Chart thread on what hyperinflation looks like.

*Rapidly increasing prices within an economy.

*Typically >50% inflation per month.

Let’s start with the amount of monetary units in circulation.

Money Supply (M2):

-Zimbabwe

-Argentina

-Venezuela

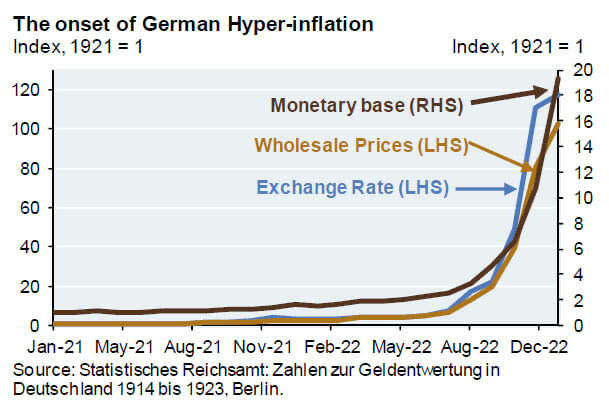

-Weimar Germany

*Rapidly increasing prices within an economy.

*Typically >50% inflation per month.

Let’s start with the amount of monetary units in circulation.

Money Supply (M2):

-Zimbabwe

-Argentina

-Venezuela

-Weimar Germany

As wealth floods into assets for protection against debasement, national stock market indexes explode to ATHs

-Zimbabwe Industrial Index

-Merval Buenos Aires Index

-Caracas Stock Market Index (IBVC)

-German Stock Market (1920-1924)

-Zimbabwe Industrial Index

-Merval Buenos Aires Index

-Caracas Stock Market Index (IBVC)

-German Stock Market (1920-1924)

What about the price of gold when denominated in national currencies?

-Zimbabwe Dollar

-Argentine Peso

-Venezuela Bolivar (‘VES’ est. 2018)

-Weimar Marks

-Zimbabwe Dollar

-Argentine Peso

-Venezuela Bolivar (‘VES’ est. 2018)

-Weimar Marks

Three of these examples are taking place before our eyes. Large discrepancies between ‘official’ rates and actual rates are common as governments will use this spread to sustain their operations.

Current ‘official’ Interest Rates of Venezuela, Zimbabwe & Argentina

Current ‘official’ Interest Rates of Venezuela, Zimbabwe & Argentina

Luckily for us we have a tool that reveals such manipulation..

-BTC/Argentine Peso (ARS)

-BTC/Venezuelan Bolivar (VES)

*Zimbabwe relaunched a new sovereign Dollar (ZWL) in 2019, pegged to the USD. Its previous currency was scrapped in 2009 due to its last hyperinflation.

-BTC/Argentine Peso (ARS)

-BTC/Venezuelan Bolivar (VES)

*Zimbabwe relaunched a new sovereign Dollar (ZWL) in 2019, pegged to the USD. Its previous currency was scrapped in 2009 due to its last hyperinflation.

Some lesser known inflation crises:

Israel, 1983

The four largest banks had been engaged in buybacks to support their stock prices. When they ran out of capital the share prices collapsed. The banks were then nationalized.

-Israel All Share Index

-CPI

-USD exchange rate

Israel, 1983

The four largest banks had been engaged in buybacks to support their stock prices. When they ran out of capital the share prices collapsed. The banks were then nationalized.

-Israel All Share Index

-CPI

-USD exchange rate

American Civil War, 1861

-Inflation Rate for the Confederate States

-Lerner Commodity Price Index (Eastern Confederate cities)

-Price of a pair of shoes (North vs. South)

-Inflation Rate for the Confederate States

-Lerner Commodity Price Index (Eastern Confederate cities)

-Price of a pair of shoes (North vs. South)

• • •

Missing some Tweet in this thread? You can try to

force a refresh