Time for me to crawl to the cross and admit DEFEAT on the Ethereum L2 vs. Bitcoin LN bet I made vs. @RyanTheGentry & @giacomozucco in September last year.

Bet amount: 2x$1000

Data thread & how I lost 👇

Bet amount: 2x$1000

Data thread & how I lost 👇

https://twitter.com/RyanTheGentry/status/1301526001252474883

Some background context--

Me: "Ethereum L2s will outrun LN so fast it's not even funny."

Ryan: "You're imagining L2 solutions that don't exist will succeed much faster than LN has. Why?

Giacomo: "Can I pile in on that?"

Me: "Ethereum L2s will outrun LN so fast it's not even funny."

Ryan: "You're imagining L2 solutions that don't exist will succeed much faster than LN has. Why?

Giacomo: "Can I pile in on that?"

We finally decided that we would compare the following TVL in $ value:

Bitcoin: LN public channels

Ethereum: rollups/state-channels/plasma

We'd exclude: fiat-backed tokens (USDT, USDC, GUSD, TUSD, BUSD etc.)

Bitcoin: LN public channels

Ethereum: rollups/state-channels/plasma

We'd exclude: fiat-backed tokens (USDT, USDC, GUSD, TUSD, BUSD etc.)

When we made the bet, these were the following stats:

Bitcoin LN public channels: ~$12m

Ethereum rollups/etc: ~$19m (99% @loopringorg)

In order for my "Ethereum L2s will outrun LN so fast it's not even funny" prediction to hold, it was decided I'd need to win by 10x (~$120m?).

Bitcoin LN public channels: ~$12m

Ethereum rollups/etc: ~$19m (99% @loopringorg)

In order for my "Ethereum L2s will outrun LN so fast it's not even funny" prediction to hold, it was decided I'd need to win by 10x (~$120m?).

I've run the numbers & here are the most recent Ethereum stats (was pretty hard, forgive errors):

Ethereum mainnet state channels

Connext - $483k (etherscan.io/address/0xe3cF…)

Kchannels - $2k (etherscan.io/address/0xbd94…, etherscan.io/address/0x1944…)

Raiden - $415 (explorer.raiden.network/tokens/0x6B175…)

Ethereum mainnet state channels

Connext - $483k (etherscan.io/address/0xe3cF…)

Kchannels - $2k (etherscan.io/address/0xbd94…, etherscan.io/address/0x1944…)

Raiden - $415 (explorer.raiden.network/tokens/0x6B175…)

Ethereum ZK-rollups

Aztec - $291k (etherscan.io/address/0x7379…)

zkSync - $7.6m (etherscan.io/address/0xabea…)

Loopring - $164m (etherscan.io/address/0x674b…)

Aztec - $291k (etherscan.io/address/0x7379…)

zkSync - $7.6m (etherscan.io/address/0xabea…)

Loopring - $164m (etherscan.io/address/0x674b…)

Ethereum plasma

Polygon (Matic Plasma) - $22m (etherscan.io/address/0x401F…)

Leverj Gluon - $5.9m (etherscan.io/address/0x75AC…, etherscan.io/address/0xDA88…)

OMG Network - $3m (etherscan.io/address/0x070c…, etherscan.io/address/0x3eed…)

Polygon (Matic Plasma) - $22m (etherscan.io/address/0x401F…)

Leverj Gluon - $5.9m (etherscan.io/address/0x75AC…, etherscan.io/address/0xDA88…)

OMG Network - $3m (etherscan.io/address/0x070c…, etherscan.io/address/0x3eed…)

Ethereum validium

DeversiFi - $15m (etherscan.io/address/0x5d22…, etherscan.io/address/0xaf8a…)

dYdX - $41m (etherscan.io/address/0x0940…)

DeversiFi - $15m (etherscan.io/address/0x5d22…, etherscan.io/address/0xaf8a…)

dYdX - $41m (etherscan.io/address/0x0940…)

Across these Ethereum solutions we find approximately $339m vs. Bitcoin LN's original $12m (28x).

But wait! After we filter out all fiat-backed tokens ($16.2m), the $339m figure is closer to $323m (27x).

(Ok, that didn't make that much of a difference 🤷♂️).

But wait! After we filter out all fiat-backed tokens ($16.2m), the $339m figure is closer to $323m (27x).

(Ok, that didn't make that much of a difference 🤷♂️).

But there's more!

Although ethereum.org/en/developers/… considers these plasmas and validiums as "L2", us bitcoiners (me, Ryan & Giacomo at least) don't really agree with that def (data availability comes with trust guarantees).

So we're down from $323m to a measly $242m (20x).

Although ethereum.org/en/developers/… considers these plasmas and validiums as "L2", us bitcoiners (me, Ryan & Giacomo at least) don't really agree with that def (data availability comes with trust guarantees).

So we're down from $323m to a measly $242m (20x).

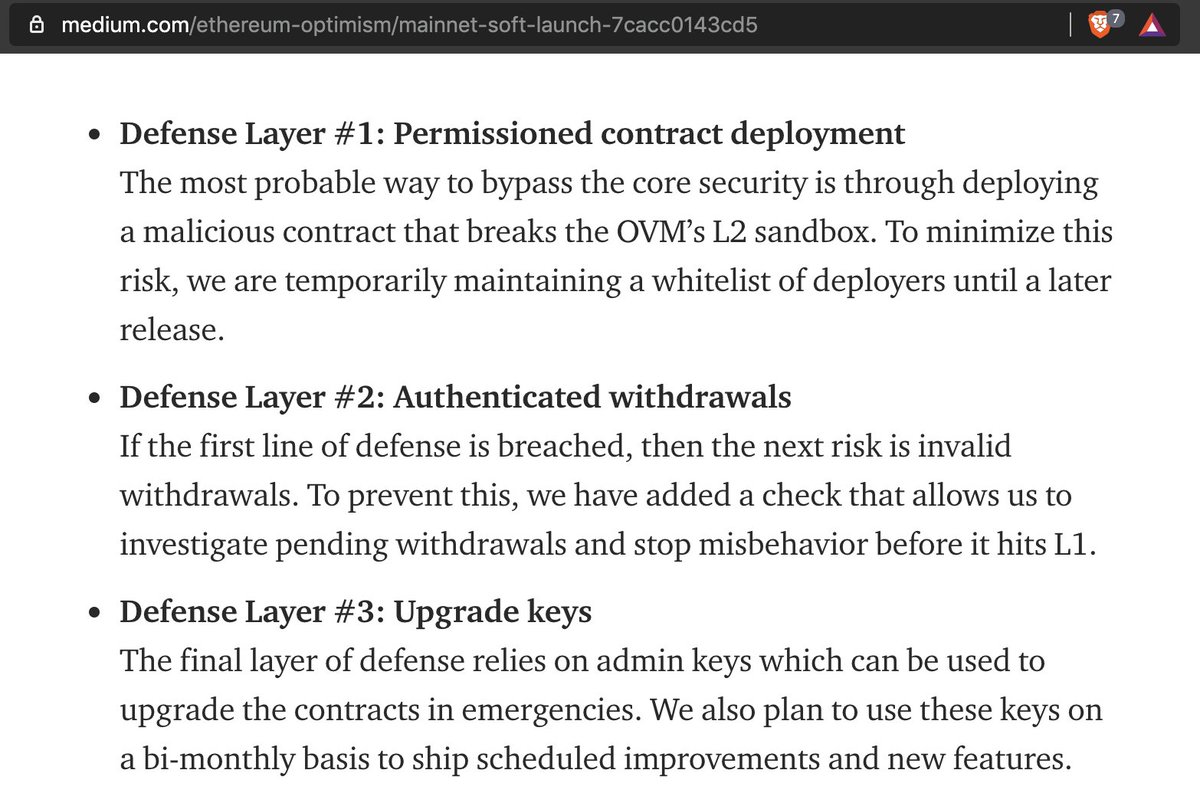

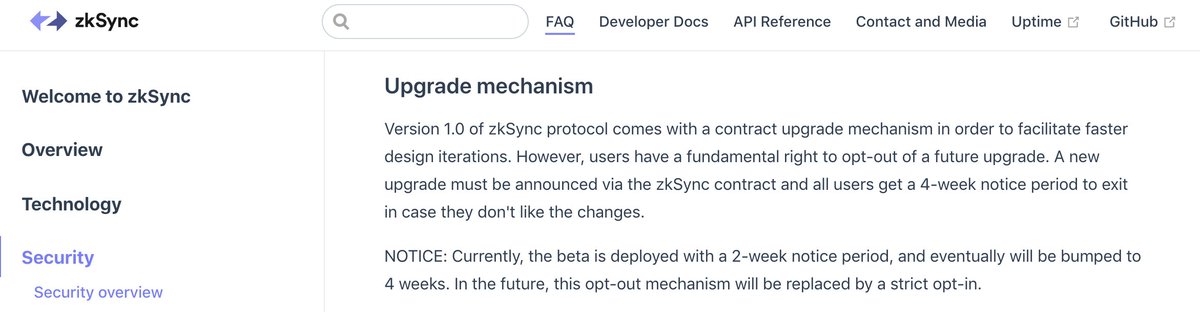

We could go further and discredit even more of these L2s. We can point out that @optimismPBC currently runs with hard safety precautions and discredit that as a "real L2"! Even @zksync has a (delayed) opt-out upgrade mechanism.

But we don't need to go that far to see why I lost.

But we don't need to go that far to see why I lost.

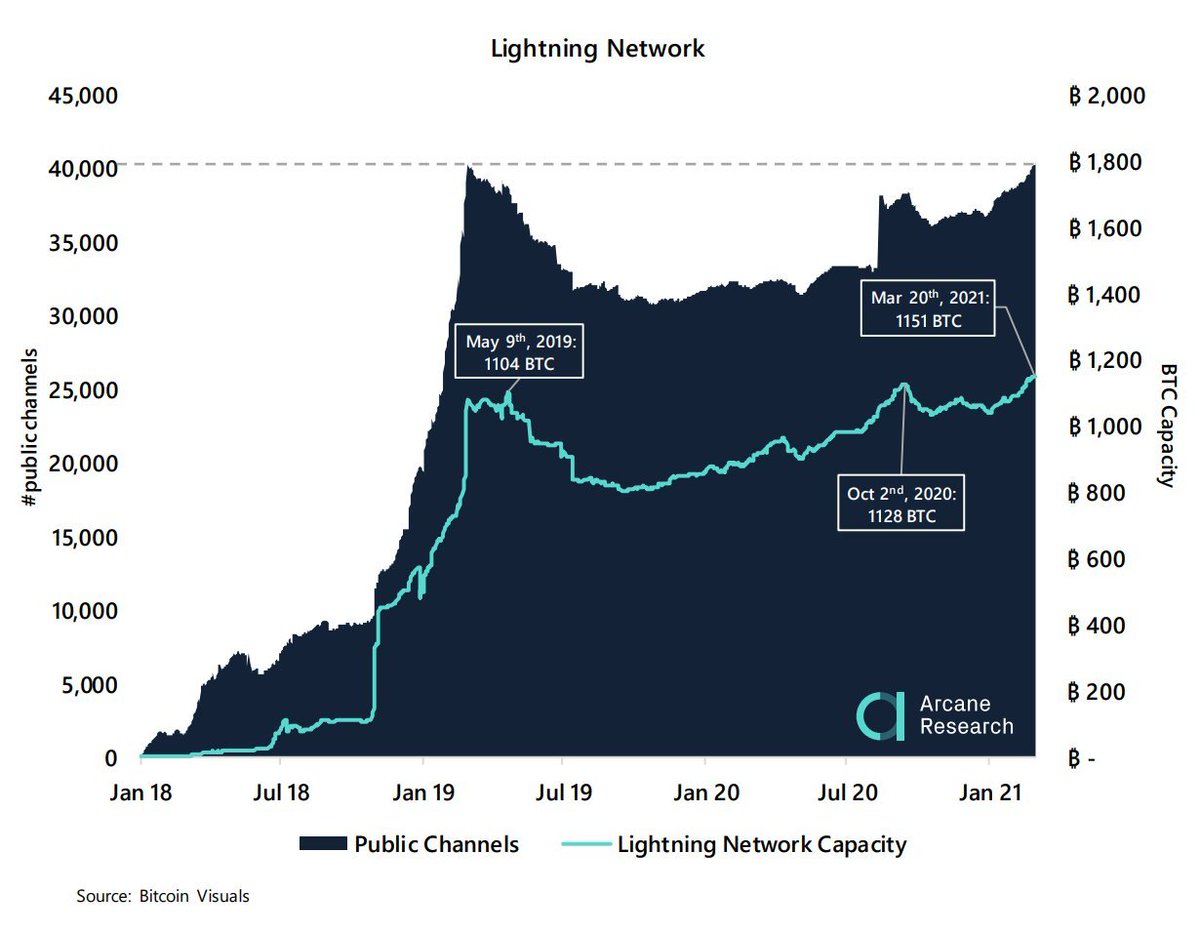

While the BTC in public LN channels has stayed almost entirely static between Sep 3-Mar 3 (1063 BTC -> 1108 BTC, now 1159 BTC), the $-value of BTC increased by almost +400%!

That $12m had turned into $56m by March 3.

So to 10x that, I'd need to show $560m in Ethereum L2s...

That $12m had turned into $56m by March 3.

So to 10x that, I'd need to show $560m in Ethereum L2s...

This is first bet I've lost on CT, and Twitter bets are a serious matter to me. I can think of nothing more humiliating than not paying one's dues.

So with that, congratulations both @RyanTheGentry & @giacomozucco!

Post your LN invoices below, and you'll receive $1000 each!

So with that, congratulations both @RyanTheGentry & @giacomozucco!

Post your LN invoices below, and you'll receive $1000 each!

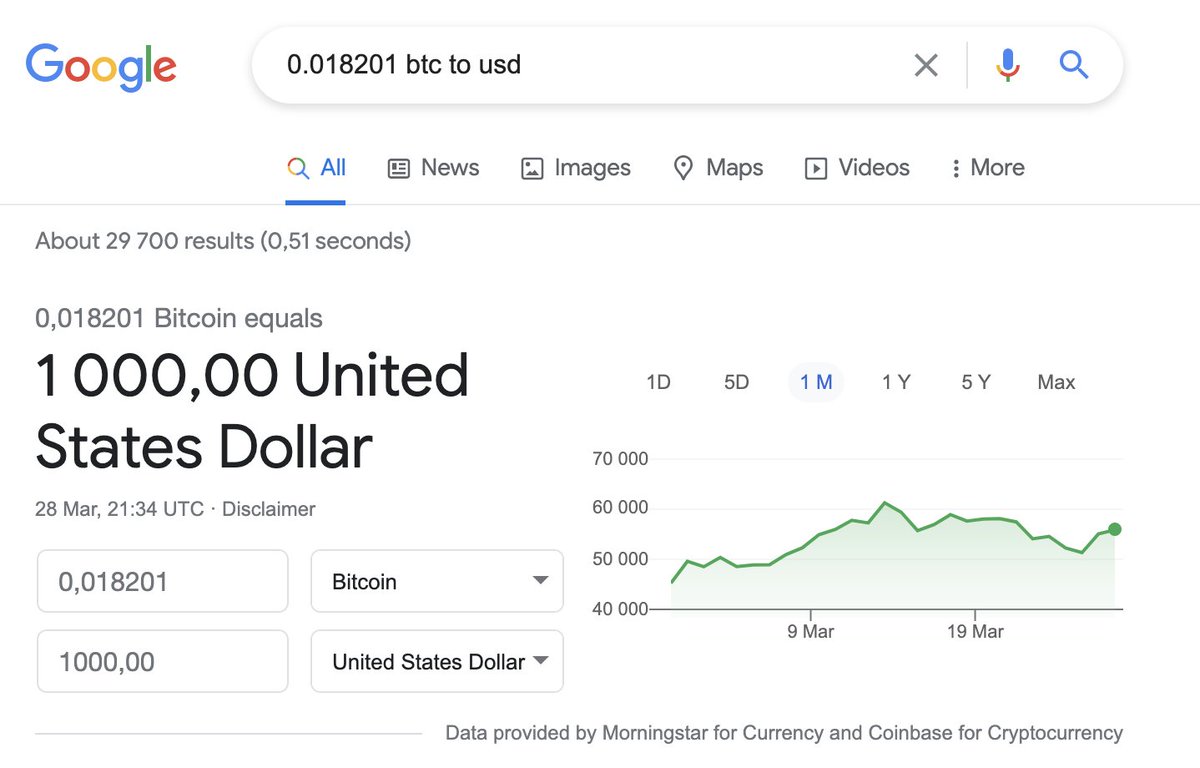

Please set the invoice amount to 0.018201 BTC ($1000) and I'll send it right away (assuming no complications with the Lightning Network).

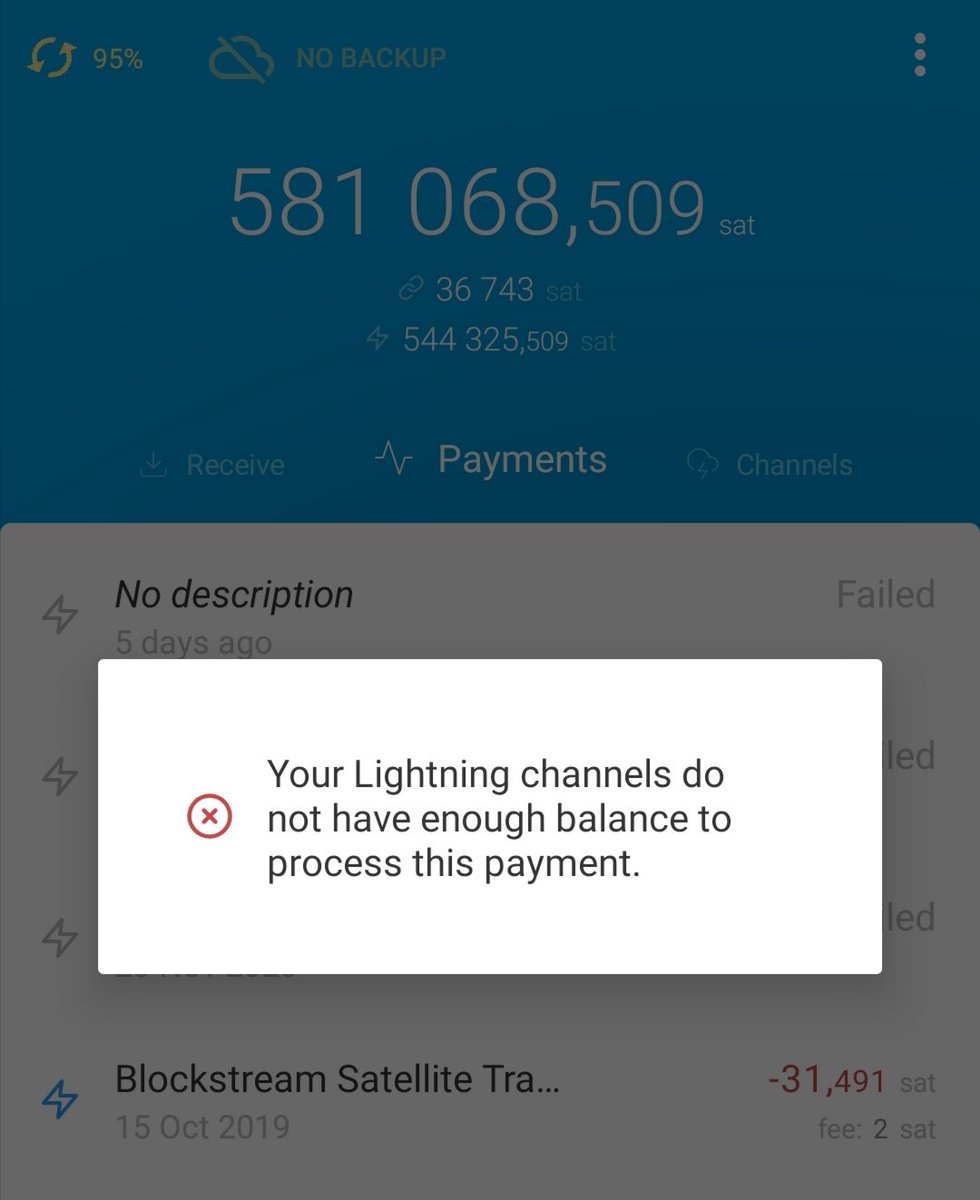

@RyanTheGentry, could you please make a smaller invoice? I have a bunch of LN wallets on my Android phone I'd like to get an opportunity to clear out. One has 581,068 sats in it we can start with but I just remembered I can't make partial invoice payments.

https://twitter.com/RyanTheGentry/status/1376288126239391744

I don't expect we can send the full amount of 581,068 sats since we need to account for fees, I'm not sure what the maximum sendable amount is over the route I'll end up have to use. Should 99.5% of the amount work (0.5% fee) you think? Try with 578,162 sats please 🙏.

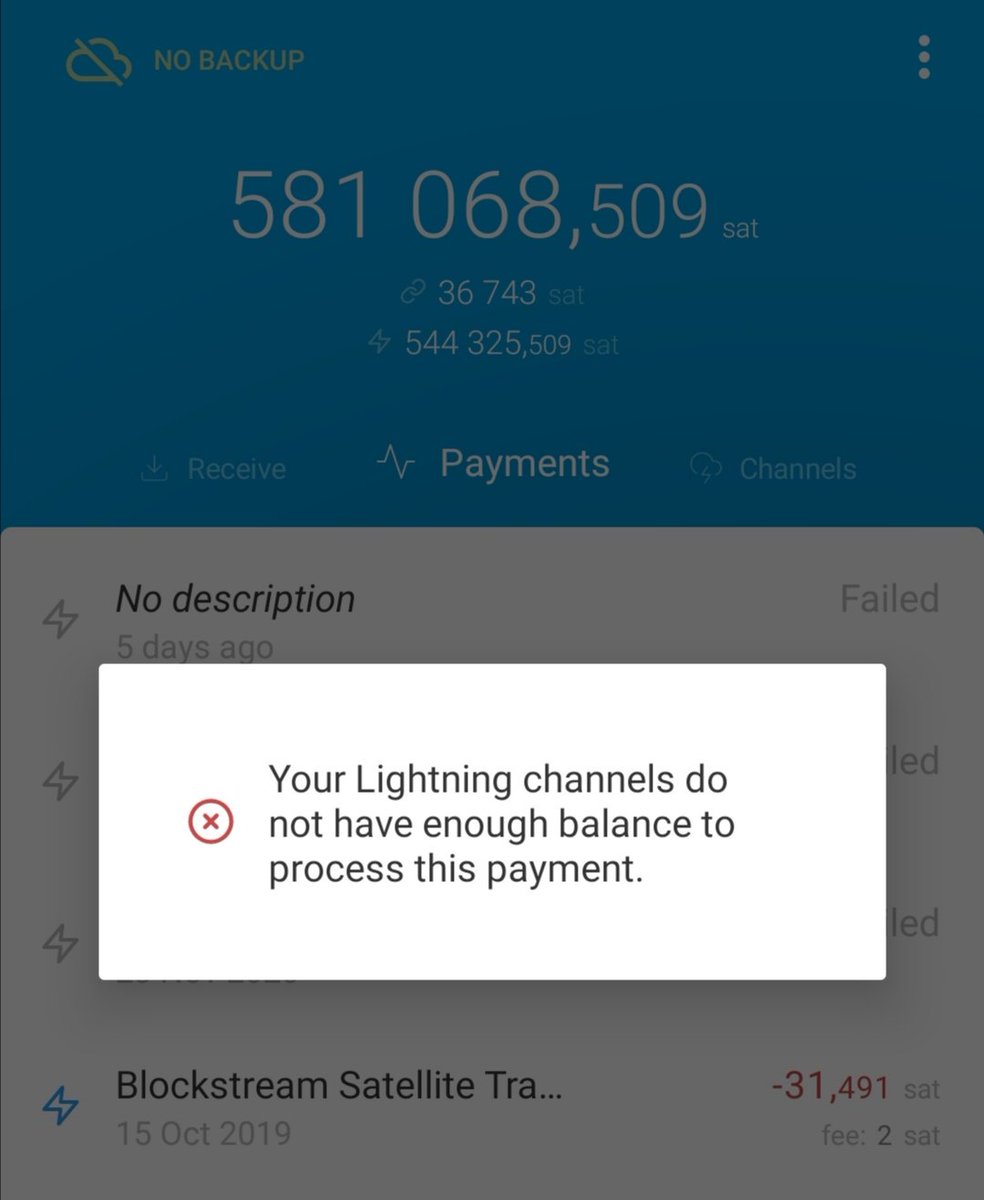

Hi @RyanTheGentry, please try the smaller amount as per the tweet above. My LN wallet could not pay your invoice I'm afraid (fees).

https://twitter.com/RyanTheGentry/status/1376292298812710912?s=19

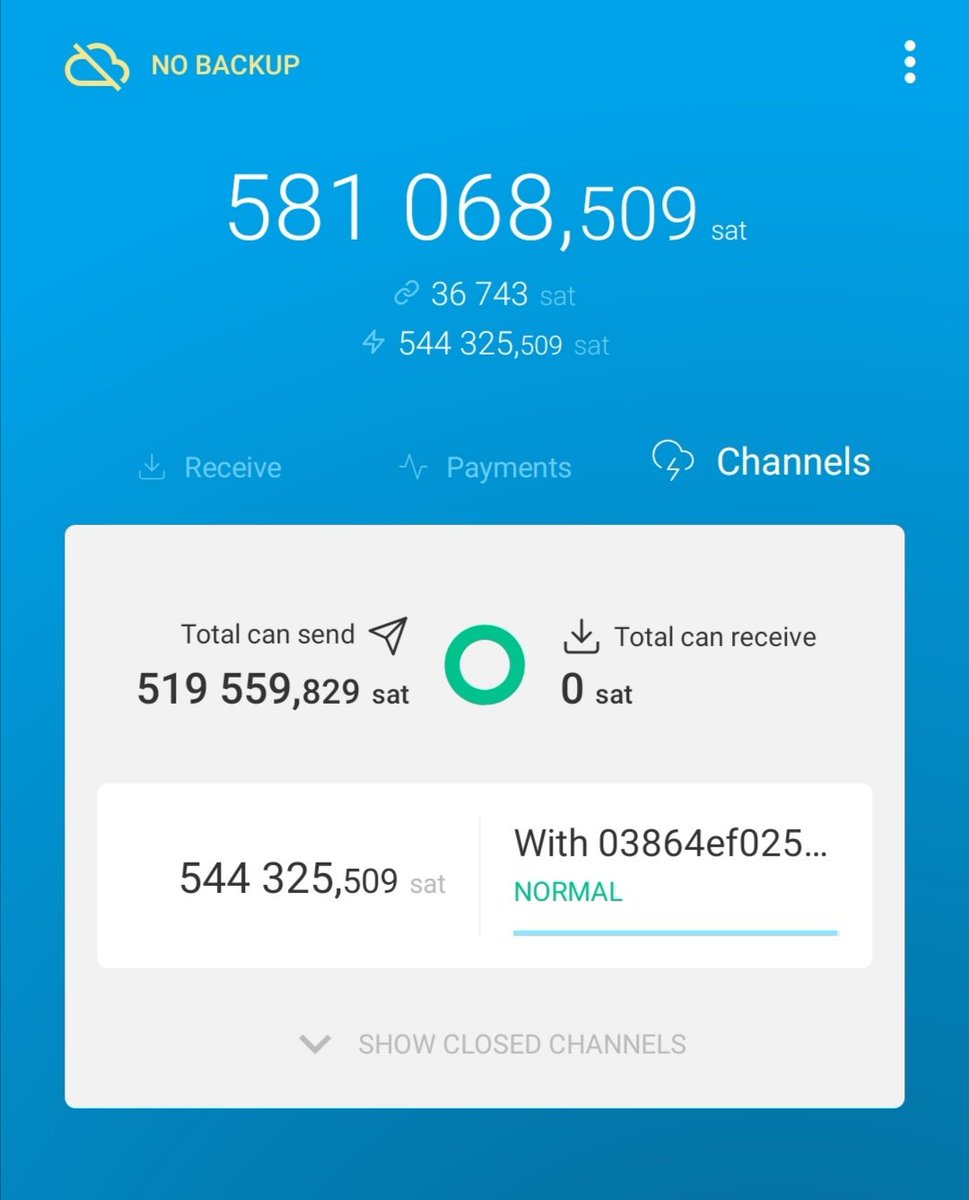

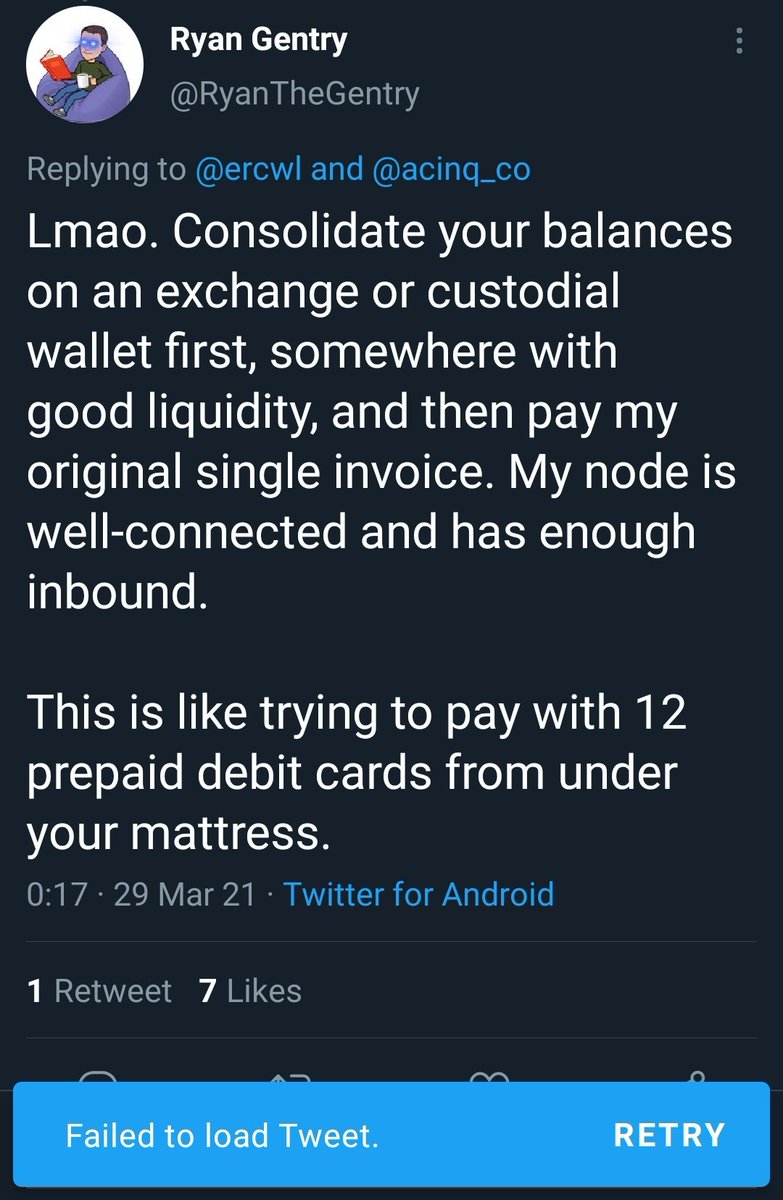

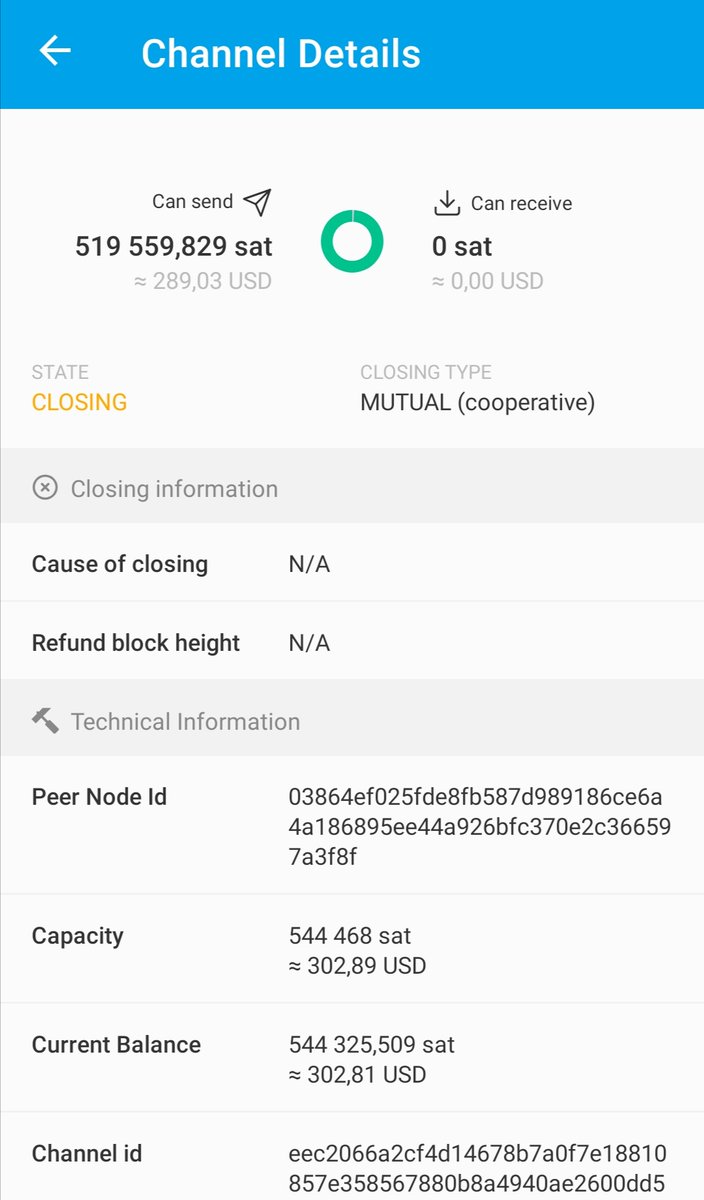

Sorry @RyanTheGentry, I am an idiot. The channel balance is actually just 544k sats, rest was onchain. I just looked up the channel info and it looks like the maximum sendable amount is 519,559 sats (4.8% fee? not sure why 🤷♂️) cc: @acinq_co

https://twitter.com/RyanTheGentry/status/1376293912566988803?s=19

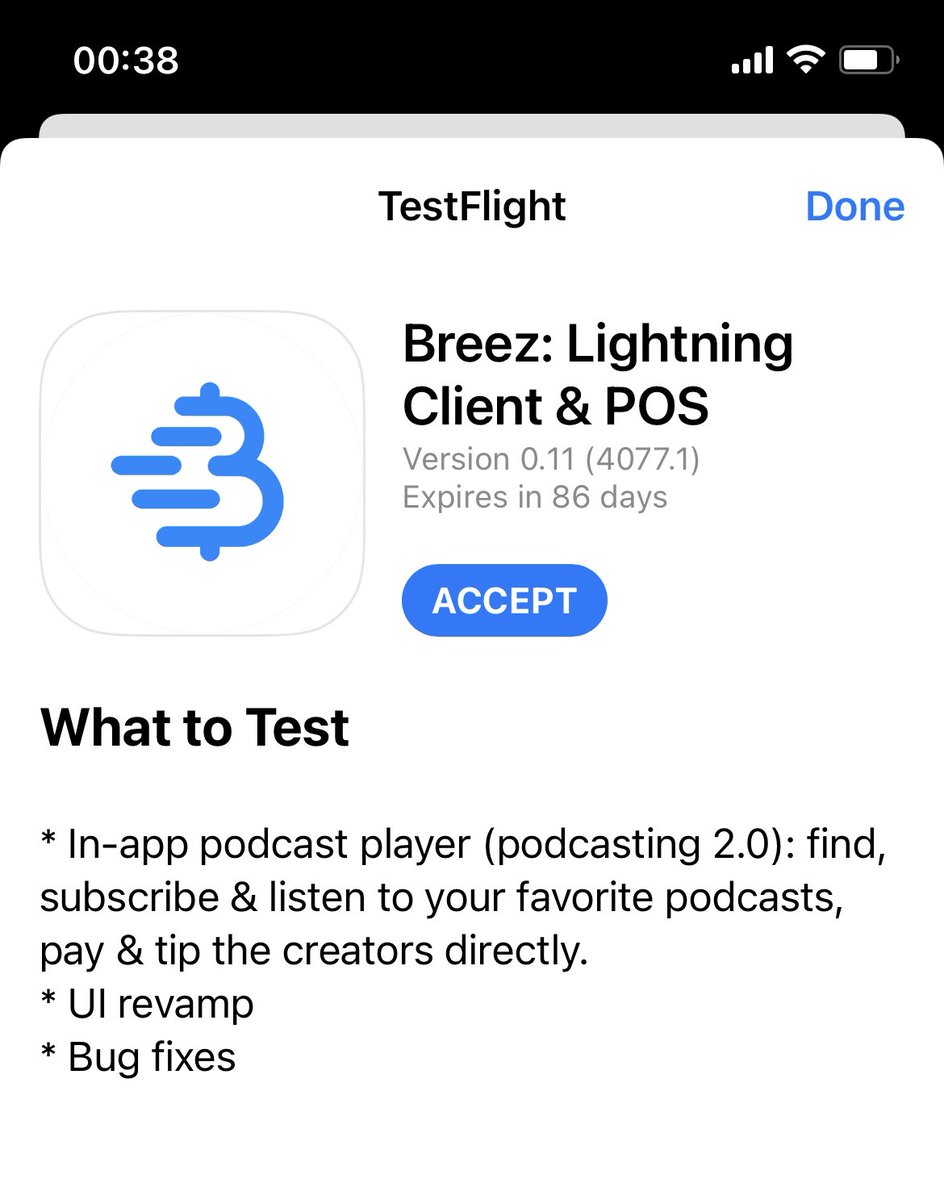

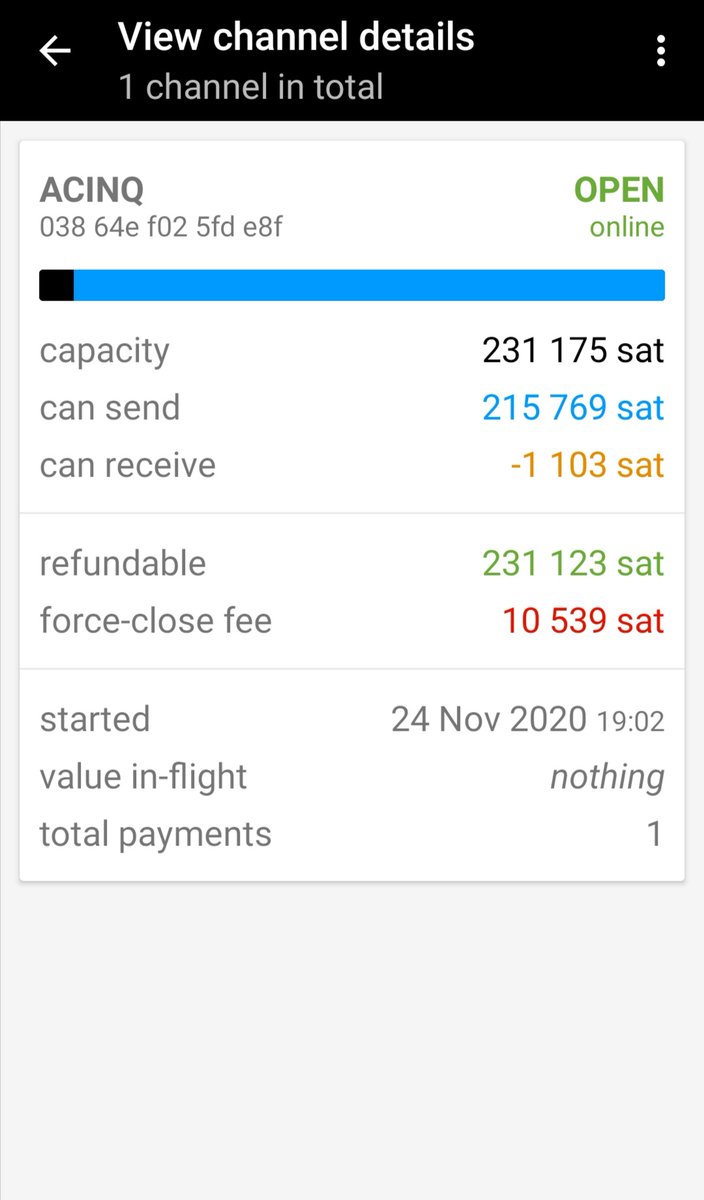

Not trying to be funny but I tried consolidating my sats, I got an iPhone for @JoinClubhouse & installed @Breez_Tech since I know it's one of the few wallets that solve inbound liquidity for you (except mb @PhoenixWallet? but no iOS) and then this happened

https://twitter.com/RyanTheGentry/status/1376297543706013700?s=19

☝️This was a response to this tweet. Are you sure you can't just make an invoice for 519,559 sats real quick? I'm not trying to frustrate you on purpose 🤝

I actually did exactly that. Not sure why it's not working.

https://twitter.com/RyanTheGentry/status/1376300616885149699?s=19

Ok, I’ll wait a few minutes. I thought the issue might be that @Breez_Tech only exists as an alpha ”podcasting app” (?) on iOS, but the problem might aswell be on @acinq_co’s side (it was a long time since I set up that channels). Retrying soon.

https://twitter.com/RyanTheGentry/status/1376302746215796739

I tried it now and atleast I only got one error this time. Seems like there just isn't a route? I think I'll just try closing the channel on @acinq_co and reopen it since it's an old one, unless someone has another suggestion (using @bluewalletio on the iPhone instead maybe?).

@RyanTheGentry can't we try just by you making a smaller invoice (519559 sats)? Maybe that's easier than consolidating this input on my end since I seem to struggle with it, maybe I have a route to you but not me. I'll consolidate the rest in the meantime.

https://twitter.com/ercwl/status/1376301482484531200?s=19

I tried to consolidate on @bluewalletio on the iPhone per this recommendation instead but that didn't work either. Must be some issue with the @acinq_co wallet channel on the Android. I'm closing it and reopening it.

https://twitter.com/ankurfr/status/1376310470496292865?s=19

I think I was able to negotiate a cooperative close on Eclair so I don't need to force-close the channel (more expensive), will just need to pay some onchain fees and wait for a few blocks and we should be good to go. Will consolidate the other wallets in the meantime.

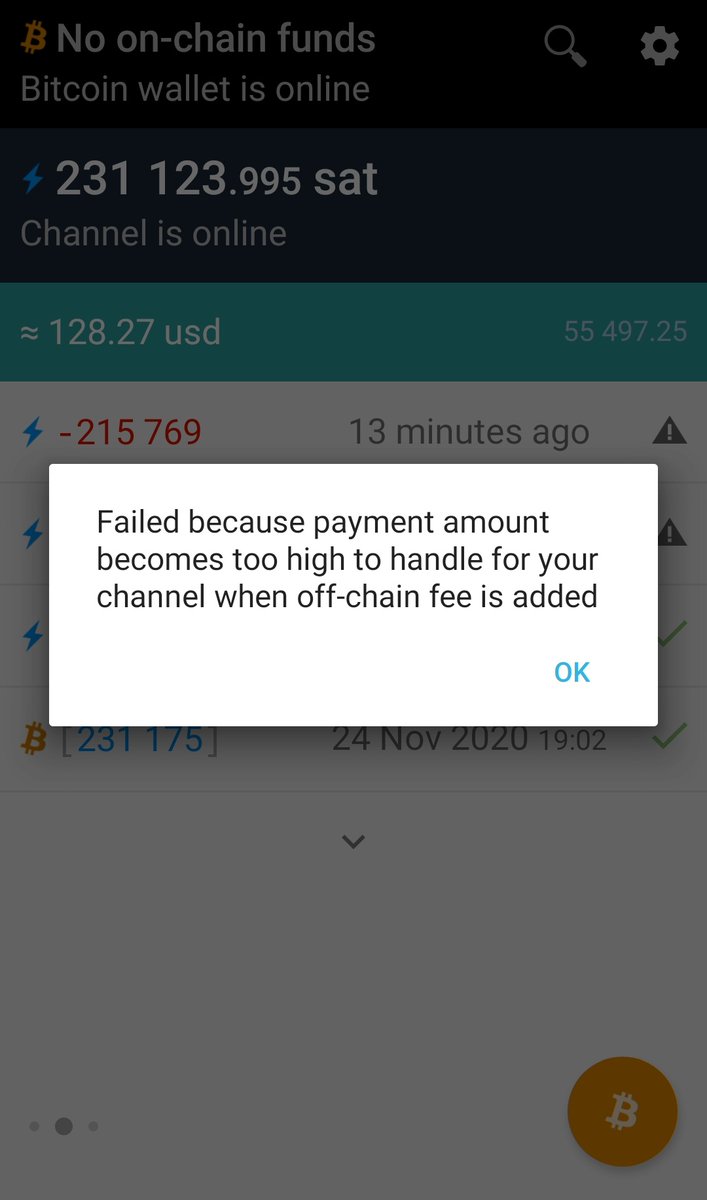

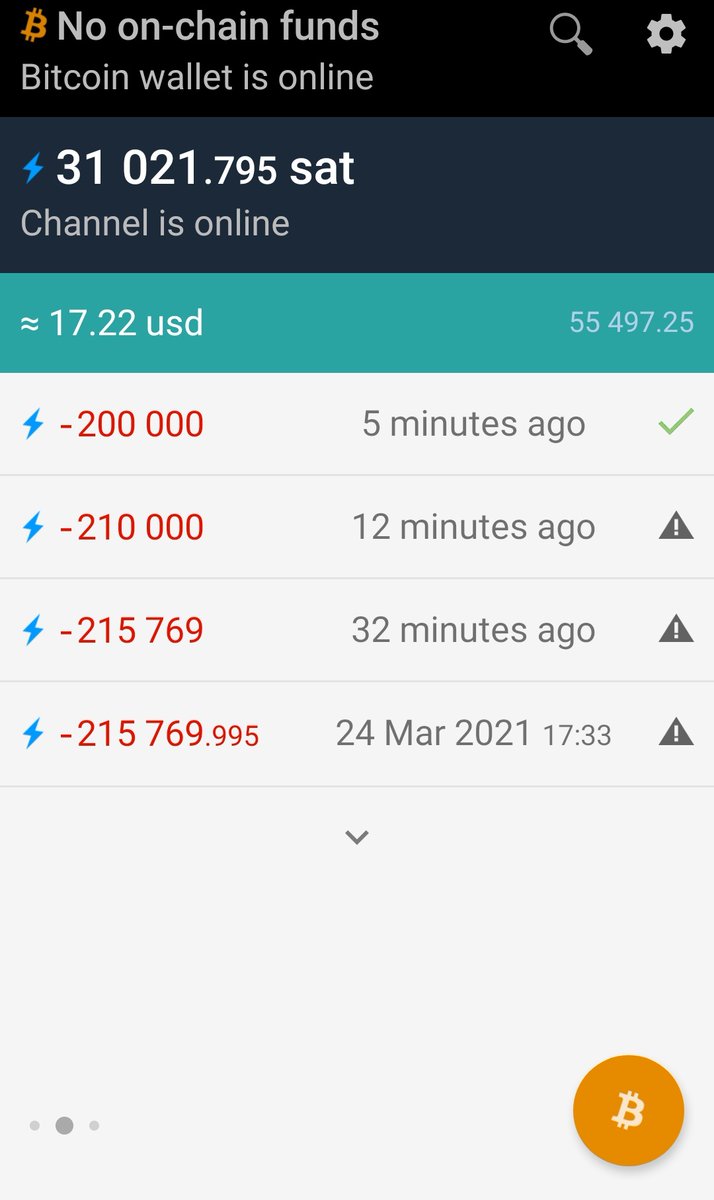

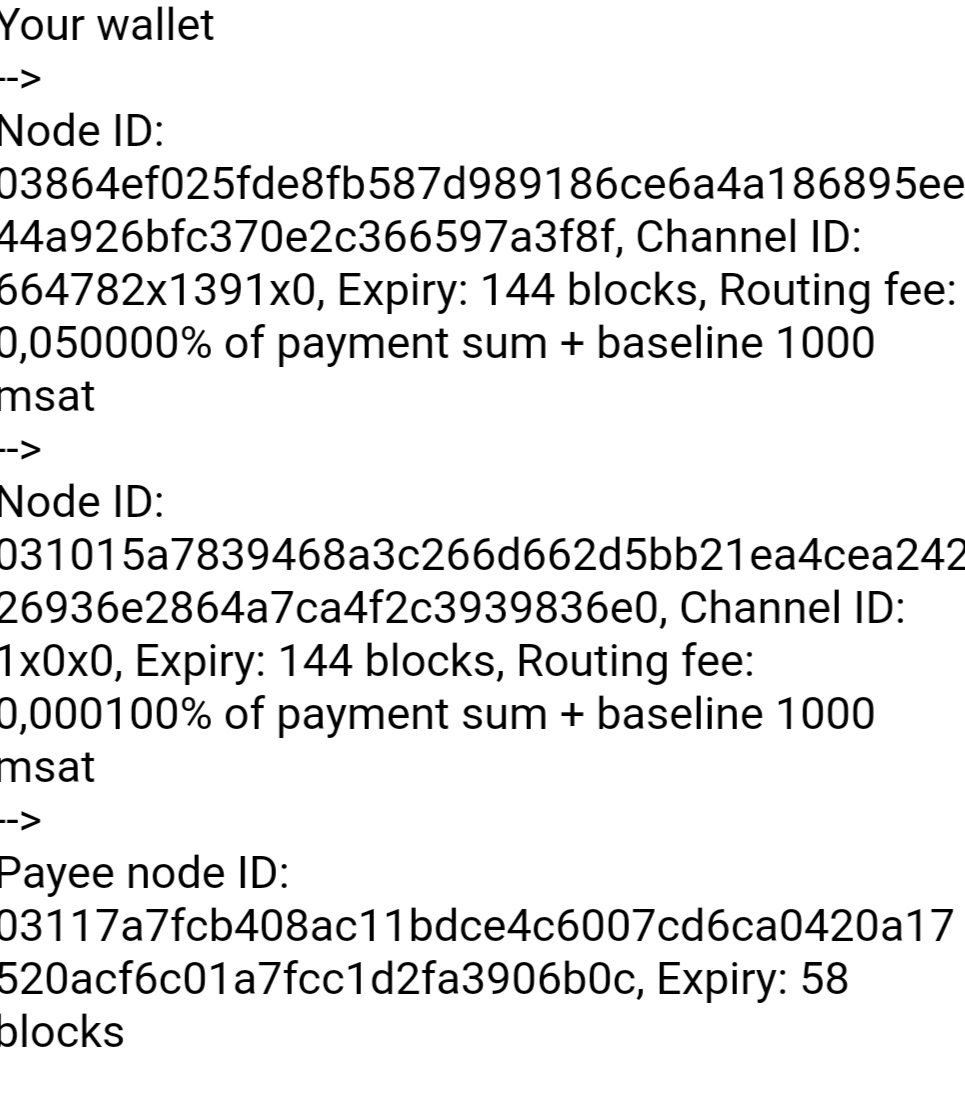

I'm now trying to consolidate my balance from BLW ("Anton's Lightning Wallet"). This channel was set up just a few months ago and the payment to @Breez_Tech just isn't coming through. Anyone have a clue what the issue might be? It's not just Eclair...

https://twitter.com/serg_tikhomirov/status/1376316288184762378?s=19

What? I was sending 215k sats (as per the "can send" amount on the channel info page), even though the channel has 231k sats. Anyone know why trying to send 93% of the channel balance is too much? What's with these fees? $9 fee for a $119 payment not enough on LN?

Was able to send 200k of my 231k sats in the end by successively decreasing the sats trying to send. Not sure what the issue was here or why needed to pay so much. Isn't 1k msat = 1 sat (debug info)? 0.05% routing also doesn't explain it. @acinq_co / @Breez_Tech connectivity :/

So only ~86% was sendable ($110 of $127).

People complaining in DMs that I'm intentionally using "bad wallets". Good thing @PhoenixWallet is up next since this is the one @RyanTheGentry recommended. The below clip has been sped up. It seems like the "send all" feature doesn't work, and this error took 6 min in reality.

Tbh, it reminds me of the ethereans that accused me of intentionally making Ethereum full node syncing seem excessively slow by using parity over geth (it was the one @cyber_hokie/@antiprosynth pointed me toward at the time).

https://twitter.com/ercwl/status/1159940020331040770?s=19

This was a triumph

I'm making a note here: HUGE SUCCESS

It's hard to overstate--

--my satisfaction

Congratulations @RyanTheGentry, the $1000 worth of sats have successfully been sent!

I'm making a note here: HUGE SUCCESS

It's hard to overstate--

--my satisfaction

Congratulations @RyanTheGentry, the $1000 worth of sats have successfully been sent!

P.S. If you don’t follow @RyanTheGentry already, you should give him a follow!

He’s the Head of Business Development at @lightning.

He’s the Head of Business Development at @lightning.

@giacomozucco is it OK if I pay you in tBTC over @zksync instead? All I need is an Ethereum address and press a button.

@giacomozucco thanks for bearing with me 👊. I'm fine with using LN and awebanalysis.com for the price as you suggested. But the BTC equivalent of $1000 has changed since you posted the invoice (and it can't be paid partially). Make a new one plz?

https://twitter.com/giacomozucco/status/1376504279477936128

Thx, sending ASAP. I just funded @Breez_Tech with some BTC from my @bisq_network wallet--the rest I'll send from @wasabiwallet. However @bisq_network can't set manual fees and @Breez_Tech gets stuck waiting because you can only send 1 deposit at a time 🤷♂️

https://twitter.com/giacomozucco/status/1377321435513905154

Sorry @giacomozucco, my deposit to @Breez_Tech has 12 confirmations now but it still says it needs to "process my previous deposit". I think they're supposed to add this to my channel balance under the hood but the Bisq UTXO hasn't been moved/used for anything yet. Will update 🤷♂️

@giacomozucco, I’ve got it ready, could you please send me a new QR code? I’m not trying to be funny but your invoice expired...

Thanks for the new invoice @giacomozucco, I’ve just sent you the payment, but unfortunately it failed. I can’t see any logfile or error report, but I’ve made sure the report was sent to @Breez_Tech, hopefully they can share the nature of the problem with us.

https://twitter.com/giacomozucco/status/1377482332110737408

I apologize for the unfitting choice of music in the clip above, I genuinely thought it would work this time.

P.S. Any suggestions what we should do now @giacomozucco? I think I’ll send the funds to @PhoenixWallet on my Android and try it again from there instead, let me know if you disagree/want to try something different. Otherwise I’ll do that in a couple of hours.

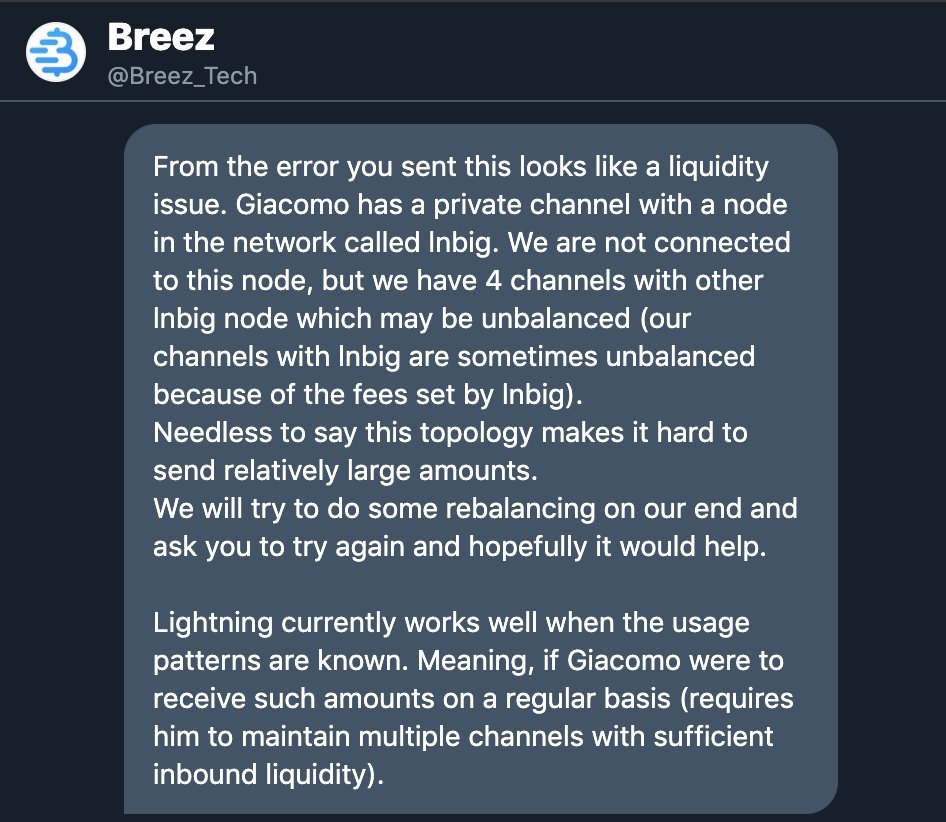

I've now received details around the problem. It's a liquidity issue, but it isn't that my balance is split up across several channels (@Breez_Tech already uses a custom multi-path payment method to get around that), but a more general topology problem.

https://twitter.com/ercwl/status/1377523791144878081

WE DID IT!

Thanks for the help with resending the invoices @giacomozucco and a huge thanks to @Breez_Tech for rebalancing their public channels with lnbig so we could smoothlessly make this happen.

My debt is now paid & you’re $1000 richer, thanks gentlemen, until next time 🎩

Thanks for the help with resending the invoices @giacomozucco and a huge thanks to @Breez_Tech for rebalancing their public channels with lnbig so we could smoothlessly make this happen.

My debt is now paid & you’re $1000 richer, thanks gentlemen, until next time 🎩

• • •

Missing some Tweet in this thread? You can try to

force a refresh