Intellect Design Arena: A behemoth in making!

#Intellect

@CapitalSapling @nid_rockz @MrRChaudhary @NeilBahal

#Intellect

@CapitalSapling @nid_rockz @MrRChaudhary @NeilBahal

The Company is engaged in the business of software development and providing software product license and related services focused on the financial services market

(1/n)

(1/n)

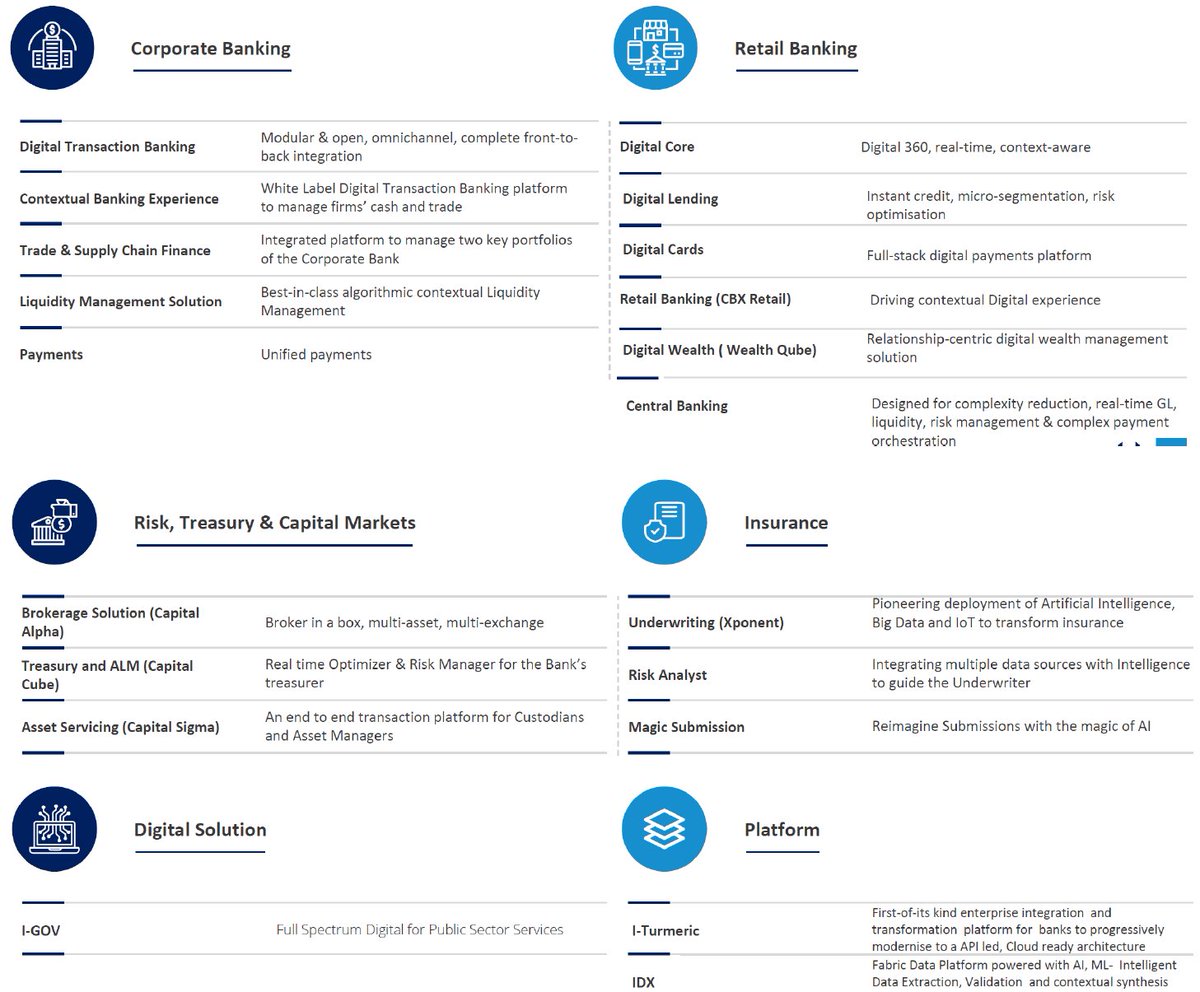

The Company has a portfolio of products across Global Consumer Banking, Central Banking, Risk and Treasury Management, Global Transaction Banking & Insurance

Intellect’s products such as iGTB, iSEEC, CBX, Consumer banking have consistently received high ratings from agencies

Intellect’s products such as iGTB, iSEEC, CBX, Consumer banking have consistently received high ratings from agencies

• Intellect was ranked as #1 for retail banking and transactional banking by IBS intelligence

• It was recognized as a challenger in Gartner’s magic quadrant for retail core banking

• It was recognized as a challenger in Gartner’s magic quadrant for retail core banking

The company was in the expansion phase during 2015-2018 which the company calls Intellect 1.0 The company was expanding the business and the products were in their initial phase

o Building expertise

o Expanding customer footprint

o Building expertise

o Expanding customer footprint

Company entered into Intellect 2.0 starting with 2019 building the right products & creating a niche for its products

•The company was able to scale its products

•Was able to unlock the value of IP investments they have done during 2015-2018

•Strengthen customer relationships

•The company was able to scale its products

•Was able to unlock the value of IP investments they have done during 2015-2018

•Strengthen customer relationships

Intellect 3.0 will be about more monetization and more customer-centricity. Intellect 2.0 was more about implementation in the first 2 years

• The company will focus on monetizing the 240 customers it has and how cross-selling of products can be achieved

• The company will focus on monetizing the 240 customers it has and how cross-selling of products can be achieved

Financial highlights

The revenue grew at CAGR of 13.5% from Rs 8,107 Mn in FY16 to Rs 13,469 Mn in FY20 while there was lumpiness in EBITDA over the period which grew from Rs (373) Mn in FY16 to Rs 708 Mn in FY20

The revenue grew at CAGR of 13.5% from Rs 8,107 Mn in FY16 to Rs 13,469 Mn in FY20 while there was lumpiness in EBITDA over the period which grew from Rs (373) Mn in FY16 to Rs 708 Mn in FY20

The company has given substantially higher performance during 9M FY21 as compared to 9M FY20 due to the effect of scale, as the company’s products have now been scaled at a higher level while the company’s cost is flat (a play on operating leverage)

License linked revenue (License, SaaS, AMC revenue) was 53% of total revenue as compared to 42% in 9M FY20

This has led to higher margin realization for the company and the company aims to increase its share of license linked revenue

This has led to higher margin realization for the company and the company aims to increase its share of license linked revenue

The license linked revenue has three components:

1. License revenue – Rs 910 Mn for 9M FY21 increased by 85% YoY

2. SaaS/Subscription revenue – Rs 745 Mn for 9M FY21 increased by 18% YoY

3. AMC revenue – Rs 418 Mn for 9M FY21 increased by 28% YoY

1. License revenue – Rs 910 Mn for 9M FY21 increased by 85% YoY

2. SaaS/Subscription revenue – Rs 745 Mn for 9M FY21 increased by 18% YoY

3. AMC revenue – Rs 418 Mn for 9M FY21 increased by 28% YoY

The license-linked revenue has increased consistently over the past 5 years and the management expects the license-linked revenue to stabilize around 60% of overall revenue.

The increase in license linked revenue will increase the EBITDA margins

The increase in license linked revenue will increase the EBITDA margins

• Net cash of the company stood at Rs 1,242 Mn on Q3 FY 21 as compared to negative Rs (1,015) Mn on Q3 FY20

• The company has a strong order backlog of Rs 12,030 Mn at end of Q3 FY21

•The company has a strong order backlog of Rs 12,030 Mn at end of Q3 FY21

• The company has a strong order backlog of Rs 12,030 Mn at end of Q3 FY21

•The company has a strong order backlog of Rs 12,030 Mn at end of Q3 FY21

Investment rationale:

The company has cracked the US market which is the most difficult market to enter, as only technology can be the differentiator in the US market

• The company has focused on AI and ML through which they could enter the US market

The company has cracked the US market which is the most difficult market to enter, as only technology can be the differentiator in the US market

• The company has focused on AI and ML through which they could enter the US market

The data platform of the company is similar to 𝐏𝐚𝐥𝐚𝐧𝐭𝐢𝐫 𝐓𝐞𝐜𝐡, while the platform of Intellect is focused on the Financial services domain

License linked revenue comes at a margin of 70% - 75%, which the management aims to reach 60% of total revenue

License linked revenue comes at a margin of 70% - 75%, which the management aims to reach 60% of total revenue

This increment in license linked revenue gives upside in total margins of the company due to which the company will be able to generate 30%+ EBITDA margins going forward

The momentum in license linked revenue has increased due to the development of tech architecture, the company has been investing in its platform for the last 4 5 years which has become more visible now as cloud has become more intense, AI those investments are now paying off

The mgmt indicates a modest 10% revenue growth given the company pursuing large 42 deals with an average deal size of Rs 450 Mn

• License based (License, AMC, Implementation revenue, etc) order backlog of Rs 12,030 Mn

• ARR of subscription/cloud-based revenue of Rs 1,672 Mn

• License based (License, AMC, Implementation revenue, etc) order backlog of Rs 12,030 Mn

• ARR of subscription/cloud-based revenue of Rs 1,672 Mn

The total expenditure has now stabilized around $40 Mn per quarter (Pre EBITDA cost of Rs 284 Cr is equivalent to $40 Mn)

• As the costs have now been stabilized even with 10% revenue growth there will be 30% growth in the EPS

(Can't stress it enough!)

• As the costs have now been stabilized even with 10% revenue growth there will be 30% growth in the EPS

(Can't stress it enough!)

The management is cautiously optimistic about the revenue growth as they target sustainable organic growth which is exceptional in the case of a software product company

The company has significantly reduced its debt and is now net cash positive amounting to Rs 1,242 Mn

The company has significantly reduced its debt and is now net cash positive amounting to Rs 1,242 Mn

Valuation highlights:

The company trades at a PS multiple of 6.6x for FY21 despite having an established product portfolio where the operating expense of the company have been now stabilized in the past 3 quarters

The company trades at a PS multiple of 6.6x for FY21 despite having an established product portfolio where the operating expense of the company have been now stabilized in the past 3 quarters

Temenos (A Swiss-based company) offers analytics, channels, funds and securities, risk and compliance, and front office and digital banking suits for the management of administrative tasks at banks and financial services

companies

companies

Temenos is a direct competitor of Intellect and it has been in this domain for the past 20 years despite

which Intellect’s product has been able to win deals over Temenos’s products and has gained superior

ratings by various agencies such as Novarcia, IBS, Celent, etc

which Intellect’s product has been able to win deals over Temenos’s products and has gained superior

ratings by various agencies such as Novarcia, IBS, Celent, etc

Temenos has been valued at a P/S of 11.1x

The earnings growth of Intellect will be superior to Temenos as the company has started posting

positive earnings regularly since Q1 FY21 and the trend will continue as the costs have been

stabilized and products being established

The earnings growth of Intellect will be superior to Temenos as the company has started posting

positive earnings regularly since Q1 FY21 and the trend will continue as the costs have been

stabilized and products being established

The EBITDA margin of Temenos is substantially higher than Intellect which shows the margin expansion

the potential of Intellect going forward

• Intellect operates in India which has its cost advantage while Temenos operates in Switzerland

which has high operating costs

the potential of Intellect going forward

• Intellect operates in India which has its cost advantage while Temenos operates in Switzerland

which has high operating costs

@threadreaderapp unroll please

Amazing amazing set by Intellect !

-PAT even surpassed a strong Q3

-Costs are stable as indicated by management

-Good deal wins during the quarter

-Increase in SAAS revenue

-Debt over, net cash positive

All this in freaking one year !!

Kudos to the execution of management 💪

-PAT even surpassed a strong Q3

-Costs are stable as indicated by management

-Good deal wins during the quarter

-Increase in SAAS revenue

-Debt over, net cash positive

All this in freaking one year !!

Kudos to the execution of management 💪

• • •

Missing some Tweet in this thread? You can try to

force a refresh