We finally have the total cost of the Archegos disaster for Credit Suisse: 4.4bn CHF.

There is one question I get A LOT: how is it possible that Credit Suisse took a multi-billion exposure on a “family office”?

I will try to explain - A thread.

There is one question I get A LOT: how is it possible that Credit Suisse took a multi-billion exposure on a “family office”?

I will try to explain - A thread.

https://twitter.com/FT/status/1379190333376970760

First it should be stressed how extraordinary that exposure is.

One of the most important rules in banking (the one which puts Greensill in a *lot* of trouble) is called the large risk limit.

It says max exposure should be 25% of own funds.

One of the most important rules in banking (the one which puts Greensill in a *lot* of trouble) is called the large risk limit.

It says max exposure should be 25% of own funds.

In practice, most banks set internal limits around 10% - that would be approx. 5bn CHF.

How on earth did Credit Suisse get to a 4bn+ exposure?

The reason is probably that they didn't even know & I will try to explain why as simply as possible.

How on earth did Credit Suisse get to a 4bn+ exposure?

The reason is probably that they didn't even know & I will try to explain why as simply as possible.

There are three main risks in banking: credit, market and operational.

Operational risk is fraud, fines, disasters, etc.

Market risk is when you’re directly exposed to the change of price of tradeable assets.

Operational risk is fraud, fines, disasters, etc.

Market risk is when you’re directly exposed to the change of price of tradeable assets.

Lending to a leveraged fund is none of those: it’s credit risk.

It might be counterintuitive but I have to stress this: lending to Archegos is *not* market risk, because CS is not directly exposed to changes in the prices of shares, that risk is fully hedged.

The risk is really a credit risk on the fund.

The risk is really a credit risk on the fund.

Credit risk has to two big components: “general” credit risk and counterparty credit risk (CCR).

The former is any loan, lease, etc., whatever transaction that exposes you to credit risk and that you hold in your balance sheet.

The former is any loan, lease, etc., whatever transaction that exposes you to credit risk and that you hold in your balance sheet.

The second is what we are interested about here: it is the risk that a counterparty defaults on a financial instrument (usually a derivative) creating a P&L impact.

The HUGE difference between the two types of credit risk is the notion of exposure.

In the general credit risk framework, exposure is (almost) straightforward: it’s the amount of the loan, lease, etc., that the borrowers owe you.

In the general credit risk framework, exposure is (almost) straightforward: it’s the amount of the loan, lease, etc., that the borrowers owe you.

CCR is a whole different animal, for two reasons:

1) the “exposures” can go both way and

2) there is collateral.

To make things clearer, I will use one example for the rest of the thread: a one-year total return swap on 10bn of Tesla shares.

1) the “exposures” can go both way and

2) there is collateral.

To make things clearer, I will use one example for the rest of the thread: a one-year total return swap on 10bn of Tesla shares.

Let’s say that when the swap is entered into, the shares are worth 420.

If the shares go up, e.g. 500, the bank has to pay 500-420=80.

If the shares go down, e.g. 300, the bank receives 420-300=120.

Simple.

If the shares go up, e.g. 500, the bank has to pay 500-420=80.

If the shares go down, e.g. 300, the bank receives 420-300=120.

Simple.

First, let’s get market risk out of the equation.

Because the bank wants none of it, it will simultaneously buy 10bn of Tesla shares to hedge that risk.

But now, you can immediately see the problem about exposure.

Because the bank wants none of it, it will simultaneously buy 10bn of Tesla shares to hedge that risk.

But now, you can immediately see the problem about exposure.

If shares go up, the bank isn’t owned money on the swap.

On the contrary, the bank owes money to the client!

It is only if shares go down that the client owes money and exposures go up.

On the contrary, the bank owes money to the client!

It is only if shares go down that the client owes money and exposures go up.

And then collateral enters into consideration.

As some have explained, collateral is a split between “Initial Amount” (IA) and “Variation Margin’ (VM).

The former is a t=0 cash collateral designed to hedge against possible variations of the price.

As some have explained, collateral is a split between “Initial Amount” (IA) and “Variation Margin’ (VM).

The former is a t=0 cash collateral designed to hedge against possible variations of the price.

The second is recalculated frequently (often daily) to reflect changes in market price.

Sticking with our example, let’s say our TRS has 5% of “Initial Amount”.

The fund posts 5%*10bn=500m of collateral (assume cash for simplicity).

This is the real leverage by the way: 20 times, since only 5% will be used to enter into the deal.

The fund posts 5%*10bn=500m of collateral (assume cash for simplicity).

This is the real leverage by the way: 20 times, since only 5% will be used to enter into the deal.

Suppose shares go down 3% the next day: the bank asks that 3% as VM.

What is the economic exposure of the bank on Day 1: it’s still 0!

Why?

The bank is owed 3%, but has 5% in cash collateral (=IA), so no risk. The bank also asks for the 3% as VM.

What is the economic exposure of the bank on Day 1: it’s still 0!

Why?

The bank is owed 3%, but has 5% in cash collateral (=IA), so no risk. The bank also asks for the 3% as VM.

Supposed VM is paid next day (time to settle) and shares go down another 4%.

What’s the bank’s exposure? Still 0!

Why?

The bank has 5% (IA) + 3% (VM) = 8% collateral against a 7% debt, so no risk.

What’s the bank’s exposure? Still 0!

Why?

The bank has 5% (IA) + 3% (VM) = 8% collateral against a 7% debt, so no risk.

Had the shares gone down 10%, then the bank would have 10% - 8%= 2% risk.

If the shares go up again, the risk can go down, but remember that the VM will also be reduced.

If the shares go up again, the risk can go down, but remember that the VM will also be reduced.

Now you get what is the economic risk – but what happens in risk and regulatory reporting for banks?

It’s clear from the mechanics I described that the bank is always “chasing the risk” by asking collateral. But there is risk of sudden price changes.

How is this modelled?

It’s clear from the mechanics I described that the bank is always “chasing the risk” by asking collateral. But there is risk of sudden price changes.

How is this modelled?

The key thing is this: unlike in “general credit risk”, where nominal is everything, in CCR, the 10bn “nominal exposure” is reported nowhere. (I mean, nowhere significant).

Regulations require banks to calculate their “economic exposure”, i.e. some kind of economic measure of what could be their credit risk because of market price changes.

The general idea is to measure how market prices could change before you can actually get the collateral you’re entitled to.

Why would that happen?

Why would that happen?

It could be because :

1) prices move too quickly (before margining happens), 2) your client disputes the collateral calculation

3) operational reasons (“sorry the boss is off today, can’t send the money”)

etc.

1) prices move too quickly (before margining happens), 2) your client disputes the collateral calculation

3) operational reasons (“sorry the boss is off today, can’t send the money”)

etc.

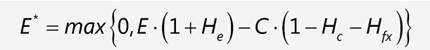

There are standard and sophisticated ways of calculating this, but the “standard formula” gives the idea:

you apply a markup to your exposure for price changes (VaR based) and haircuts to your collateral for FX and MtM risk.

you apply a markup to your exposure for price changes (VaR based) and haircuts to your collateral for FX and MtM risk.

In practice, how does it work?

Your model says in 99% cases you can adjust collateral without any operational glitch in, say, 4 days.

Your VaR model says the 99% risk is a 10% drop of the share price.

Over the 4 days, you scale VaR as 10%*sqrt(4)=20%.

Your model says in 99% cases you can adjust collateral without any operational glitch in, say, 4 days.

Your VaR model says the 99% risk is a 10% drop of the share price.

Over the 4 days, you scale VaR as 10%*sqrt(4)=20%.

So, based on your model, if you ask an IA of 20% you should always have 0 exposure.

LET ME STRESS THIS AGAIN.

You don’t have a 0 probability of default, or loss.

You have 0 *exposure*. You REPORT NO RISK.

LET ME STRESS THIS AGAIN.

You don’t have a 0 probability of default, or loss.

You have 0 *exposure*. You REPORT NO RISK.

And yet your client is leveraged 5 times because your IA was 20%.

Sounds familiar?

Sounds familiar?

This how you get the kind of table you see in Credit Suisse Pillar 3 report: impossible to see the nominal exposure to Archegos in there or any risk.

But there is genuine risk, of course.

But there is genuine risk, of course.

Indeed, the model can be totally wrong.

Let’s assume you didn’t model fat tails properly and the real one day 99% quantile is -15%.

Also, the VaR 4-day scaling formula (used everywhere) is total bullshit because extreme events are often followed by extreme events.

Let’s assume you didn’t model fat tails properly and the real one day 99% quantile is -15%.

Also, the VaR 4-day scaling formula (used everywhere) is total bullshit because extreme events are often followed by extreme events.

So let’s assume the true scaling factor should 3 instead of 2: the price change should be 3*15%=45%.

And if that move actually happens, and your IA was only 20%... you’re screwed for 25%, that’s 2.5bn on the swap.

On something that wasn’t even reported as an exposure.

And if that move actually happens, and your IA was only 20%... you’re screwed for 25%, that’s 2.5bn on the swap.

On something that wasn’t even reported as an exposure.

Good luck explaining that to your management 😊

Which banks get that kind of problems?

Banks with shitty models and (more importantly) banks that trust their shitty models so much that they don’t pay enough attention to nominal and model risk…

Banks with shitty models and (more importantly) banks that trust their shitty models so much that they don’t pay enough attention to nominal and model risk…

And this how with a tricky combination of confusing regulation, lousy reporting and poor modelling ends up losing billions, on a risk that didn’t even show up as material in your risk reporting.

(For the geeks : I chose to simplify a lot of concepts on purpose, but you get the idea, I hope)

Apparently for some people the next tweet appears deleted ; no clue why : here it is again

"CCR is a whole different animal, for two reasons: 1) the “exposures” can go both way and 2) there is collateral.

To make things clearer, I will use one example for the rest of the thread: a one-year total return swap on 10bn of Tesla shares.

To make things clearer, I will use one example for the rest of the thread: a one-year total return swap on 10bn of Tesla shares.

• • •

Missing some Tweet in this thread? You can try to

force a refresh