Breaking: latest IMF World Economic Outlook is out.

Having flicked through, strikes me this is the most positive outlook since the onset of the pandemic (with some important provisos).

- UK, US and most advanced economies get a big vaccine-related upgrade this year & next

Having flicked through, strikes me this is the most positive outlook since the onset of the pandemic (with some important provisos).

- UK, US and most advanced economies get a big vaccine-related upgrade this year & next

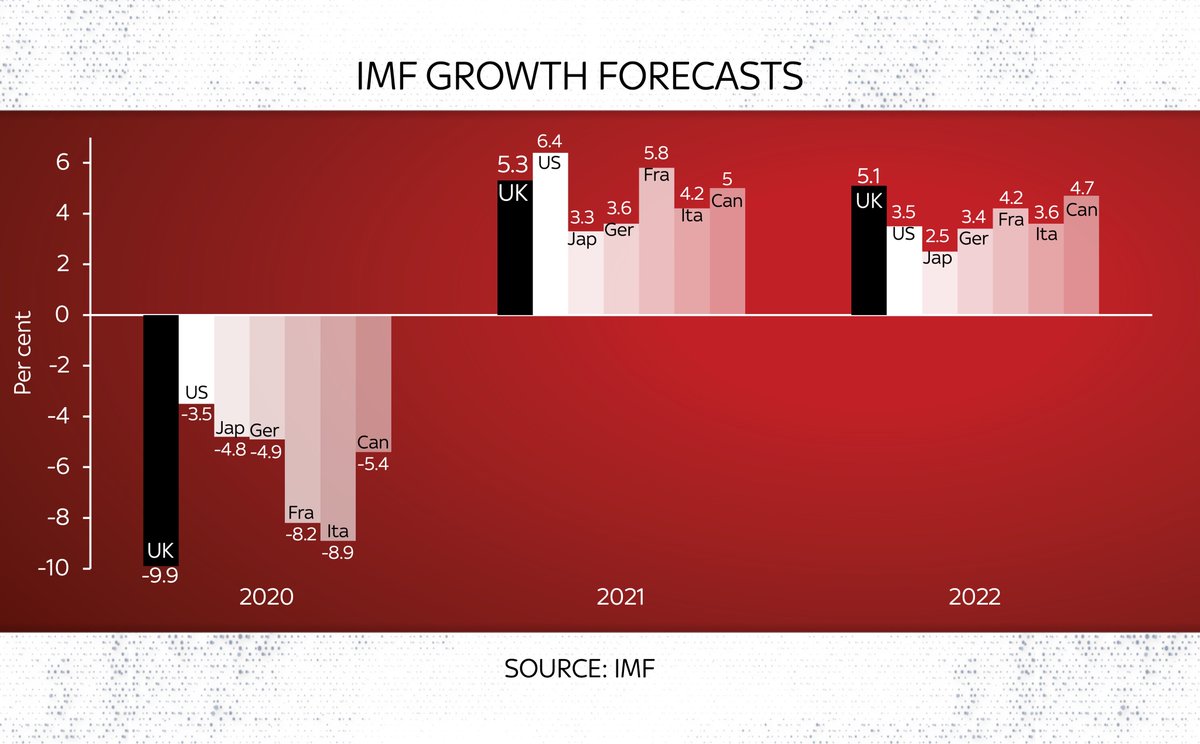

Here are the latest IMF GDP forecasts for G7 members. As you can see, an awful 2020 followed by pretty strong growth in 2022. UK actually strongest in G7 in 2022 (and given the OBR thinks 2022 GDP could be over 7% it’s poss the IMF is undercooking it slightly)

But look at the LEVEL of GDP growth and it’s a somewhat different story. The UK is the second last in the G7 to get back to its pre-crisis peak (Italy the slowest).

One striking line from the IMF is that the global recession could have been THREE TIMES as deep had governments not intervened with rescue measures.

Given 2020 was already the worst year on record, that’s quite something. White bar here illustrates that “three times worse”

Given 2020 was already the worst year on record, that’s quite something. White bar here illustrates that “three times worse”

Here’s the full IMF World Economic Outlook. If you’re interested in the state of the global economy, the recovery and the extent to which it’s being balanced between advanced and developing economies (not very balanced), it’s well worth a read imf.org/-/media/Files/…

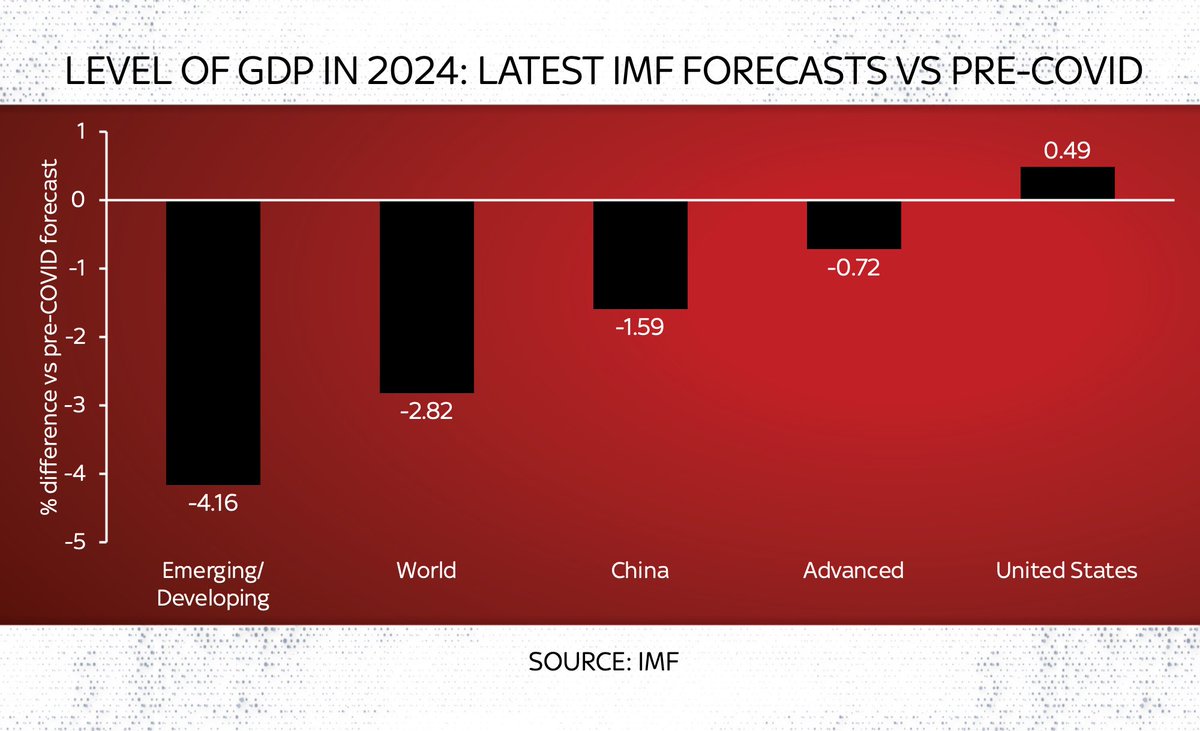

Big deal: the IMF now reckon that advanced economies will almost completely avoid permanent COVID-related economic scarring.

Eg by 2024 their GDP LEVEL will be close to what was forecast pre-COVID.

US GDP will be even HIGHER.

For poorer countries… v different story

Eg by 2024 their GDP LEVEL will be close to what was forecast pre-COVID.

US GDP will be even HIGHER.

For poorer countries… v different story

The IMF has been wondering aloud about whether countries should be introducing more taxes on the wealthy for some time. In today’s Fiscal Monitor they’ve gone further than ever before, recommending a “temporary COVID-19 recovery contribution” on incomes or assets of the wealthy.

News story on everything IMF related here on the @SkyNews site: news.sky.com/story/covid-19…

The more I think abt it, the bigger a deal this is.

Conventional wisdom is China did best - economically at least - out of COVID, bouncing back first/fastest.

But IMF’s forecasts suggests it will face MORE scarring than advanced economies.

And that the US is the biggest winner

Conventional wisdom is China did best - economically at least - out of COVID, bouncing back first/fastest.

But IMF’s forecasts suggests it will face MORE scarring than advanced economies.

And that the US is the biggest winner

• • •

Missing some Tweet in this thread? You can try to

force a refresh