Hello friends, I am back! I have been doing a ton of financial research and am very disturbed by what I have learned.

Please enjoy a long (irresponsibly LONG) story about central banking, manufactured crises, George Soros, and the Great Reset.

Please enjoy a long (irresponsibly LONG) story about central banking, manufactured crises, George Soros, and the Great Reset.

This thred will be much longer and more dry than my usual, pls bear with me. This one's legit important. The first portion will reference works by Dr. Richard Werner, and the latter George Soros.

Note my views are not indicative of those of people quoted. This post does not constitute investment counsel.

To understand current financial conditions you bare minimum have to go back to WWII. Bretton Woods has just been signed, establishing the IMF and World Bank, and the USD as standard for international settlement.

But we're not talking about US history (yet), we have to look at Japan. Unlike Germany, which had it's economy stripped down and sold off by the victorious Allies, Japan's system remained remarkably intact.

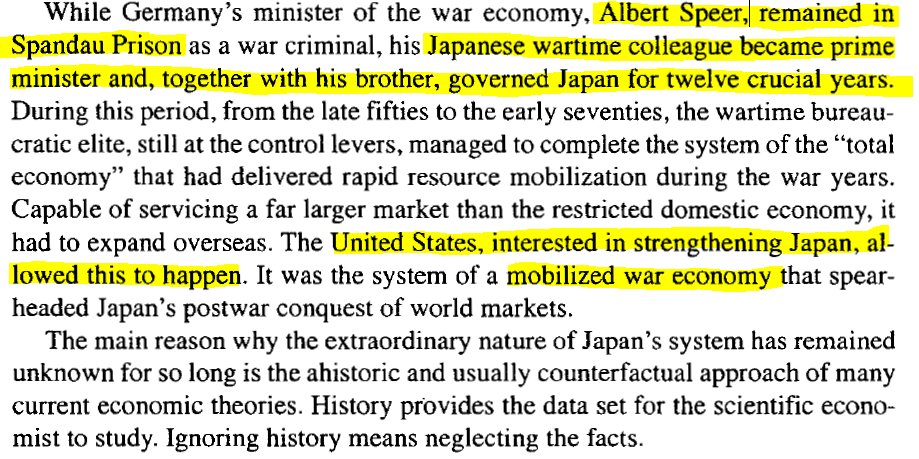

Japan's war economy was remarkably centralized and powerful. The Ministry of Commerce and Industry aggregated separate production ministries, including the powerful Ministry of Munitions. These managed production and manufacturing during the war.

In 1949 this aggregate of ministries was further centralized under the Ministry of International Trade and Industry (MITI). Alongside the ancient Ministry of Finance (MOF), they would play a key role in Japan's "economic miracle", their meteoric rise to global economic power.

Alongside the MITI and MOF there is a third (or perhaps fifth...) column, the Bank of Japan (BOJ). Unlike the previous domestic ministries, the BOJ is an international central bank.

So remember this, the MITI manages industry, the MOF regulates domestic 𝑐𝑜𝑚𝑚𝑒𝑟𝑐𝑖𝑎𝑙 banking and lending, while the BOJ behaves like a modern central bank, regulating monetary policy.

And as such, it's objectives and behavior can reveal a lot about current central banking. Over the 50 years following WWII the BOJ essentially waged a clandestine power struggle against the domestic Ministries, a battle that culminated in Japan's catastrophic "lost decade".

Back to the MITI and MOF. Throughout the late 1800s and the war Japan's production economy was dominated by Zaibatsu, dynastic familial cartels. These cartels retained their structure from the war effort, with highly regulated top-down control coming from the MITI and MOF.

As soon as the war ended these groups switched from making military goods to consumer products, deftly coordinated and with extreme efficiency.

These cartels were despised by foreign and central bankers, an illiberal stumbling block in the way of Western objectives, global free market capitalism. The McArthur administration attempted to dissolve them; they sprang back as Keiretsu, nominally shareholder controlled.

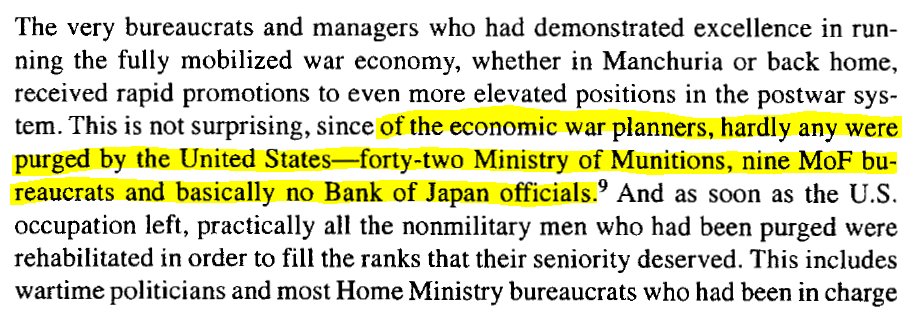

There was also an attempted purge of the MOF and MITI by the US. They removed key figures, though like the zaibatsu purge it was less than effective. Tellingly, no members of the central BOJ were purged.

This war economy (now without the burden of an actual war) swiftly resulted in massive trade surpluses. Raking in the cash from exports, Japan developed a unique financial culture. Individual citizens held huge purchasing power, and retained large % savings.

Additionally, the nation saw immense material growth in both industrial power and infrastructure, with living standards rising to meet first-world status in record time.

The US, UN, and international central banks were willing to allow this to continue for a while; Japan provided a useful bulwark against Soviet states (who were also attempting a rapid growth model).

But, as the decades following the war wore on, their tone changed. Unlike many Western nations, which had been dominated by central bank policy for centuries, Japan began to pose a problem to international markets.

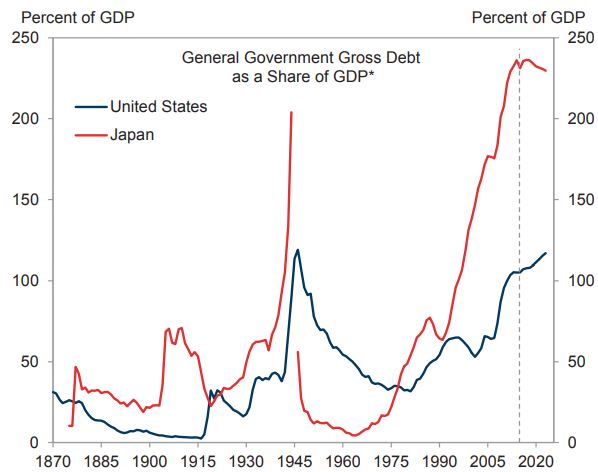

Rather than accumulating national debt, Japan was running a surplus, paying down their own debts while maintaining a soaring equities and land market. Capital began flowing out of Japan, they were making massive acquisitions in foreign nations.

Soros writes about this a lot, he's utterly contemptuous that the Japanese were running a "closed society", with individual profit subordinated to material growth. Given monopoly-cartel conditions, profit (and taking on debt) was of low priority.

As reduction in debt, improved living standards, and individual autonomy are clearly anathema to central bankers, a plan was hatched. The BOJ would blow it up.

In 1962 they exercised their power over monetary policy through what they called Window Guidance. The BOJ would set mandatory targets for how much MOF-controlled commercial banks had to lend. They were obligated to provide ever larger loans, to increasingly dubious creditors.

Now, what does that do? Well, it created a huge asset bubble obviously. But here's where we get wacky. Bear with me hardcore for this.

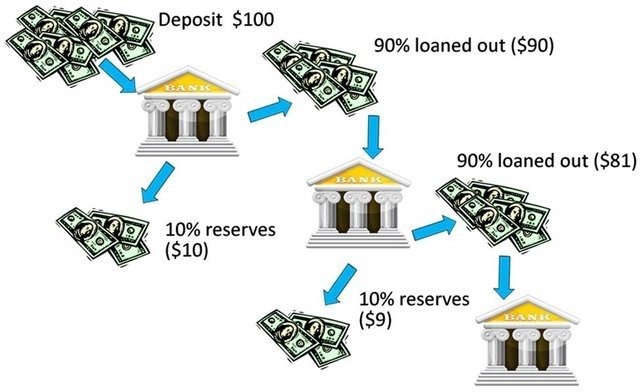

I'm sure you've heard of fractional reserve lending right? Always popular in libertarian/conspiracy circles, it's how money comes from nothing. Think I remember seeing this in Zeitgeist when I was 12.

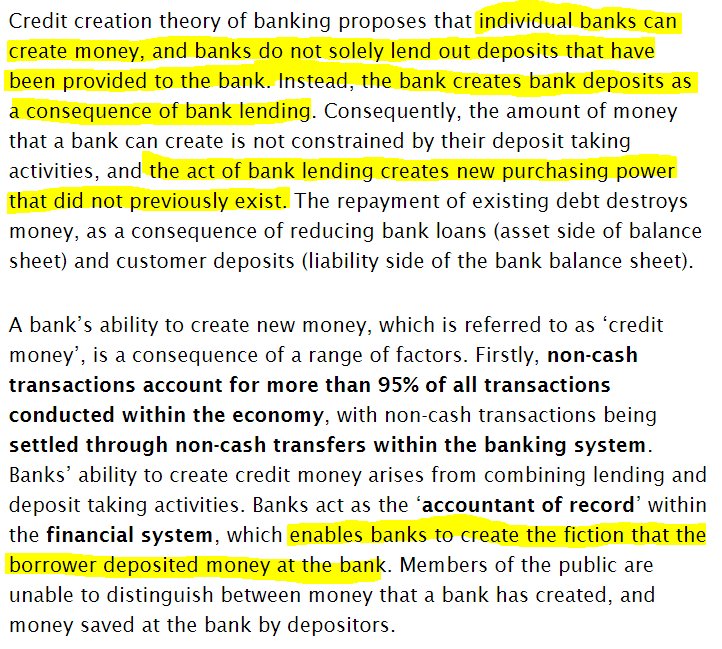

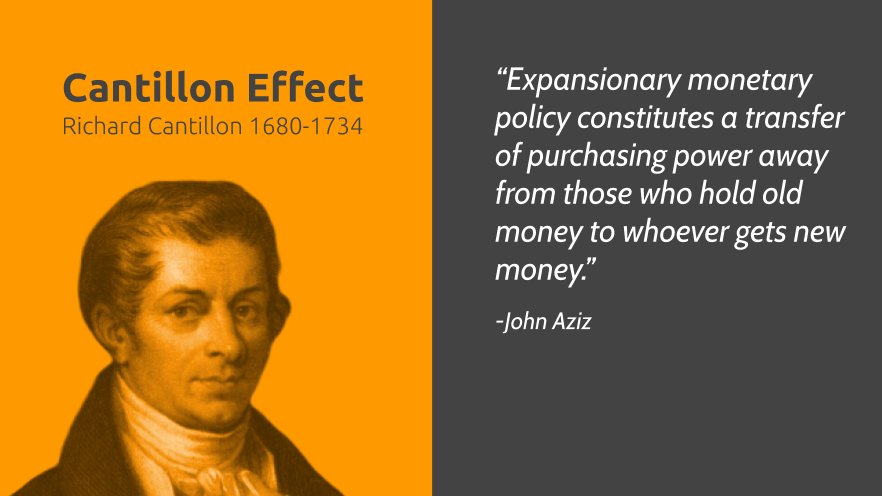

Wrong. It's a spurious theory. I literally think it's a counter-conspiracy theory, purposefully inserted into public consciousness. The true one? Credit Creation Theory, widely acknowledged in the early 20th century, now absent from even advanced textbooks.

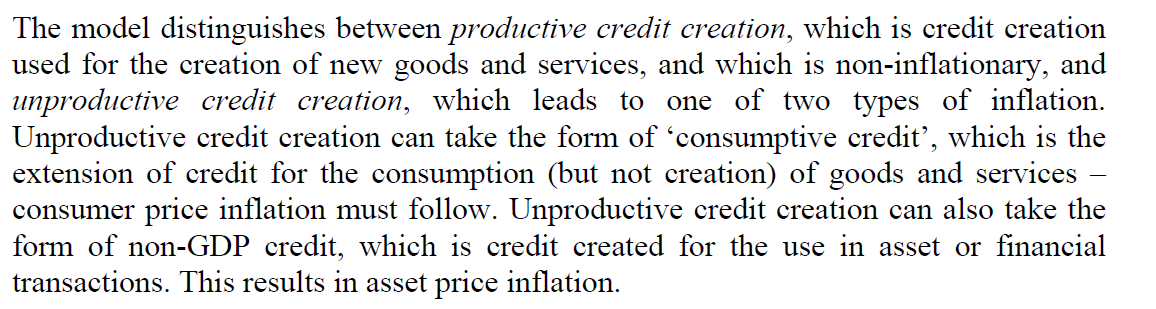

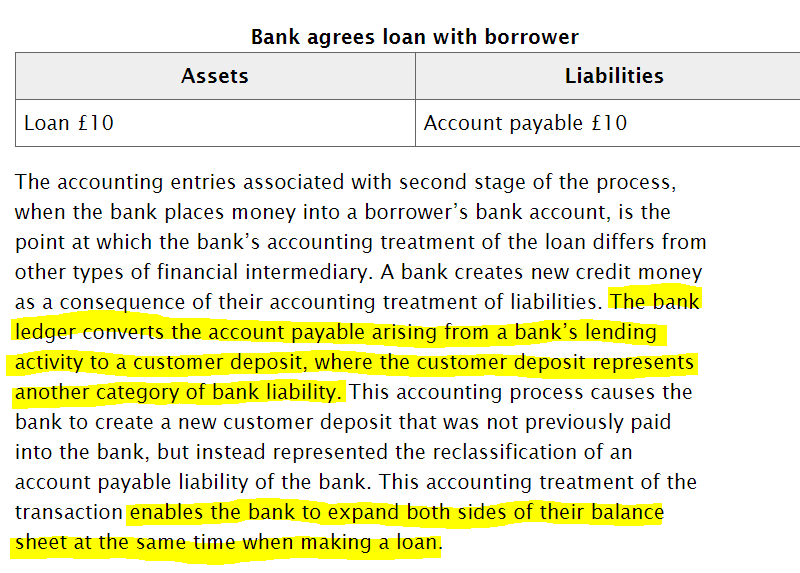

While Fractional Reserve theory posits banks act as intermediaries, multiplying money supply via lending, Credit Creation goes further. While reserve requirements do literally exist, they do not constrain commercial banks from adding to the money supply.

Instead, whenever ANY commercial bank gives out a loan, they directly add to the money supply. The act of adding credit to their balance sheet creates money, right then and there. As such, commercial banks cannot be thought of as mere intermediaries.

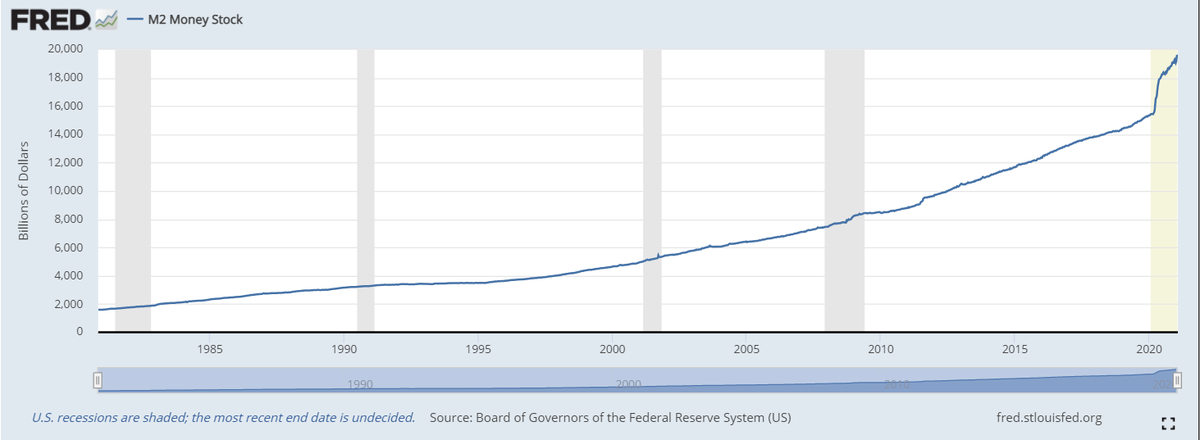

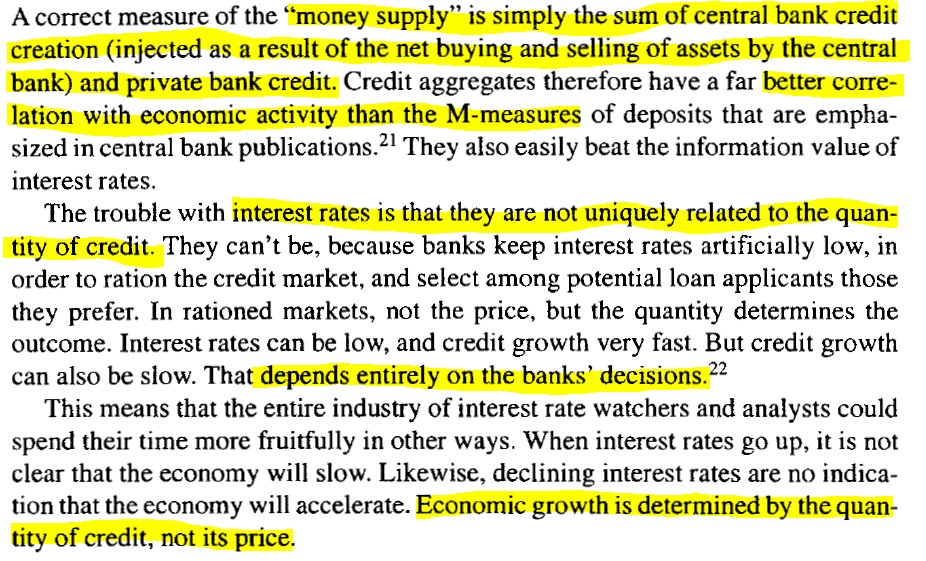

The implications of this are vast. For starters, all money supply estimates (M1-M3) must be thought of as not just inaccurate, but truly false. Any true estimate of a nation's money supply would have to come from outstanding loans provided by commercials.

And yes, I fully realize how insane this sounds. Decades of monetary policy, every econ textbook, every FOMC hike or cut, every boom and bust, it all starts to lose or take on bizarre alternate meanings. Complete reality warp.

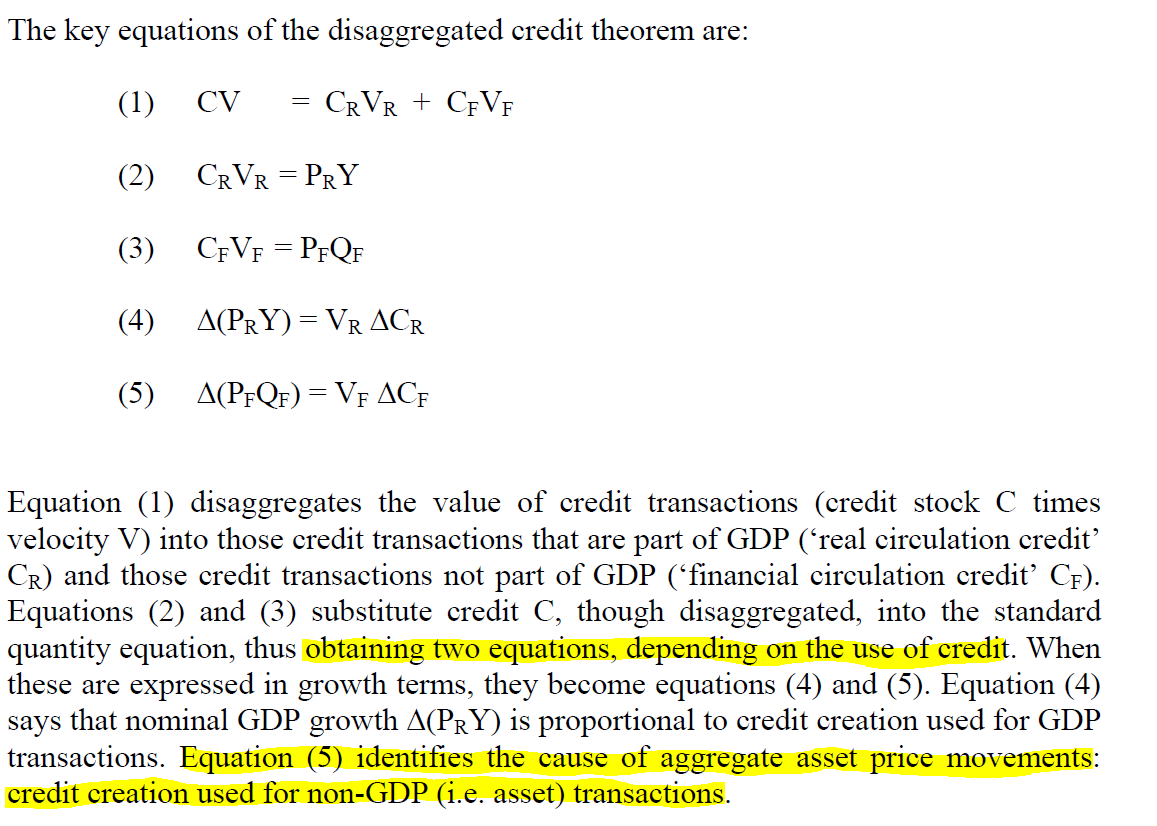

If true, it becomes clear that the application of credit matters much more than most think. Differentiation between credit used for GDP vs non-GDP purchases becomes critical, huge GDP spending becomes possible wholly without inflation.

Most shockingly of all is what this implies about the federal fund rate. While the price of credit is not entirely irrelevant, it becomes tempting to look at rate cuts as a punitive measure, something inflicted on commercials not extended to them…

Lends new meaning to the Greenspan put perhaps. We’ll help you out, if you take a long-term blow to your autonomy. Also, you don’t get to say no.

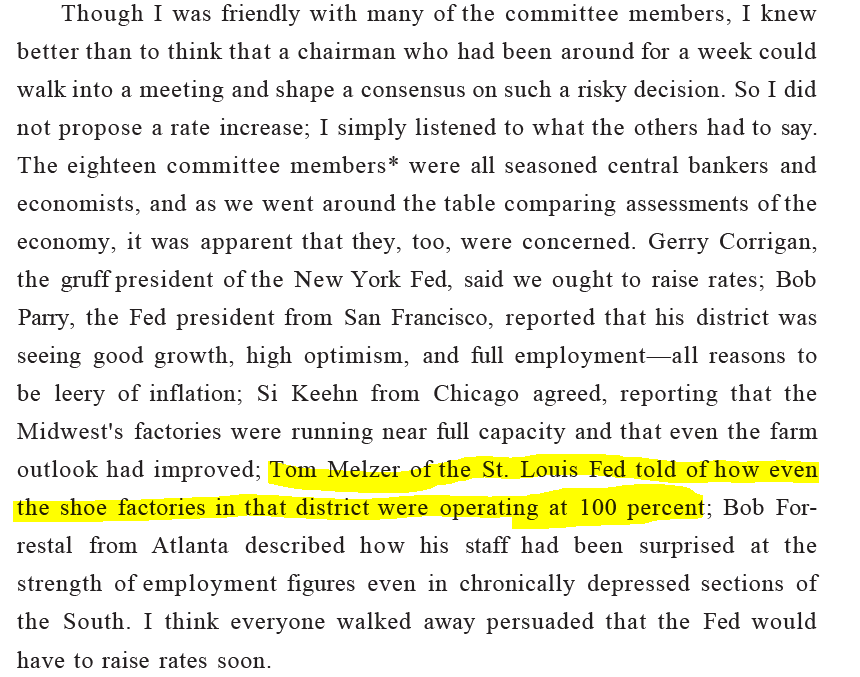

Negative rates then, a death sentence. If you’ve ever personally interacted with a modern Japanese bank you’ll know what it’s done to them. Husk institutions, resorting to pedantic measures to stay afloat.

However crazy, this seems directly provable. Let's return to Japan. It's the late 70s-early 80s, and the BOJ (operating with secret knowledge of Credit Creation) has made provision of huge loans mandatory for commercial banks.

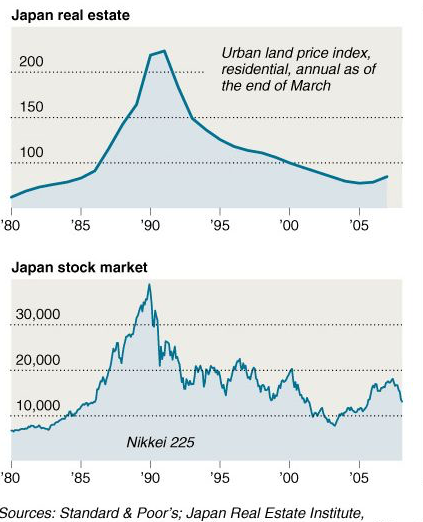

Immediately, the predictable happens. Equities, yields, land prices, everything Japanese skyrockets in value. The BOJ is blowing a bubble of insane proportions, and is working hard to make sure everyone thinks the MOF are the ones doing it.

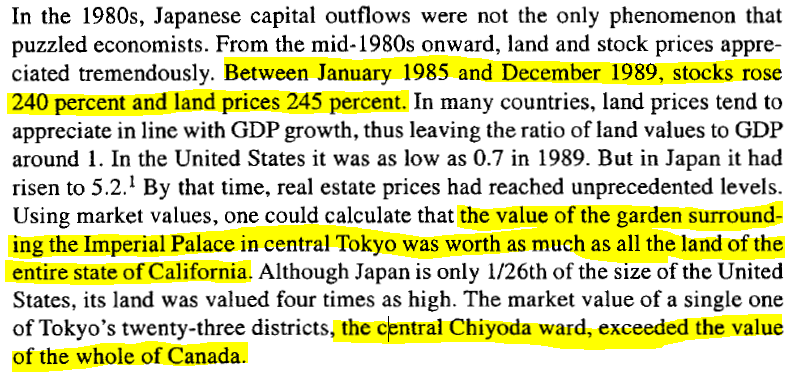

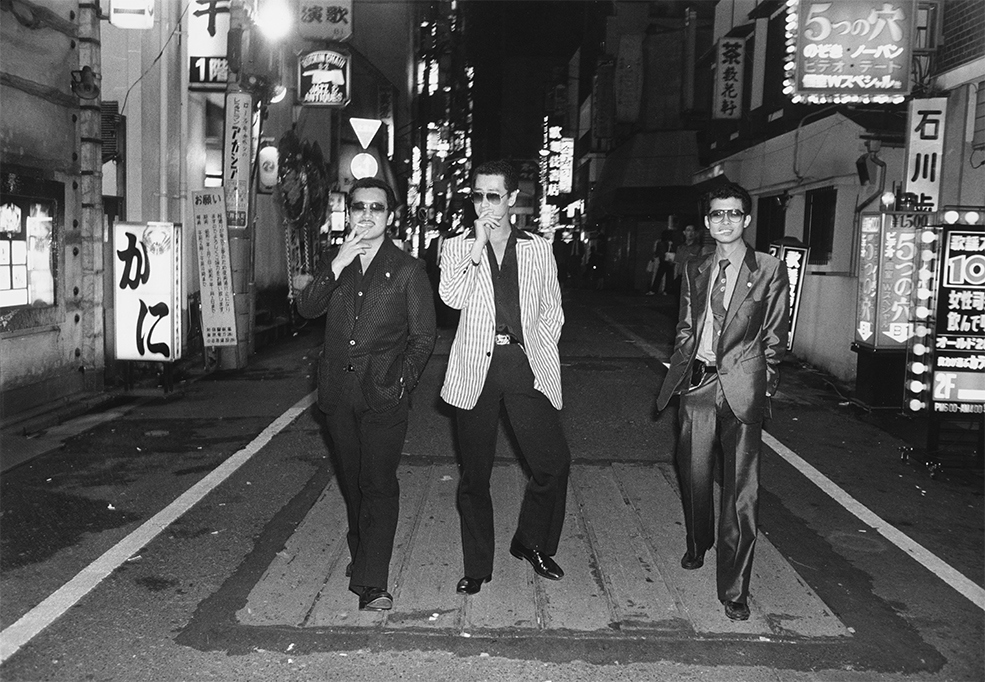

Valuations reach absurdist levels. The land value of the garden outside the Imperial Palace is worth more than all land in California, combined. It's the roaring 80s, anyone who owns any land, or buys any stock at all is a millionaire.

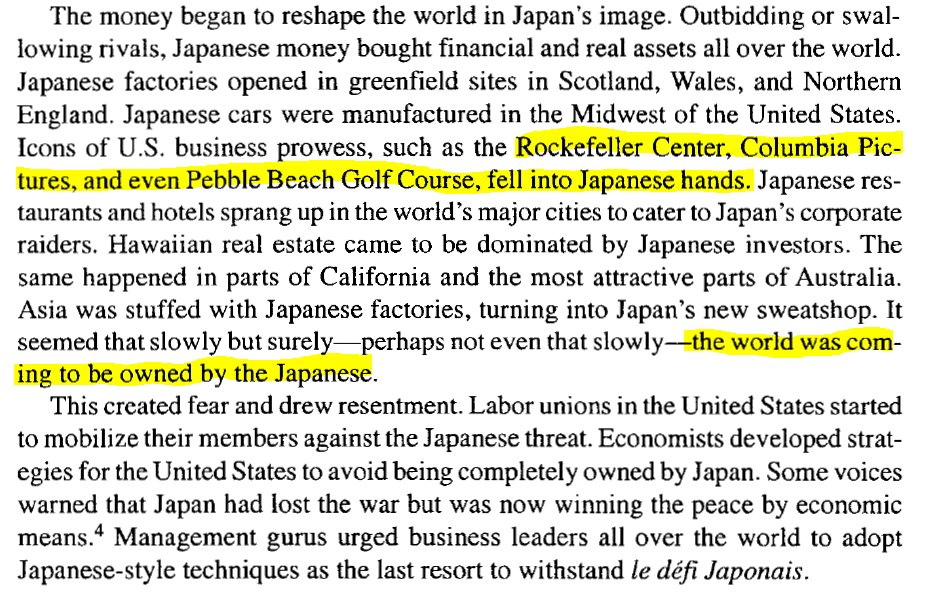

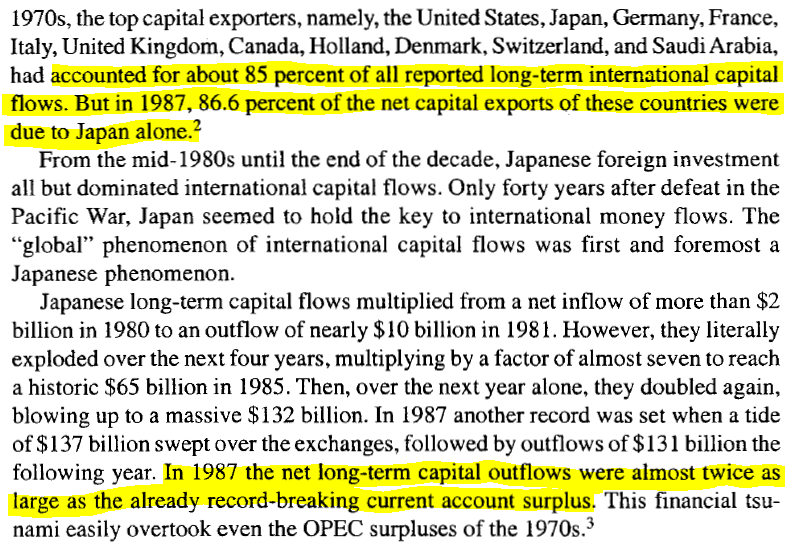

Capital outflows from Japan increase to impossible levels. Tiny Japanese companies can afford to buy out whole industries in foreign nations. Fear spreads around the western world, the Japanese are going to own everything and everybody.

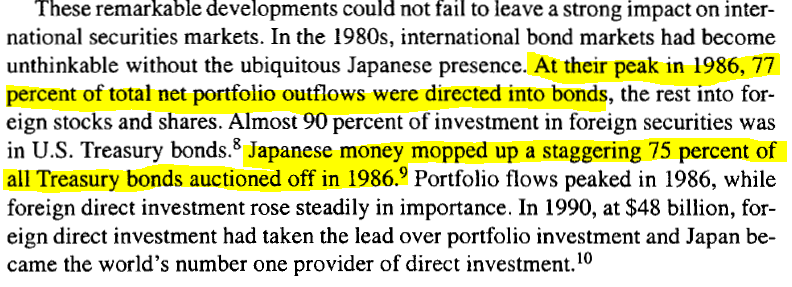

Japanese hedgies and forex traders are killing it, unstoppable. Japanese traders buy 75% of all US Treasuries sold in 1986. They buy half the gold produced in the world.

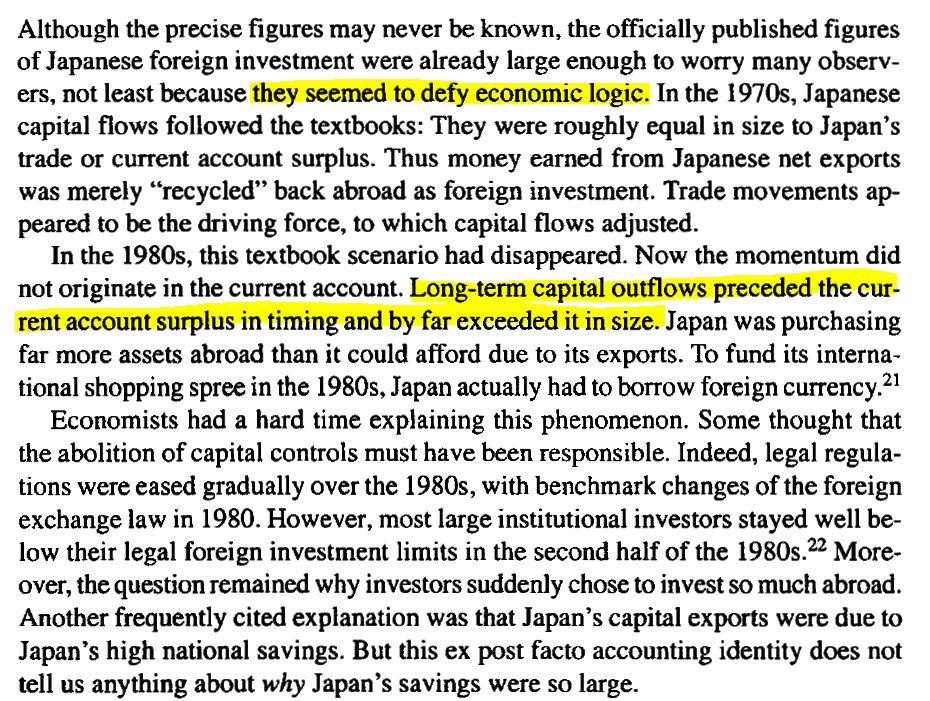

They have so much money it seems (quite literally) impossible. Even accounting for obfuscatory accounting practices and export surpluses, these figures are completely inexplicable. They're creating value from thin air, only explanation is it's cash literally created by credit.

The BOJ has stoked the economy white-hot, blown the bubble to impossible proportions. Now, step two, popping it (and pinning the blame on the MOF). Remember, while many did not realize what was happening, central bankers all over the world had planned this, for decades.

Now, let's change gears. We're in the US, 1987, lets see what Soros has to say. Ah, he seems perfectly aware the BOJ has offloaded responsibility onto commercial banks and the MOF. He finds the idea of Japanese (closed society) dominance disturbing.

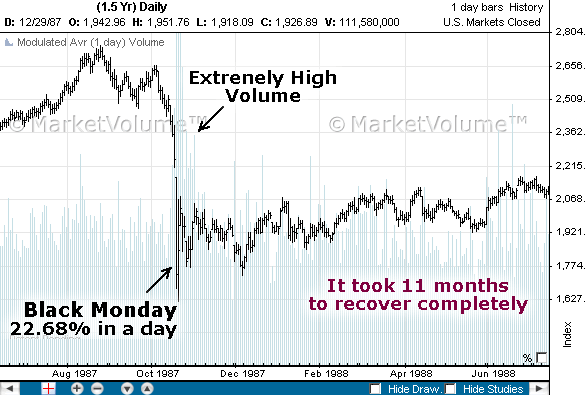

Now, the Crash of '87. US equities plunge 22.6%, Black Monday, Vol's grim smile stretching across terminals everywhere, traders abruptly remember fat-tail risk exists.

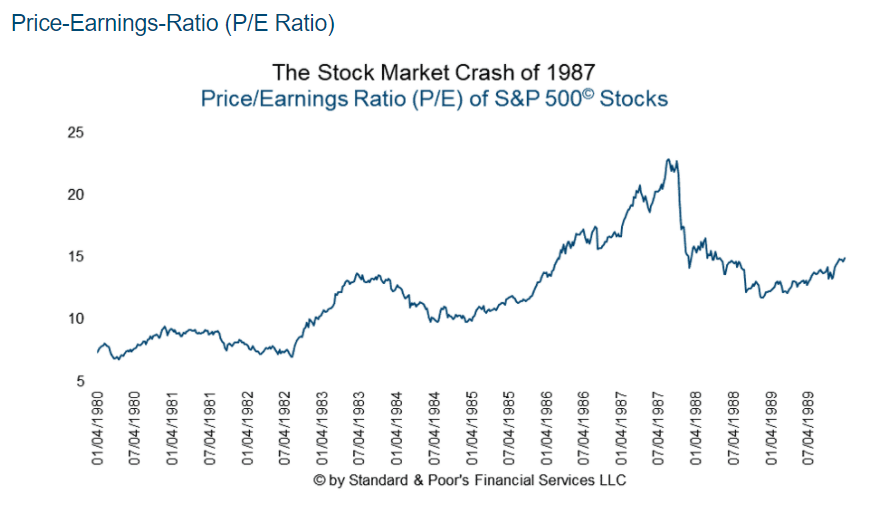

So, what caused it? US equities were running hot, at a (comparatively tame these days) average forward p/e of 18. There was a significant but not crazy bearish surprise on deficit figures (wonder what caused that lol).

Now, there's a lot of other things people point to, proliferation of crude automated momentum """insurance""" strategies? Personally I love the story about NYSE traders moronically trying to arbitrage index futures against a halted market, getting rekt by their own sell wall.

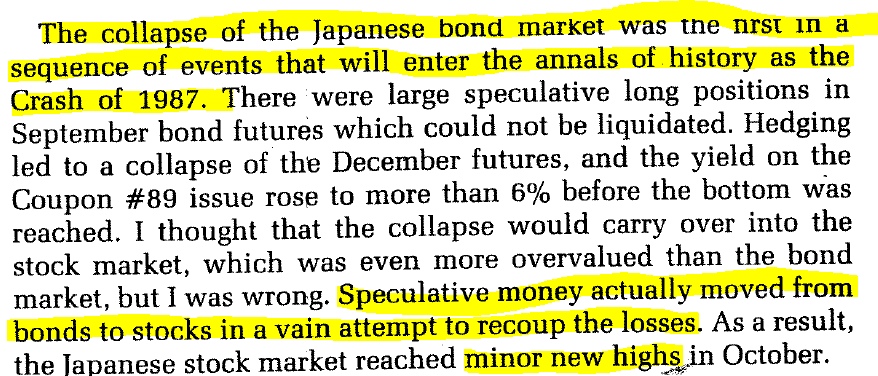

But in the end I'm not really sure of the cause. Point is, this sends a shockwave through global markets, particularly Australia, HK, New Zealand. Though Japan appeared to weather it well, I strongly believe it caused damage under the hood which wouldn't appear for 2 years.

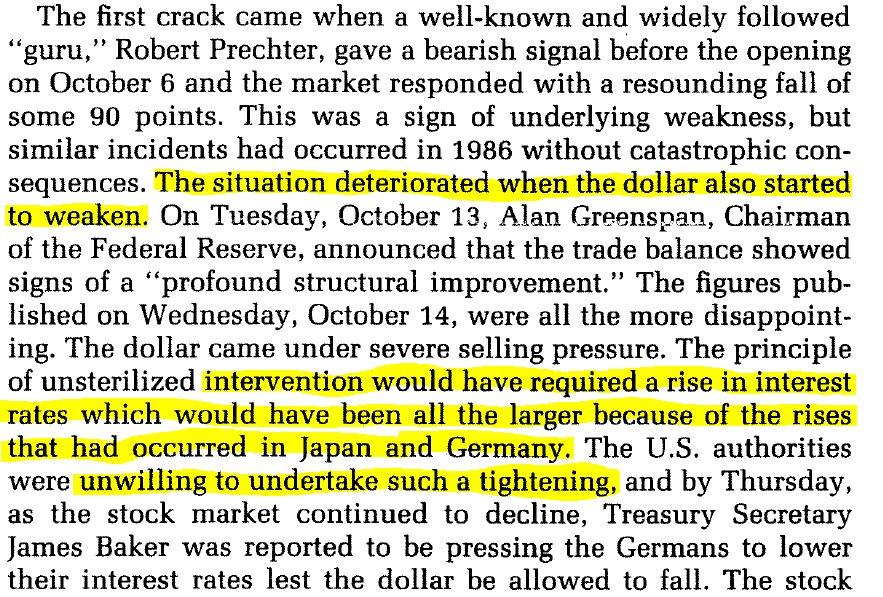

What's critical for now is that falling US equities were preceded and accompanied by a falling dollar. Greenspan and the US Fed can't raise rates, it'd further screw up equities. Curiously, Soros points to a dip in Japanese bonds as the original catalyst.

Greenspan famously gives only a short statement, the US Fed "affirmed today it's readiness to serve as a source of liquidity". No promises of anything, no direct intervention, no nothing.

And then, miraculously, the markets recover (kinda). Black 'n Blue Tuesday was still a little rough, but would you look at that, buys in the overnight futures, gap up on open, everything levels out over the coming year.

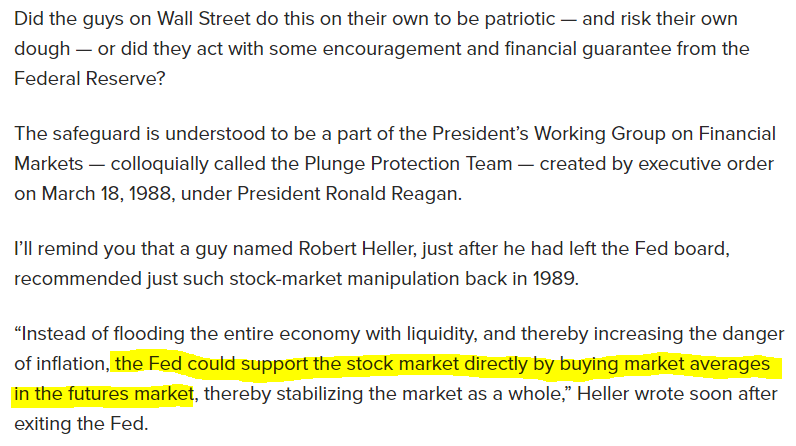

A short time later the Reagan administration forms by executive order the Working Group on Financial Markets, aka the Plunge Protection Team. Greenspan, Treasury Secretary Brady, SEC Chairman Ruder, Commodities Chairwoman Gramm.

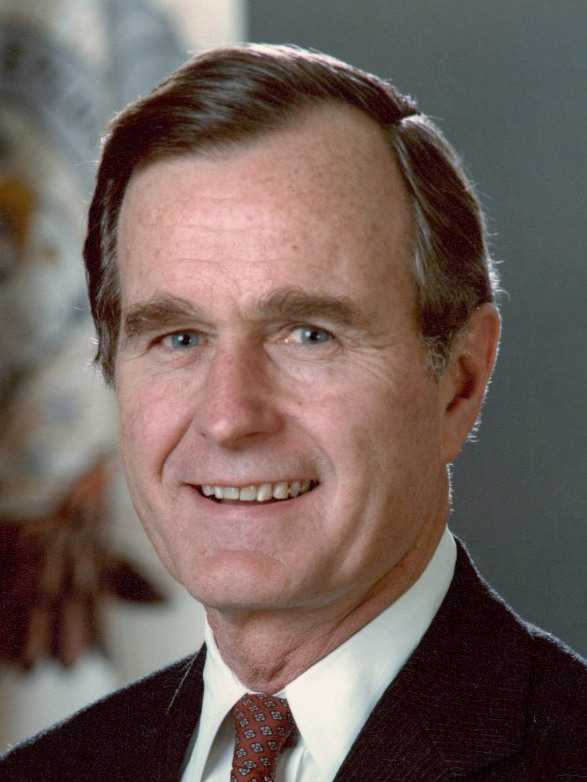

What these guys do has never been exactly clear. They support the market. Now, in 1987 the election was coming up. Poppy Bush really wanted to win, and the worst crash since the great depression sure would look bad...

Now this I'll never be able to prove, but read this statement from Fed board member Heller. They could support the market by buying index futures in an open market operation? I'm not saying they did it, I have no evidence, but wowee that'd be a secret to take to the grave.

I’m sure you remember Christmas Eve 2018, when Mnuchin made the call. Not saying it happened then either, just weird.

As a semi-related aside, Greenspan's memoir may be the worst book I've ever read. Creepily, it's written at a third-grade level. This guy expects me to believe he wanted to hike rates because some shoe factory in Missouri was booming?

Interesting that seems to imply that high employment and growth are NOT fed priorities though...

Anyway, back to Japan. It's 1989, the BOJ decides it's time to deliver the coup de grace to the overextended MOF and their commercial banks. They hike interest rates, knowing full well current asset prices will react horribly.

The bubble pops, and the commercial's books are now loaded with outstanding debt, debt that cannot be paid by abruptly unprofitable creditors. Their response, though natural, only exacerbates the problem.

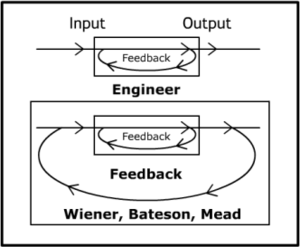

See, they become unwilling to make loans to unprofitable enterprises. Less loans, less cash, lower asset prices, less profit, less loans. It's a vicious cycle, one that central bankers (and Soros, being more of a cyberneticist than a trader) are acutely aware of.

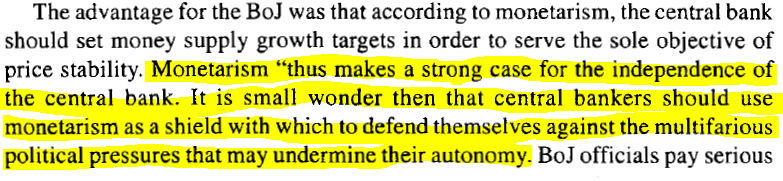

The BOJ responds with what on the outside looks benevolent, cutting rates. But despite massive and continuing rate cuts, asset prices don't improve, rather, they fall further. See, as we learned before, traditional monetary measures like this are not the source of money supply.

This also serves to deliver a second blow to commercials, with rates slashed to zero (eventually becoming negative), they're now unprofitable enterprises themselves. They get huge bailouts, they're termed "zombie banks".

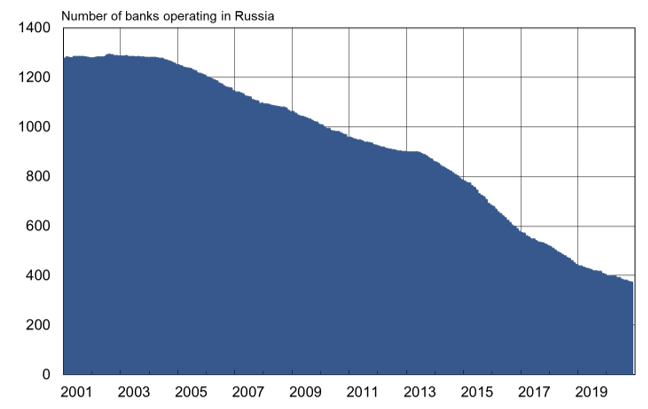

These bailouts though, like the rate cuts, appear conciliatory towards them. Wrong! The commercials are put in inescapable debt to the central bank, and slowly begin to collapse, consolidating into just 4 institutions all under the guidance of the BOJ.

The BOJ has achieved a total monopoly on the power of credit creation, an insane roll-up of power. What's more, they can use credit creation however they wish, after all central bank balance sheets are hardly impacted by bad debt.

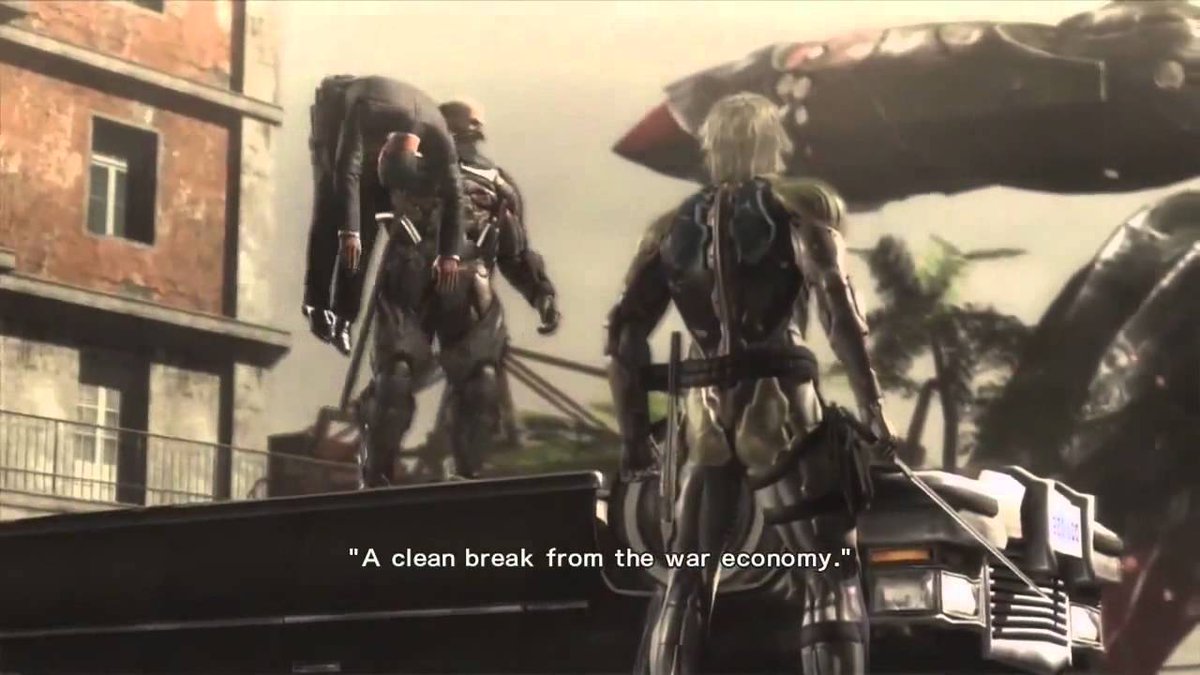

So, as the 90s wear on, businesses fail, Japan's suicide rate, unemployment reaches astonishing proportions, the average citizen's purchasing power is desolated, the BOJ does... nothing. They took all this power, they could end the nightmare at any time, yet they choose not to.

And with that, the war-economy system, and it's impediment to central bank control, disappears. Japan no longer runs a surplus, it now accrues national debt, like all other first world nations. It's government is now beholden to the IMF, and the Bank for International Settlements

BOJ Governer Mieno is essentially promoted, he becomes a board member at the BIS. Job well done, destroyed the most exemplary economy in the world.

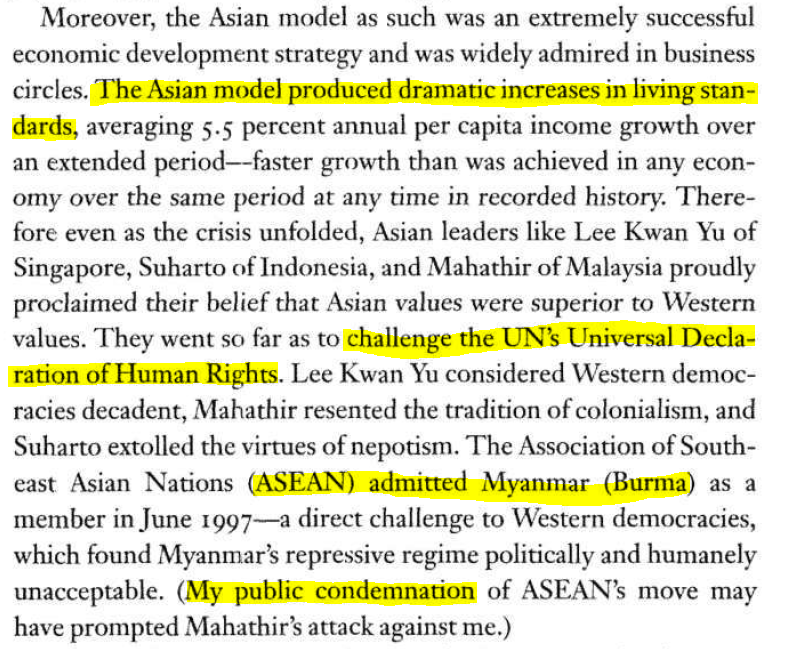

But the story doesn't end there, not even close. Let's take a closer look at what George Soros specifically was doing. We have to look at Thailand, Malaysia, Singapore, and South Korea. All three of these nations had (to varying degrees) attempted to emulate Japan's success.

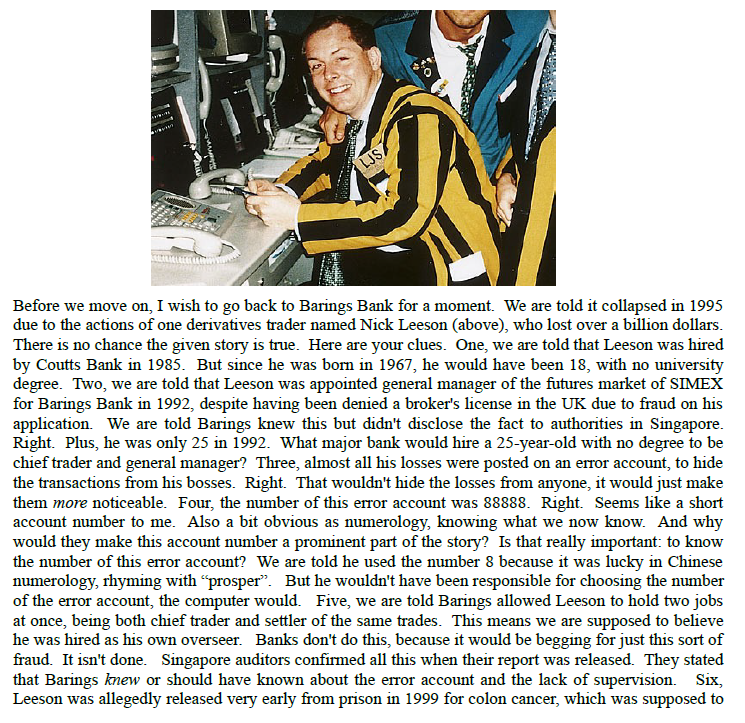

The "Emerging Market" boom was in full swing. It seemed like anyone could make money trading in SE Asia. Perhaps most famous is Nick Leeson, the rogue trader who's imbecilic delta one trading bankrupted Barings, charter bank in the City of London.

This is again, something I cannot prove, but given the theme of planned demolition of commercial banks, the inconsistencies in his story make me raise my eyebrows. Here's a truly paranoid take from Miles Mathis lol

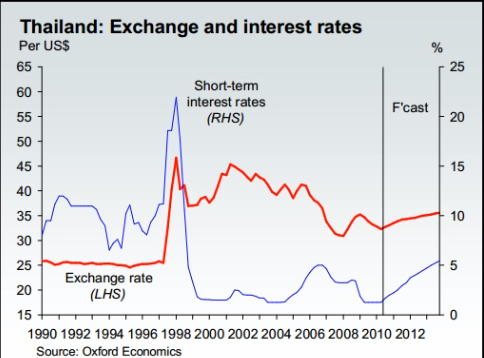

But anyway, a disturbingly similar story plays out in SE Asia. SEA banks borrow against the US Dollar, free to operate at a profit because their own central banks have established a currency peg to the USD.

But, they're getting too profitable! Standards of living are rising! Autocratic rulers like LKY are in charge, it's a Closed Society! Something must be done!

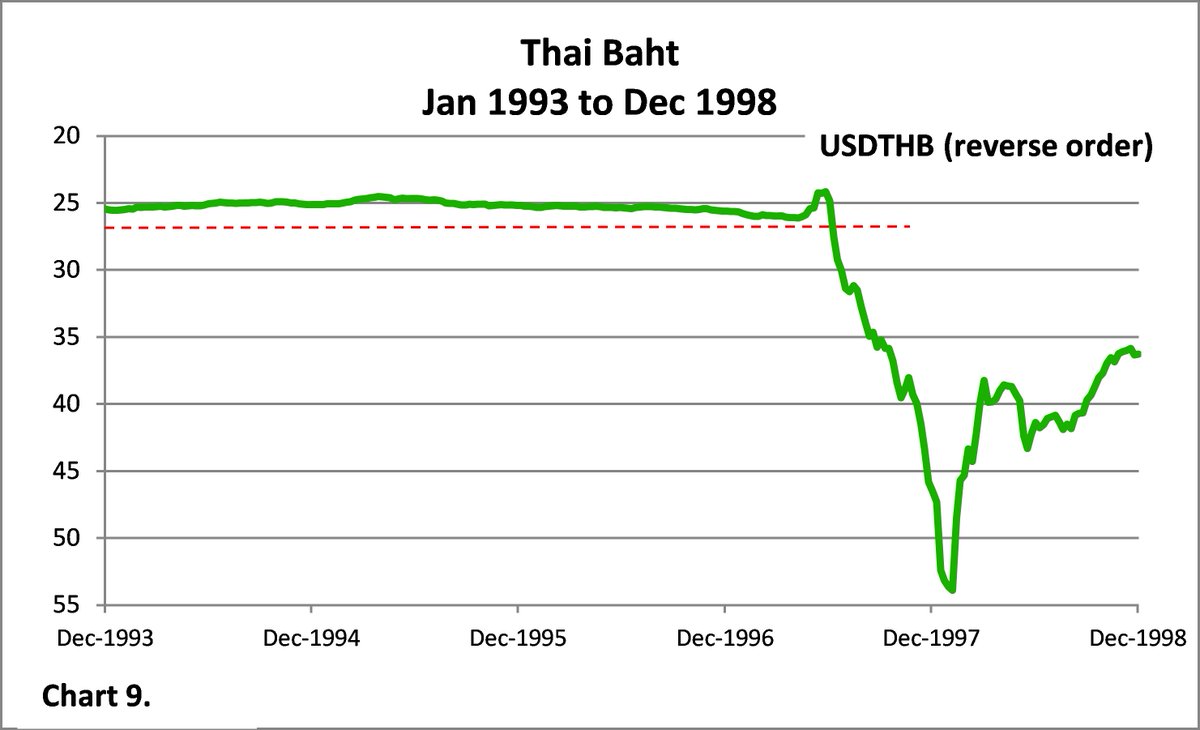

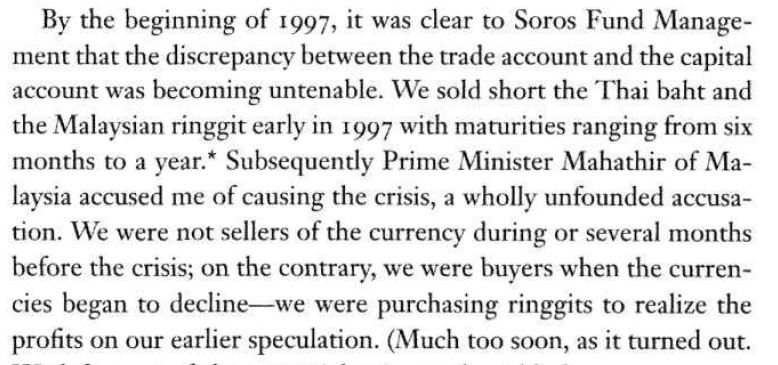

Soros' Quantum Fund, likely alongside his accomplice Joe Lewis' Tavistock Group (no relation to the Tavistock Institute, haha..) take a massive short position on the Thai Bhat and Malay Ringgit.

Now, Soros isn’t a central banker himself obviously, but his goals seem remarkably in line with theirs. In fact, he criticizes the IMF repeatedly for not being effective ENOUGH. Possible then, that he serves as sort of executioner for them, secondary to personal profit?

Unable to hold through the onslaught, the currency peg snaps. SEA banks now face massive exposure to their own rapidly depreciating currency. All the loans they offered are now bad debt which they cannot hope to get paid back.

Malay Prime Minister Mahathir says some not-so-nice stuff about Soros' ethnicity. The IMF steps in, offering to provide liquidity and stabilize the situation, as long as their geopolitical objectives will be acceded to.

Societies: Opened. But again, it doesn't end here. The consequences leapfrog around the world, and here's where I go fully paranoid. Soros had to have been aware that Russia and Ukraine had huge exposure to SEA credit and commodities demand.

What if the true attack was not against SEA nations, but halfway around the world in Russia? Soros was acutely ware of the geopolitical problems a newly capitalist Closed Society could pose.

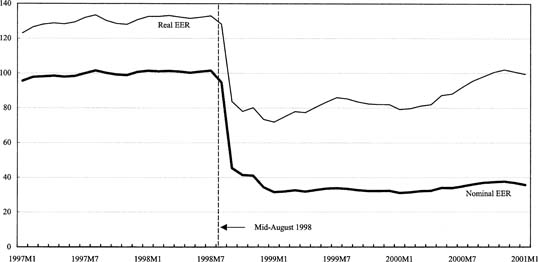

The shockwaves of the SEA crisis hit Russia hard, they were forced to default on their domestic debt, it devalued the Ruble, Russia (and it's oligarchs) were forced to take an IMF package which included "social reforms".

The consequences of this extend to extremely recent times. Oligarchs attempt to evacuate capital to Cyprus, they get hit again in 2013 during the Cypriot banking crisis.

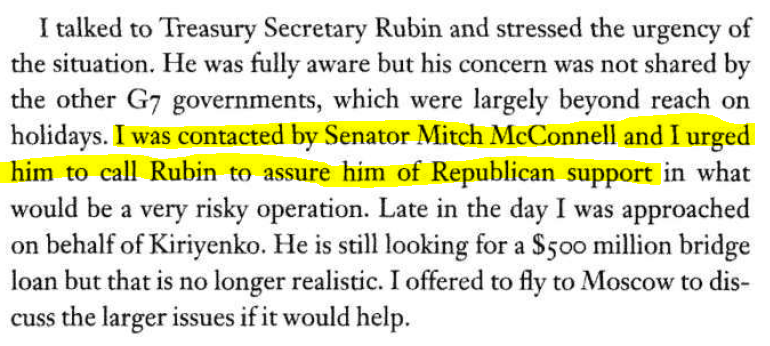

During this crisis Soros was personally involved in constructing the package. And apparently Mitch McConnell, who has his phone number?

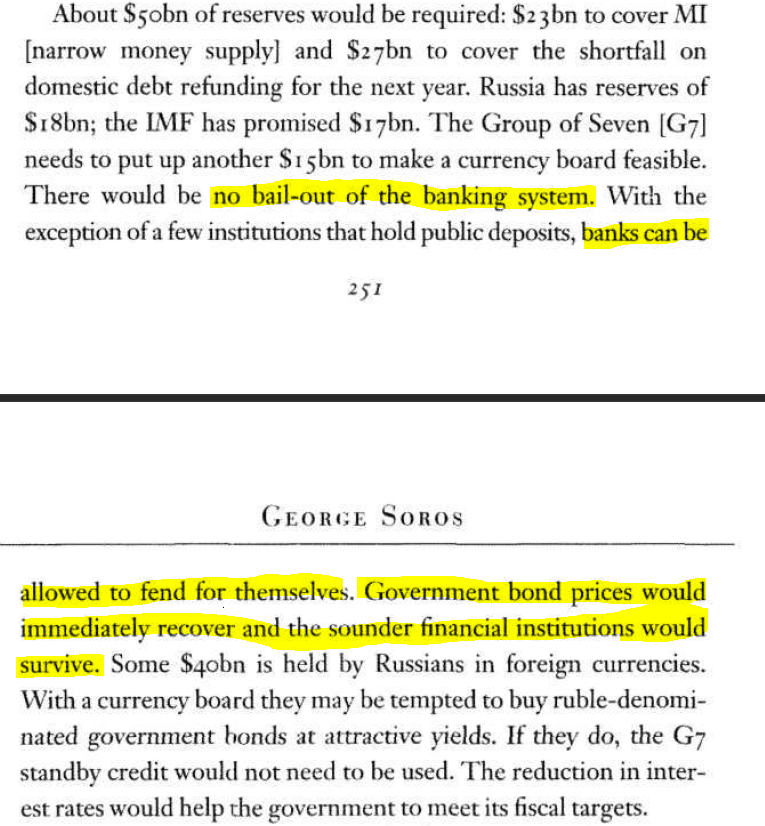

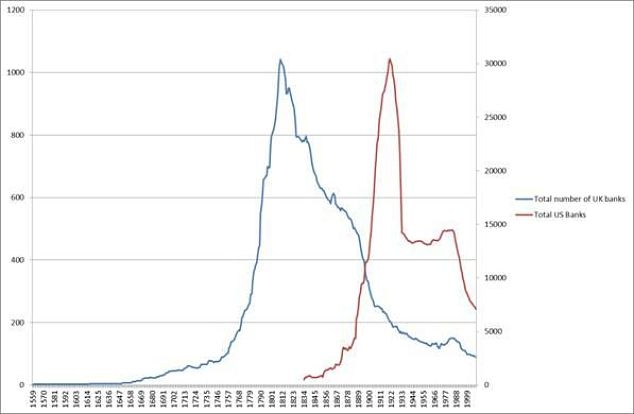

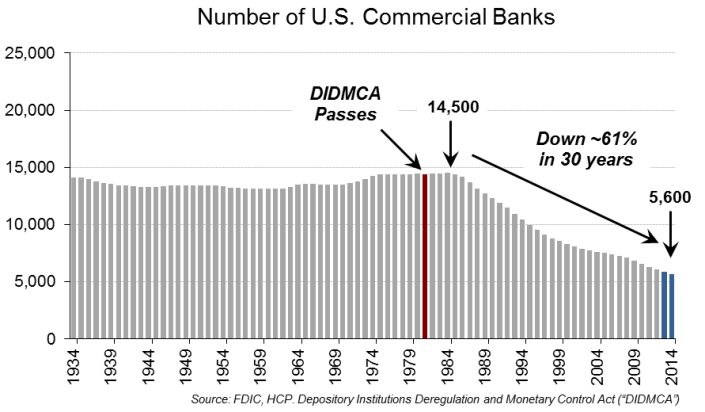

Many banks were not bailed out, left to go under. More centralization of power, less individual institutions capable of creating credit.

Let's look at what Soros has to say about Putin (who's rolling up of oligarchs cleaned up this mess). If Putin succeeds (he pretty much did, this was written in '98), Soros profits directly.

But, look at that. If he fails, Soros and central banks gain ideological power. That's the way this works, they set up a win-win situation, capturing capital on the way up, and accruing power on the way down.

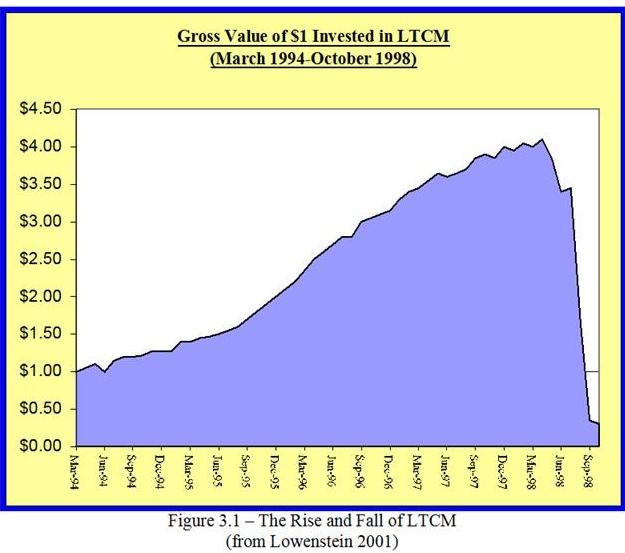

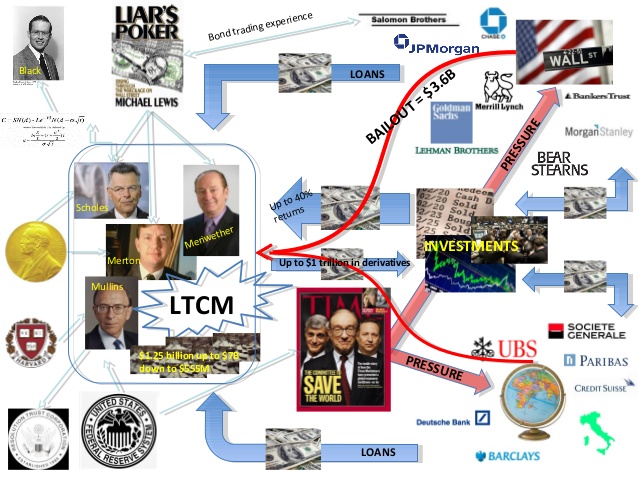

The Russia crisis had the added benefit of blowing up LTCM (rip Scholes and Merton ;_;), which led to Salomon Brothers being rolled into Citi. It's not like it isn't happening in the US.

Alright, last part, I promise. I think it's important to realize this hasn't ended, it's an uninterrupted chain, an endless power grab by central banks intent on eliminating the autonomy of individual institutions to impinge on the money supply.

All crashes and crises should be assumed to further these ends. Dotcom bubble (big thred on that one day), 2008 to clean up the scraps, Corona, this is leading somewhere. No commercials, all Fed.

And Soros spells it out unambiguously. Back in the late 90's he was an advocate of a bunch of weird NGO stuff like Jubilee 2000 and the Meltzer Commission, that didn't really seem to go anywhere. Horrible spooky aesthetic to Jubilee 2000 btw

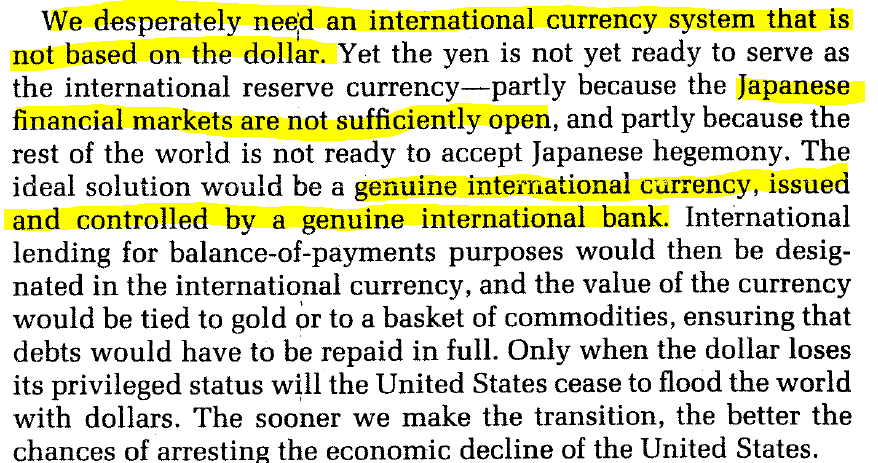

But look at this, as early at 1997 he knew what he wanted. Abolishment of national currencies, created and distributed by a new central bank, a world central bank. Full-spectrum centralized control of money supply.

He lamented there being "no architectural solution AT PRESENT". Well, there's an architecture now. Ever since Corona rekt the markets last year there's been growing talk of a Central Bank Digital Currency from the Fed.

Look, Klaus Schwab himself mentions this as an objective in his The Great Reset book. He also explicitly says he sees the Japanification of the US in the cards, though anomalously, he doesn't see inflation...

And the conditions to implement it are almost perfect. I think it goes without saying (sorry GME boys) that the most interesting trade in the last year has been the DXY.

Now, not to be an alarmist, but I could see this developing into an intractable balance-of-payments issue. Falling dollar, rising yields, what happens when the equity market falls alongside? Yellen's gonna try n defend the dollar, but secular inflation looms large in my mind.

What does unlimited QE turn into, massive treasury purchases? UBI proffering a falling dollar, an unemployed populace being victimized by fed policy? Yield curve ““Control””? Threatening rumors of a gold-backed digital Yuan can’t have escaped notice.

This would be the power grab to (quite literally) end all power grabs. Introduce negative rates, let the banks go under or consolidate them into controlled enterprises; gone forever would be the opportunity to re-introduce authentic growth.

• • •

Missing some Tweet in this thread? You can try to

force a refresh