As DeFi matures, quantifiable metrics will supplant vaporware memes in determining valuations for cryptoassets.

A brief look at some of the major protocols today 👇

A brief look at some of the major protocols today 👇

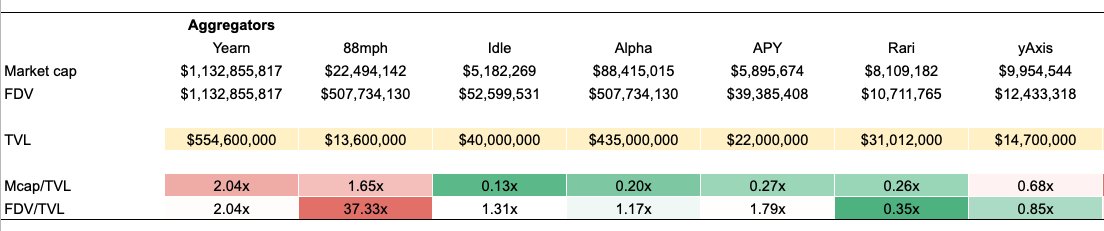

1/ While liquidity is highly mercenary and hence TVL is a poor benchmark for protocol value, it is a serviceable benchmark.

More sophisticated approaches will likely use trailing 6m average TVL to factor in retention.

Here are the DeFi aggregators:

More sophisticated approaches will likely use trailing 6m average TVL to factor in retention.

Here are the DeFi aggregators:

2/ One note here is that there's option value with auxiliary products not reflected here - e.g. $ALPHA has an upcoming perpetual swaps product which may warrant another way of ascertaining a multiple.

Such as the one below...

Such as the one below...

3/ For decentralized exchanges, the meaningful KPI is volume.

A more sophisticated way to do this would be to use say 3m revenues, or fees captured by token.

The following is just a 24h snapshot.

A more sophisticated way to do this would be to use say 3m revenues, or fees captured by token.

The following is just a 24h snapshot.

3/ Few observations:

- Among DeFi peers, $SUSHI seems to be grossly undervaluing its volumes on a fully diluted basis

- People have high expectations for Synthetix's Optimism implementation (can't wait!)

- For tokens with long dilution schemes this metric is less useful

- Among DeFi peers, $SUSHI seems to be grossly undervaluing its volumes on a fully diluted basis

- People have high expectations for Synthetix's Optimism implementation (can't wait!)

- For tokens with long dilution schemes this metric is less useful

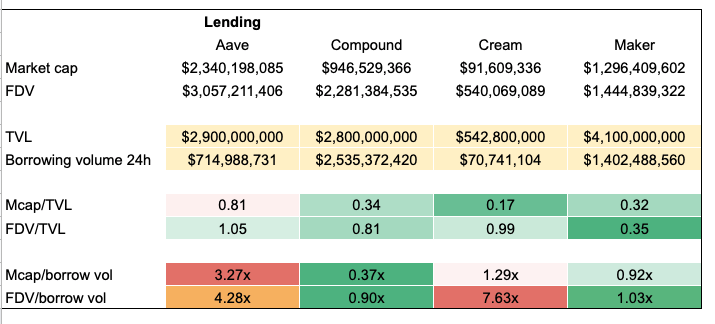

4/ For lending protocols, borrow volumes is the meaningful KPI as that is where fees are extracted.

Following is in line with my expectations that people are pricing $AAVE as the higher growth counterpart to $COMP.

Following is in line with my expectations that people are pricing $AAVE as the higher growth counterpart to $COMP.

5/ Just like tradfi multiples, a lower multiple does not necessarily mean the token is better value, and a higher multiple does not imply the token is overvalued.

I'd rather pay 2x the price for a team that ships 10x as a fast than pay a discount for a product with no PMF.

I'd rather pay 2x the price for a team that ships 10x as a fast than pay a discount for a product with no PMF.

6/ One day we'll get to a point where @DuneAnalytics is this industry's 10-K but until then narratives probably matter more than fundamentals in a bull market.

But narratives can go as quickly as they come...

But narratives can go as quickly as they come...

fin/ Disclaimer: not financial advice; writer is long multiple assets in the post above

• • •

Missing some Tweet in this thread? You can try to

force a refresh