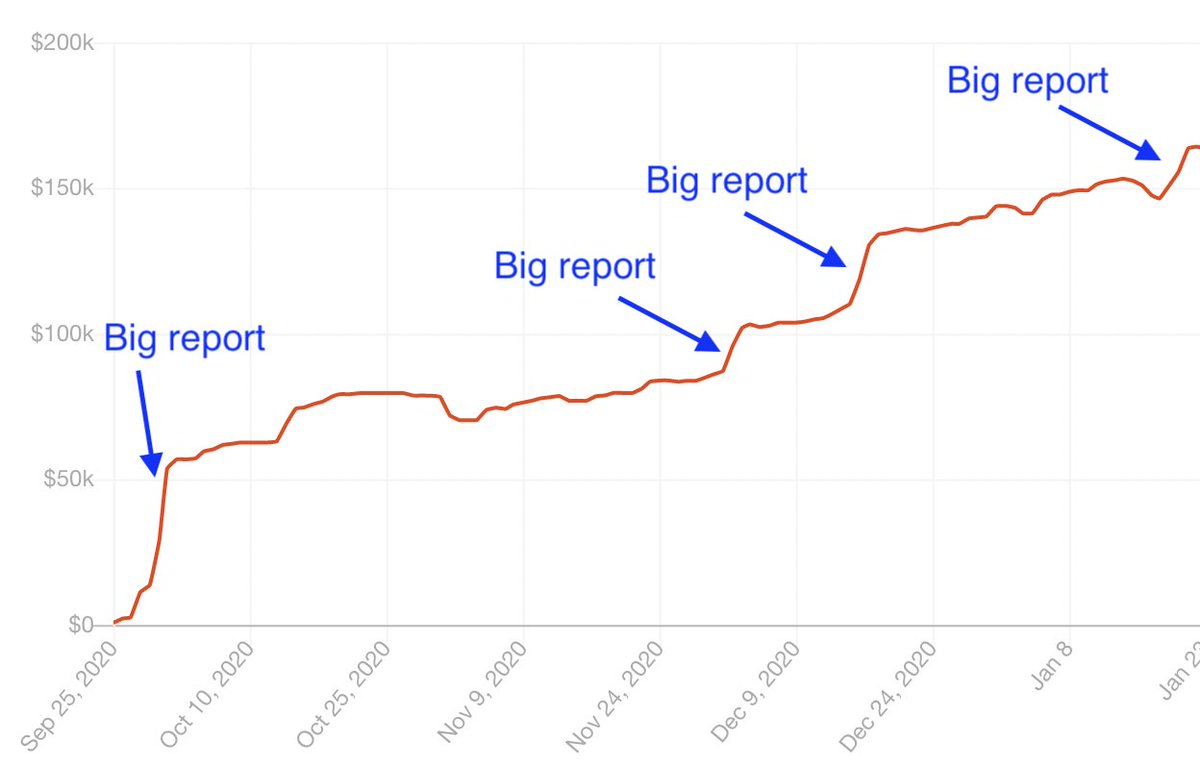

After one year of a free newsletter, and now four months into paid, this thing is for real:

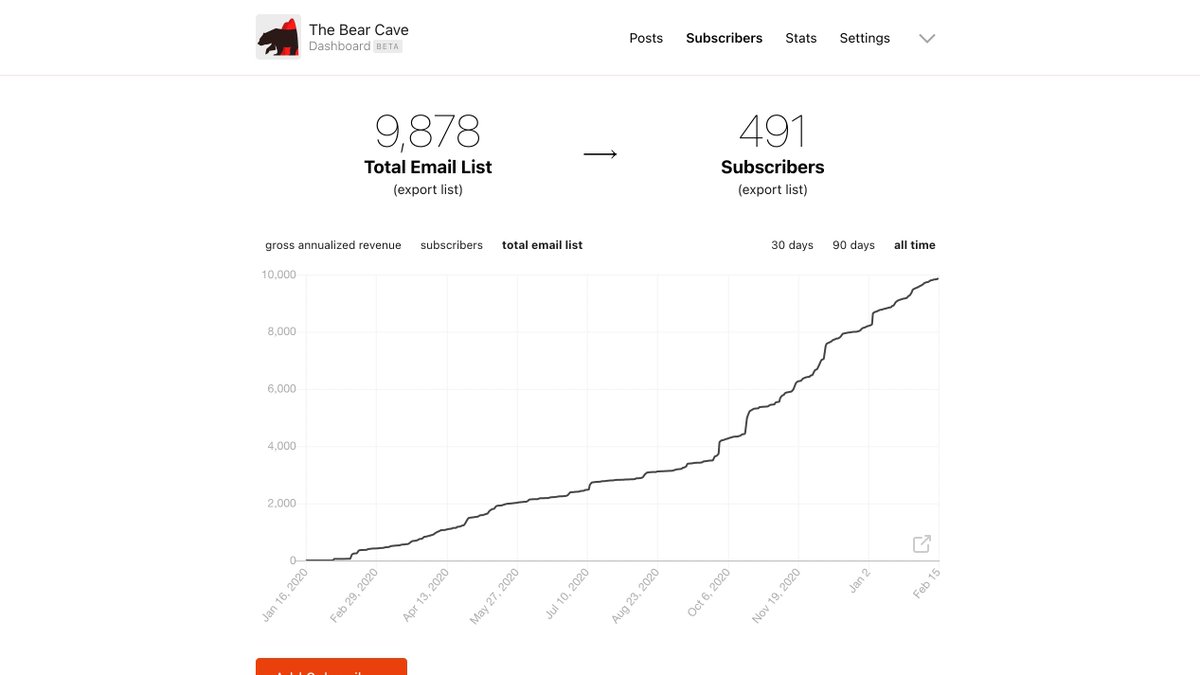

🙏 ~500 paid subscribers

🎉 ~10,000 free subscribers

🤯 ~$160k ARR (before fees)

For anyone thinking about launching a newsletter, some early learnings in the thread below 👇

🙏 ~500 paid subscribers

🎉 ~10,000 free subscribers

🤯 ~$160k ARR (before fees)

For anyone thinking about launching a newsletter, some early learnings in the thread below 👇

1/ Do something UNIQUE. You want to be the only person who does what you do. Build a personal monopoly.

No one wants more email, so you need something unique and differentiated to make it work.

No one wants more email, so you need something unique and differentiated to make it work.

2/ Internet niches are bigger than you think, even when your account for the fact they are bigger than you think.

Passionate about agricultural tech? European bonds? Distressed debt in India? Busted tech IPOs?

Each of these would work if you're passionate and dominate it.

Passionate about agricultural tech? European bonds? Distressed debt in India? Busted tech IPOs?

Each of these would work if you're passionate and dominate it.

3/ Keep it simple and short.

Keep the max length below 1,500 words. If you are even thinking about cutting something, then cut it. Brevity is the soul of wit.

Keep the max length below 1,500 words. If you are even thinking about cutting something, then cut it. Brevity is the soul of wit.

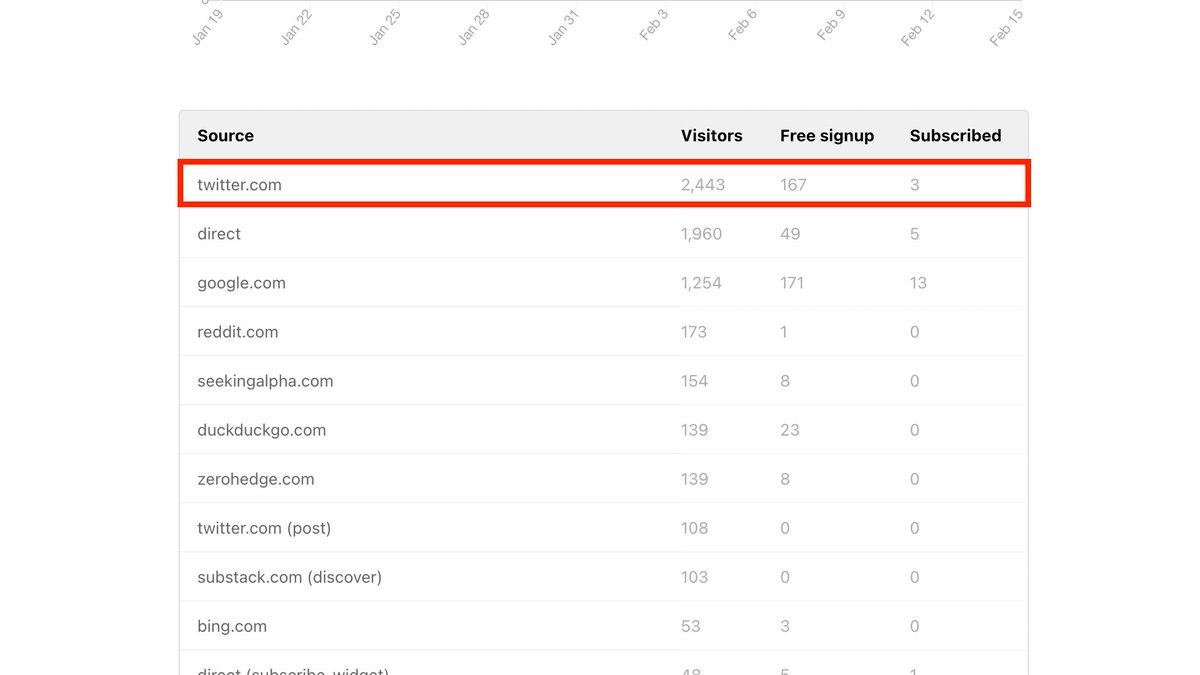

4/ Use Twitter.

Almost all successful newsletter authors use Twitter to promote their newsletter. It is a great way to get momentum and build true fans. Twitter, word of mouth, and earned media are best growth strategies IMO.

Almost all successful newsletter authors use Twitter to promote their newsletter. It is a great way to get momentum and build true fans. Twitter, word of mouth, and earned media are best growth strategies IMO.

5/ Fewer emails.

I send six emails every month (4 free and 2 paid). Daily emails are not required, especially in professional services. People would much rather read something great once a week, than something mediocre every day.

I send six emails every month (4 free and 2 paid). Daily emails are not required, especially in professional services. People would much rather read something great once a week, than something mediocre every day.

6/ Respond to email quickly.

Responding to email quickly (especially from reporters) has led to a ton of new opportunities. It is flattering for the other person and doesn’t require more time from you.

Responding to email quickly (especially from reporters) has led to a ton of new opportunities. It is flattering for the other person and doesn’t require more time from you.

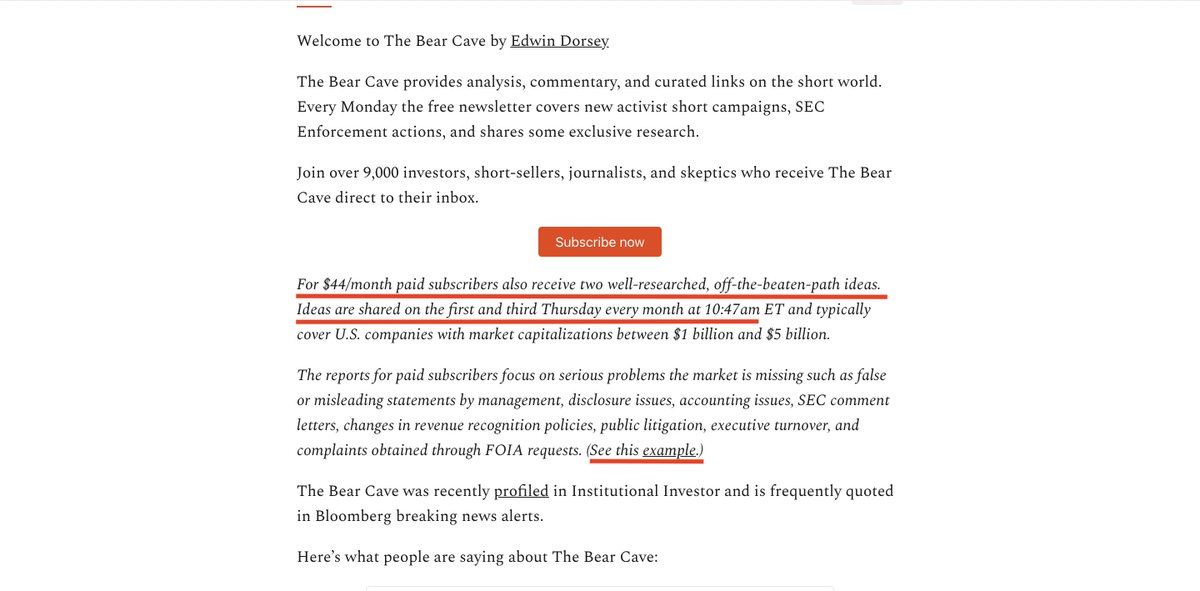

7/ Clearly define what paid subscribers get.

Have a very clear policy on what free subscribers get and what paid subscribers get. People want to know what they are paying for. Having it wishy-washy is a big turn off and will generate complaints.

Have a very clear policy on what free subscribers get and what paid subscribers get. People want to know what they are paying for. Having it wishy-washy is a big turn off and will generate complaints.

8/ Occasionally target free subscribers with promo emails.

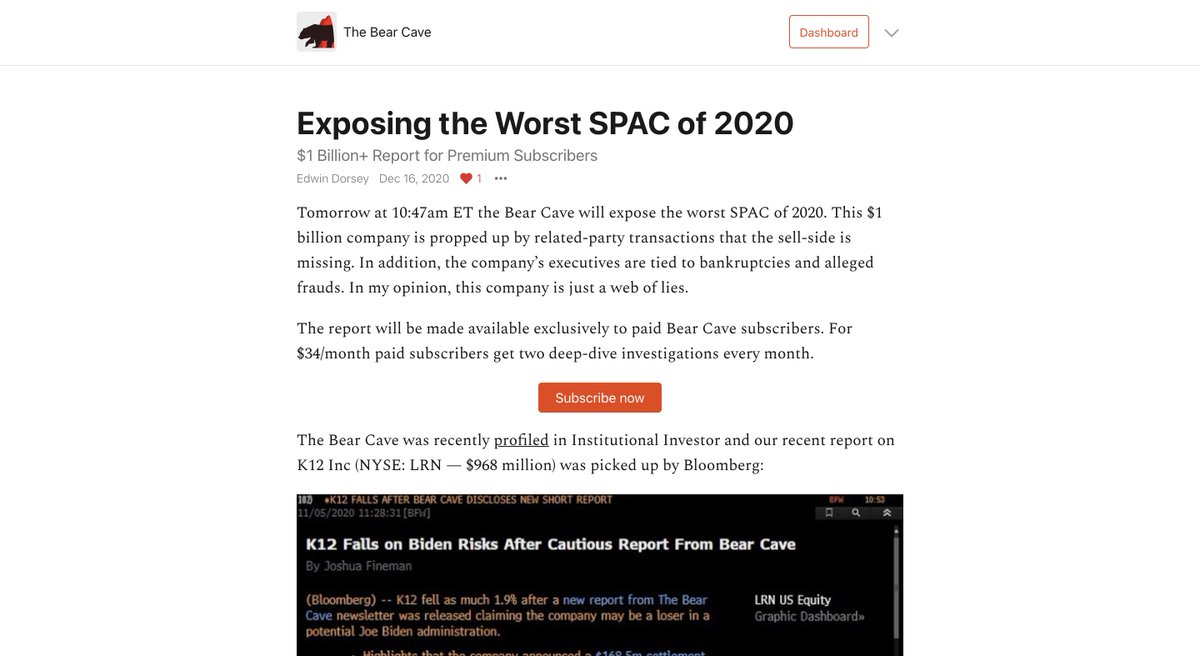

A truthful and intriguing promo email can work wonders. The email below generated $10K+ of revenue in one day.

A truthful and intriguing promo email can work wonders. The email below generated $10K+ of revenue in one day.

10/ Newsletter economics.

Substack takes 10%. Stripe takes ~4%. Refund requests ~1%.

BUT you are paid a lot up front with annual subscriptions. Low churn in the professional services sector. If people can expense it, they are much less price-sensitive.

Substack takes 10%. Stripe takes ~4%. Refund requests ~1%.

BUT you are paid a lot up front with annual subscriptions. Low churn in the professional services sector. If people can expense it, they are much less price-sensitive.

This thread was inspired by @lennysan. He puts out great content.

https://twitter.com/lennysan/status/1265072097849602048

This is a good video for anyone interested in starting a newsletter. @david_perell has EXCELLENT content about writing online.

https://twitter.com/david_perell/status/1259539005097426944

Also, I highly recommend using Substack. @hamishmckenzie and @cjgbest are world-class.

We are in the early innings of a newsletter revolution.

https://twitter.com/borrowed_ideas/status/1360692022101893131

Update! The Bear Cave gained ~700 free subscribers and 12 paying ones in the last three days!!

Thank you all for your incredible support. thebearcave.substack.com/subscribe

Thank you all for your incredible support. thebearcave.substack.com/subscribe

• • •

Missing some Tweet in this thread? You can try to

force a refresh