In her Senate Finance Committee hearing today, USTR-nominee Katherine Tai stated, "the Biden administration itself is committed to a holistic review of China and the US-China strategy."

Good. In a new paper, I too reviewed US-China strategy.

My latest 1/

piie.com/publications/w…

Good. In a new paper, I too reviewed US-China strategy.

My latest 1/

piie.com/publications/w…

US-China trade war average tariffs:

• US tariff on China went from 3% to 19.3%

• China's tariff on US exports went from 8% to 20.7%

Trump did get China to liberalize - just toward everyone else, not the US:

• China cut its tariff toward rest of world from 8% to 6.1%

2/

• US tariff on China went from 3% to 19.3%

• China's tariff on US exports went from 8% to 20.7%

Trump did get China to liberalize - just toward everyone else, not the US:

• China cut its tariff toward rest of world from 8% to 6.1%

2/

Despite the Phase One agreement, US tariffs on China remain in effect, covering $335 billion of imports from China.

US tariffs remain on a lot of intermediate inputs, raising costs to US businesses and their workers...

3/

US tariffs remain on a lot of intermediate inputs, raising costs to US businesses and their workers...

3/

Despite the Phase One agreement, China's tariffs technically remain in effect, covering $90 billion of imports from the United States.

If someone in China wants to import from the US, there is a separate tariff exemption process run by its Ministry of Finance...

4/

If someone in China wants to import from the US, there is a separate tariff exemption process run by its Ministry of Finance...

4/

In 2018, Trump administration set up an opaque "product exclusion" process for companies to beg for an exemption from tariffs on China.

We now have estimates for how much imports they excluded (4% of tariffed products) and how much US tariff revenue was foregone ($8.3 bn)...

5/

We now have estimates for how much imports they excluded (4% of tariffed products) and how much US tariff revenue was foregone ($8.3 bn)...

5/

Trade Remedies!!!

Fear not! US antidumping and countervailing duties continued on their upward trend during the Trump administration.

US antidumping duties covered 7.4% of imports from China at the end of 2016, increasing to 10.3% by end of 2020...

6/

Fear not! US antidumping and countervailing duties continued on their upward trend during the Trump administration.

US antidumping duties covered 7.4% of imports from China at the end of 2016, increasing to 10.3% by end of 2020...

6/

US-China trade war tariffs: What if you throw in...

• Antidumping – the average tariff goes up (by A LOT in the US case)

• Product exclusions – the average tariff goes down a bit

7/

• Antidumping – the average tariff goes up (by A LOT in the US case)

• Product exclusions – the average tariff goes down a bit

7/

Oof! By the end of the Trump administration, you are left with A LOT of overlapping US tariffs on China.

I.e., many products being hit with MULTIPLE special tariffs all at once.

Take Steel: Antidumping duties! Section 232 national security tariffs!! Section 301 tariffs!!!

8/

I.e., many products being hit with MULTIPLE special tariffs all at once.

Take Steel: Antidumping duties! Section 232 national security tariffs!! Section 301 tariffs!!!

8/

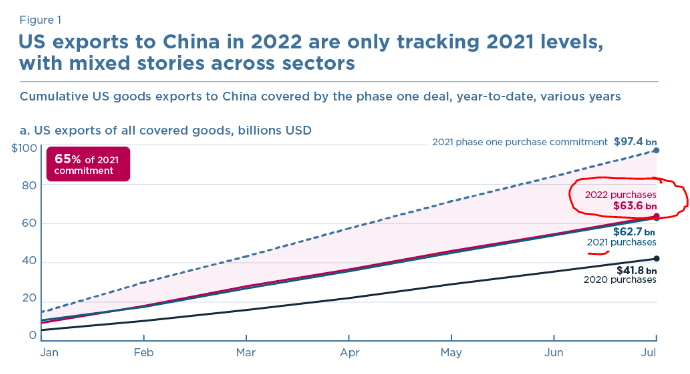

In late 2019, China agreed to buy tens of billions of dollars of additional US exports in 2020 under Trump's Phase One deal.

That didn't happen...

9/

That didn't happen...

9/

MANUFACTURING: Trump cast his trade war as designed to help US manufacturing.

US manufacturing exports to China had nearly doubled 2009-17. The trade war put an end to that.

And in the first year of Phase One, manufacturing continued to suffer, declining another 5%...

10/

US manufacturing exports to China had nearly doubled 2009-17. The trade war put an end to that.

And in the first year of Phase One, manufacturing continued to suffer, declining another 5%...

10/

AGRICULTURE: Amazing! It got back to 2017 levels. But Ag exports...

• ended up 18% short of the 2020 legal commitment

• FAR lower than Trump's deal (see Annex 6-1 footnote b) wanted - ie, China would “strive” to buy $5bn more per year ON TOP OF the unmet commitments...

11/

• ended up 18% short of the 2020 legal commitment

• FAR lower than Trump's deal (see Annex 6-1 footnote b) wanted - ie, China would “strive” to buy $5bn more per year ON TOP OF the unmet commitments...

11/

ENERGY: The commitments themselves were a puzzle

And those exports performed the worst of the three goods sectors, reaching less than 40% of the 2020 legal commitment...

12/

And those exports performed the worst of the three goods sectors, reaching less than 40% of the 2020 legal commitment...

12/

The paper has more, including

• export controls!

• withhold release orders!

• reclassification of Hong Kong!

Most importantly, find **ALL THE DATA** organized to conduct your own (better!!!) research and holistic review of US-China strategy.

ENDS /

piie.com/publications/w…

• export controls!

• withhold release orders!

• reclassification of Hong Kong!

Most importantly, find **ALL THE DATA** organized to conduct your own (better!!!) research and holistic review of US-China strategy.

ENDS /

piie.com/publications/w…

• • •

Missing some Tweet in this thread? You can try to

force a refresh