A children's book explanation of what's happening:

1. If you are "smart money" you are allowed to take your $1 and leverage it up to $15+

2. You can now buy $15 of stock AND if you promise to short companies, you can short $15 of stock as well

1. If you are "smart money" you are allowed to take your $1 and leverage it up to $15+

2. You can now buy $15 of stock AND if you promise to short companies, you can short $15 of stock as well

3. In finance language, this means that you are $30 "gross" ($15 of longs + $15 of shorts) but $0 net (+$15 of longs -$15 of shorts). This makes everyone feel good because it feels like you are taking zero risk...but in reality, your $1 is exposed to $30 of risk.

4. Now you go around and tell your friends about both your longs and your shorts and when you do it at a restaurant vs on Reddit, its called an "ideas dinner".

5. You also publish your longs on a quarterly lag via an SEC rule. You don't have to tell anyone about your shorts.

5. You also publish your longs on a quarterly lag via an SEC rule. You don't have to tell anyone about your shorts.

6. Now the less cool people who weren't invited to the ideas dinners, start copying your longs based on your report.

7. You realize that publicizing your shorts is also a good idea so instead of only selling stocks, you also BUY options (puts) which has to be reported.

7. You realize that publicizing your shorts is also a good idea so instead of only selling stocks, you also BUY options (puts) which has to be reported.

8. Now everyone can see both your longs and your shorts and if you have a hot hand, you can likely predict that the cool people from the dinner as well as the less cool people monitoring your filings will copy you.

9. But then an outsider notices that the math is way off!

9. But then an outsider notices that the math is way off!

10. Apparently, some of these shorts that you own represent more than 100% of the entire stock of the company. Huh?

11. So he grabs his chicken fingers and champagne and buys, starts a massive short squeeze.

12. Other's see what's happening and they jump in.

11. So he grabs his chicken fingers and champagne and buys, starts a massive short squeeze.

12. Other's see what's happening and they jump in.

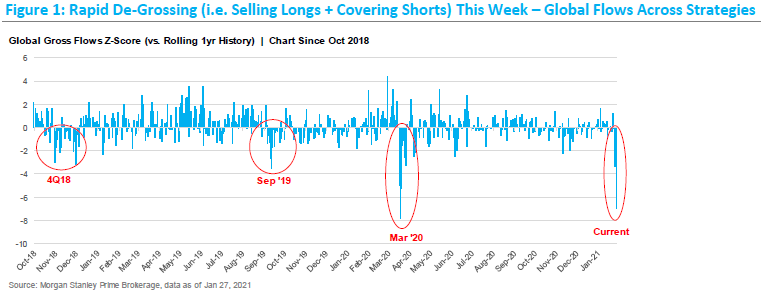

13. Now a massive short squeeze starts. You have to cover your shorts ASAP. But the banks also notice that you don't have enough credit to cover the $30 they lent you and ask for more collateral. You now also have to sell your long positions. It looks like this:

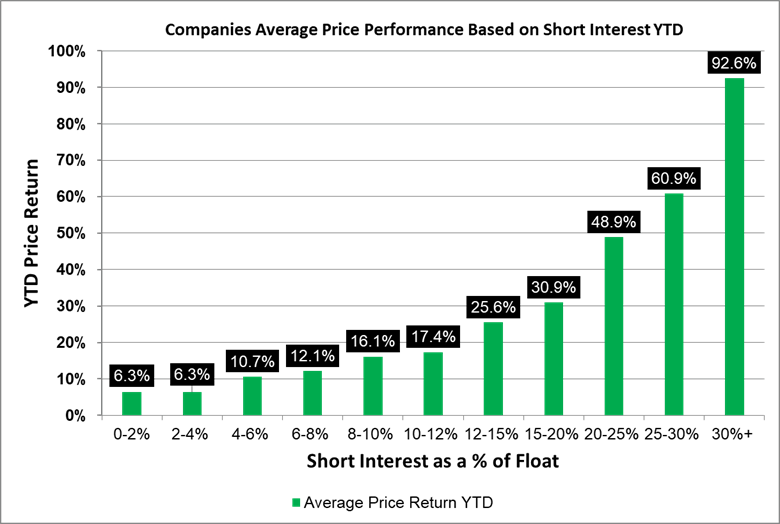

14. What happens next is that a cascade of short covering and long selling starts driving some stocks to the moon and others way down. Which stocks went up? Basically the ones that were the most heavily shorted by you and your buddies in the first place.

So the outsider won?

So the outsider won?

It's not clear. You and your buddies are strong, rich and have a lot of influence so you need to do whatever you can to keep the rules in your favor.

Maybe the SEC will ask for an open inquiry?

Maybe Congress will hold hearings?

Let's see...now go to bed.

Maybe the SEC will ask for an open inquiry?

Maybe Congress will hold hearings?

Let's see...now go to bed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh