1/

Get a cup of coffee.

In this thread, I'll tell you a story about a man and his dog.

This will help you think more clearly about volatility, risk, and the relationship between the two.

Get a cup of coffee.

In this thread, I'll tell you a story about a man and his dog.

This will help you think more clearly about volatility, risk, and the relationship between the two.

2/

This is Mr. Biswas Singh.

Friends call him "Biz".

He's 50 years old. He owns and operates several gas stations and convenience stores around town.

This is Mr. Biswas Singh.

Friends call him "Biz".

He's 50 years old. He owns and operates several gas stations and convenience stores around town.

4/

Every morning, Biz takes Spock out for a walk.

They go to a local park that has a beautiful trail.

They get there around 6am.

They walk along the trail for about an hour -- until 7am or so.

Then they make their way back home.

Every morning, Biz takes Spock out for a walk.

They go to a local park that has a beautiful trail.

They get there around 6am.

They walk along the trail for about an hour -- until 7am or so.

Then they make their way back home.

5/

Biz walks more or less at a steady speed -- say, 3.5 miles per hour.

Spock, of course, does no such thing.

Sometimes, Spock races ahead of Biz -- straining his leash.

Other times, Spock lags behind Biz, distracted by a lamp post or a squirrel.

Biz walks more or less at a steady speed -- say, 3.5 miles per hour.

Spock, of course, does no such thing.

Sometimes, Spock races ahead of Biz -- straining his leash.

Other times, Spock lags behind Biz, distracted by a lamp post or a squirrel.

6/

If we plot the positions of Biz and Spock over time, they'll look something like this.

The blue line is Biz -- covering his ground steadily over time.

The orange line is Spock -- covering his ground in fits and spurts, but leashed to Biz the entire time.

If we plot the positions of Biz and Spock over time, they'll look something like this.

The blue line is Biz -- covering his ground steadily over time.

The orange line is Spock -- covering his ground in fits and spurts, but leashed to Biz the entire time.

7/

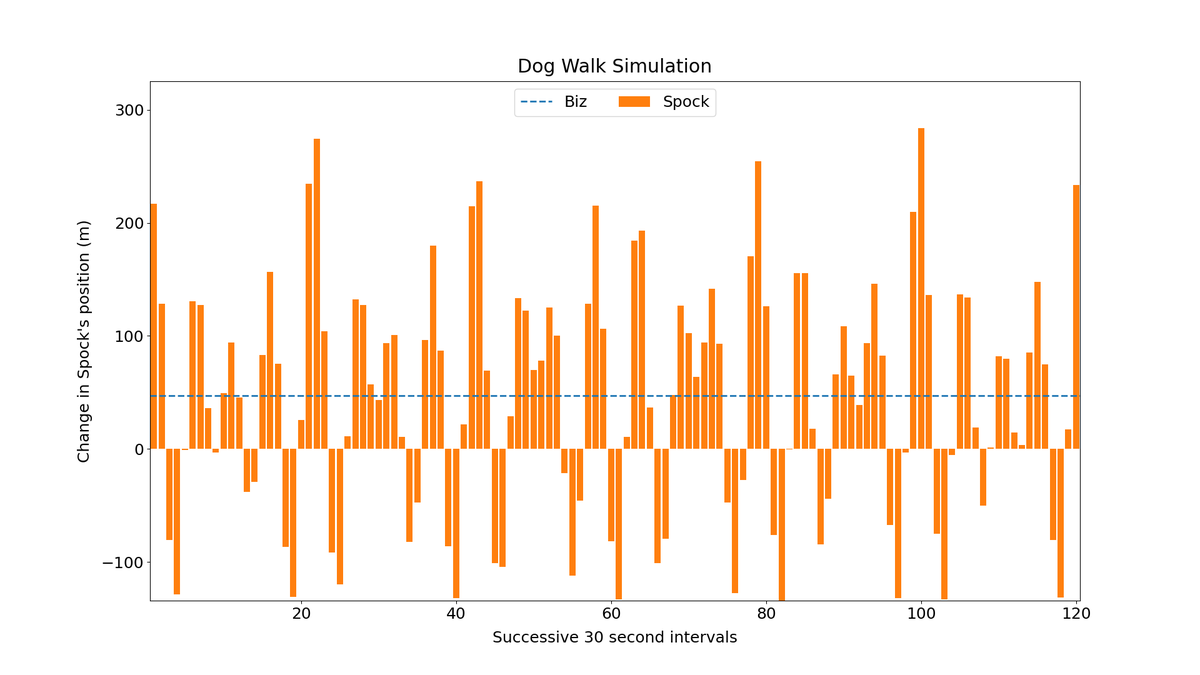

Over short durations -- say, 30 second intervals -- there's not much correlation between Spock and Biz.

Biz, at his steady pace, *always* advances ~47m in any 30s interval.

Spock is far more unpredictable. In some 30s intervals, he advances 250m; in others, he recedes 100m.

Over short durations -- say, 30 second intervals -- there's not much correlation between Spock and Biz.

Biz, at his steady pace, *always* advances ~47m in any 30s interval.

Spock is far more unpredictable. In some 30s intervals, he advances 250m; in others, he recedes 100m.

8/

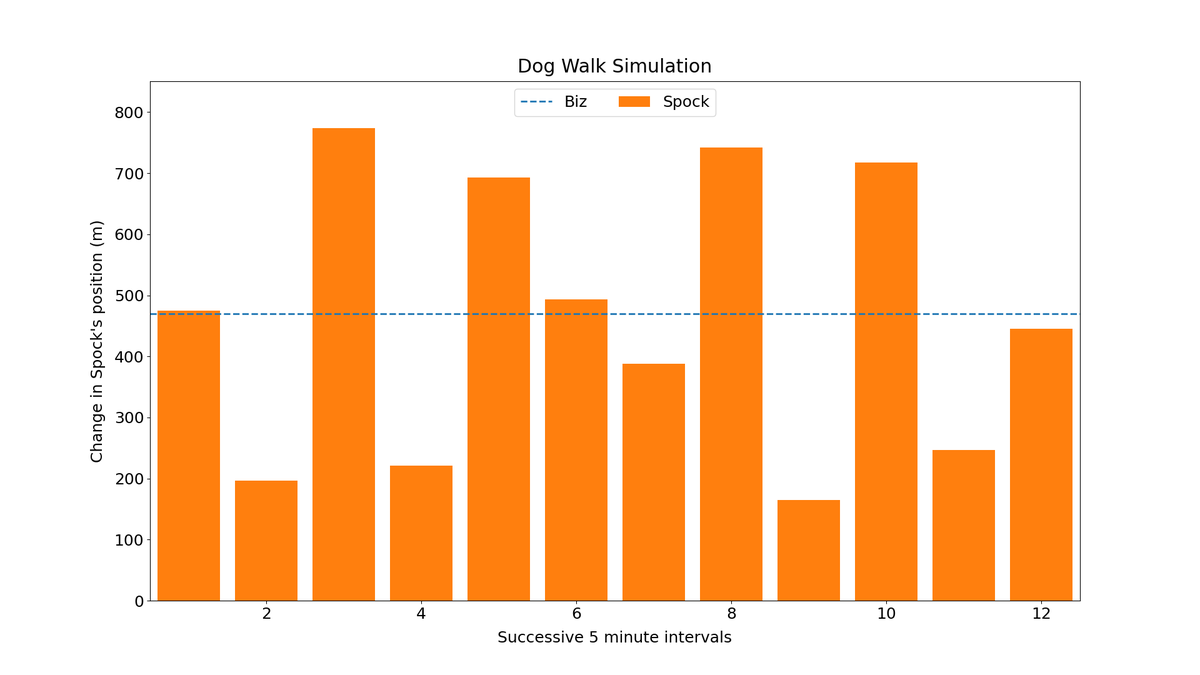

But over *longer* durations -- say, 5 minute intervals -- Spock's movements are far more predictable.

Where Biz goes, Spock follows.

But over *longer* durations -- say, 5 minute intervals -- Spock's movements are far more predictable.

Where Biz goes, Spock follows.

9/

Some dogs are even more unpredictable than Spock. These tend to be younger, more energetic, and more rambunctious. Or they just have a longer leash.

Other dogs are calmer than Spock -- and follow their master more closely. These dogs tend to be older, or on a short leash.

Some dogs are even more unpredictable than Spock. These tend to be younger, more energetic, and more rambunctious. Or they just have a longer leash.

Other dogs are calmer than Spock -- and follow their master more closely. These dogs tend to be older, or on a short leash.

10/

There's also variation in the dog owners.

Some dog owners walk fast. Others walk slowly.

For example, on some days, Biz is tired. He walks slowly.

On other days, he's more energetic, and sets a brisk pace.

There's also variation in the dog owners.

Some dog owners walk fast. Others walk slowly.

For example, on some days, Biz is tired. He walks slowly.

On other days, he's more energetic, and sets a brisk pace.

11/

Now imagine we have a whole bunch of (dog, owner) pairs.

Say, 500 of them.

Some dogs are very calm. Others are very energetic.

Some dogs are on short leashes. Others are on long leashes.

Some dog owners are brisk walkers. Others drag their feet.

Now imagine we have a whole bunch of (dog, owner) pairs.

Say, 500 of them.

Some dogs are very calm. Others are very energetic.

Some dogs are on short leashes. Others are on long leashes.

Some dog owners are brisk walkers. Others drag their feet.

12/

How will it look if all these 500 (dog, owner) pairs started their walk from the same place at the same time?

To give you an idea, here are the dogs from 25 such pairs.

The orange one is Spock. The other 24 are colored various shades of grey.

How will it look if all these 500 (dog, owner) pairs started their walk from the same place at the same time?

To give you an idea, here are the dogs from 25 such pairs.

The orange one is Spock. The other 24 are colored various shades of grey.

13/

Here's an idea.

Instead of grappling with 500 dogs, let's just *average* them.

That is, let's dream up an "average dog".

At any time, this average dog's position is simply the average of all our 500 dogs' individual positions.

Here's Spock vs this "average dog":

Here's an idea.

Instead of grappling with 500 dogs, let's just *average* them.

That is, let's dream up an "average dog".

At any time, this average dog's position is simply the average of all our 500 dogs' individual positions.

Here's Spock vs this "average dog":

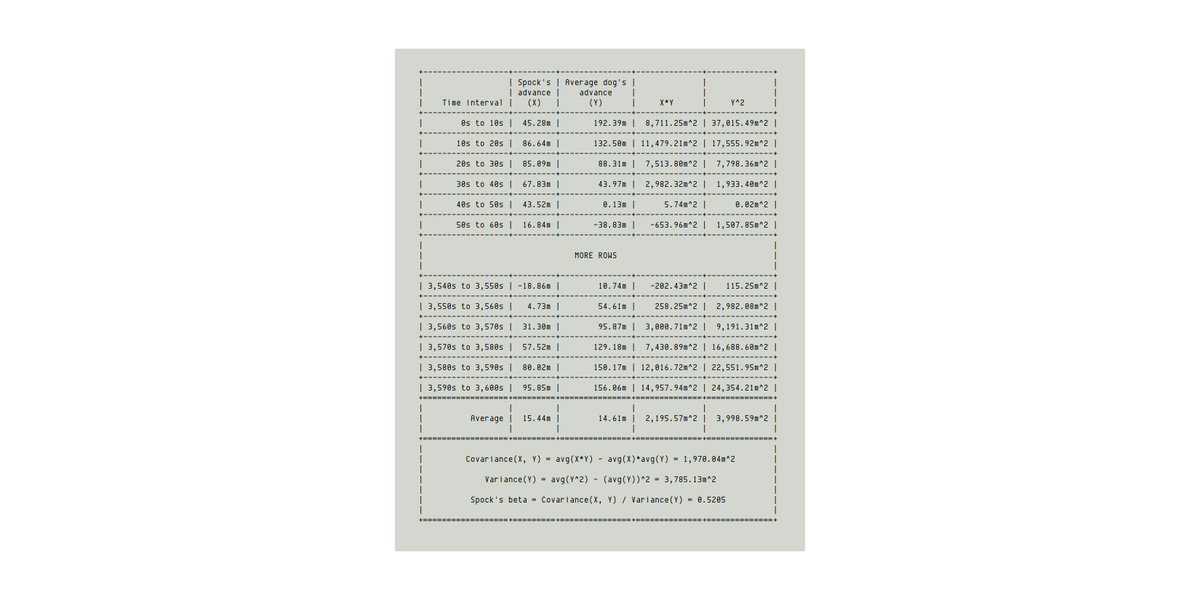

14/

We now split our 1 hour into small chunks -- say, 10 second intervals.

In each chunk, we compare Spock's advance against our average dog's advance.

For example, in the first 10 seconds, Spock advances ~45m, but the average dog advances ~192m.

And so on.

We now split our 1 hour into small chunks -- say, 10 second intervals.

In each chunk, we compare Spock's advance against our average dog's advance.

For example, in the first 10 seconds, Spock advances ~45m, but the average dog advances ~192m.

And so on.

15/

If we put together such comparisons for many, many 10 second intervals, we get a measure called "beta" for Spock.

Beta is a measure of how unpredictable Spock's short-term movements are, compared to those of the average dog.

Formulas, calculations:

If we put together such comparisons for many, many 10 second intervals, we get a measure called "beta" for Spock.

Beta is a measure of how unpredictable Spock's short-term movements are, compared to those of the average dog.

Formulas, calculations:

16/

A dog that has a high beta is more unpredictable over short durations.

And unpredictability is usually a bad thing. That's why people like lower betas.

From the picture above, we see that Spock's beta is about 0.5.

So, how does this compare against the other 499 dogs?

A dog that has a high beta is more unpredictable over short durations.

And unpredictability is usually a bad thing. That's why people like lower betas.

From the picture above, we see that Spock's beta is about 0.5.

So, how does this compare against the other 499 dogs?

17/

It turns out that our 500 dogs range in beta from ~0.2 to ~1.8.

Of our 500 dogs, Spock is ranked 94'th.

That is, 93 dogs have a lower beta (and 406 have a higher beta) than Spock.

This isn't so bad. Spock is in the top 20%.

He's a Good Boy.

It turns out that our 500 dogs range in beta from ~0.2 to ~1.8.

Of our 500 dogs, Spock is ranked 94'th.

That is, 93 dogs have a lower beta (and 406 have a higher beta) than Spock.

This isn't so bad. Spock is in the top 20%.

He's a Good Boy.

18/

But here's the thing to understand.

Over longer durations, beta is almost meaningless.

Why? Because, in the long run, dogs go where their masters go.

Biz's rate of advance is a far more powerful predictor of Spock's position than Spock's own beta.

But here's the thing to understand.

Over longer durations, beta is almost meaningless.

Why? Because, in the long run, dogs go where their masters go.

Biz's rate of advance is a far more powerful predictor of Spock's position than Spock's own beta.

19/

For example, suppose we wait at the 3 mile mark with a treat in hand for Spock.

If Spock reaches our spot by 7am, we give him the treat. That's success!

But if Spock doesn't get to us by 7am, we give up and go home. That's failure.

For example, suppose we wait at the 3 mile mark with a treat in hand for Spock.

If Spock reaches our spot by 7am, we give him the treat. That's success!

But if Spock doesn't get to us by 7am, we give up and go home. That's failure.

20/

We know Biz walks at 3.5mph. So, at 7am, he'll be at the 3.5 mile mark.

For us to fail, Spock would have to lag behind Biz by more than half a mile.

What are the chances of that? Pretty low.

If the Biz makes good progress, the Spock will follow.

We know Biz walks at 3.5mph. So, at 7am, he'll be at the 3.5 mile mark.

For us to fail, Spock would have to lag behind Biz by more than half a mile.

What are the chances of that? Pretty low.

If the Biz makes good progress, the Spock will follow.

21/

If "risk" is the probability of failure in the long term, then beta is not particularly relevant in assessing risk.

For example, here's Joy, an Irish terrier.

Being a super high energy dog, her beta was 1.63. She placed 462'nd out of our 500 dogs.

If "risk" is the probability of failure in the long term, then beta is not particularly relevant in assessing risk.

For example, here's Joy, an Irish terrier.

Being a super high energy dog, her beta was 1.63. She placed 462'nd out of our 500 dogs.

22/

But her master walks at 4mph.

So, in spite of her "volatility", she has very little "risk" of missing our treat.

But her master walks at 4mph.

So, in spite of her "volatility", she has very little "risk" of missing our treat.

23/

On the other hand, here's Mickey -- a 10 year old German Shepherd.

His beta is super low. In our 500 dog sample, there was only 1 dog that had a beta lower than Mickey's.

But his master is an old dude who can't walk much faster than 2.5mph.

On the other hand, here's Mickey -- a 10 year old German Shepherd.

His beta is super low. In our 500 dog sample, there was only 1 dog that had a beta lower than Mickey's.

But his master is an old dude who can't walk much faster than 2.5mph.

24/

So, Mickey's risk of missing the treat is high, even with his super low beta.

Again, when evaluating long-term risk, focusing on beta is letting the tail wag the dog.

So, Mickey's risk of missing the treat is high, even with his super low beta.

Again, when evaluating long-term risk, focusing on beta is letting the tail wag the dog.

25/

Thank you very much for reading to the end of another long thread!

I hope this improved your understanding of volatility and risk.

Please stay safe. Happy Easter weekend!

And if you have a dog, please pass this message to him:

Thank you very much for reading to the end of another long thread!

I hope this improved your understanding of volatility and risk.

Please stay safe. Happy Easter weekend!

And if you have a dog, please pass this message to him:

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh