Markets are shifting. Narrative stocks are getting killed relative to valuation plays. I made this poll to discuss valuing companies. A thread 👇

1/ The Twitter consensus for this hypothetical business is 21.4x Earnings. To quote Elon, the price is too high imo. Why?

1/ The Twitter consensus for this hypothetical business is 21.4x Earnings. To quote Elon, the price is too high imo. Why?

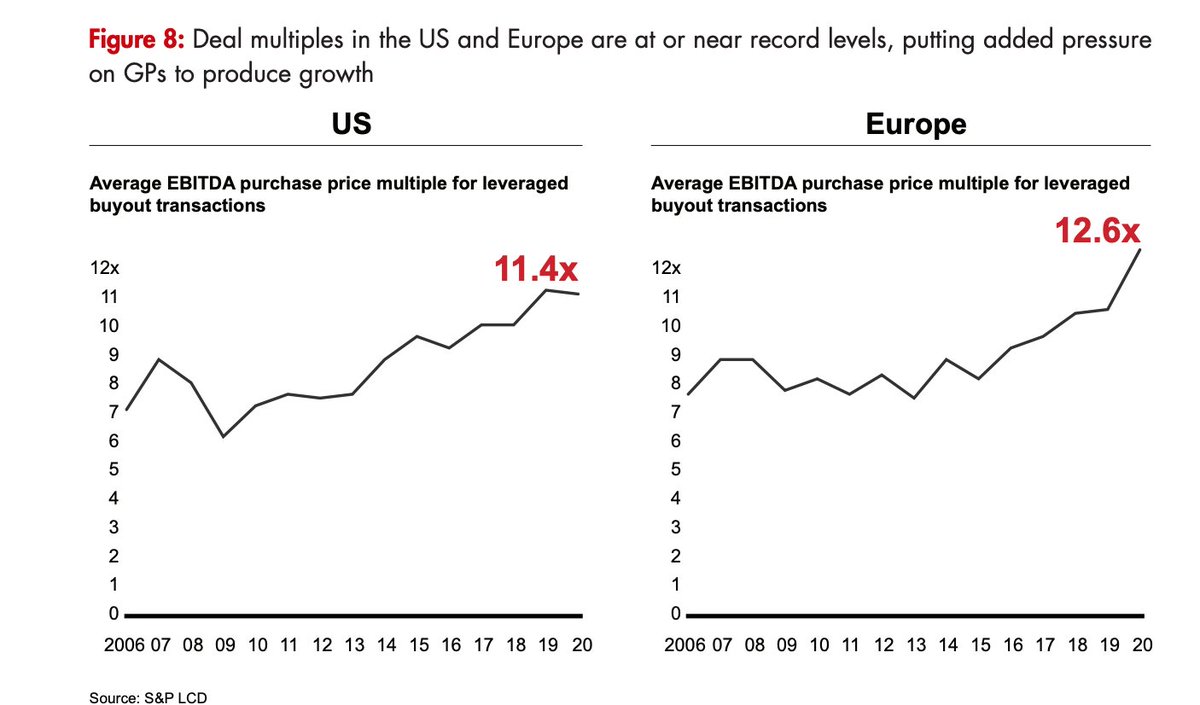

2/ Takeout Premium. The firm is likely private. Bain and Deloitte stats for a PE takeout in Consumer & Software are ~12.5x EBITDA for this growth. Back of envelope given industry cap structures, about 21x EPS. If you pay the exit multiple up front, you have no upside.

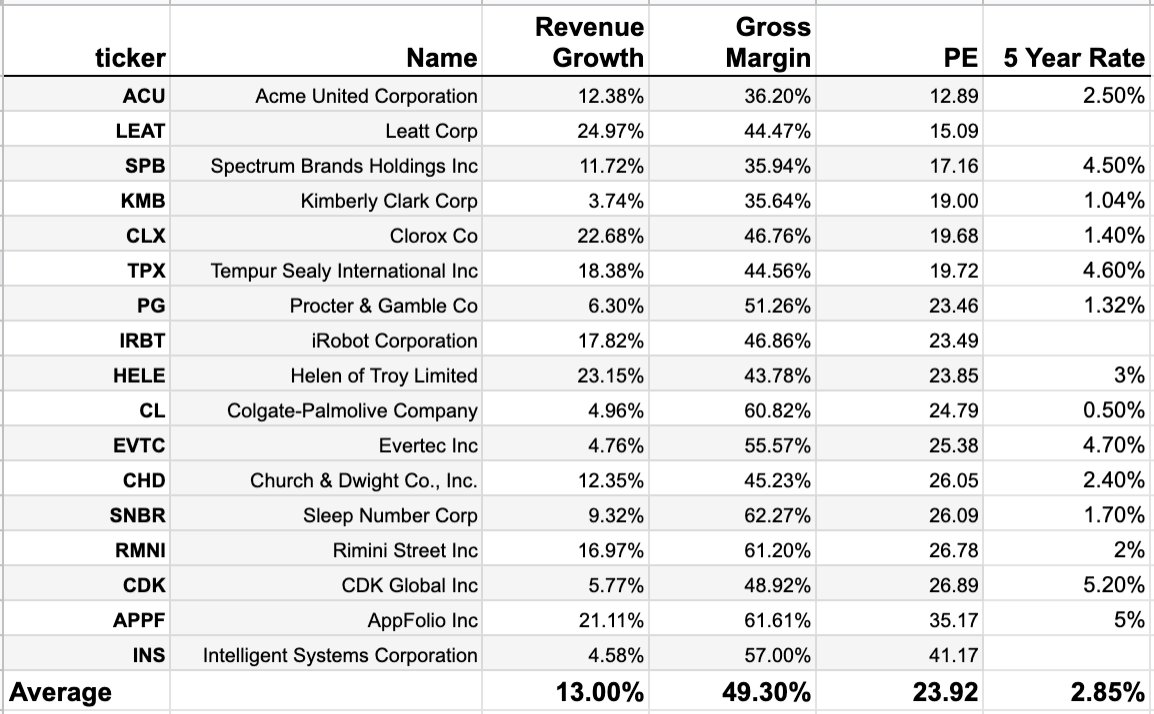

3/ Liquidity Premium. Because the firm is private, you can't sell if things get bad. You're paying above Clorox and P&G's multiple for this random biz. And if things go south you could lose 50%+ trying to liquidate vs only gaining 10% for avg IPO multiple. Bad risk reward.

4/ Interest Rate. The avg public comparable has a 5y debt rate of 2.85% because of access to liquid credit markets. Bank loans are less predictable and liquid. If you discount the 4% bank loan to an IG loan at 2.8% the resulting multiple is ~17x, so paying 21x is once again high.

5/ Info Premium. As many commenters noted, you know nothing about the business or the terms of the deal (share structure, board seat?). Your willingness to pay up for a business you know nothing about should be lower. Underwriting 21 years of earnings w no knowledge is unwise.

6/ Implied Mix. Given the margin mix and growth rate -- it's highly probable the business is primarily consumer goods (software typically 70%+ gross margins, and covid saw big SAAS growth). This, all things being equal should lower your multiple bc it has lower terminal margins

7/ Key points to get across, relevant to today's market 1) you don't have to transact if you don't know a business 2) good to have quantified upside that is realistic based on comps 3) liquidity & capital access should get a premium. credit is a relevant discount rate.

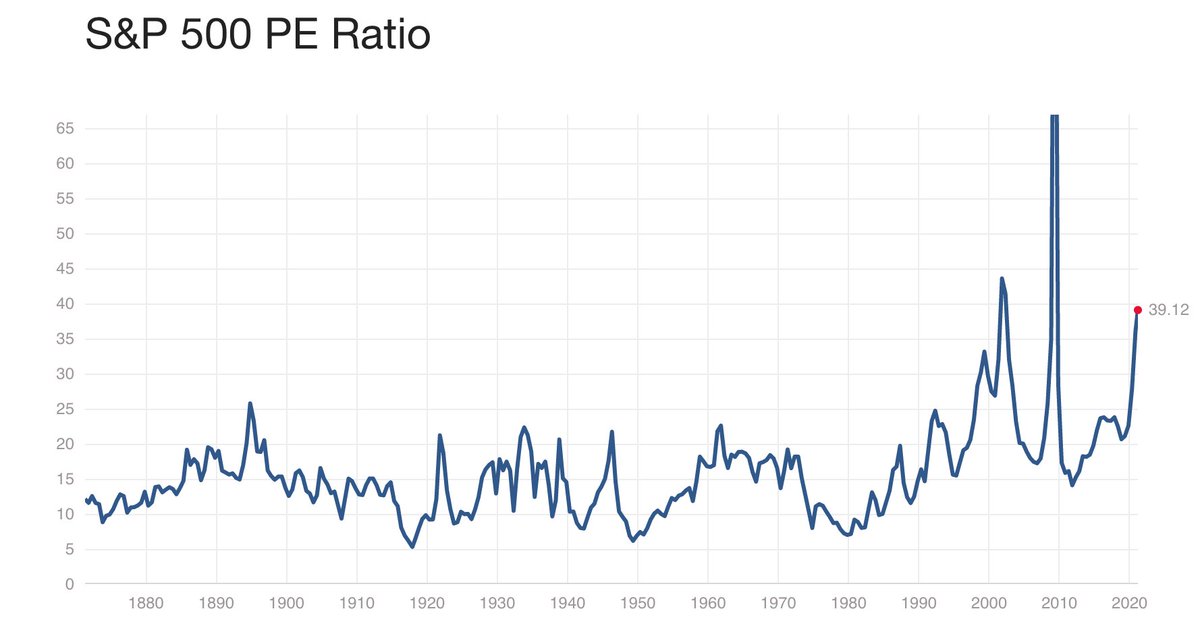

8/ I'll end with the stats on the S&P 500. Trailing revenue Growth (using past 3 months vs prior year) +2%. Gross margin 40%. PE Ratio: 39x. Blended cost of debt (all maturities): 2%. Is it worth it? When the market starts focusing on value - I think it's worth asking.

• • •

Missing some Tweet in this thread? You can try to

force a refresh