DeFi is roaring back. A quick review of the story so far in 2021 with a little help from @DuneAnalytics 👇

1/ USD denominated DEX volumes are 65x what they were this time last year 🤯

That said, given the global crypto mcap has 10x'ed since, the adjusted growth rate is closer to 6.5x--down from 10x between 2019 and 2020.

Still...🤯

That said, given the global crypto mcap has 10x'ed since, the adjusted growth rate is closer to 6.5x--down from 10x between 2019 and 2020.

Still...🤯

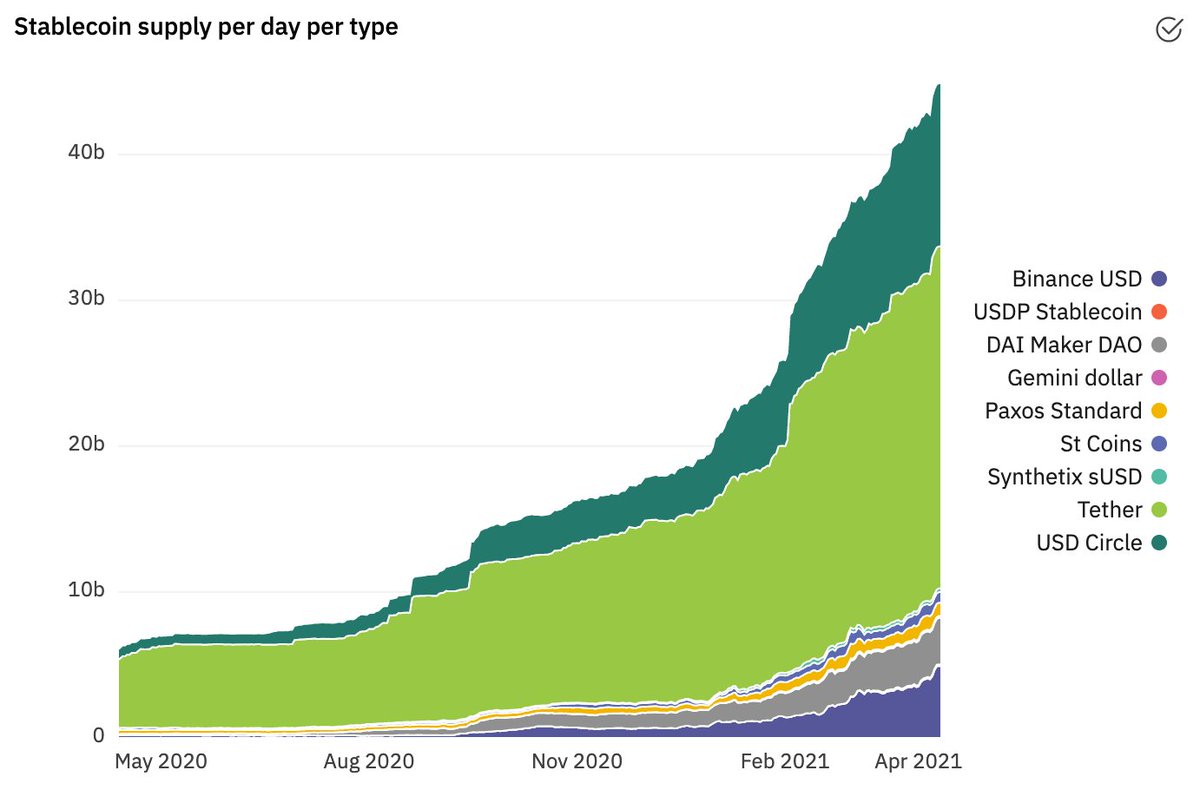

2/ Stablecoin supply on Ethereum has 10x'ed in a year and 2.5x'ed since Jan 2021 . All real–i.e. no token appreciation factored in here.

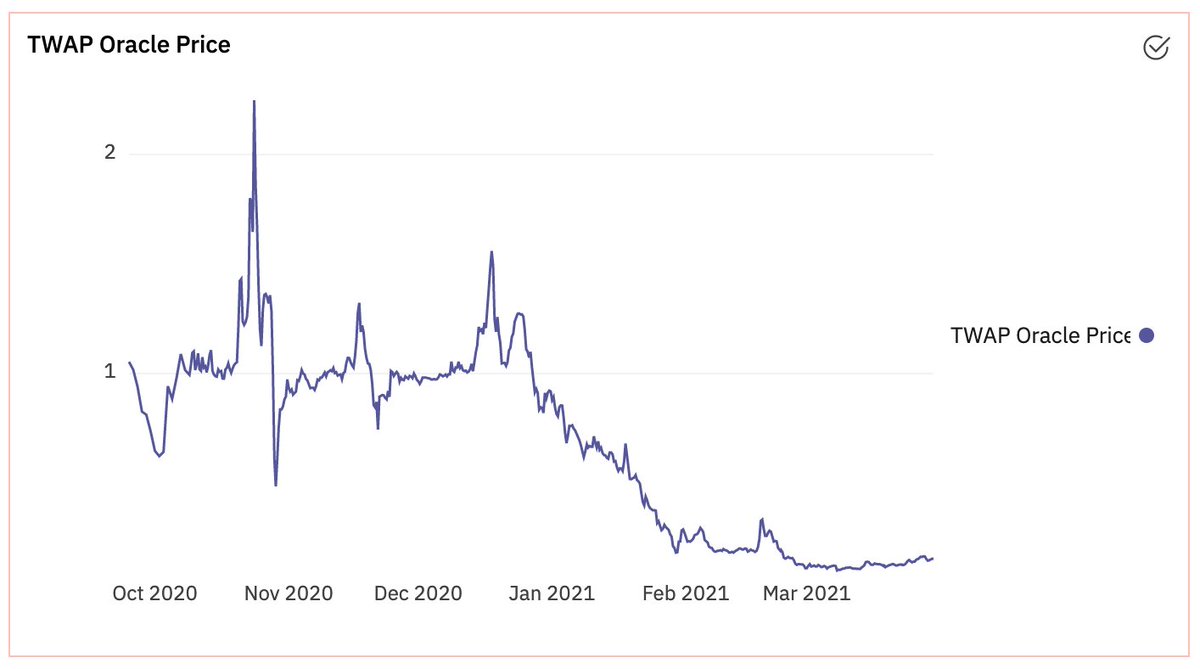

3/ The road to seeding the ecosystem with stable value is not without the remnants of the (temporarily) fallen.

$ESD was all the rage in H2 2020; and then it wasn't. It's now well below the 1 USD peg, but $ESD's mcap still stands at ~$100M. Any takers here?

h/t @jonitzler

$ESD was all the rage in H2 2020; and then it wasn't. It's now well below the 1 USD peg, but $ESD's mcap still stands at ~$100M. Any takers here?

h/t @jonitzler

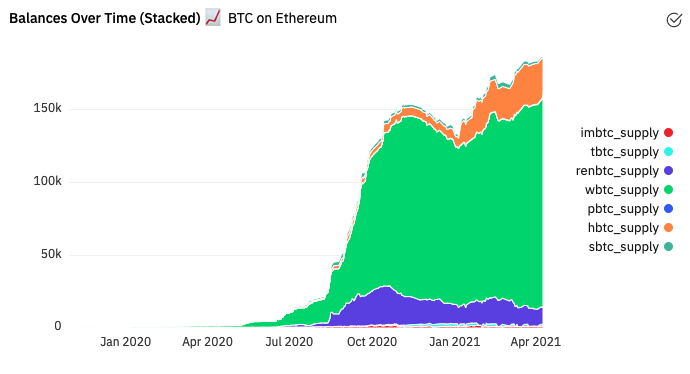

4/ If stable value is an essential piece of the growth puzzle, another is surely high quality collateral.

Although past the "vertical" growth stage, $BTC on Ethereum is breaching all-time-highs (193k ~= $12.5B), dominated by the more capital efficient of products.

Although past the "vertical" growth stage, $BTC on Ethereum is breaching all-time-highs (193k ~= $12.5B), dominated by the more capital efficient of products.

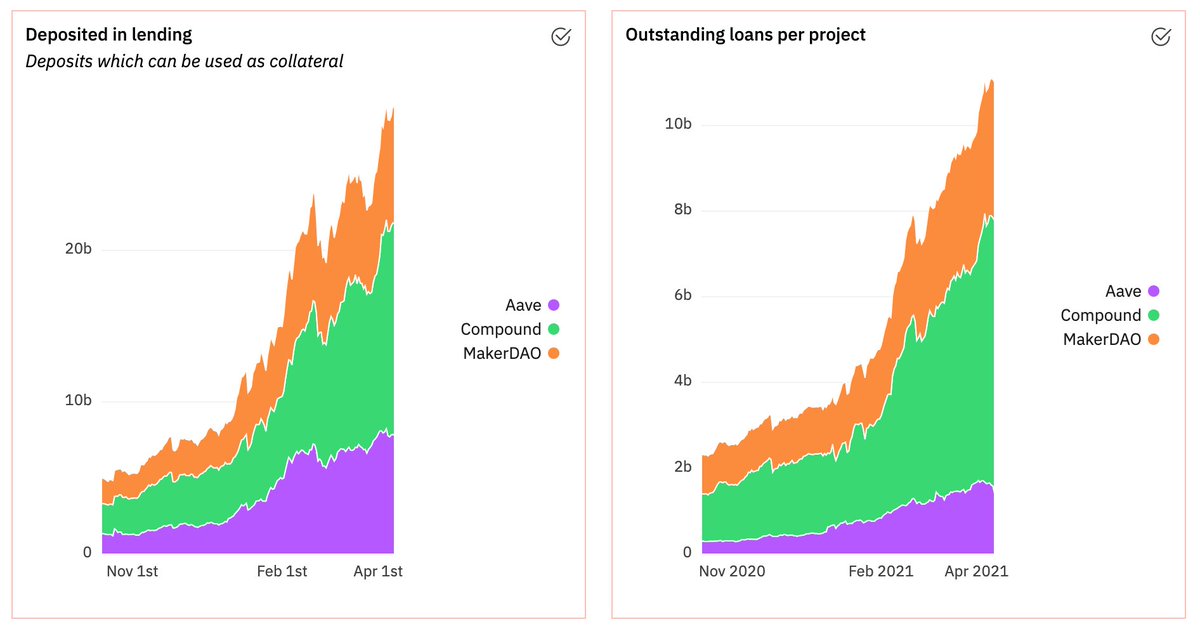

5/ And what do you do with all that collateral? You put it to good use of course.

At the moment, there is ~$28B TVL among the 3 top lending protocols on Ethereum. However, only about 1/3 of that is being utilized 🧐

At the moment, there is ~$28B TVL among the 3 top lending protocols on Ethereum. However, only about 1/3 of that is being utilized 🧐

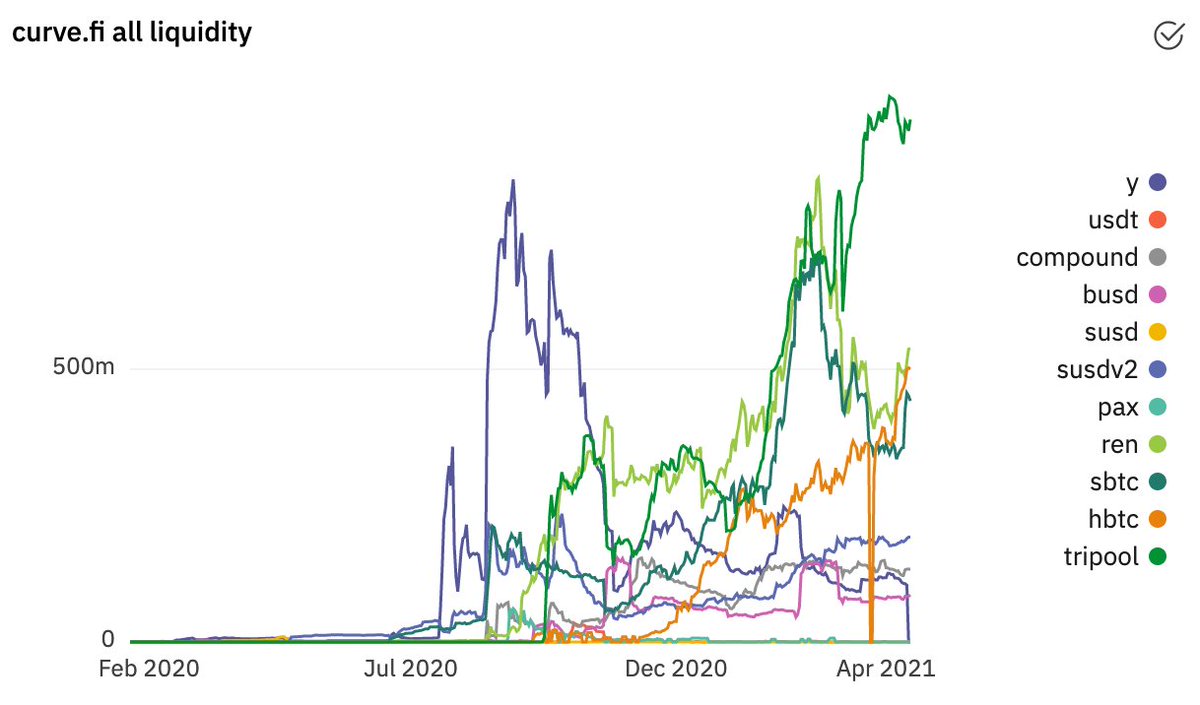

6/ Another popular use of that collateral is providing liquidity on AMM's. Too much going on here to fit in a tweet!

To insulate from token/USD denomination, it's worth noting that the tripool (DAI-USDT-USDC) from Curve has grown ~5x since Jan.

h/t penguindev

To insulate from token/USD denomination, it's worth noting that the tripool (DAI-USDT-USDC) from Curve has grown ~5x since Jan.

h/t penguindev

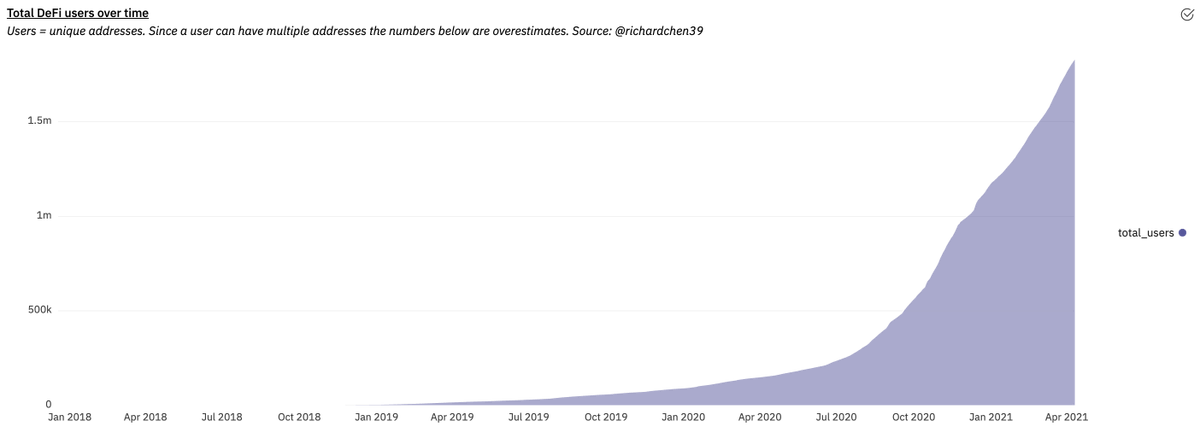

7/ So capital flow's are literally booming, but they're only part of the story. Another key piece is users.

Unique addresses interacting with DeFi protocols on Ethereum have 12x'ed since this time last year–but only grown by 50% YTD.

Top of funnel bottleneck or gas too high?

Unique addresses interacting with DeFi protocols on Ethereum have 12x'ed since this time last year–but only grown by 50% YTD.

Top of funnel bottleneck or gas too high?

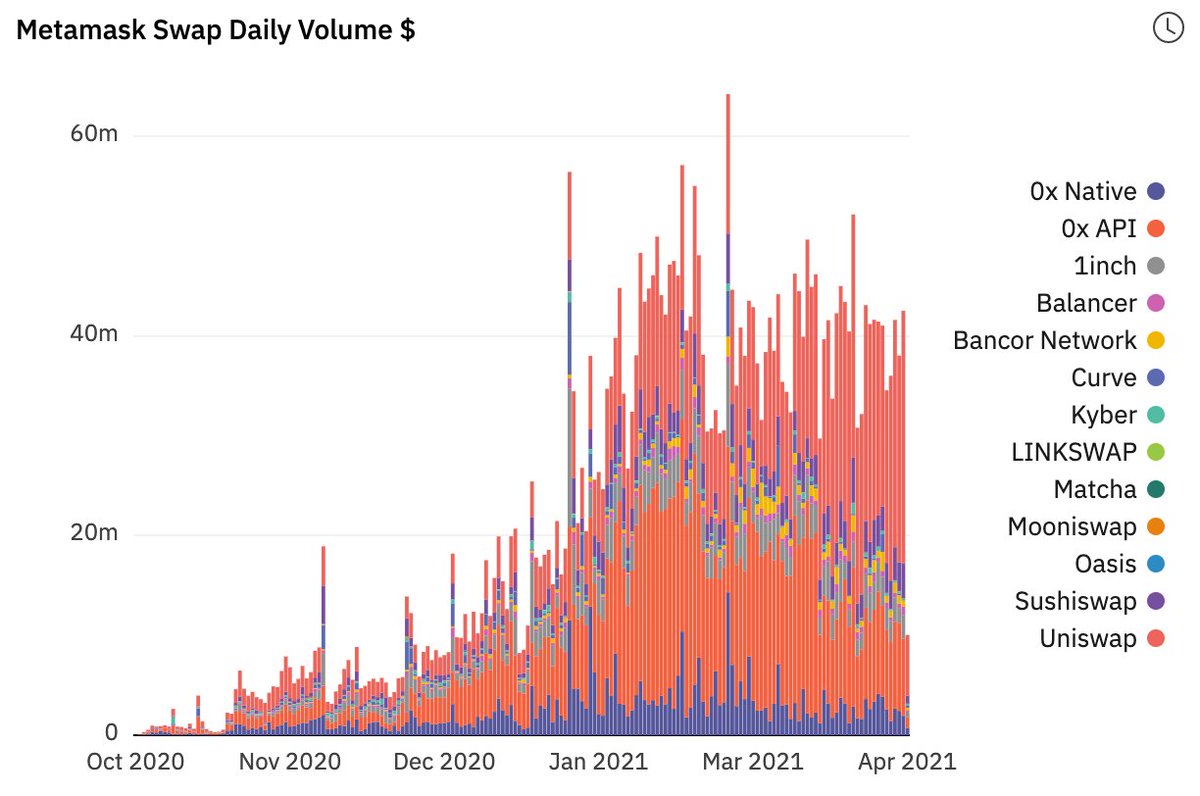

8/ Speaking of users, last time I checked Metamask had ~2M MAUs accessing Ethereum through their wallet.

Since swaps were enabled natively, they have been making bank. Daily volumes stand north of $30M on average, translating to $320k in fees daily in 2021.

Wen $MASK?

Since swaps were enabled natively, they have been making bank. Daily volumes stand north of $30M on average, translating to $320k in fees daily in 2021.

Wen $MASK?

9/ If you told me in April 2020 that DeFi would be posting these kinds of numbers in a year, I would have told you maybe 2023.

Yes, reflexivity plays a huge part in it all. But the growth rates are persistently high when you look at pockets that are somewhat insulated from it.

Yes, reflexivity plays a huge part in it all. But the growth rates are persistently high when you look at pockets that are somewhat insulated from it.

10/ To put things in perspective, Ethereum DEXes are trading daily ~25% of the USD denominated volume of the LSE, ~6% of the volume in Hong Kong and ~3% of that in Nasdaq.

These are big numbers friends...

These are big numbers friends...

• • •

Missing some Tweet in this thread? You can try to

force a refresh