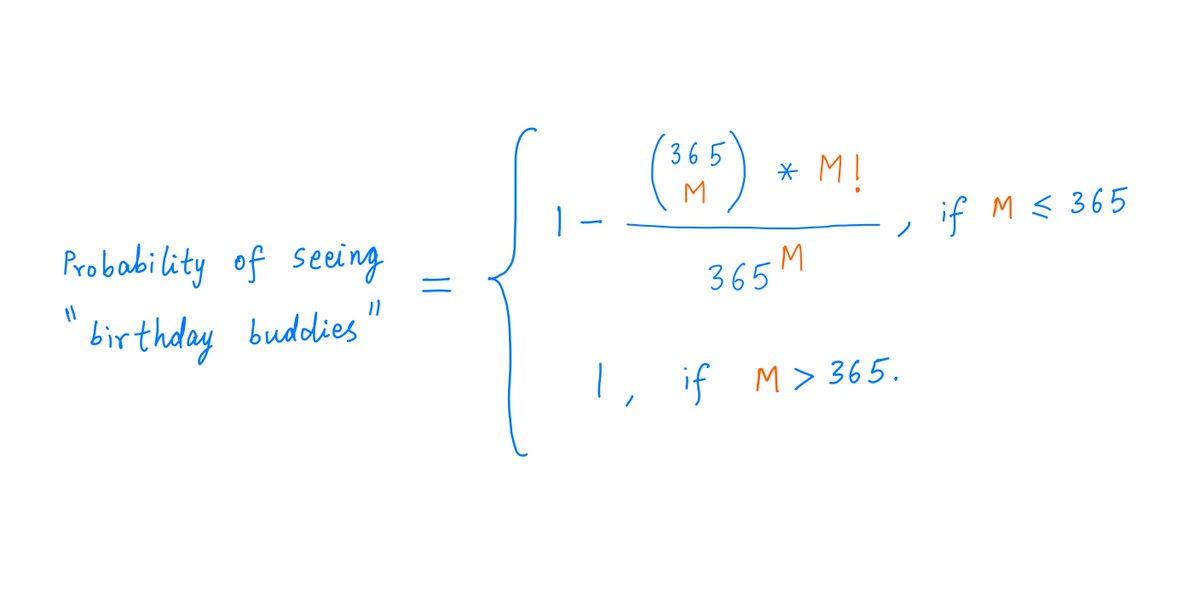

Since all these ways are equally likely, we can just divide one by the other to get the probability of *not* seeing birthday buddies:

Since all these ways are equally likely, we can just divide one by the other to get the probability of *not* seeing birthday buddies:

16/

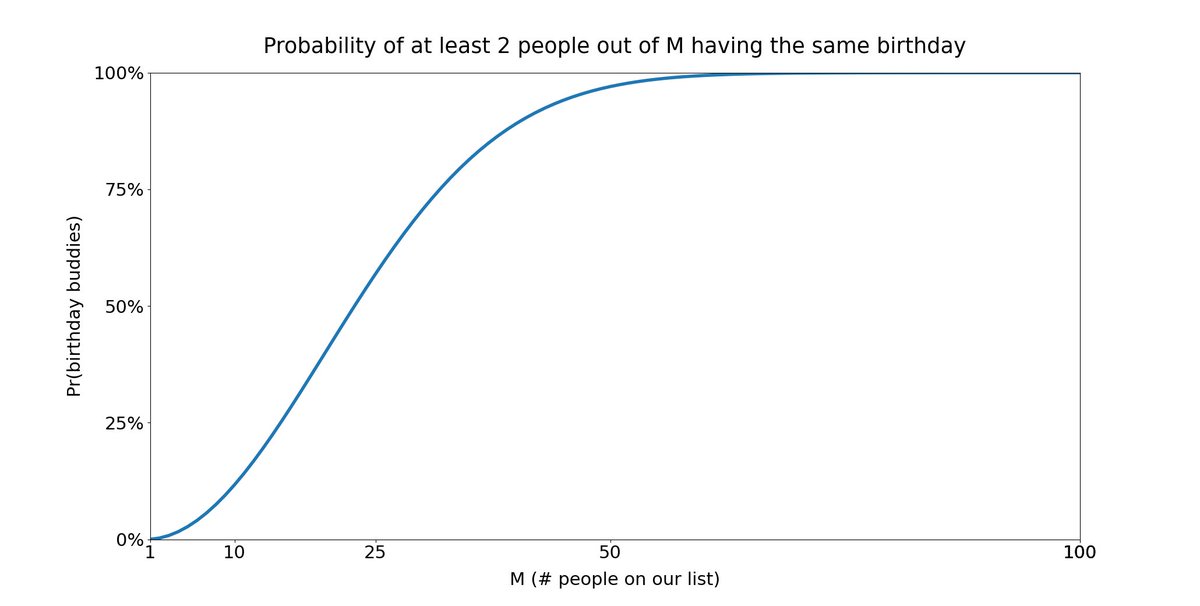

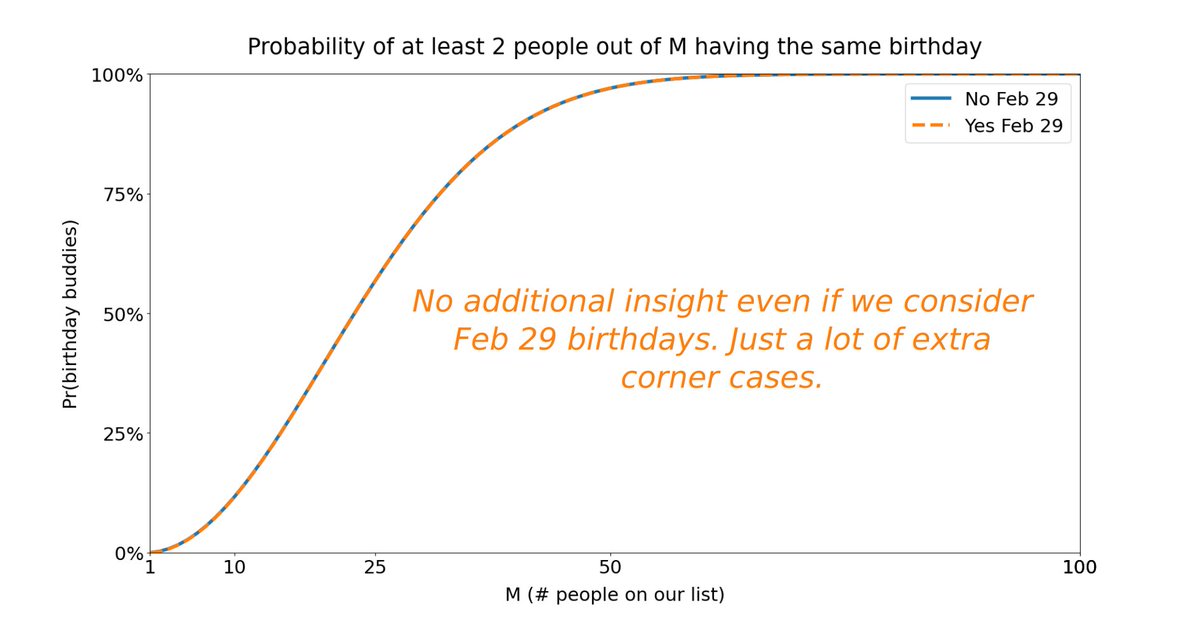

With this formula, we can plot the probability of seeing birthday buddies vs M.

From the plot, we see that as M increases, birthday buddies *rapidly* become more and more likely.

Linear thinking grossly *underestimates* this rapidity.

With this formula, we can plot the probability of seeing birthday buddies vs M.

From the plot, we see that as M increases, birthday buddies *rapidly* become more and more likely.

Linear thinking grossly *underestimates* this rapidity.

17/

To give you an idea of this rapidity:

At M = 23, the probability of seeing birthday buddies crosses the 50% mark.

At M = 32, the 75% mark.

At M = 41, the 90% mark.

And at M = 57, the 99% mark.

To give you an idea of this rapidity:

At M = 23, the probability of seeing birthday buddies crosses the 50% mark.

At M = 32, the 75% mark.

At M = 41, the 90% mark.

And at M = 57, the 99% mark.

18/

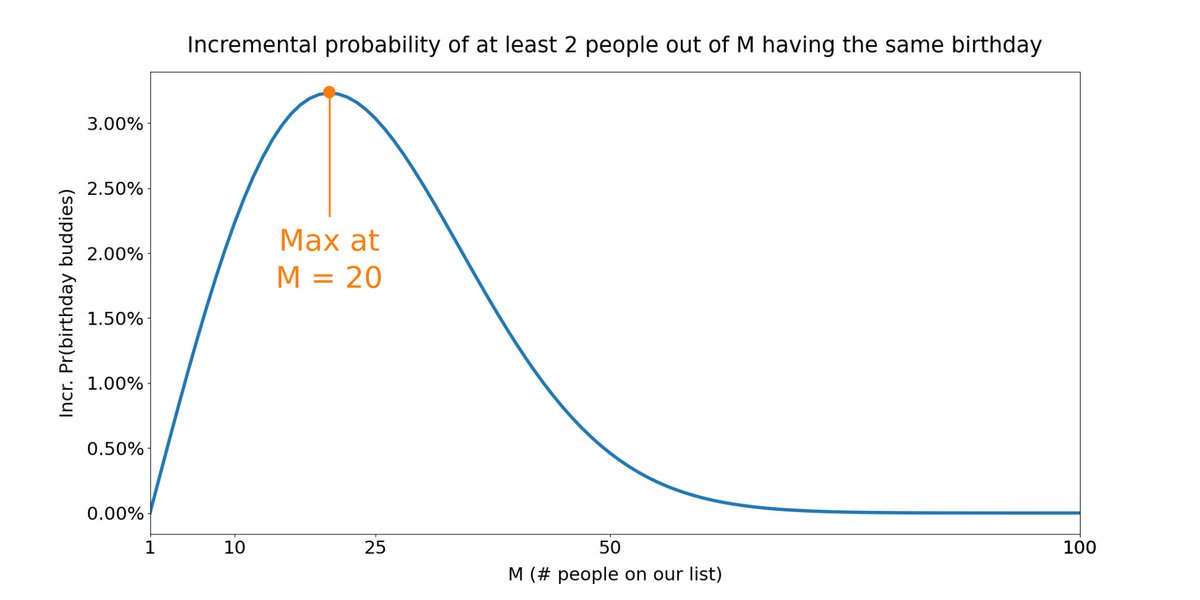

We also gain insight by looking at the *incremental* contribution of each increase in M.

For example, when M = 10, the probability of birthday buddies is about ~11.69%. At M = 11, it's ~14.11%.

So, the 11'th person's *incremental* contribution is 14.11 - 11.69 = ~2.42%.

We also gain insight by looking at the *incremental* contribution of each increase in M.

For example, when M = 10, the probability of birthday buddies is about ~11.69%. At M = 11, it's ~14.11%.

So, the 11'th person's *incremental* contribution is 14.11 - 11.69 = ~2.42%.

19/

Here's a plot of these *incremental* contributions vs M.

This plot is very interesting.

It shows that initially, there's a *law of increasing returns*: each increment to M produces progressively *bigger* increments to birthday buddy likelihood.

Here's a plot of these *incremental* contributions vs M.

This plot is very interesting.

It shows that initially, there's a *law of increasing returns*: each increment to M produces progressively *bigger* increments to birthday buddy likelihood.

20/

But then, at around M = 20, this reverses course and becomes a *law of diminishing returns* instead.

Now, each increment to M produces progressively *smaller* increments to birthday buddy likelihood.

But then, at around M = 20, this reverses course and becomes a *law of diminishing returns* instead.

Now, each increment to M produces progressively *smaller* increments to birthday buddy likelihood.

21/

In other words, up to M = 20, each person contributes *more* than the previous one.

But starting at M = 21, each person contributes *less*.

The 20'th person contributes more than the 19'th. But the 21'st person contributes less than the 20'th.

In other words, up to M = 20, each person contributes *more* than the previous one.

But starting at M = 21, each person contributes *less*.

The 20'th person contributes more than the 19'th. But the 21'st person contributes less than the 20'th.

22/

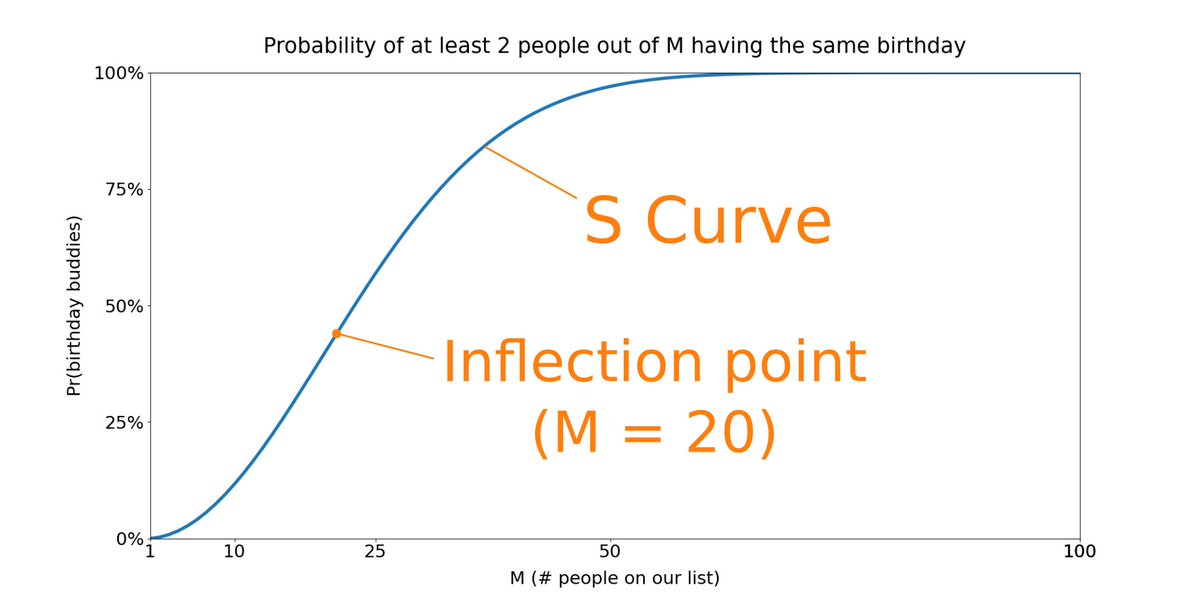

This kind of "increasing returns up to a point, followed by diminishing returns after that point", is a common feature we see in many life situations.

It applies to learning new subjects. Building muscle. Returns on invested capital in many businesses.

This kind of "increasing returns up to a point, followed by diminishing returns after that point", is a common feature we see in many life situations.

It applies to learning new subjects. Building muscle. Returns on invested capital in many businesses.

23/

These situations are characterized by an "S curve".

Every S curve has an *inflection point*. This is where it transitions from increasing to diminishing returns. In our birthday paradox, this is M = 20.

When we see an S curve, it usually pays to think *non-linearly*.

These situations are characterized by an "S curve".

Every S curve has an *inflection point*. This is where it transitions from increasing to diminishing returns. In our birthday paradox, this is M = 20.

When we see an S curve, it usually pays to think *non-linearly*.

24/

Here's a picture to help you think non-linearly.

As the picture shows, the key idea is to think in terms of *incremental* returns: are they increasing (convex), diminishing (concave), constant (linear), or at first increasing but later on diminishing (S curve)?

Here's a picture to help you think non-linearly.

As the picture shows, the key idea is to think in terms of *incremental* returns: are they increasing (convex), diminishing (concave), constant (linear), or at first increasing but later on diminishing (S curve)?

25/

There are at least 5 key lessons we can learn from the birthday paradox.

Key lesson 1: Simplify the problem to its essentials.

For example, we decided to ignore Feb 29 birthdays. This helped us get rid of many messy corner cases -- *without* causing us to lose any insight.

There are at least 5 key lessons we can learn from the birthday paradox.

Key lesson 1: Simplify the problem to its essentials.

For example, we decided to ignore Feb 29 birthdays. This helped us get rid of many messy corner cases -- *without* causing us to lose any insight.

26/

Key lesson 2: Don't over-simplify.

Linear thinking is an example of over-simplification in this case. It causes us to dramatically underestimate the likelihood of seeing birthday buddies -- and thereby miss crucial insights.

Key lesson 2: Don't over-simplify.

Linear thinking is an example of over-simplification in this case. It causes us to dramatically underestimate the likelihood of seeing birthday buddies -- and thereby miss crucial insights.

27/

Key lesson 3: Think probabilistically.

Most outcomes in life are not deterministic. Chance often plays a big role.

So, it's usually a good idea to enumerate the various possible outcomes, work out which ones are desirable and undesirable, the odds of each, etc.

Key lesson 3: Think probabilistically.

Most outcomes in life are not deterministic. Chance often plays a big role.

So, it's usually a good idea to enumerate the various possible outcomes, work out which ones are desirable and undesirable, the odds of each, etc.

28/

Key lesson 4: Invert, always invert.

In many probabilistic situations, inverting the problem (eg, asking how many ways birthday buddies *cannot* occur) can help us solve it.

As Charlie Munger is fond of saying: I only want to know where I'll die, so I'll never go there.

Key lesson 4: Invert, always invert.

In many probabilistic situations, inverting the problem (eg, asking how many ways birthday buddies *cannot* occur) can help us solve it.

As Charlie Munger is fond of saying: I only want to know where I'll die, so I'll never go there.

29/

Key lesson 5: Think non-linearly.

This often means thinking in terms of *incremental* or *marginal* returns.

For this, it's useful to bear in mind mental models like convexity, concavity, S curves, inflection points, etc.

Key lesson 5: Think non-linearly.

This often means thinking in terms of *incremental* or *marginal* returns.

For this, it's useful to bear in mind mental models like convexity, concavity, S curves, inflection points, etc.

30/

As usual, I'll leave you with some useful references.

I love Shannon's 1952 speech outlining 6 methods for thinking creatively and solving problems strategically. Two of the methods are "simplifying" and "inverting". (h/t @jimmyasoni)

For more:

As usual, I'll leave you with some useful references.

I love Shannon's 1952 speech outlining 6 methods for thinking creatively and solving problems strategically. Two of the methods are "simplifying" and "inverting". (h/t @jimmyasoni)

For more:

https://twitter.com/10kdiver/status/1260191715954049024?s=20

31/

I also recommend listening to this (~1 hr, 23 min) podcast episode, where @ShaneAParrish and @Scott_E_Page discuss several mental models for both non-linear and probabilistic thinking -- including convexity and concavity, Markov chains, etc. fs.blog/knowledge-proj…

I also recommend listening to this (~1 hr, 23 min) podcast episode, where @ShaneAParrish and @Scott_E_Page discuss several mental models for both non-linear and probabilistic thinking -- including convexity and concavity, Markov chains, etc. fs.blog/knowledge-proj…

32/

Also, this article by @eugenewei on how to anticipate inflection points in S curves (he calls them invisible asymptotes) is excellent: eugenewei.com/blog/2018/5/21…

Also, this article by @eugenewei on how to anticipate inflection points in S curves (he calls them invisible asymptotes) is excellent: eugenewei.com/blog/2018/5/21…

33/

Finally, I want to thank my friend @SahilBloom.

It was his 30'th birthday earlier this week (and @aryamanar99's suggestion that I "gift" him a thread) that prompted me to reflect on birthdays and the birthday paradox.

Happy birthday, Sahil!

Finally, I want to thank my friend @SahilBloom.

It was his 30'th birthday earlier this week (and @aryamanar99's suggestion that I "gift" him a thread) that prompted me to reflect on birthdays and the birthday paradox.

Happy birthday, Sahil!

34/

If you're still with me, kudos to your perseverance!

Forget *non-linear* thinking. Most people can't follow a thread linearly from start to finish. But you're not one of them, and I appreciate it!

Take care. Enjoy your weekend!

/End

If you're still with me, kudos to your perseverance!

Forget *non-linear* thinking. Most people can't follow a thread linearly from start to finish. But you're not one of them, and I appreciate it!

Take care. Enjoy your weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh